Kansas Letter Tendering Payment

Description

How to fill out Letter Tendering Payment?

Are you currently in a location where you require documents for both business or specific purposes nearly every day.

There are various legal document templates available online, but locating trustworthy ones can be challenging.

US Legal Forms offers thousands of form templates, such as the Kansas Letter Tendering Payment, designed to comply with federal and state requirements.

Once you locate the appropriate form, click Purchase now.

Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Kansas Letter Tendering Payment template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct city/state.

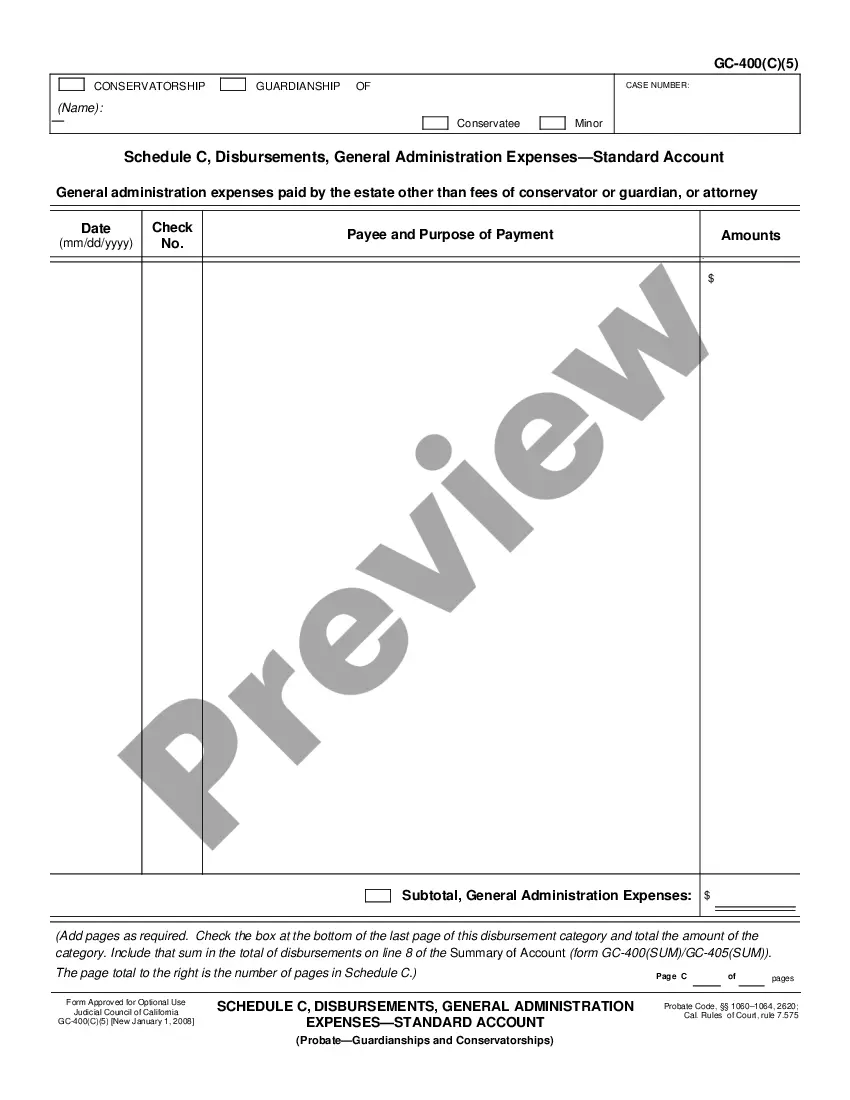

- Use the Preview option to review the form.

- Check the description to ensure that you have selected the correct form.

- If the form is not what you're looking for, utilize the Search section to find the form that fits your needs and requirements.

Form popularity

FAQ

The Kansas Secretary of State handles various important functions, such as managing business registrations, overseeing elections, and maintaining public records. This office plays a crucial role in maintaining transparency and compliance in state governance. If you receive a Kansas Letter Tendering Payment that involves business or election-related fees, the Secretary of State’s office can guide you on the next steps.

The Kansas Department of Education sets policies, provides guidance, and ensures educational standards are met across the state. They help in managing funding for public education and support initiatives to improve student outcomes. If you encounter a Kansas Letter Tendering Payment related to educational assessments or fees, this department will be the right contact to resolve your concerns.

The Kansas Department of Administration oversees the state’s budget management and offers administrative support to various state agencies. They ensure the effective use of public resources. When dealing with issues related to state payments, including a Kansas Letter Tendering Payment, contacting this department can provide clarity on financial obligations.

You might receive a letter from the Kansas Department of Revenue for various reasons, such as outstanding tax obligations or important updates regarding your tax status. This notification could include a Kansas Letter Tendering Payment, requesting action on your part. Addressing these letters promptly helps you maintain compliance and avoid additional penalties.

The Kansas Department of Revenue manages state taxes and oversees vehicle registrations. They ensure compliance with tax laws and collect revenue needed for public services. If you receive a Kansas Letter Tendering Payment, it may involve tax payments or other dues required by the department.

Prompt payment required means that payments must be made within a specified time frame agreed upon by both parties in a transaction. For employers and employees in Kansas, this emphasizes the importance of timely funding of wages as described in the Kansas Letter Tendering Payment. Adhering to this principle fosters trust and stability in workplace relationships.

Handling withholding taxes requires careful tracking of employee earnings and timely remittances to the state. It is essential to stay informed about tax rates and regulations that affect your business. A Kansas Letter Tendering Payment can facilitate the payment process and keep your records organized. If you need assistance, platforms like uslegalforms can offer valuable resources to manage your tax obligations efficiently.

To post withholding tax in Kansas, you will need to accurately calculate the amounts based on employee wages and complete the necessary tax forms. Ensure you submit your filings according to the deadlines to avoid any issues. Utilizing a Kansas Letter Tendering Payment can streamline the process and provide a clear record of your submissions. Remember to keep copies of all documents for your records.

You can mail your Kansas tax payment to the address specified on your tax form. Generally, the payment should go to the Kansas Department of Revenue, P.O. Box 750280, Topeka, Kansas 66675-0280. To ensure your payment is processed correctly and on time, consider using a Kansas Letter Tendering Payment as part of your submission. Always check the latest guidelines for any changes to the mailing process.

If you need to contact the Kansas setoff program, you can reach them at (785) 368-8222. This program assists in collecting debts owed to the state through tax refunds. Maintaining accurate records and utilizing a Kansas Letter Tendering Payment can help facilitate smoother transactions. Don't hesitate to call for guidance on your specific situation.