Kansas Consumer Loan Agreement

Description

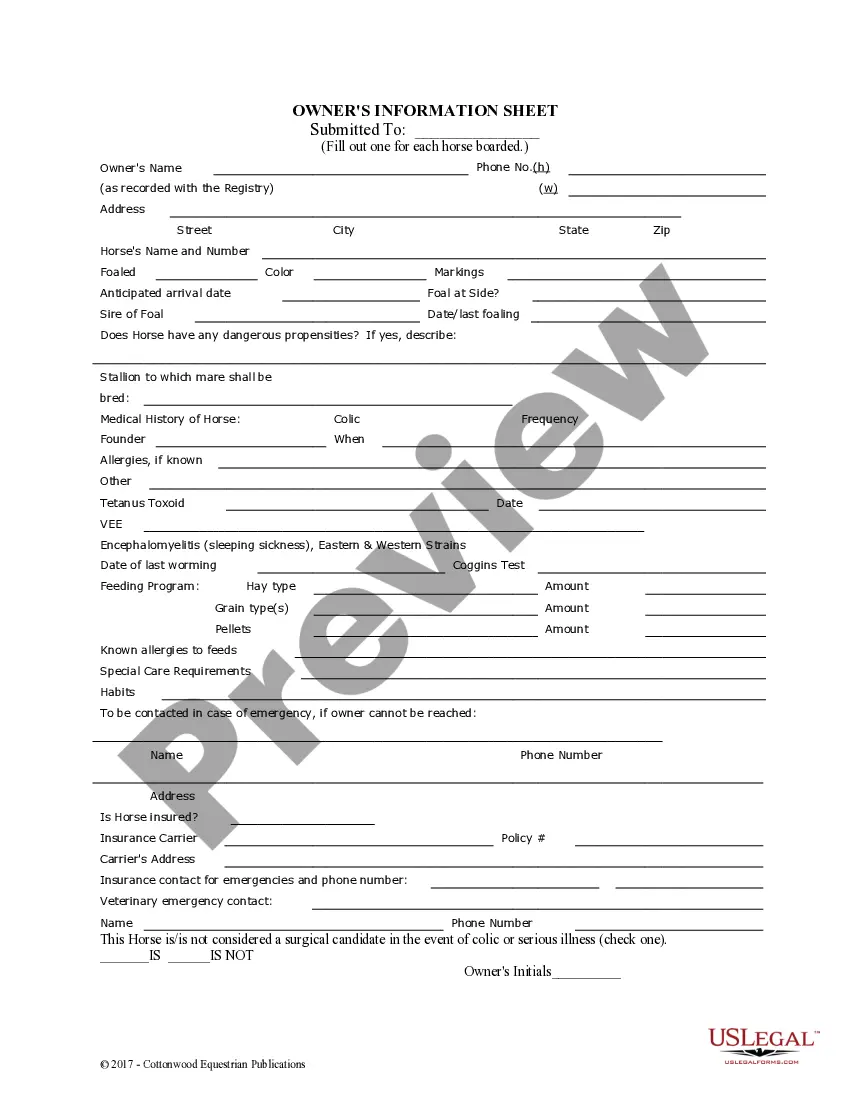

How to fill out Consumer Loan Agreement?

Are you currently within a placement in which you require papers for possibly enterprise or personal reasons just about every day? There are a variety of legitimate record themes available online, but finding kinds you can depend on isn`t easy. US Legal Forms offers 1000s of form themes, such as the Kansas Consumer Loan Agreement, that are created to fulfill state and federal specifications.

In case you are presently familiar with US Legal Forms web site and have a merchant account, simply log in. After that, you are able to download the Kansas Consumer Loan Agreement web template.

Unless you provide an account and wish to begin using US Legal Forms, adopt these measures:

- Get the form you need and make sure it is for the appropriate metropolis/area.

- Make use of the Review switch to analyze the form.

- Look at the explanation to ensure that you have selected the correct form.

- In case the form isn`t what you are searching for, take advantage of the Search industry to obtain the form that meets your needs and specifications.

- Whenever you get the appropriate form, just click Purchase now.

- Choose the rates strategy you would like, fill out the specified info to create your money, and pay for the transaction with your PayPal or bank card.

- Choose a hassle-free file file format and download your copy.

Locate each of the record themes you possess bought in the My Forms food list. You may get a additional copy of Kansas Consumer Loan Agreement at any time, if possible. Just go through the essential form to download or print out the record web template.

Use US Legal Forms, one of the most extensive variety of legitimate varieties, to conserve time and avoid faults. The support offers skillfully made legitimate record themes which you can use for a range of reasons. Produce a merchant account on US Legal Forms and begin creating your lifestyle a little easier.

Form popularity

FAQ

The repayment period of a mortgage is longer ? up to 30 years. A consumer loan usually has a term of a few months to 5 years. But both loans can be repaid prematurely. Usually, monthly mortgage payments are lower than for a consumer loan, because of the longer repayment schedule.

Today's Mortgage Rates in Kansas ProductTodayLast Week15 year fixed6.88%4.00%5/1 ARM4.63%3.00%30 yr fixed mtg refi6.75%7.50%15 yr fixed mtg refi6.88%6.10%3 more rows

There is no federal regulation on the maximum interest rate that your issuer can charge you, though each state has its own approach to limiting interest rates. State usury laws often dictate the highest interest rate that can be charged on loans, but these often don't apply to credit card loans.

Avoid loans with APRs higher than 10% (if possible) ing to Rachel Sanborn Lawrence, advisory services director and certified financial planner at Ellevest, you should feel OK about taking on purposeful debt that's below 10% APR, and even better if it's below 5% APR.

The maximum legal rate of interest is 10%, when no other rate is agreed upon. The maximum rate at which parties can contract, which is higher, is 15% per year, unless otherwise specifically authorized to be higher by law.

1 Uniform Consumer Credit Code and Interest Rates Background. Enacted in 1973, the Kansas Uniform Consumer Credit Code (UCCC) applies to all aspects of consumer credit addressing transactions for personal, family, and household purposes.

A consumer credit contract is a formal written agreement to borrow money, or pay something off over time, for personal use. You pay interest and fees for the use of the bank or finance company's money. One or more of your assets might secure the loan. Examples include: vehicle finance to buy a car, van, or boat.

A usury interest rate is an interest rate deemed to be illegally high. To discourage predatory lending and promote economic activity, states may enact laws that set a ceiling on the interest rate that can be charged for certain types of debt. Interest rates above this ceiling are considered usury and are illegal.