Kansas Letter to Creditors Notifying Them of Identity Theft for New Accounts

Description

How to fill out Letter To Creditors Notifying Them Of Identity Theft For New Accounts?

Are you currently in the position where you will need documents for either organization or individual reasons almost every day time? There are a variety of legal document templates available on the Internet, but finding ones you can rely on isn`t effortless. US Legal Forms delivers a huge number of kind templates, just like the Kansas Letter to Creditors Notifying Them of Identity Theft for New Accounts, that happen to be published to satisfy federal and state demands.

When you are currently informed about US Legal Forms site and have a merchant account, merely log in. Following that, you are able to down load the Kansas Letter to Creditors Notifying Them of Identity Theft for New Accounts template.

If you do not provide an bank account and wish to start using US Legal Forms, abide by these steps:

- Discover the kind you need and make sure it is for your right town/region.

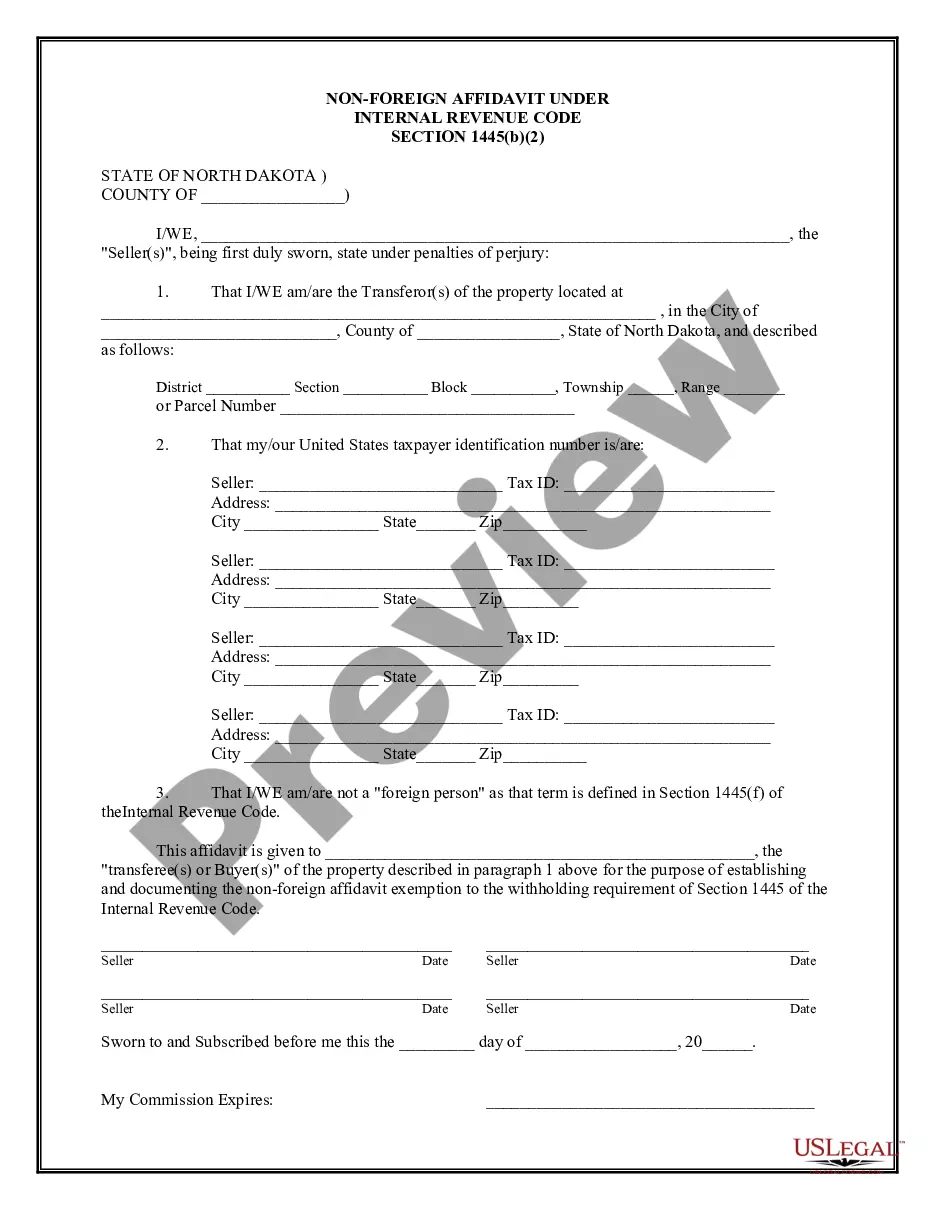

- Make use of the Preview button to examine the form.

- Look at the outline to actually have chosen the right kind.

- In case the kind isn`t what you are searching for, make use of the Search field to find the kind that meets your requirements and demands.

- If you get the right kind, just click Buy now.

- Choose the costs prepare you would like, fill out the specified info to create your account, and purchase your order utilizing your PayPal or charge card.

- Select a practical data file formatting and down load your duplicate.

Find all of the document templates you have purchased in the My Forms menus. You can obtain a extra duplicate of Kansas Letter to Creditors Notifying Them of Identity Theft for New Accounts at any time, if possible. Just click the needed kind to down load or printing the document template.

Use US Legal Forms, probably the most considerable assortment of legal kinds, to conserve efforts and stay away from faults. The support delivers appropriately produced legal document templates that can be used for a range of reasons. Create a merchant account on US Legal Forms and start creating your life a little easier.

Form popularity

FAQ

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

As a severity level 8, nonperson felony, identity theft is punishable by a maximum of 11 months in prison and a fine of up to $100,000.

Sample dispute letter to credit reporting agencies: [RE: Your Account Number (if known)] Dear Sir or Madam: I am a victim of identity theft and I write to dispute certain information in my file resulting from the crime. I have circled the items I dispute on the attached copy of the report I received.

Dispute Credit Fraud With Your Lenders Call any affected companies where fraud has occurred. Contact your credit card company and cancel all affected cards. Place a fraud alert with all three credit bureaus. Dispute incorrect information on your credit report. Close any other new accounts opened in your name.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

Asked by: Mr. Jillian Rau | Last update: February 9, 2022 Score: 4.1/5 (71 votes) Section 623 of the FRCA allows you to dispute any inaccurate information on your credit report directly with the original creditor, as long as you've already completed the process with the credit bureau.