Kansas Sample Letter to Beneficiaries regarding Trust Money

Description

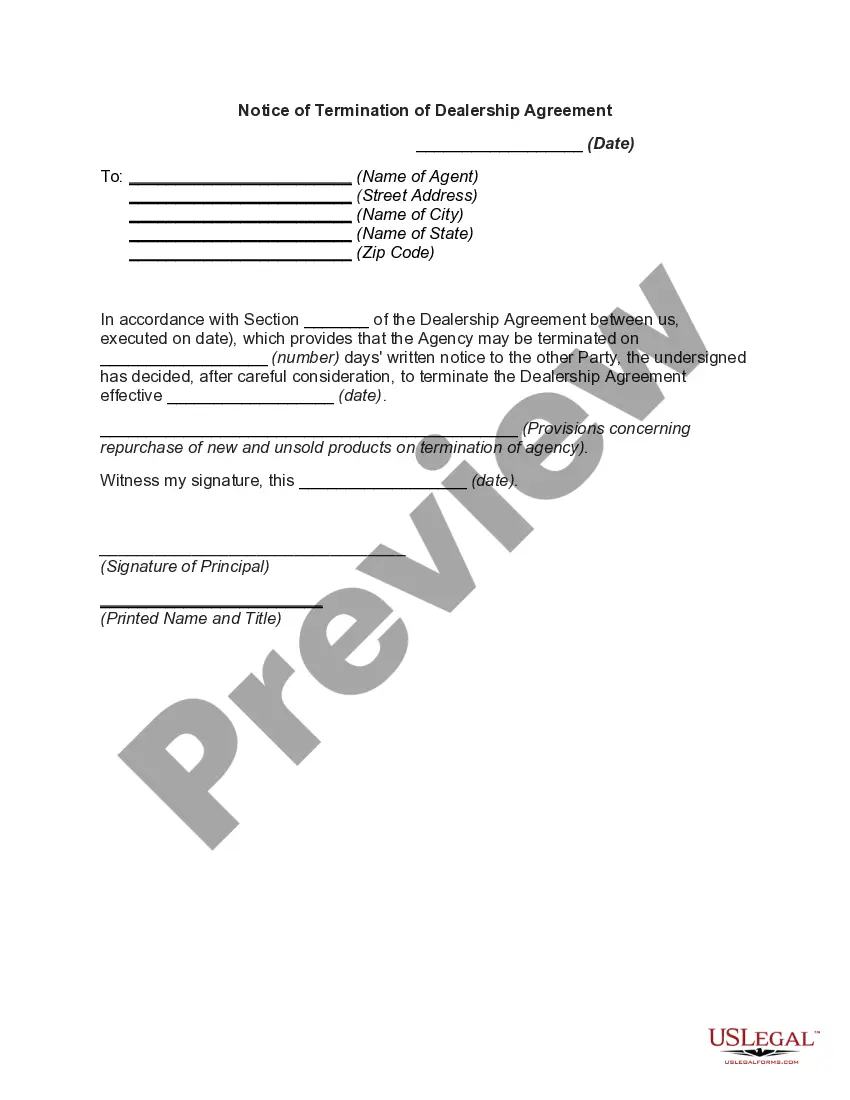

How to fill out Sample Letter To Beneficiaries Regarding Trust Money?

Are you presently within a placement where you need files for sometimes organization or person reasons virtually every day time? There are plenty of authorized papers themes available online, but getting ones you can depend on is not straightforward. US Legal Forms provides a huge number of kind themes, such as the Kansas Sample Letter to Beneficiaries regarding Trust Money, which can be published to fulfill federal and state demands.

In case you are already informed about US Legal Forms site and possess a merchant account, merely log in. Afterward, it is possible to acquire the Kansas Sample Letter to Beneficiaries regarding Trust Money design.

Unless you provide an profile and want to begin using US Legal Forms, adopt these measures:

- Discover the kind you will need and ensure it is for your appropriate area/region.

- Use the Preview option to check the form.

- Look at the description to ensure that you have selected the correct kind.

- In case the kind is not what you are looking for, use the Look for industry to discover the kind that meets your needs and demands.

- If you get the appropriate kind, click Get now.

- Choose the costs prepare you want, fill in the necessary info to produce your account, and pay money for the transaction with your PayPal or credit card.

- Decide on a handy paper formatting and acquire your copy.

Get all the papers themes you have bought in the My Forms menus. You can get a additional copy of Kansas Sample Letter to Beneficiaries regarding Trust Money any time, if necessary. Just click the required kind to acquire or print out the papers design.

Use US Legal Forms, the most substantial assortment of authorized kinds, to save lots of time as well as steer clear of errors. The assistance provides appropriately created authorized papers themes which you can use for a range of reasons. Create a merchant account on US Legal Forms and begin generating your way of life a little easier.

Form popularity

FAQ

A good first step for the beneficiary is to meet with the trustee who is tasked with executing the terms of the trust. It may be an individual, such as a CPA or lawyer, family member, or potentially a corporate trustee such as Wells Fargo Bank.

It is often written by the executor or trustee to provide beneficiaries with specific details about their inheritance, such as the assets they will receive, distribution timelines, any applicable taxes or fees, and any requirements or conditions that need to be fulfilled.

When writing your letter of instruction, include as much information about your estate and your assets as possible, and provide detailed instruction for how you want any assets not mentioned in your formal will to be dispersed among your heirs. Your letter of intent doesn't supersede the terms of your will.

In terms of content, an Estate distribution letter should include: the deceased's personal details; a detailed and complete list of all assets and liabilities; the Beneficiary names and the details of their respective inheritances; any details on debt settlement and creditor communication;

The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

Start by addressing the letter correctly, including the recipient's name, address, and contact information. Clearly state the purpose of the letter, which is to designate a beneficiary or beneficiaries for a specific matter, such as a life insurance policy or retirement account.

The letter of instruction should include the following information: A summary of all assets and debts. The location of valuable physical assets (e.g., jewelry, art, collectibles, real estate) Details about your retirement and investment accounts.

Here are the essentials, in most states: Explain that the trust exists. ... Provide your name and contact information. ... Tell beneficiaries that they have the right to see a copy of the trust document and that you will send them one if they request it. ... Give the deadline for court challenges.