Kansas Letter regarding trust money

Description

How to fill out Letter Regarding Trust Money?

If you wish to gather, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms accessible online.

Take advantage of the website's straightforward and user-friendly search to find the documents you require.

A selection of templates for business and personal purposes is categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Select your preferred pricing plan and provide your credentials to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Use US Legal Forms to access the Kansas Letter related to trust money in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Kansas Letter concerning trust money.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct jurisdiction/state.

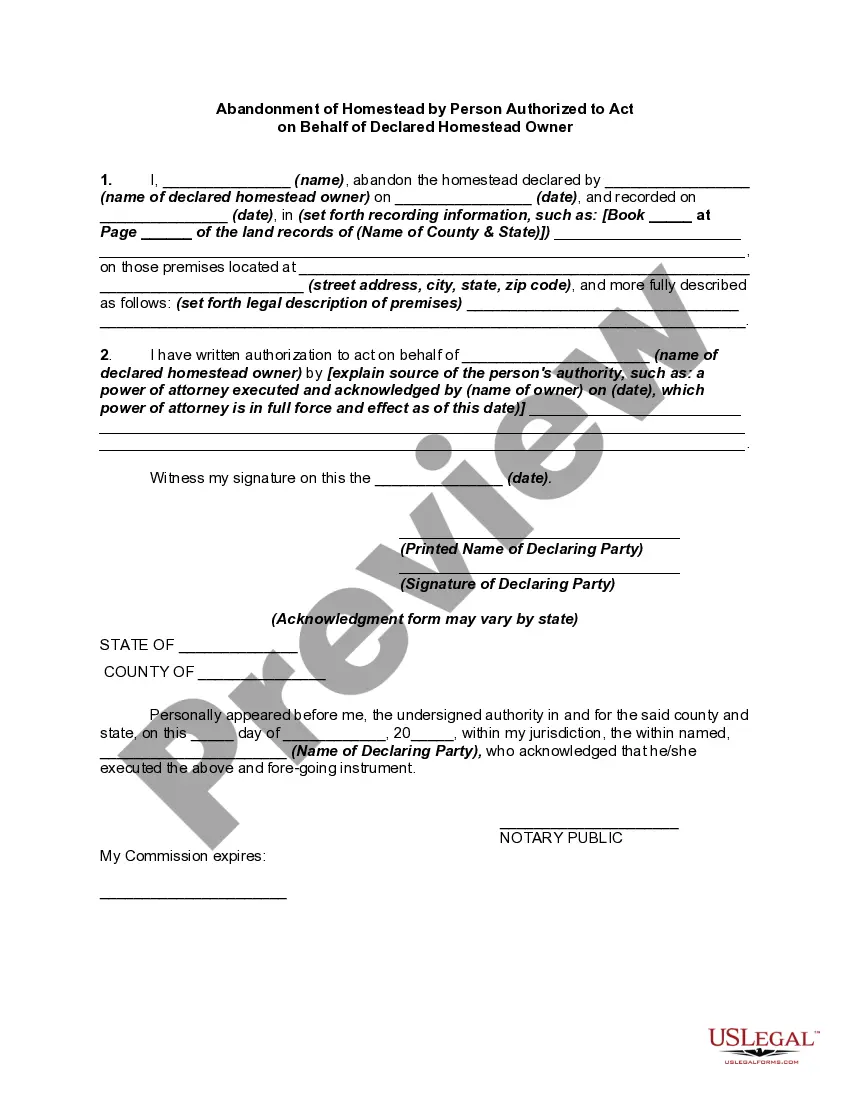

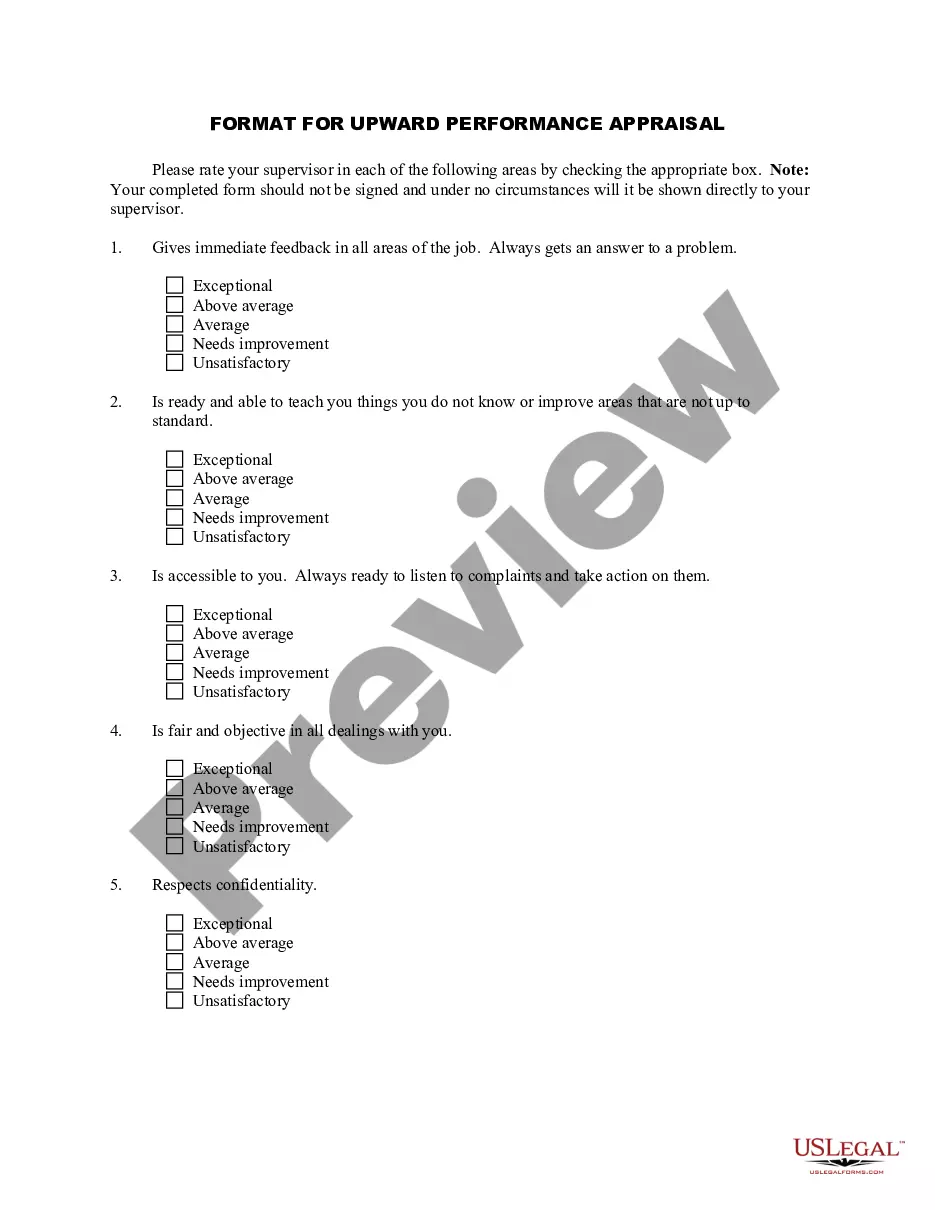

- Step 2. Utilize the Preview option to check the form’s contents. Don't forget to review the details.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other types in the legal form collection.

Form popularity

FAQ

Yes, it is possible to contest a trust in Kansas. Grounds for contesting may include issues such as lack of capacity, undue influence, or improper creation of the trust. Consulting with a legal professional can provide guidance on how to navigate the complexities involved and ensure your rights and interests are protected in the process.

For trusts, distributions are taxable to the beneficiary, and the trust must file a Schedule K-1 for each beneficiary paid. The beneficiary will then report the income on their tax return. The trust must also generate a Form 1041 to report the total amount of income the trust earned from the grantor's date of death.

Identify yourself as a beneficiary of the irrevocable trust in the body of the letter. State that you are requesting money from the trust, and the reason for the request. Include supporting documentation. For example, if you are requesting money to pay medical bills, enclose copies of the bills.

Write the name of the trustee, his address, city, state, and zip code about one-quarter inch below the date. Reference the name of your trust, and your trust account number if applicable. Write a salutation followed by a colon, for example, "Dear Mr.

Beneficiaries of a trust typically pay taxes on distributions they receive from the trust's income. However, they are not subject to taxes on distributions from the trust's principal.

Generally speaking, beneficiaries have a right to see trust documents which set out the terms of the trusts, the identity of the trustees and the assets within the trust as well as the trust deed, any deeds of appointment/retirement and trust accounts.

For trusts, distributions are taxable to the beneficiary, and the trust must file a Schedule K-1 for each beneficiary paid. The beneficiary will then report the income on their tax return. The trust must also generate a Form 1041 to report the total amount of income the trust earned from the grantor's date of death.

The income keeps the same character as it had for the trust; for example, if the trust had long-term capital gains and distributes them, the beneficiary has long-term capital gains. This amount is a deduction on the trust's income tax return. So, somebody's going to pay income taxes on any income earned by the trust.

Trust beneficiaries must pay taxes on income and other distributions that they receive from the trust. Trust beneficiaries don't have to pay taxes on returned principal from the trust's assets. IRS forms K-1 and 1041 are required for filing tax returns that receive trust disbursements.

Essentially, it's a letter from you to your personal representative/trustee and/or beneficiaries discussing your personal thoughts that resulted in your estate plan as well as any personal wishes to be considered in implementing your plan.