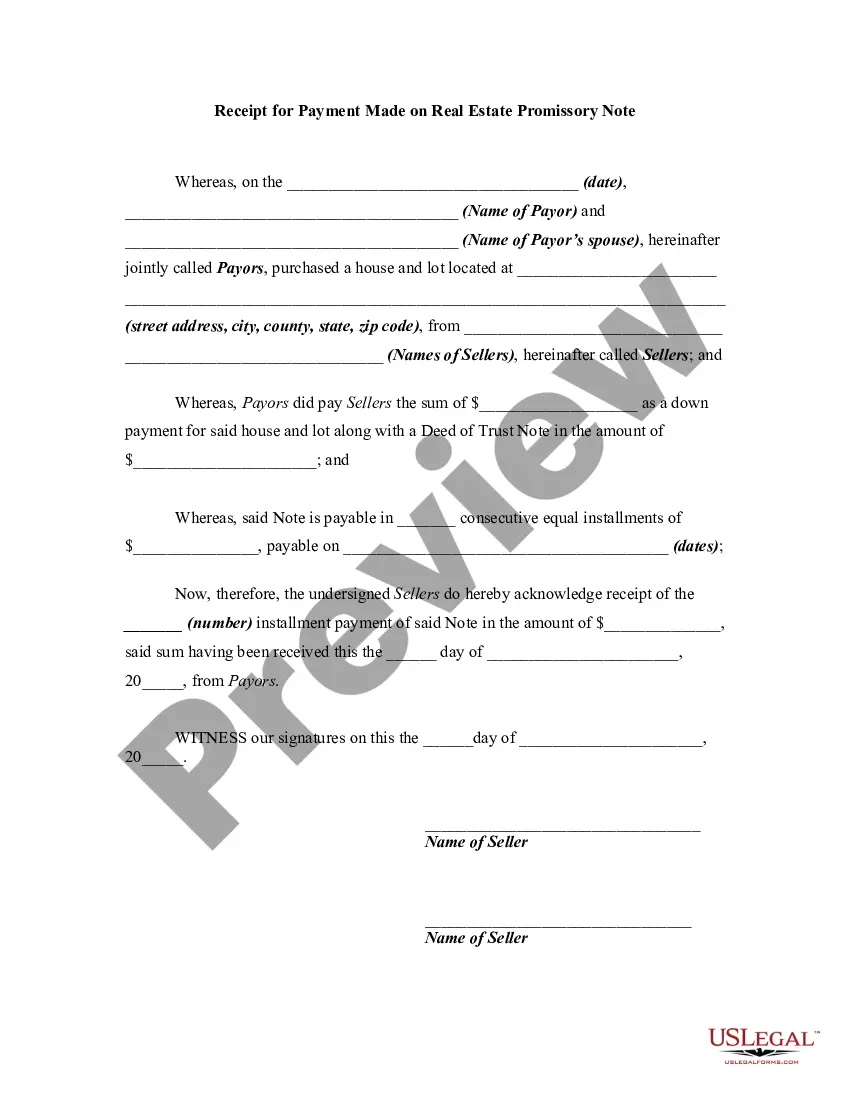

In this form, the beneficiary of a trust acknowledges receipt from the trustee of all monies due to him/her pursuant to the terms of the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Kansas Receipt for Payment of Trust Fund and Release

Description

How to fill out Receipt For Payment Of Trust Fund And Release?

Locating the appropriate legal document template can be a challenge.

Certainly, there are numerous online templates available on the web, but how can you find the legal form you need? Utilize the US Legal Forms website.

This service provides thousands of templates, such as the Kansas Receipt for Payment of Trust Fund and Release, suitable for both business and personal purposes. All forms are reviewed by professionals and satisfy state and federal requirements.

If the form does not fulfill your requirements, utilize the Search field to find the appropriate form. Once you confirm that the form is suitable, click the Get now button to obtain it. Select the pricing plan you want and provide the required information. Create your account and complete your purchase using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Fill out, modify, print, and sign the acquired Kansas Receipt for Payment of Trust Fund and Release. US Legal Forms is the largest collection of legal templates where you can find various document templates. Use the service to download professionally crafted documents that comply with state requirements.

- If you are already registered, Log In to your account and select the Download option to obtain the Kansas Receipt for Payment of Trust Fund and Release.

- Use your account to search for the legal forms you have previously purchased.

- Navigate to the My documents section of your account to retrieve another copy of the document you need.

- If you're a new user of US Legal Forms, follow these straightforward steps.

- First, ensure you have chosen the correct form for your city/region.

- You can review the form using the Review option and read the form details to confirm it's right for you.

Form popularity

FAQ

A trust fund example could be an education trust established to cover college expenses for a child or grandchild. In this case, the trust holds the funds until the beneficiary reaches a certain age or meets specific criteria. When the distribution occurs, the trustee issues a Kansas Receipt for Payment of Trust Fund and Release, ensuring transparency and legality in the transaction. This structure helps safeguard the funds while achieving the intended goal.

The best person to set up a trust usually is an attorney experienced in estate planning or trust law. They can provide tailored advice based on your specific situation, helping you avoid common pitfalls. You may also consider financial advisors who specialize in trusts, as they can guide you through the setup process, ensuring you receive a Kansas Receipt for Payment of Trust Fund and Release as proof of the transaction.

Filling out a trust fund typically requires you to provide detailed information about the assets you wish to place in the trust. You'll need to indicate the beneficiaries and the terms of distribution clearly. Utilizing platforms like US Legal Forms can simplify this process by offering templates that guide you in generating a Kansas Receipt for Payment of Trust Fund and Release, ensuring you meet all legal requirements.

To release funds from a trust, you need to follow specific guidelines set forth in the trust document. Usually, this involves submitting a written request to the trustee along with any necessary supporting documentation. Once approved, the trustee will provide a Kansas Receipt for Payment of Trust Fund and Release, confirming the transaction. It's important to ensure all parties involved are informed throughout this process.

One major mistake parents make is failing to designate clear beneficiaries and guidelines for the distribution of trust assets. Without clarity, beneficiaries may experience confusion and disputes over the trust's intent. It is essential to address these points, especially in the context of the Kansas Receipt for Payment of Trust Fund and Release, ensuring smooth transactions when the time comes.

Trust funds are disbursed based on the terms outlined in the trust document, which may specify timing and conditions for distributions. The trustee is responsible for ensuring that these distributions are made in accordance with Kansas law. Typically, beneficiaries receive proper documentation, such as the Kansas Receipt for Payment of Trust Fund and Release, to confirm their disbursements.

In Kansas, a trust operates by transferring ownership of assets from the grantor to the trust, managed by a trustee for the benefit of beneficiaries. The trustee has the responsibility to manage these assets according to the trust's instructions. Understanding how trust management works is crucial, especially when dealing with the Kansas Receipt for Payment of Trust Fund and Release.

As a beneficiary, you become entitled to receive assets held in the trust according to its terms. You also gain the right to request information and ensure that the trust is managed properly according to Kansas law. This position can significantly impact your financial future, particularly relating to the Kansas Receipt for Payment of Trust Fund and Release.

A receipt and release of trustee is a formal document acknowledging the receipt of trust funds and releasing the trustee from further obligations. This document helps to clarify that the beneficiary has received the benefits due to them without any claims against the trustee. It plays a vital role in transactions involving the Kansas Receipt for Payment of Trust Fund and Release.

In Kansas, trust beneficiaries have the right to receive distributions, inspect trust documents, and request regular accountings. Beneficiaries are entitled to fair treatment by the trustee, ensuring that their interests are respected. Knowing these rights can empower you in discussions around the Kansas Receipt for Payment of Trust Fund and Release.