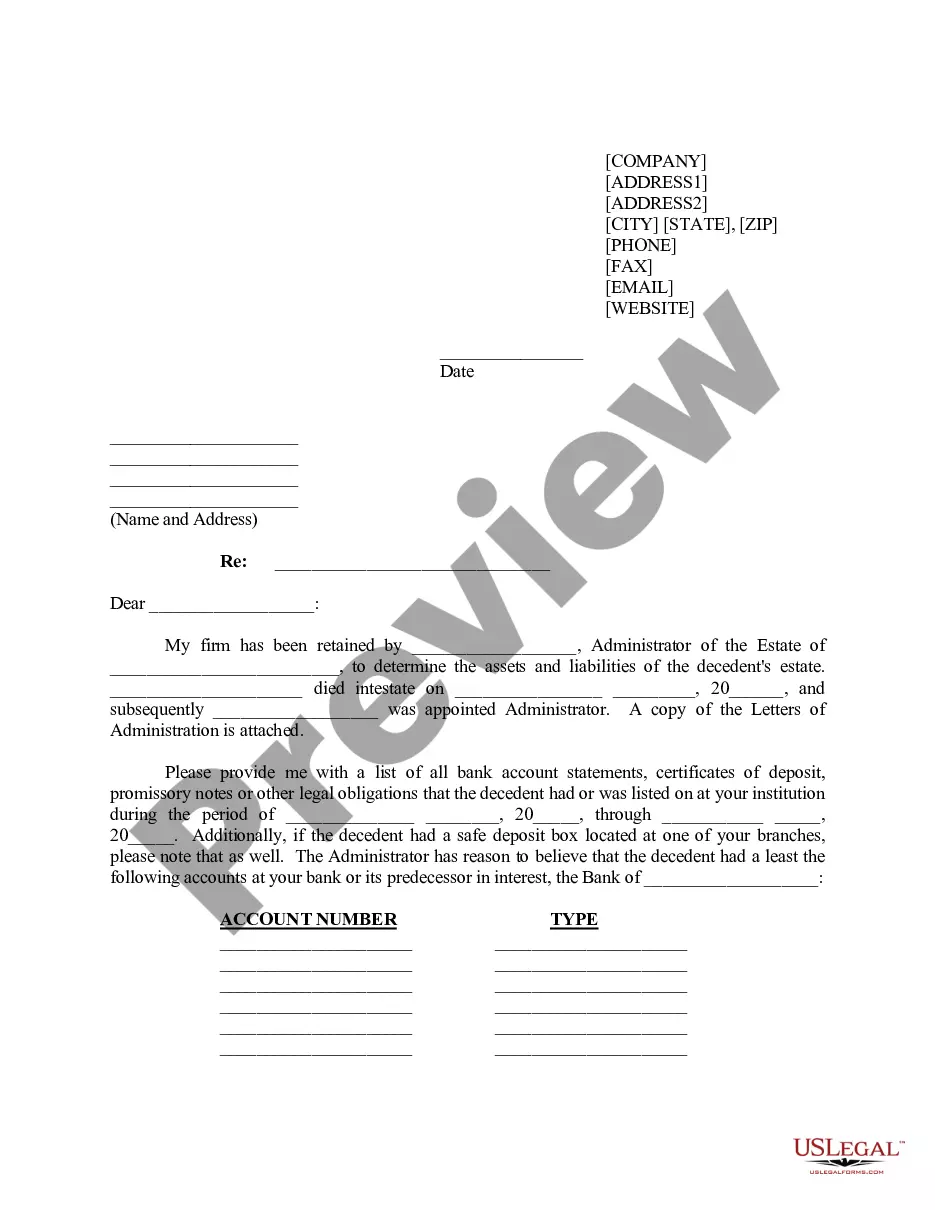

This form anticipates that a decedent left a will directing that all assets in a certain investment account be transferred to a trust. This form is a sample request to the investment firm from the trustee/executor for the assets.

Kansas Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent

Description

How to fill out Letter Of Instruction To Investment Firm Regarding Account Of Decedent From Executor / Trustee For Transfer Of Assets In Account To Trustee Of Trust For The Benefit Of Decedent?

Selecting the appropriate sanctioned document format can pose a challenge.

It goes without saying that there are numerous templates accessible online, but how can you find the sanctioned version you require.

Utilize the US Legal Forms website.

First, ensure you have selected the correct document for your region/state. You can review the form using the Review button and examine the form description to confirm it is suitable for you.

- The service offers thousands of templates, such as the Kansas Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent, usable for both business and personal purposes.

- All templates are verified by professionals and comply with state and federal regulations.

- If you are already a registered user, Log In to your account and click the Acquire button to download the Kansas Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent.

- Utilize your account to search for the sanctioned templates you have acquired previously.

- Visit the My documents tab of your account and download another copy of the document you need.

- If you are a new customer of US Legal Forms, here are simple steps to follow.

Form popularity

FAQ

Mail your Illinois tax return to the department address specified in the instructions accompanying your tax form. Ensure that you send it to the correct location to prevent any processing delays. When dealing with estate issues, the Kansas Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can be valuable for outlining specific instructions.

To file as executor of an estate in Kansas, you must submit a petition for probate to the appropriate county district court. Include necessary documents such as the death certificate and the will. A clear understanding of the probate process can be beneficial; the Kansas Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can clarify executor responsibilities.

File IL 1041 with the Illinois Department of Revenue at the address specified in the form's instructions. It is important to file at the correct location to avoid delays in processing. Many find that the Kansas Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent serves as a helpful guide in this process.

You should mail form IL 1041, the Illinois Income Tax Return for Estates and Trusts, to the address provided in the form's instructions. Proper mailing is essential to ensure your return is processed timely. For those managing decedent accounts, consider using the Kansas Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent to facilitate asset transfers.

Fiduciary income tax in Kansas applies to estates and trusts generating income. This tax is calculated based on the income earned by the estate or trust during the tax year. Understanding this tax is crucial, and utilizing a Kansas Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can help ensure compliance.

Yes, a complex trust typically issues a Schedule K-1 to its beneficiaries. This document reports each beneficiary's share of the trust's income, deductions, and credits for the year. If you are navigating the complexities of trusts, utilizing the Kansas Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can ease communication with service firms.

You should file your Illinois estate tax return with the Illinois Department of Revenue. It's important to ensure you submit the return on time to avoid any potential penalties. For those needing assistance, using the Kansas Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can clarify the process and requirements.

When a trustee of an irrevocable trust passes away, the trust document typically outlines the procedure for appointing a successor trustee. This ensures that the management of the trust continues without interruption. It is beneficial to include a Kansas Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent for clear directives on handling the trust's assets during this transition.

An irrevocable trust is distributed according to the terms specified in the trust agreement. The trustee has the responsibility to manage and distribute the assets as directed in the trust document. Using tools like the Kansas Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can help ensure that financial institutions follow the intended distribution plan.

To obtain a letter of administration in Kansas, you must file a petition with the probate court in the county where the decedent resided. This process typically involves submitting necessary documentation and attending a court hearing. Consulting with a legal expert can further streamline this process, ensuring that you adequately prepare your Kansas Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent.