Kansas Sample Letter to City Clerk regarding Ad Valorem Tax Exemption

Description

How to fill out Sample Letter To City Clerk Regarding Ad Valorem Tax Exemption?

If you wish to finalize, acquire, or create valid document templates, utilize US Legal Forms, the primary collection of lawful forms available online.

Employ the site’s straightforward and efficient search to locate the documents you require. Various templates for business and personal purposes are organized by categories and states, or keywords.

Utilize US Legal Forms to find the Kansas Sample Letter to City Clerk regarding Ad Valorem Tax Exemption within just a few clicks.

Every legal document template you purchase is yours permanently. You have access to every form you downloaded within your account. Click on the My documents section and select a form to print or download again.

Stay competitive and acquire, and print the Kansas Sample Letter to City Clerk regarding Ad Valorem Tax Exemption with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to locate the Kansas Sample Letter to City Clerk regarding Ad Valorem Tax Exemption.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

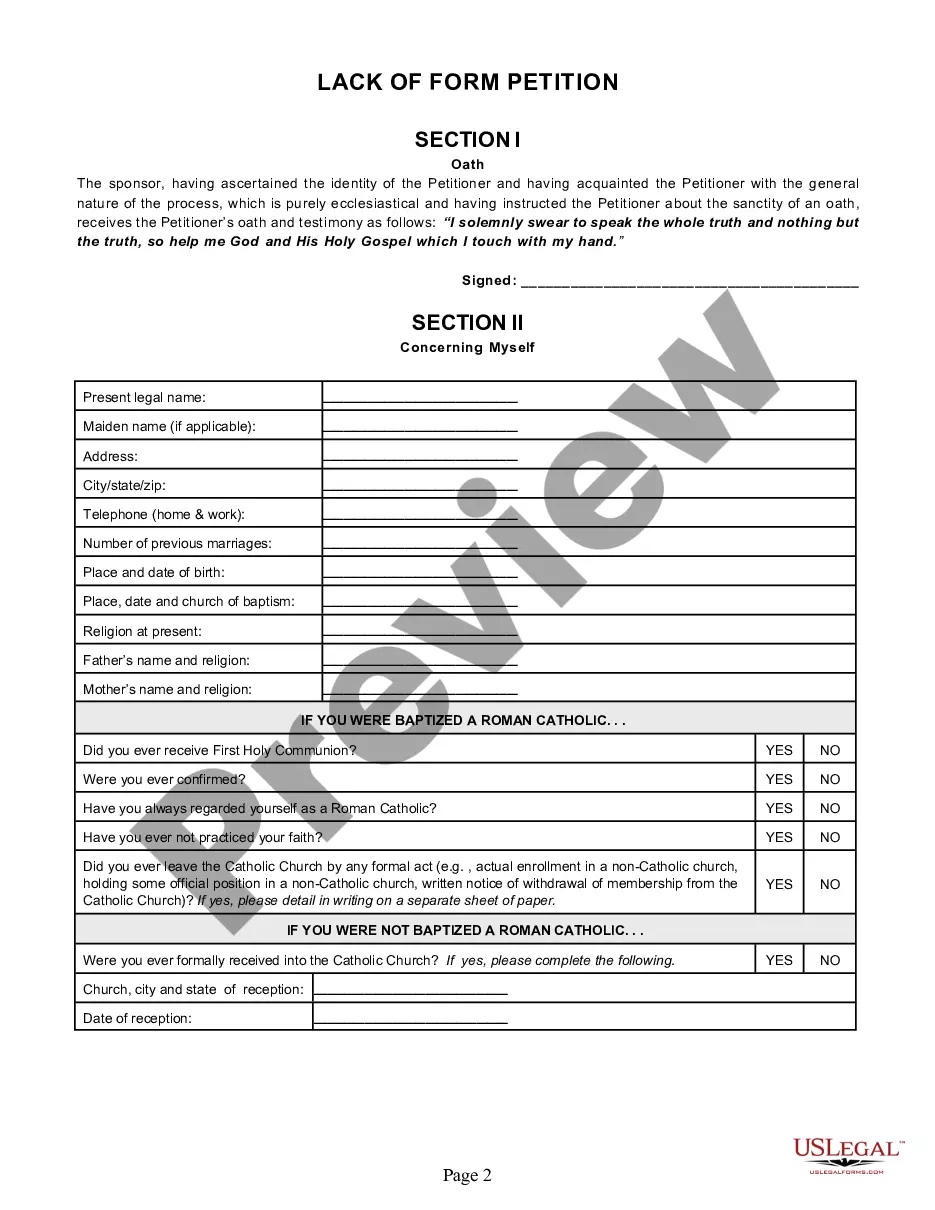

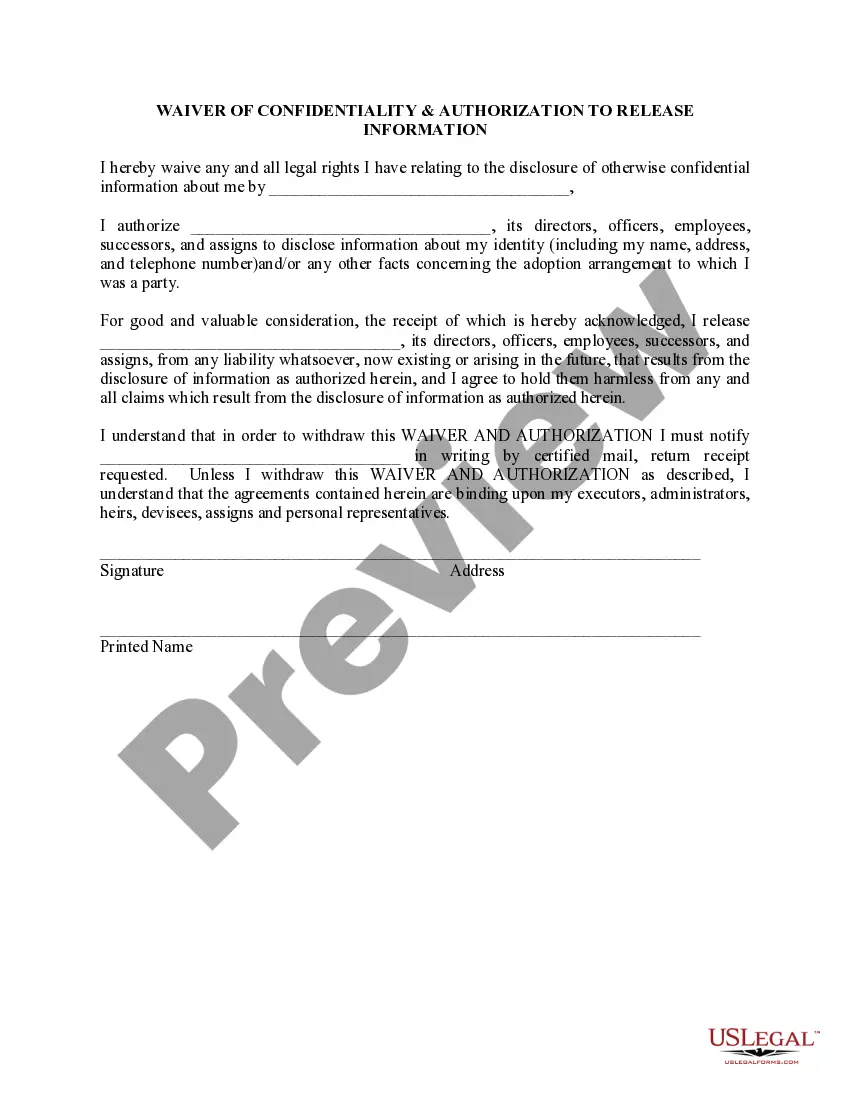

- Step 2. Use the Preview option to review the form’s content. Don't forget to read the description.

- Step 3. If you are not satisfied with the template, use the Search field at the top of the screen to find alternative models in the legal form template.

- Step 4. Once you have found the form you desire, select the Purchase now button. Choose the payment plan you prefer and enter your information to create an account.

- Step 5. Process the payment. You can use your Visa or Mastercard or PayPal account to complete the transaction.

- Step 6. Retrieve the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Kansas Sample Letter to City Clerk regarding Ad Valorem Tax Exemption.

Form popularity

FAQ

Only goods or merchandise intended for resale (inventory) are exempt. Tools, equipment, fixtures, supplies, and other items purchased for business or personal use are TAXABLE since the buyer is the final consumer of the property.

Government Exemptions Property used exclusively for state, municipal or political subdivision purposes, including leased vehicles if leased for a period of at least one year and property leased for medical services and certain property funded by industrial revenue bonds, up to 10 years.

In fact, in some states, inventory carries additional taxes, though the exact amount varies by location. This means that inventory is one of those expenses that is very difficult to offset come tax time, and you need to be aware of how much you can afford to keep.

To claim exempt status on purchases, the qualified entity and organization must be authorized by statute and provide to the retailer a department issued Tax Entity Exemption Certificate. The certificate must be completed and signed by an authorized agent of the organization and presented to the seller.

Some goods are exempt from sales tax under Kansas law. Examples include farm machinery and equipment, prescription drugs, and some medical devices.

Inventory affects a company's taxable income by reducing the amount of revenue that is subject to taxation. By deducting the cost of goods sold from revenue, businesses can lower their taxable income and, thus, their tax liability.

Inventory Tax Exemption All merchants' and manufacturers' inventories have been exempt from property taxes by constitutional amendment since 1989 (K.S.A. 79-201m).

How do I value my inventory for tax purposes? Your inventory should be valued at your purchase cost. Items that cannot be sold or are "worthless" can be taken out of inventory, and the loss is reflected as a higher cost of goods sold on your tax return. (You have the cost of the item, but no revenue for the sale).