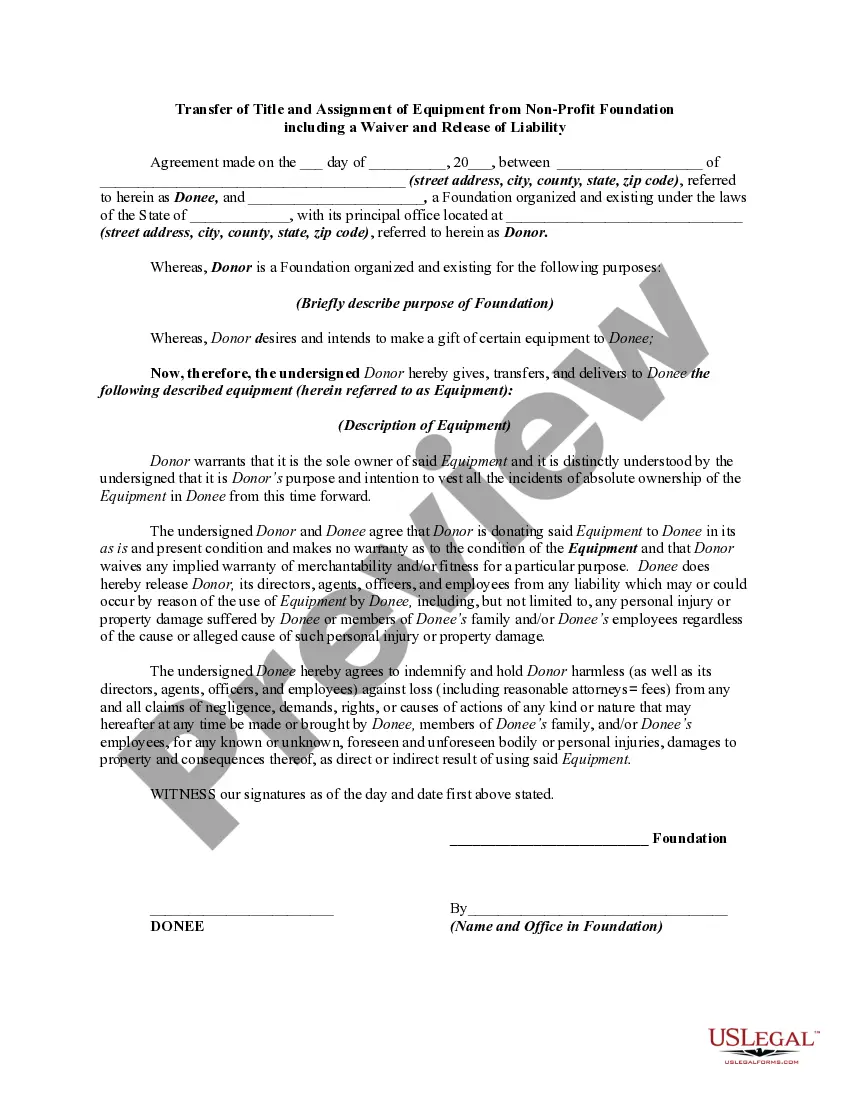

Kansas Transfer of Title and Assignment of Equipment from Nonprofit Foundation including a Waiver and Release of Liability

Description

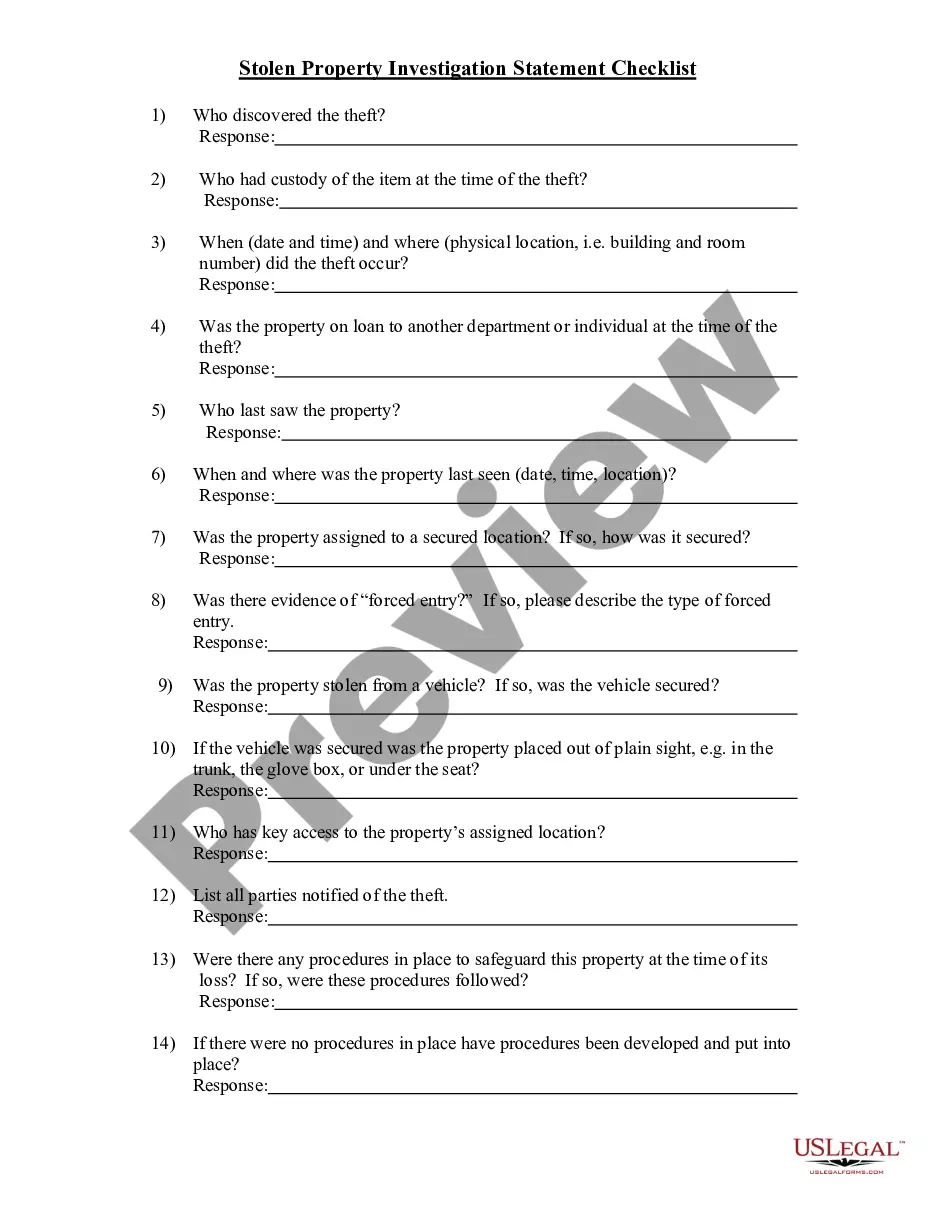

How to fill out Transfer Of Title And Assignment Of Equipment From Nonprofit Foundation Including A Waiver And Release Of Liability?

If you need to gather, acquire, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Leverage the website's straightforward and user-friendly search to find the documents you require.

A range of templates for business and personal uses are organized by categories and states, or keywords.

Step 5. Complete the transaction. You can use your Misa or MasterCard, or PayPal account to finalize the payment.

Step 6. Choose the format of the legal document and download it to your device. Step 7. Complete, edit, and print or sign the Kansas Transfer of Title and Assignment of Equipment from Nonprofit Foundation, including a Waiver and Release of Liability. Each legal document template you acquire is yours permanently. You will have access to every form you downloaded in your account. Navigate to the My documents section and select a document to print or download again. Be proactive and obtain, and print the Kansas Transfer of Title and Assignment of Equipment from Nonprofit Organization, including a Waiver and Release of Liability from US Legal Forms. Numerous professional and state-specific forms are available for your business or personal requirements.

- Use US Legal Forms to access the Kansas Transfer of Title and Assignment of Equipment from Nonprofit Organization, along with a Waiver and Release of Liability, with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to obtain the Kansas Transfer of Title and Assignment of Equipment from Nonprofit Organization, including a Waiver and Release of Liability.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow these steps.

- Step 1. Confirm that you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form's details. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you find the form you need, click the Buy now button. Choose your preferred pricing strategy and enter your information to register for an account.

Form popularity

FAQ

Does Kansas require a notary on documents submitted for application for title and registration? The Kansas Division of Vehicles does not require most title assignments, title applications and bills of sale completed within Kansas to be notarized.

Financial Actions Once the decision has been made to dissolve, the nonprofit must stop transacting business, except to wind down its activities. The assets of a charitable nonprofit can only be used for exempt purposes. 6feff This means that assets may not go to staff or board members.

The release of lien for an electronic title may be accomplished by providing this completed form to the person who satisfied the lien, purchased the vehicle, or requested the release, and/or by faxing it to the Title & Registration Bureau at (785) 296-2383 or e-mail to KDORlienrelease@ks.gov .

The nonprofit corporation generally owns assets of the business and is entitled to receive the revenue from its operation. Many nonprofits are managed by boards, others may be managed by voting members, some are managed by a combination of those.

Because of its tax exempt status, nonprofit assets cannot be distributed to business members. Such distribution would violate the nonprofit status of the company. You are not permitted to give away or sell the assets of a nonprofit, but must rather transfer them to a similar nonprofit organization.

Explanation. A nonprofit corporation can buy and sell assets, similar to a profit-oriented entity. The fact that the nonprofit doesn't operate with a profit motive doesn't preclude it from signing a contract, borrowing and purchasing resources deemed operationally essential.

A nonprofit corporation can buy and sell assets, similar to a profit-oriented entity. The fact that the nonprofit doesn't operate with a profit motive doesn't preclude it from signing a contract, borrowing and purchasing resources deemed operationally essential.

A nonprofit corporation has no owners (shareholders) whatsoever. Nonprofit corporations do not declare shares of stock when established. In fact, some states refer to nonprofit corporations as non-stock corporations.

Financial Actions Once the decision has been made to dissolve, the nonprofit must stop transacting business, except to wind down its activities. The assets of a charitable nonprofit can only be used for exempt purposes. 6feff This means that assets may not go to staff or board members.

The first step in the voluntary dissolution process is the approval by the majority of the board of directors or members, or both, to elect to wind up and dissolve the nonprofit corporation. (Corporations Code, sections 5033, 5034, 6610, 6610.5, 8610, 8610.5, 9680.)