Kansas Sample Letter for Withheld Delivery

Description

How to fill out Sample Letter For Withheld Delivery?

If you aim to be thorough, acquire, or produce sanctioned document templates, utilize US Legal Forms, the largest repository of legal forms, which can be accessed online.

Employ the website's straightforward and user-friendly search to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours forever. You will have access to every form you previously downloaded within your account. Click on the My documents section and select a form to print or download again.

Be proactive and acquire, and print the Kansas Sample Letter for Withheld Delivery with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Step 1. Ensure you have selected the form for the correct city/state.

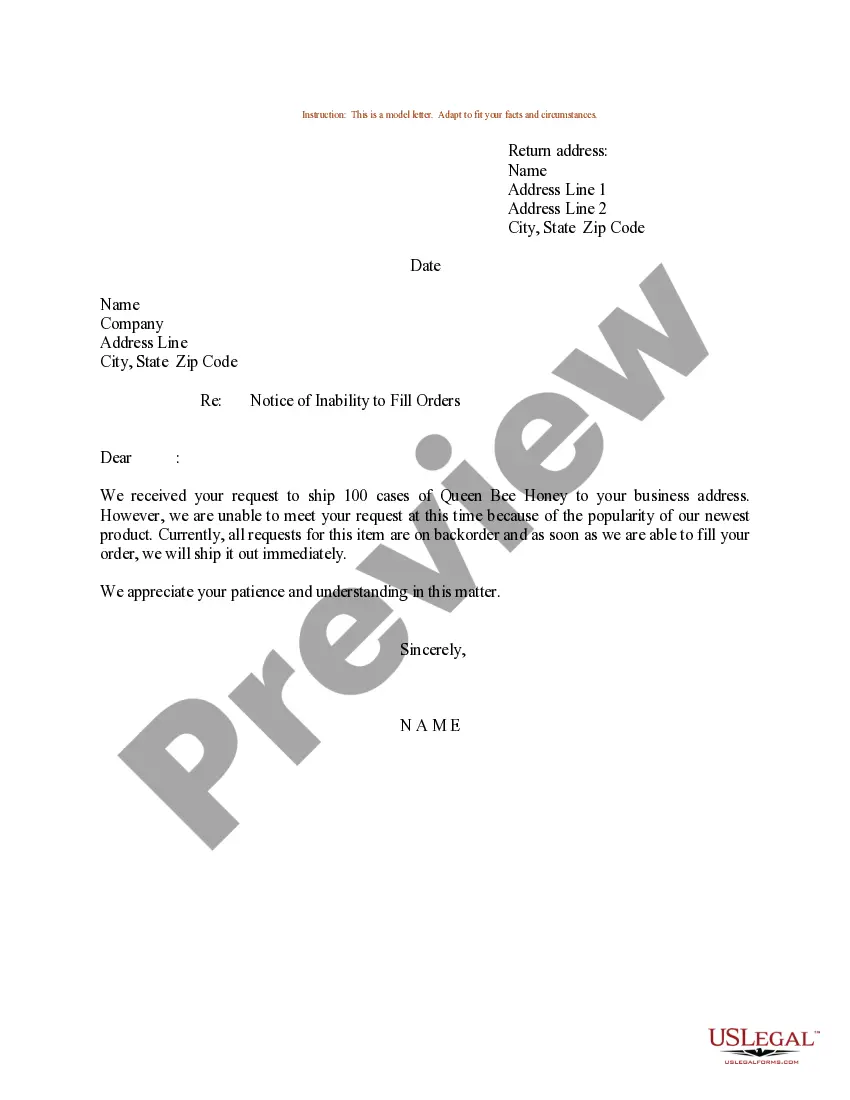

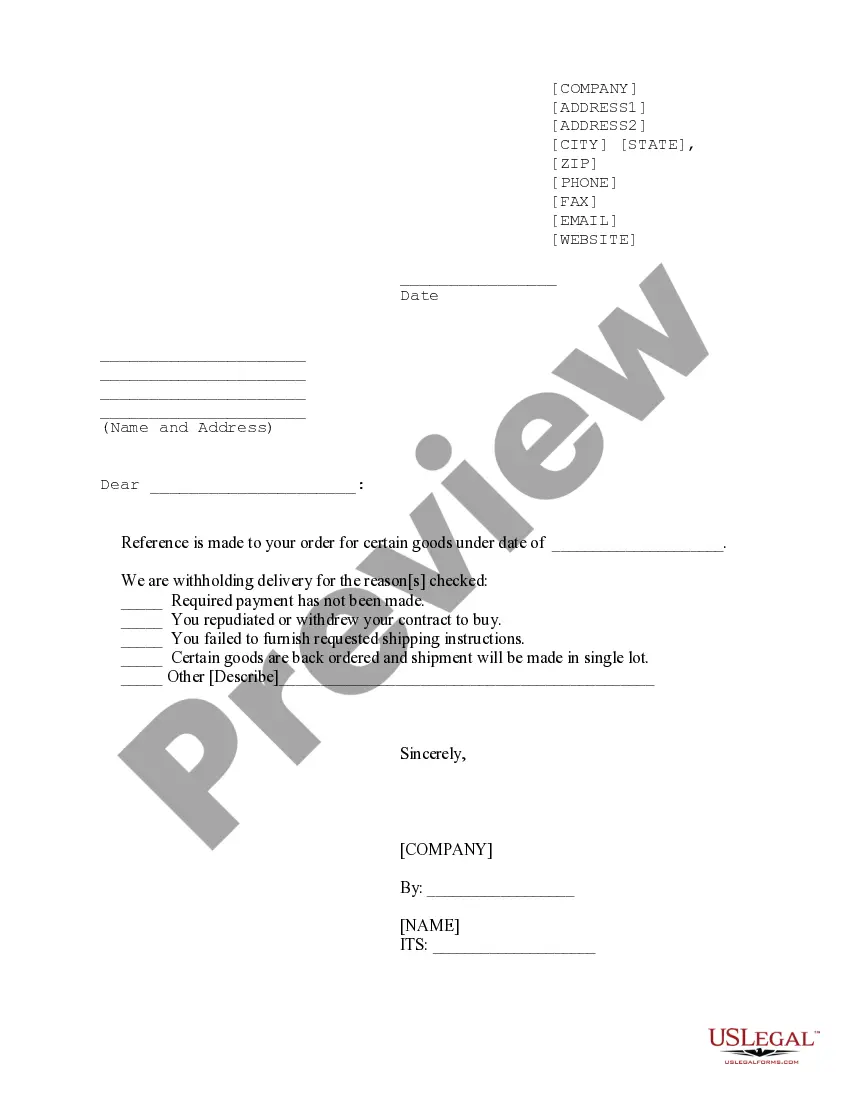

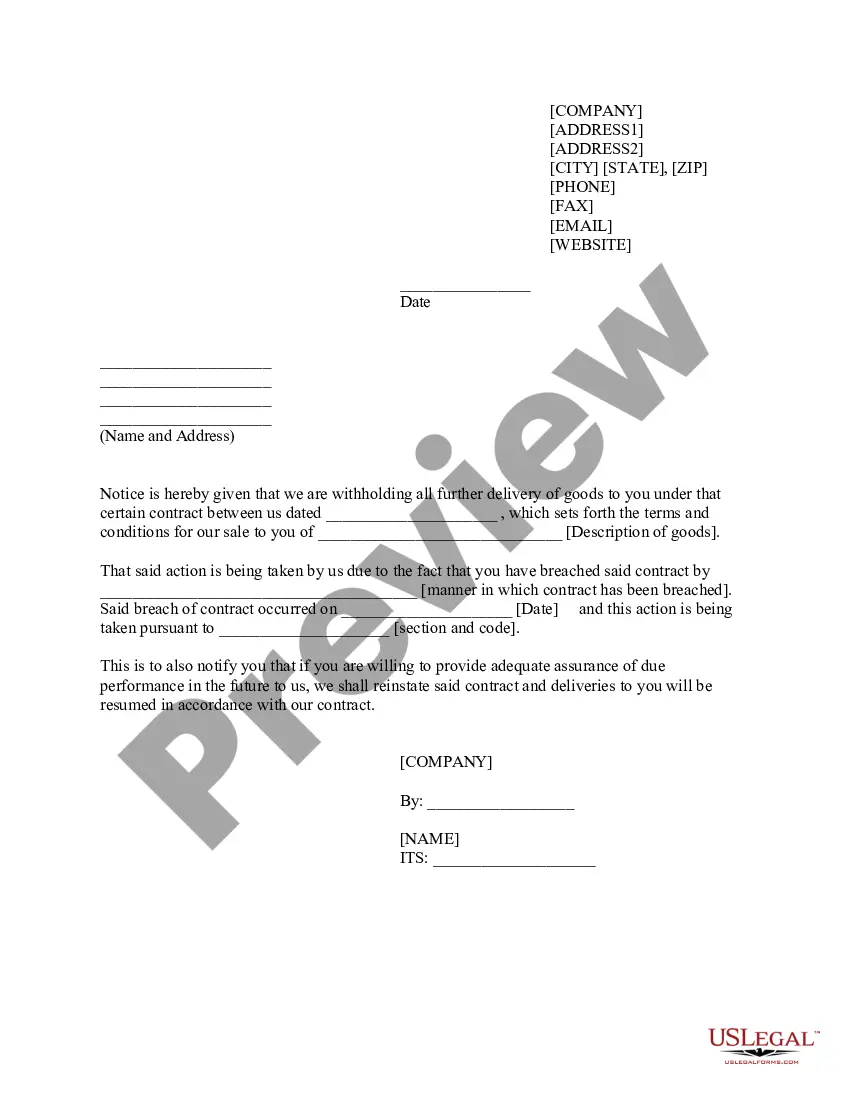

- Step 2. Utilize the Review option to examine the form's contents. Remember to read through the details.

- Step 3. If you are dissatisfied with the type, use the Search field at the top of the screen to find other templates of the legal form type.

- Step 4. After locating the form you need, click on the Buy now button. Choose the pricing plan you prefer and input your credentials to register for an account.

- Step 5. Process the payment. You may utilize your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Kansas Sample Letter for Withheld Delivery.

Form popularity

FAQ

Exemptions from Kansas withholding can arise from various factors, including types of income or specific tax statuses. If your income is below a certain level or if you fall into a tax-exempt category, you may qualify. Understanding your situation is key, so consider using a Kansas Sample Letter for Withheld Delivery to outline your exemption.

You may be exempt from Kansas withholding if your income does not meet the state’s filing threshold. Additionally, certain tax-exempt organizations may qualify for exemption. To confirm your status and apply necessary documentation, a Kansas Sample Letter for Withheld Delivery can be beneficial.

The partnership itself is responsible for withholding on partnership income. This includes withholding taxes for nonresident partners in accordance with Kansas law. To make this process easier, consider referring to a Kansas Sample Letter for Withheld Delivery as a guideline.

To fill out a Kansas withholding form, begin by gathering the necessary information about the employee or partner. Include their personal details, such as name and Social Security number, and ensure you understand the withholding rates. Utilizing forms and templates, such as a Kansas Sample Letter for Withheld Delivery, can streamline the process.

Several states, including Kansas, require nonresident withholding. Each state has its specific regulations around nonresident income and tax obligations. Understanding these requirements can prevent issues, so using a Kansas Sample Letter for Withheld Delivery may help you stay compliant.

Yes, Kansas mandates nonresident partner withholding. If a partnership has nonresident partners, it must withhold taxes on their share of Kansas income. This can be a complex task, and utilizing resources like a Kansas Sample Letter for Withheld Delivery can simplify documentation.

Yes, Kansas is a mandatory withholding state. Employers are required to withhold state income tax from employees' wages. This requirement also applies to certain payments to nonresidents. To navigate this process effectively, consider using a Kansas Sample Letter for Withheld Delivery as a template.

Yes, Kansas state withholding regulations can change periodically, reflecting new tax laws or budget adjustments. It’s crucial to stay informed about these updates to ensure compliance and effective tax planning. Utilizing a Kansas Sample Letter for Withheld Delivery can assist you in addressing any concerns or questions related to changes in withholding practices. Keeping abreast of these changes helps you manage your finances more effectively.

Proof of Kansas withholding refers to the documentation showing that the state has withheld a portion of your income for tax purposes. This proof is often necessary when you apply for tax refunds or verify your income status. Using a Kansas Sample Letter for Withheld Delivery can help you formally request this information from your employer or the state. It's essential to keep these records, as they provide clear evidence of your tax contributions.