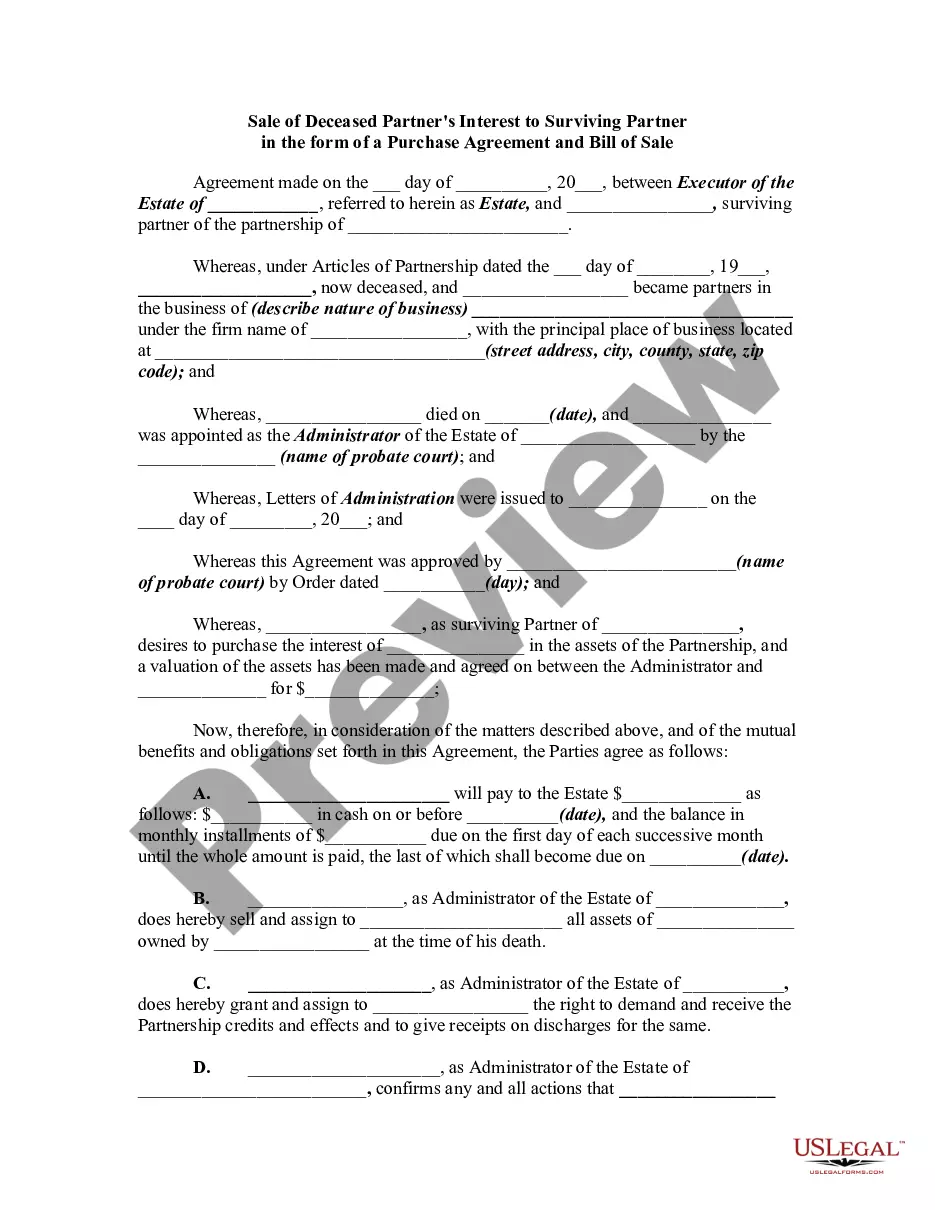

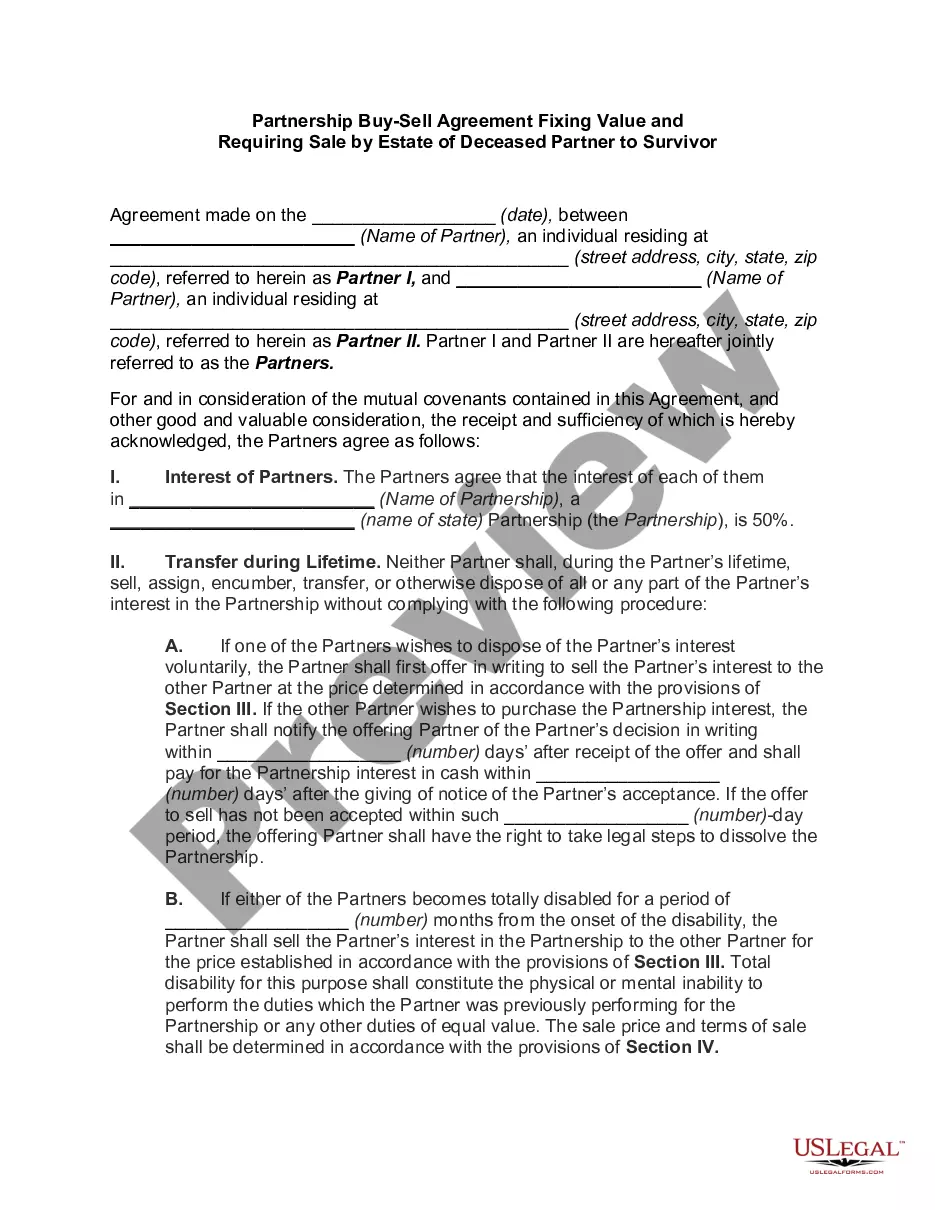

Kansas Sale of Deceased Partner's Interest

Description

How to fill out Sale Of Deceased Partner's Interest?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a range of legal document templates that you can download or create.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of forms such as the Kansas Sale of Deceased Partner's Interest within minutes.

If you already possess an account, Log In to download the Kansas Sale of Deceased Partner's Interest from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms from the My documents tab of your account.

Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make edits. Fill in, revise, print, and sign the downloaded Kansas Sale of Deceased Partner's Interest. Each template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or produce another version, just go to the My documents section and click on the form you desire. Access the Kansas Sale of Deceased Partner's Interest with US Legal Forms, the most extensive library of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal requirements.

- Make sure you have selected the correct form for your location/region.

- Click the Preview button to review the form's content.

- Read the form description to ensure you have chosen the correct form.

- If the form does not meet your needs, use the Search bar at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select your preferred payment plan and provide your details to subscribe for the account.

Form popularity

FAQ

Form 706 must be filed by the executor of the estate of every U.S. citizen or resident: Whose gross estate, adjusted taxable gifts, and specific exemptions total more than the exclusion amount: $11.7 million for decedents who died in 2021 ($12.06 million in 2022), or 2.

Form 706 must generally be filed along with any tax due within nine months of the decedent's date of death.

You report any income after death on the estate's income tax return or on the tax return of the beneficiary who received it directly. If the decedent's Form 1099 reflects income both prior to and after death, you should request and obtain a corrected 1099.

This means that the Form 706 must be filed within 9 months after the decedent's death or by the last day of the period covered by a timely-filed extension request.

Form 706 must generally be filed along with any tax due within nine months of the decedent's date of death.

If the decedent is a U.S. citizen or resident and decedent's death occurred in 2016, an estate tax return (Form 706) must be filed if the gross estate of the decedent, increased by the decedent's adjusted taxable gifts and specific gift tax exemption, is valued at more than the filing threshold for the year of the

The executor of a decedent's estate uses Form 706 to figure the estate tax imposed by Chapter 11 of the Internal Revenue Code. Form 706 is also used to compute the generation-skipping transfer (GST) tax imposed by Chapter 13 on direct skips.

If the decedent is a U.S. citizen or resident and decedent's death occurred in 2016, an estate tax return (Form 706) must be filed if the gross estate of the decedent, increased by the decedent's adjusted taxable gifts and specific gift tax exemption, is valued at more than the filing threshold for the year of the

person partnership does not terminate upon a partner's death if the deceased partner's successor in interest (usually the estate) continues to share in the partnership's profits or losses (Regs. Sec. 1. 7081(b)(1)(I)).

The form must be filed within nine months of the date of the decedent's death.