Kansas Option For the Sale and Purchase of Real Estate - Residential Home

Description

How to fill out Option For The Sale And Purchase Of Real Estate - Residential Home?

US Legal Forms - one of the largest collections of legal templates in the country - offers a vast selection of legal document templates available for download or printing. By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can quickly find the latest versions of forms such as the Kansas Option For the Sale and Purchase of Real Estate - Residential Home.

If you already have a subscription, Log In and download the Kansas Option For the Sale and Purchase of Real Estate - Residential Home from your US Legal Forms library. The Download button will be visible on each form you view. You can access all previously downloaded forms from the My documents tab of your account.

Edit as needed. Complete, modify, print, and sign the downloaded Kansas Option For the Sale and Purchase of Real Estate - Residential Home.

Every design you upload to your account is permanent and has no expiration date. So, if you wish to download or print another copy, simply visit the My documents section and click on the desired form. Gain access to the Kansas Option For the Sale and Purchase of Real Estate - Residential Home with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal requirements.

- If you are new to using US Legal Forms, here are some basic tips to get you started.

- Ensure you have chosen the correct form for your city/county. Click on the Review button to examine the form's details. Review the form description to confirm you have selected the right document.

- If the form does not meet your needs, utilize the Search box at the top of the page to find one that does.

- Once you are satisfied with the form, validate your choice by clicking the Buy now button. Then, select your preferred pricing plan and provide your information to create an account.

- Proceed with the payment. Use your credit card or PayPal account to finalize the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

To qualify if you have a USDA, VA or conventional loan, you need a credit score of at least 640. You'd need a credit score of at least 660 if you have an FHA loan. You must also meet certain credit score minimums and income limits, as well as home type and location rules.

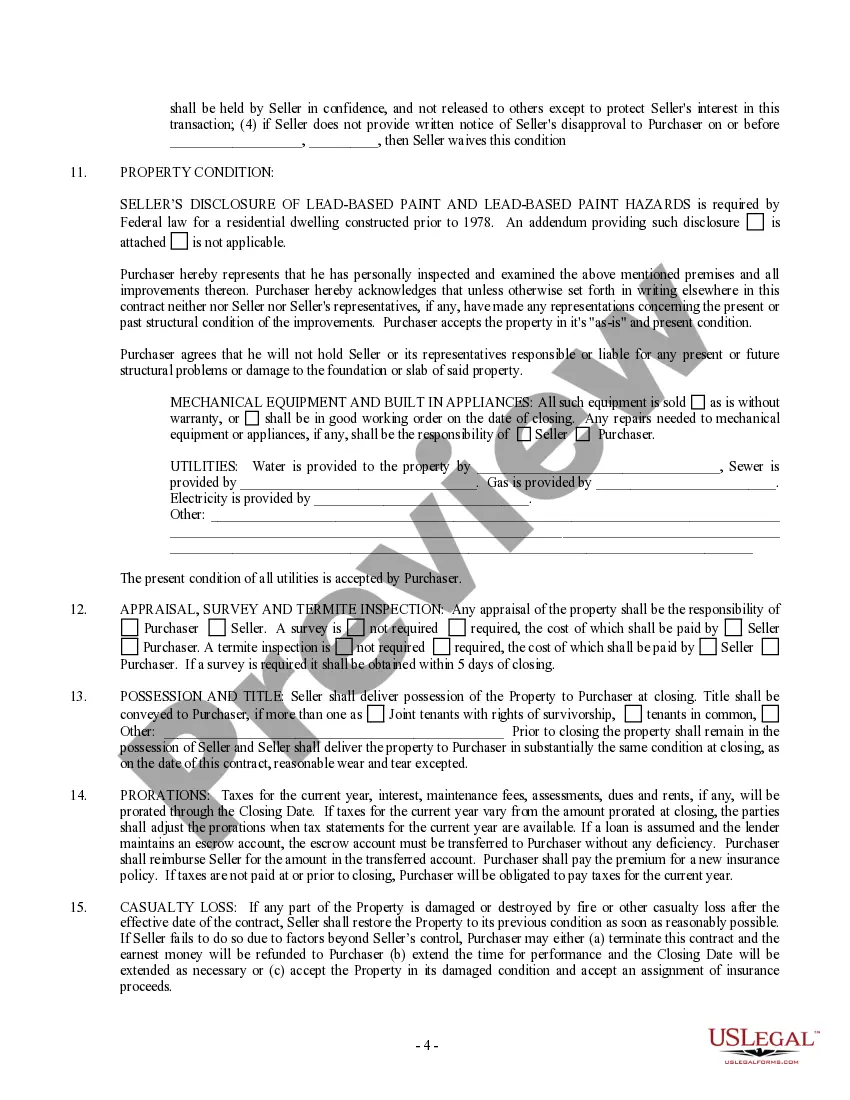

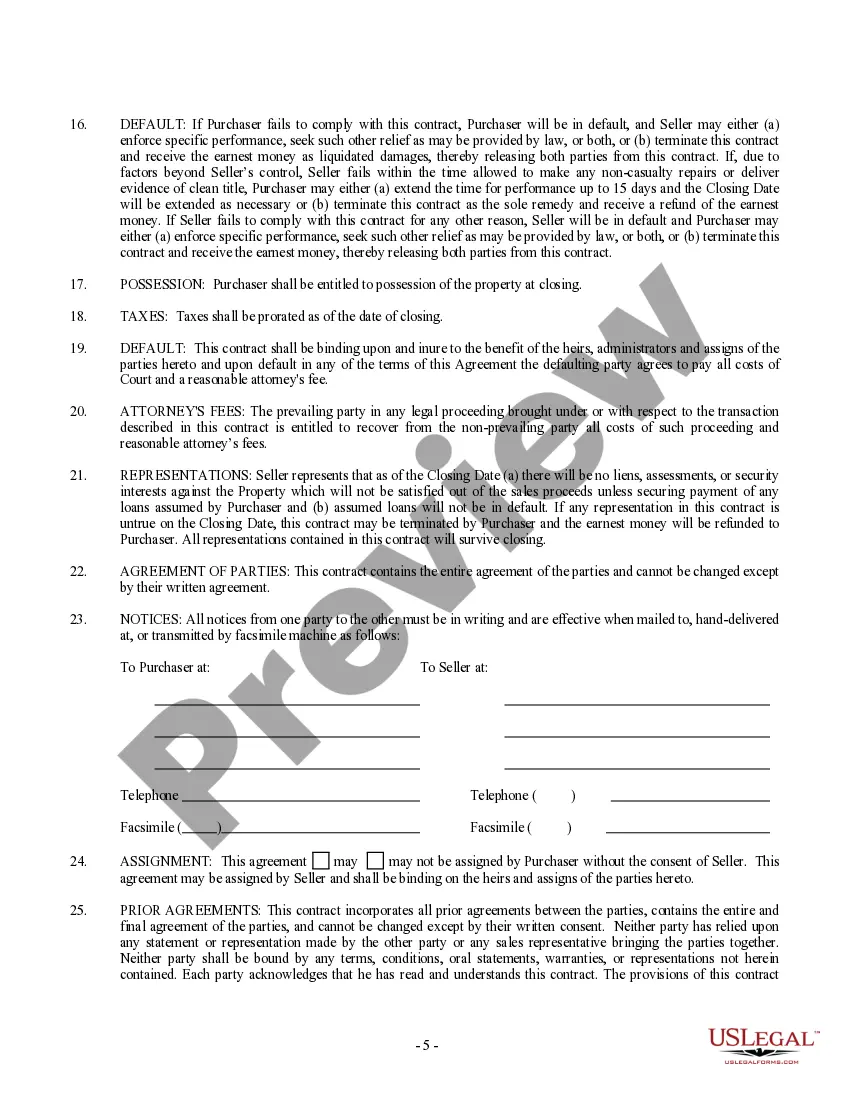

Any purchase agreement should include at least the following information:The identity of the buyer and seller.A description of the property being purchased.The purchase price.The terms as to how and when payment is to be made.The terms as to how, when, and where the goods will be delivered to the purchaser.More items...?

No minimum credit score, but you'll need to be approved for a 30-year conventional, FHA, VA or USDA loan for at least the first 80 percent of the home's purchase price. You must contribute at least 2 percent of your own funds to the purchase.

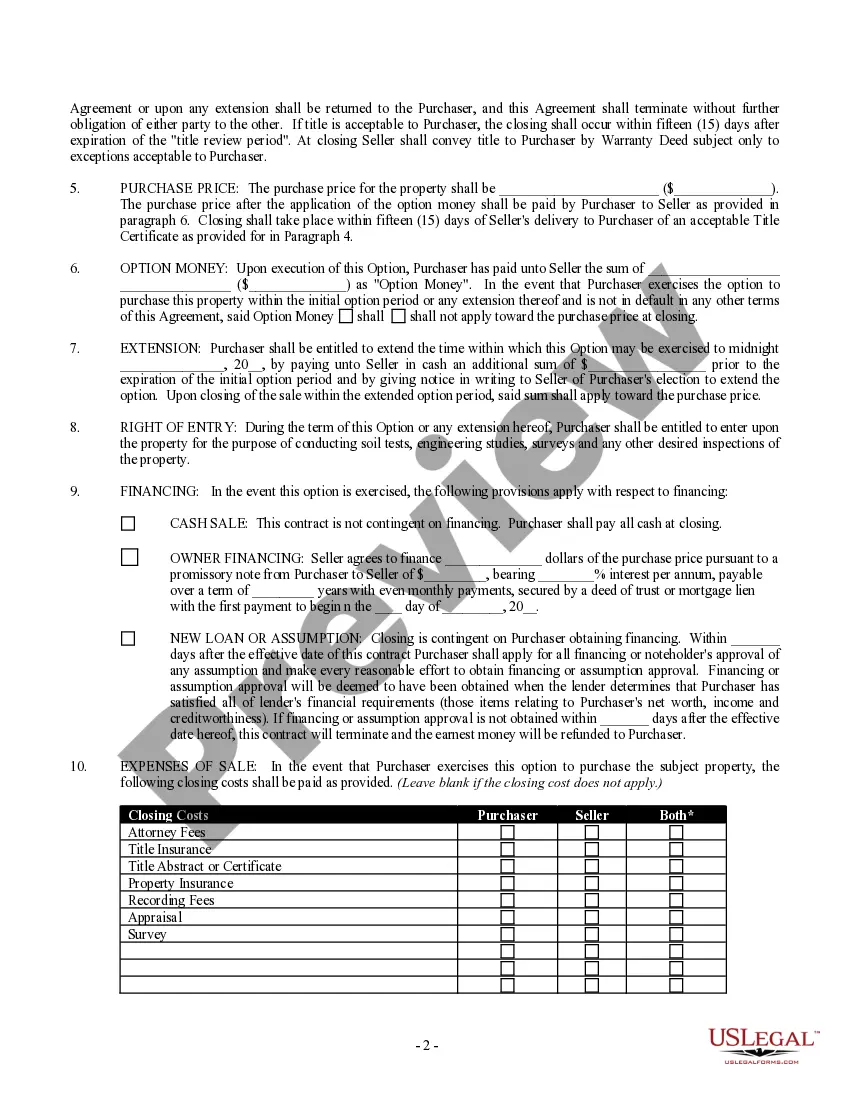

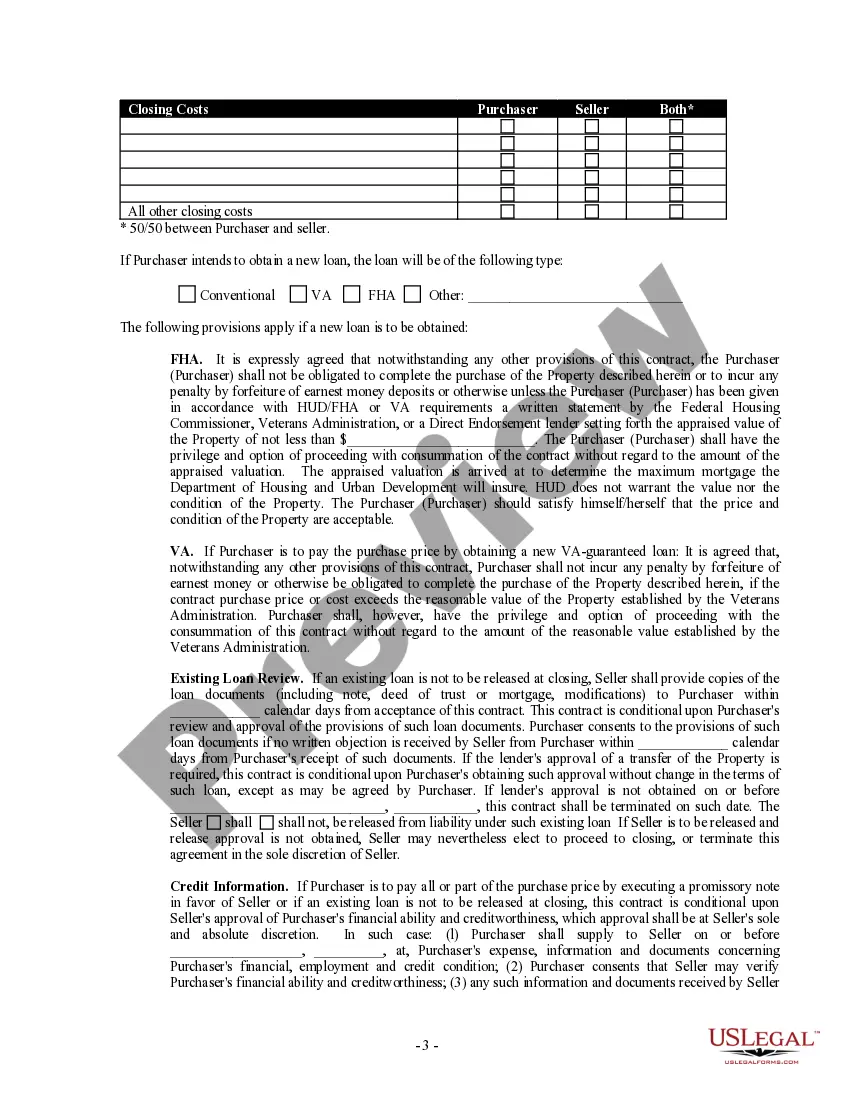

The purpose of an options contract in real estate is to offer the buyer alternatives. Outcomes may vary according to the type of buyer, including early exercise, option expiration, or second-buyer sales. Real estate professionals use option contracts to provide flexibility on specific types of real estate transactions.

Come to the bargaining table prepared by making sure your home offer includes these essential key points.The date and amount of deposit (earnest money).Your name as buyer and the property owner's name as seller.The total purchase price.Full legal description and street address of the property.More items...

What are the steps to buying a house in Kansas?Save for down payment.Get pre-approved for a mortgage.Choose your preferred Kansas.Partner with the right real estate agent in Kansas.Go house hunting.Make a strong offer.Pass inspections and appraisal.Do a final walkthrough and close.

Broadly, a real estate option is a specially designed contract provision between a buyer and a seller. The seller offers the buyer the option to buy a property by a specified period of time at a fixed price. The buyer purchases the option to buy or not buy the property by the end of the holding period.

Kansas Housing Assistance Program To qualify if you have a USDA, VA or conventional loan, you need a credit score of at least 640. You'd need a credit score of at least 660 if you have an FHA loan. You must also meet certain credit score minimums and income limits, as well as home type and location rules.

Requirements for buying a home include:A good credit record. As far as your bank is concerned, your credit score is a big number above your head that tells them how much of a risk you are.A deposit.Prequalification certificate (optional)A home loan.Money set aside for 'hidden costs'Estate agent (optional)

Broadly, a real estate option is a specially designed contract provision between a buyer and a seller. The seller offers the buyer the option to buy a property by a specified period of time at a fixed price. The buyer purchases the option to buy or not buy the property by the end of the holding period.