Kansas Guaranty of Promissory Note by Individual - Corporate Borrower

Description

How to fill out Guaranty Of Promissory Note By Individual - Corporate Borrower?

If you wish to finalize, obtain, or print legal document templates, utilize US Legal Forms, the largest repository of legal documents, available online.

Utilize the site's straightforward and efficient search to find the documents you require.

Numerous templates for business and personal applications are categorized by types and states, or keywords.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

Step 6. Choose the format of the legal document and download it to your device. Step 7. Complete, modify, and print or sign the Kansas Guaranty of Promissory Note by Individual - Corporate Borrower.

- Utilize US Legal Forms to access the Kansas Guaranty of Promissory Note by Individual - Corporate Borrower in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to access the Kansas Guaranty of Promissory Note by Individual - Corporate Borrower.

- You can also access forms you have previously purchased in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the correct form for your area/region.

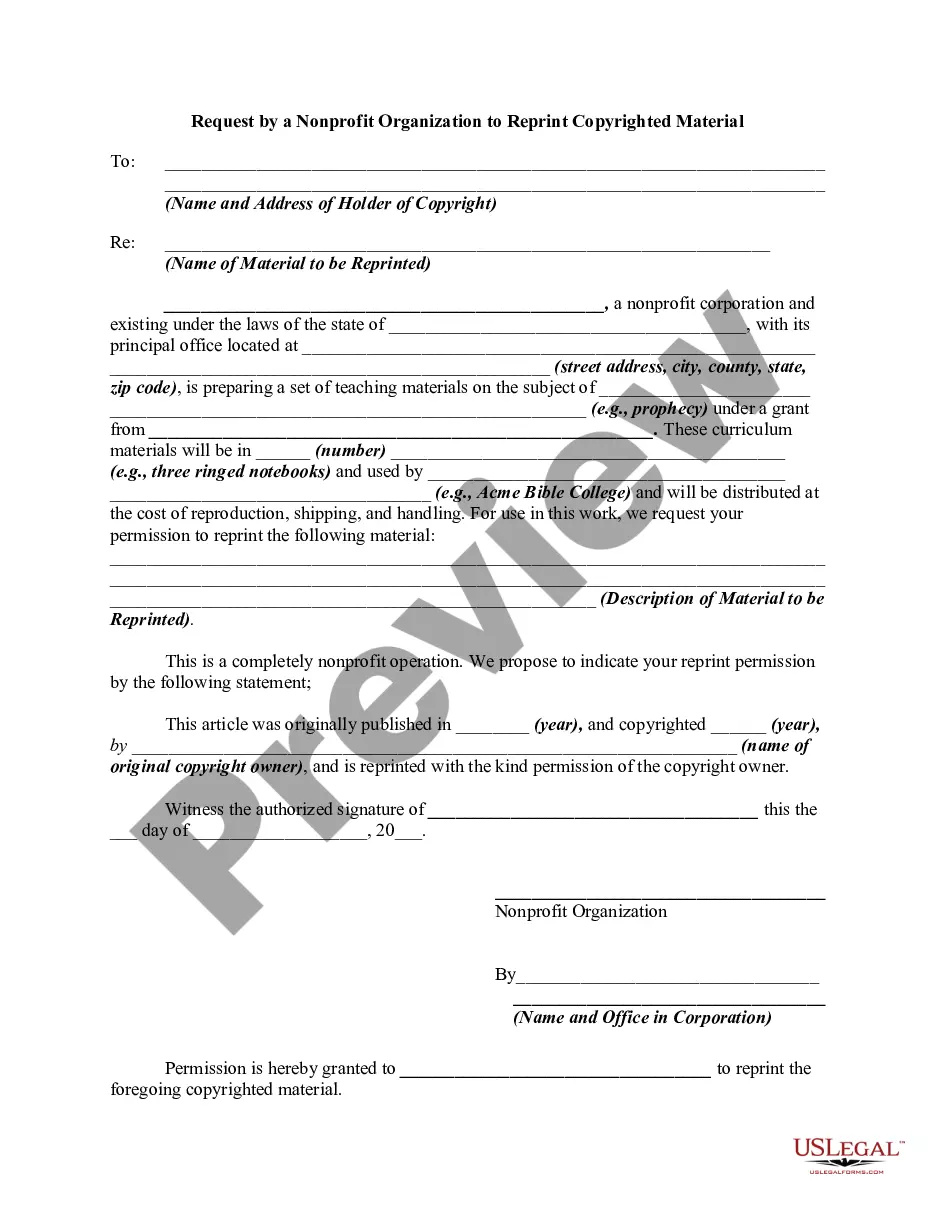

- Step 2. Use the Preview option to review the form's details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find additional forms in the legal document template.

- Step 4. Once you have located the form you seek, click the Get now button. Select your preferred payment method and enter your information to register for an account.

Form popularity

FAQ

The person or entity that guarantees the borrower's debt is called a guarantor. A guarantor is one whose promise 'is collateral to a primary or principal obligation on the part of another and which binds the obligor to performance in the event of nonperformance by such other, the latter being bound to perform

Secured Promissory NotesA secured promissory note is an obligation to pay that is secured by some type of property. This means that if the payor fails to pay, the payee can seize the designated property to obtain reimbursement of the loan.

The Benefits of a Personal GuaranteeThe asset (promissory note) is protected by the collateral (the guarantor's promise to pay, and the ability to sue the guarantor personally for noncompliance with the terms of the promissory note). As with any collateral, a personal guarantee gives the asset more security.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

Guarantee Obligation as to any Person (the guaranteeing person), any obligation, including a reimbursement, counterindemnity or similar obligation, of the guaranteeing Person that guarantees or in effect guarantees, or which is given to induce the creation of a separate obligation by another Person (including any

A Promissory note is essentially an unconditional written promise to repay a loan or other debts, at a fixed or determinable future date. Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved.

A promissory note is a legal document signed by a debtor who promises to pay a debt in a form and manner as described in the document. A personal guaranty, as defined at businessdictionary.com, is an agreement that makes one liable for one's own or a third party's debts or obligations.

As per the definition of a promissory note, they are used as a legal guarantee to repay lenders. They are now no longer used as widely as they once were but some examples and benefits of their uses include: Business loans businesses lending or borrowing money.

In order for the promissory note to be valid, the borrower needs to sign it. The lender may require the borrower to sign this document in front of a notary to guarantee the signature.