Kansas Revocable or Irrevocable Proxy

Description

How to fill out Revocable Or Irrevocable Proxy?

Are you in a situation where you require documents for potentially business or personal tasks almost every day.

There are numerous legal document templates available online, but finding reliable versions can be challenging.

US Legal Forms provides a vast array of document templates, including the Kansas Revocable or Irrevocable Proxy, designed to meet state and federal regulations.

Select the pricing plan you prefer, provide the necessary information to create your account, and make your payment using PayPal or a credit card.

Choose a convenient file format and download your version. Access all the document templates you have purchased in the My documents menu. You can acquire an additional copy of the Kansas Revocable or Irrevocable Proxy at any time if needed. Just select the necessary form to download or print the document template. Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and minimize errors. The service offers professionally crafted legal document templates for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the Kansas Revocable or Irrevocable Proxy template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and confirm it is for the correct city/state.

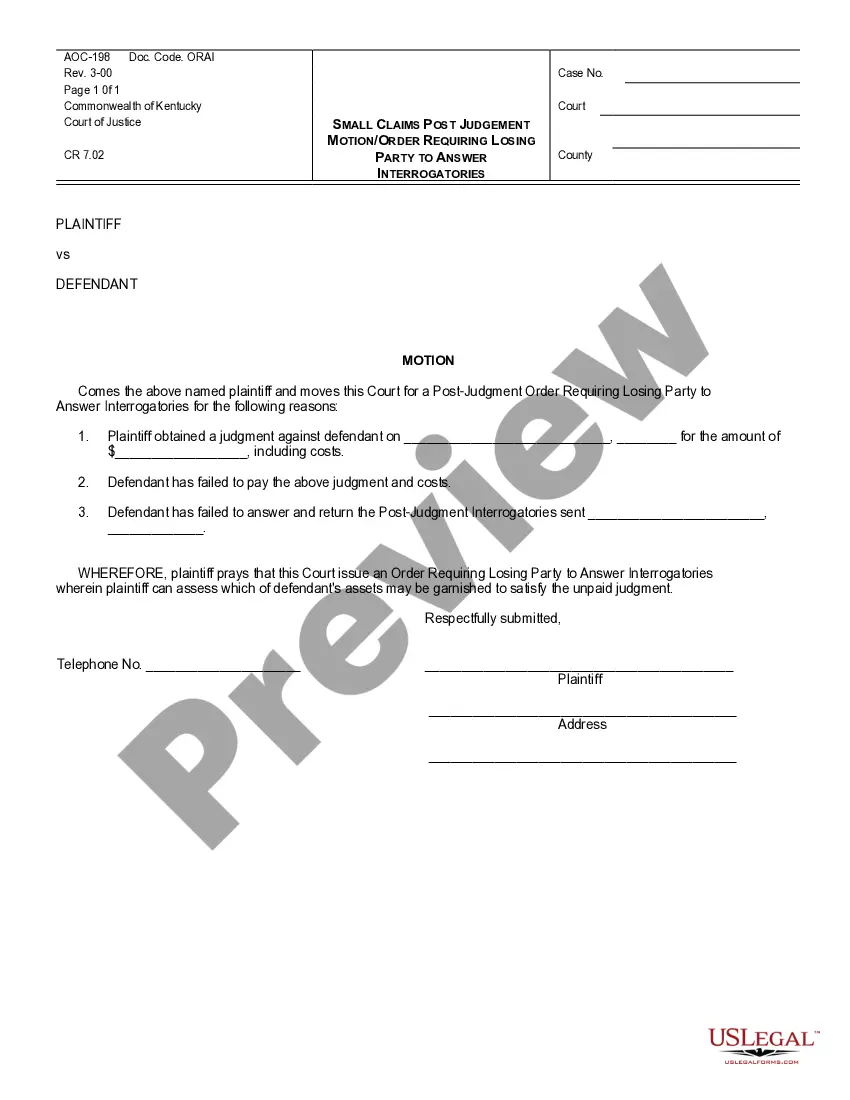

- Use the Review button to review the form.

- Read the description to ensure you have selected the appropriate form.

- If the form is not what you're looking for, use the Search field to find the document that suits your needs and specifications.

- Once you locate the correct form, click on Purchase now.

Form popularity

FAQ

To determine if your trust is a Kansas revocable or irrevocable proxy, review the trust documents. Revocable trusts provide flexibility, allowing you to alter or cancel them at any time during your lifetime. In contrast, irrevocable trusts typically cannot be modified once established, meaning you relinquish control over the assets. If you need assistance identifying your trust type, consider using USLegalForms, which offers tools and resources tailored to guide you through the process.

A revocable proxy means that the authority given to another person to vote on behalf of the original holder can be withdrawn or canceled at will. This arrangement empowers individuals to stay in control of their decisions while still allowing others to represent their interests if necessary. In the framework of Kansas Revocable or Irrevocable Proxy, having clarity on this concept can aid in making informed choices. Moreover, uslegalforms offers resources to effectively draft revocable proxy agreements tailored to your needs.

A revocable proxy allows an individual to assign their voting rights to another person, with the ability to revoke that authority at any time. This flexibility can be beneficial when circumstances change, allowing the original holder to retain control over their decisions. For those navigating Kansas Revocable or Irrevocable Proxy, understanding this distinction is crucial. Utilizing uslegalforms can provide you with the necessary documents to establish a revocable proxy easily.

An example of an irrevocable proxy is a situation where a shareholder grants their voting rights to another person for a specific period, and this authority cannot be rescinded. This type of proxy helps ensure that important decisions are made consistently, without the risk of last-minute changes. In the context of Kansas Revocable or Irrevocable Proxy, it is essential to understand how this commitment can influence business governance. Using platforms like uslegalforms can simplify creating and managing irrevocable proxies.

You generally do not file an irrevocable trust with a court in Kansas, but you should keep it in a safe place and share it with your trustee and beneficiaries. If you're transferring real estate into the trust, you may need to file certain documents with the county recorder's office. For thorough assistance and templates, consider consulting USLegalForms to ensure your Kansas Revocable or Irrevocable Proxy is correctly managed.

Typically, a trustee cannot change the terms of an irrevocable trust once it has been established. This characteristic is what distinguishes irrevocable trusts from revocable ones. However, it’s essential to review the trust's language; USLegalForms offers guidelines to ensure you’re aware of your rights and limitations regarding your Kansas Revocable or Irrevocable Proxy.

Yes, an irrevocable trust must file a tax return, typically using IRS Form 1041. The trust may be subject to its own tax obligations, separate from your personal tax return. Understanding the financial implications of your Kansas Revocable or Irrevocable Proxy setup is crucial, and you might find USLegalForms helpful for tax-related resources.

In some cases, you might be able to decant an irrevocable trust into a revocable trust, depending on state laws and the provisions of the original trust. Make sure to review the terms and consult a legal expert for advice tailored to your situation. If you consider this transition, USLegalForms can assist you in drafting the necessary documents.

The best state to set up an irrevocable trust often depends on your specific needs, but many people find Kansas to be suitable due to its favorable laws and tax treatment. Creating your trust in Kansas can allow for easier management of your assets as per your Kansas Revocable or Irrevocable Proxy preferences. Using USLegalForms can help you navigate state-specific advantages efficiently.

Filing an irrevocable trust involves preparing the trust document and signing it before a notary. After creating the trust, you should consider transferring ownership of your assets to align with your Kansas Revocable or Irrevocable Proxy. Although filing isn't always required, consulting with a platform like USLegalForms can help clarify necessary steps.