If you need to full, obtain, or print out legal document templates, use US Legal Forms, the largest assortment of legal forms, that can be found on the Internet. Use the site`s basic and handy look for to get the documents you want. Different templates for business and specific reasons are sorted by groups and claims, or keywords. Use US Legal Forms to get the Kansas Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company within a couple of mouse clicks.

If you are currently a US Legal Forms consumer, log in to the account and then click the Acquire key to find the Kansas Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company. You can also access forms you formerly acquired within the My Forms tab of the account.

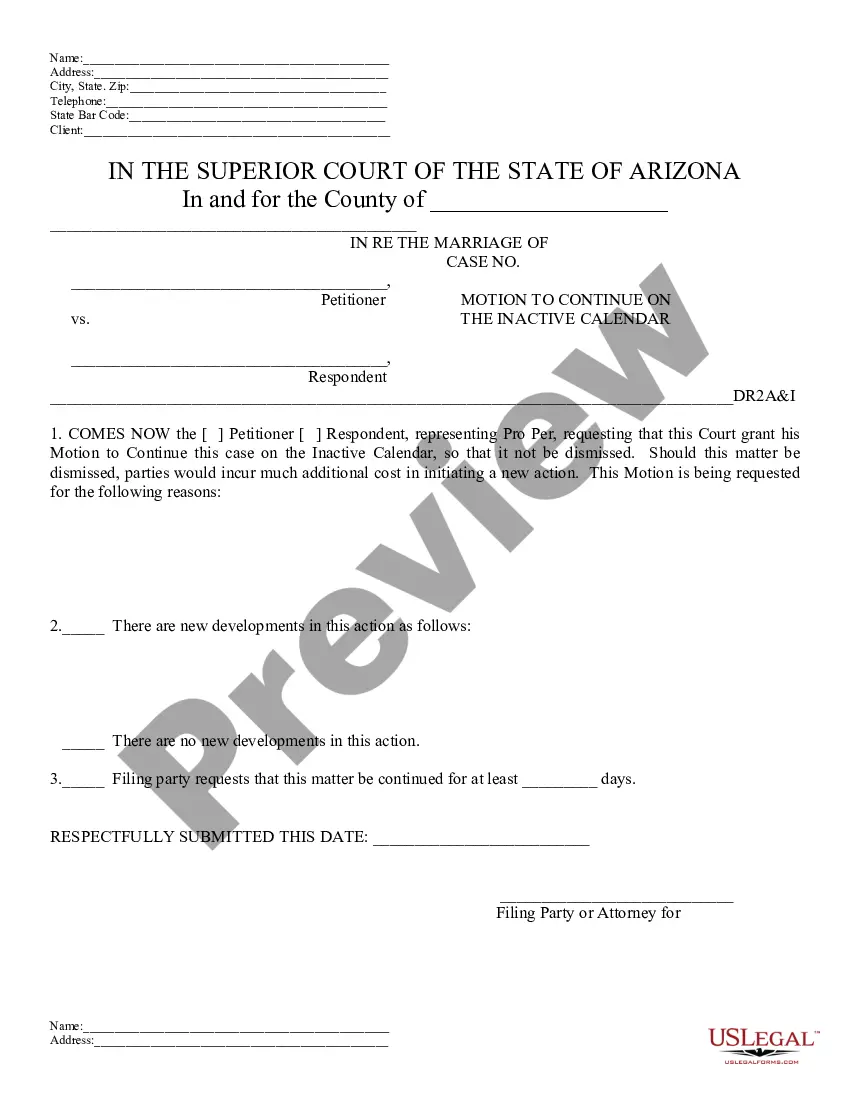

If you are using US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the form for the appropriate town/nation.

- Step 2. Take advantage of the Review solution to check out the form`s information. Do not overlook to read the information.

- Step 3. If you are unhappy with the develop, make use of the Lookup industry at the top of the monitor to discover other types from the legal develop format.

- Step 4. Once you have discovered the form you want, select the Acquire now key. Choose the rates strategy you choose and add your qualifications to register for the account.

- Step 5. Method the financial transaction. You should use your Мisa or Ьastercard or PayPal account to complete the financial transaction.

- Step 6. Pick the formatting from the legal develop and obtain it on the product.

- Step 7. Full, change and print out or indicator the Kansas Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company.

Each legal document format you buy is the one you have forever. You might have acces to every single develop you acquired inside your acccount. Click the My Forms portion and select a develop to print out or obtain yet again.

Compete and obtain, and print out the Kansas Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company with US Legal Forms. There are millions of skilled and condition-particular forms you can use for your business or specific requirements.