Kansas Corporation - Consent by Shareholders

Description

How to fill out Corporation - Consent By Shareholders?

Locating the appropriate legal document template can be a challenge.

Certainly, there are numerous templates available online, but how do you find the legal form you require.

Utilize the US Legal Forms website. The platform offers an extensive selection of templates, including the Kansas Corporation - Consent by Shareholders, which you can utilize for business and personal needs.

You can view the document using the Review button and examine the form details to confirm it is right for you.

- All documents are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to access the Kansas Corporation - Consent by Shareholders.

- Use your account to look for the legal forms you have previously purchased.

- Navigate to the My documents tab in your account to obtain another copy of the desired document.

- If you are a new user of US Legal Forms, follow these straightforward steps.

- First, ensure you have selected the correct form for your state/region.

Form popularity

FAQ

Corporation bylaws in Kansas are the rules that govern the internal management of a corporation. These bylaws outline procedures for meetings, decision-making processes, and shareholder rights, including consent actions. They are crucial for maintaining order and clarity within the corporation and must comply with Kansas state laws. By establishing well-defined bylaws, a Kansas corporation can efficiently implement the consent by shareholders process.

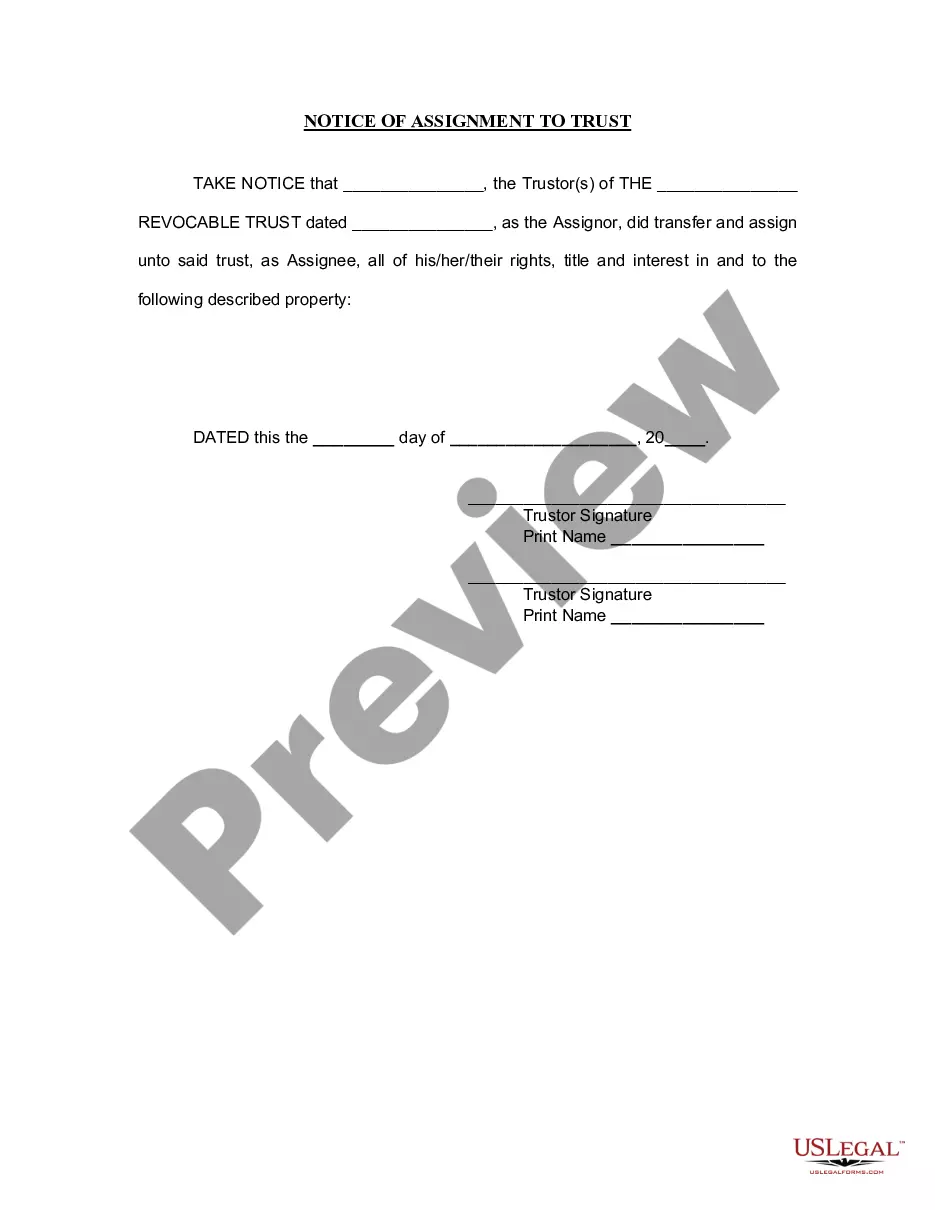

Written consent refers to a document signed by shareholders that indicates their agreement to a corporate action. This legal instrument must meet the requirements outlined in the Kansas Corporation law, ensuring it is valid and enforceable. Understanding the nuances of written consent can empower shareholders to protect their interests effectively. It is a fundamental feature of the Kansas Corporation - Consent by Shareholders framework.

Shareholders act by written consent when they agree on corporate decisions through signed documents instead of during a meeting. This method streamlines the decision-making process, making it easier for shareholders to respond to changes or concerns. It is especially important for Kansas corporations looking to maintain operational flexibility. Embracing this practice ensures compliance with laws surrounding Kansas Corporation - Consent by Shareholders.

In Kansas, shareholders have the right to act by written consent, allowing them to approve decisions without a meeting. This process requires a majority or unanimous consent, depending on the corporation’s bylaws. This right ensures that shareholders can take necessary actions in a timely manner. It's a key aspect of the Kansas Corporation - Consent by Shareholders approach, promoting agility in corporate governance.

The shareholder consent clause allows shareholders of a Kansas corporation to make decisions without holding a formal meeting. This clause provides flexibility, enabling shareholders to act quickly on important matters. It enhances efficiency by allowing for prompt decision-making, which is particularly beneficial for small businesses. Understanding this clause is crucial for navigating the Kansas Corporation - Consent by Shareholders effectively.

Yes, you can set up an S Corp yourself, but be prepared for the paperwork involved. You will need to file your Articles of Incorporation with the state and make sure to have the necessary consent by shareholders for S Corp status. While doing this independently can save costs, using a platform like uslegalforms can guide you through the process and ensure that everything is done correctly, reducing your stress and workload.

In Kansas, any business that operates as a partnership must file a partnership return if it has both income and expenses. This includes general partnerships and limited partnerships. If your business has consent by shareholders due to incorporation, that may shift your filing requirements. Otherwise, make sure to stay informed about deadlines to avoid penalties.

While it is possible to set up an S Corp yourself, working with an accountant can simplify the process significantly. An accountant can help ensure that your Articles of Incorporation are properly filed and that you're compliant with all tax regulations. They can also assist with obtaining consent by shareholders, which is essential for your S Corp election. Their expertise will save you time and reduce the likelihood of errors.

Closing a corporation in Kansas involves obtaining consent from shareholders, which is a vital first step. Once you have consent, file the Articles of Dissolution with the Kansas Secretary of State to officially terminate the corporation. Be sure to handle any remaining liabilities, taxes, or obligations to ensure a smooth dissolution process. The US Legal platform can help guide you through this procedure, ensuring compliance and efficiency.

To close a Kansas corporation, start by ensuring you have obtained shareholder consent for the termination. Next, you must file Articles of Dissolution with the Kansas Secretary of State. It's crucial to settle all debts and obligations, including taxes, before finalizing the closure. Consider using the US Legal platform to access necessary forms and ensure you meet all legal requirements.