Kansas Contractor's Affidavit of Payment to Subs

Description

How to fill out Contractor's Affidavit Of Payment To Subs?

Are you in a situation where you require documents for business or personal purposes nearly every day.

There is a range of legal document templates accessible online, but finding reliable ones isn't simple.

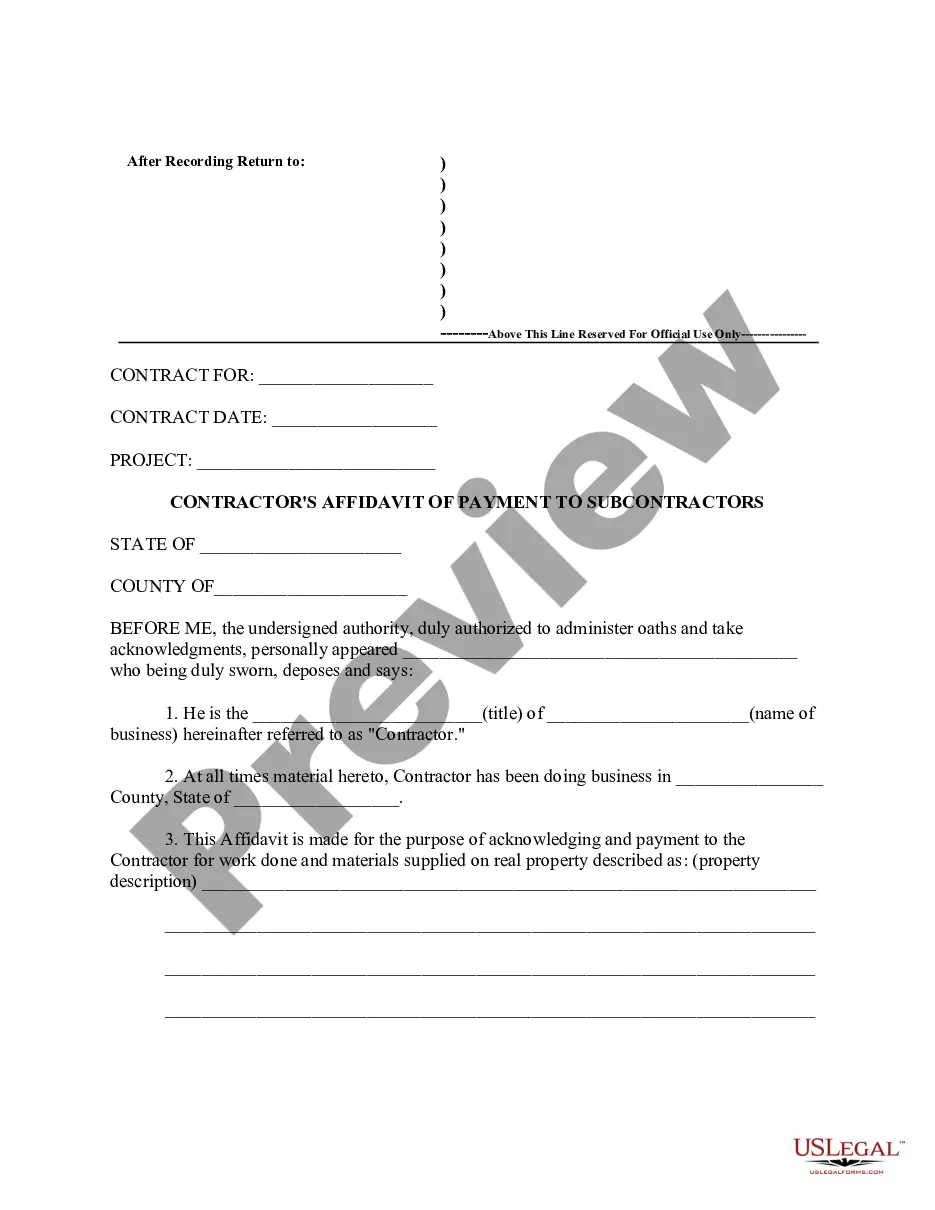

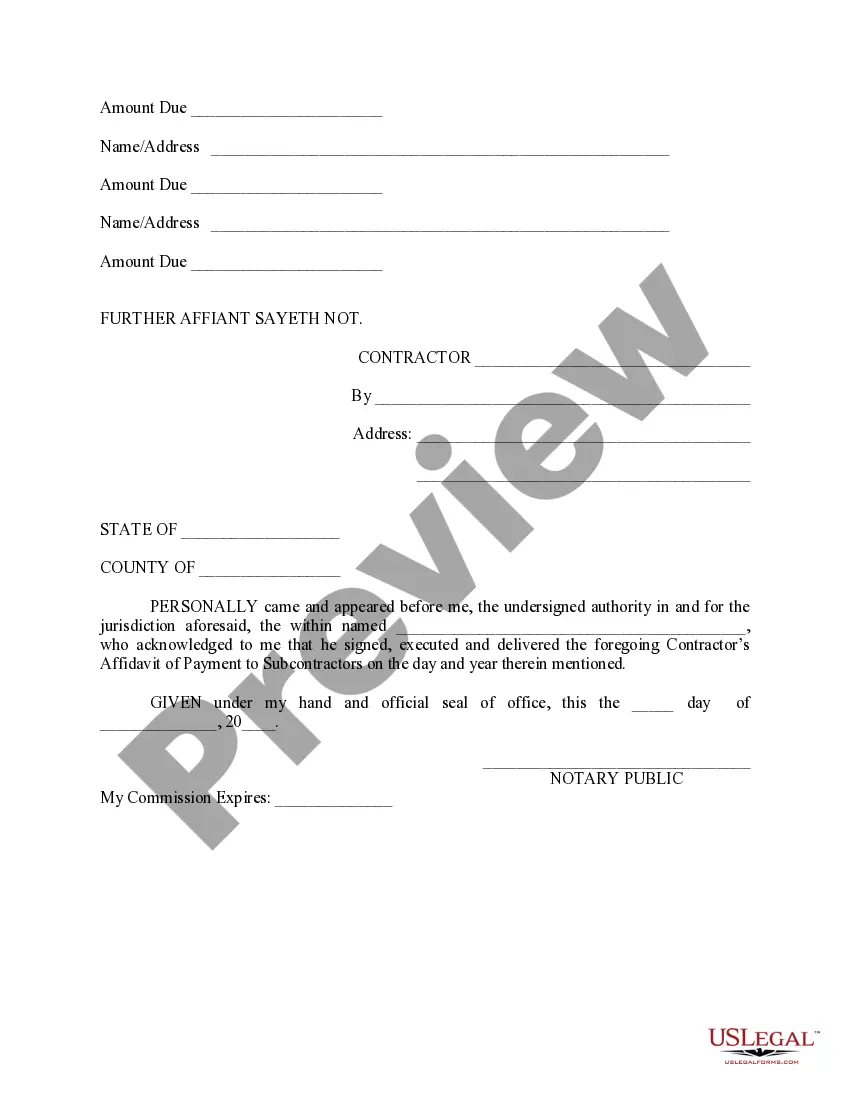

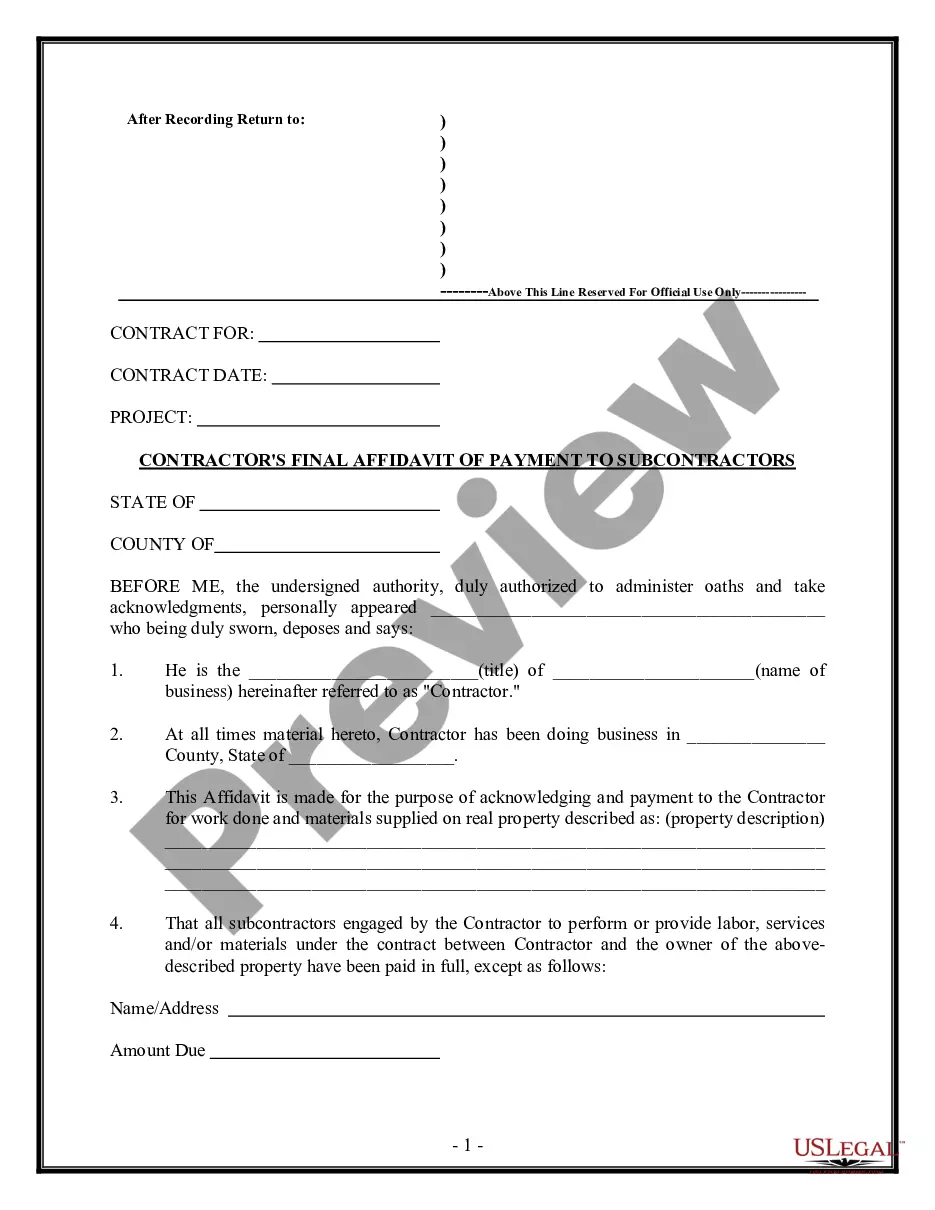

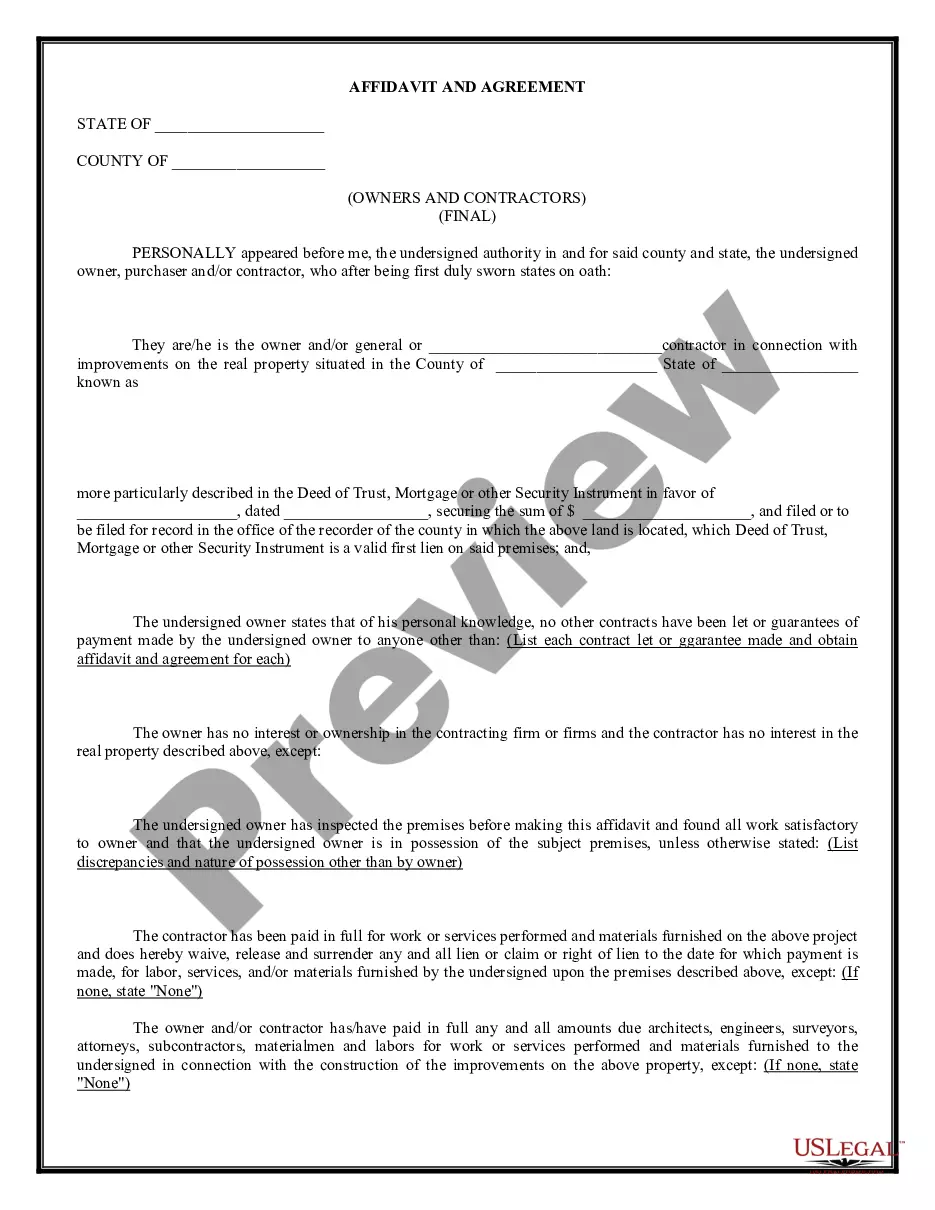

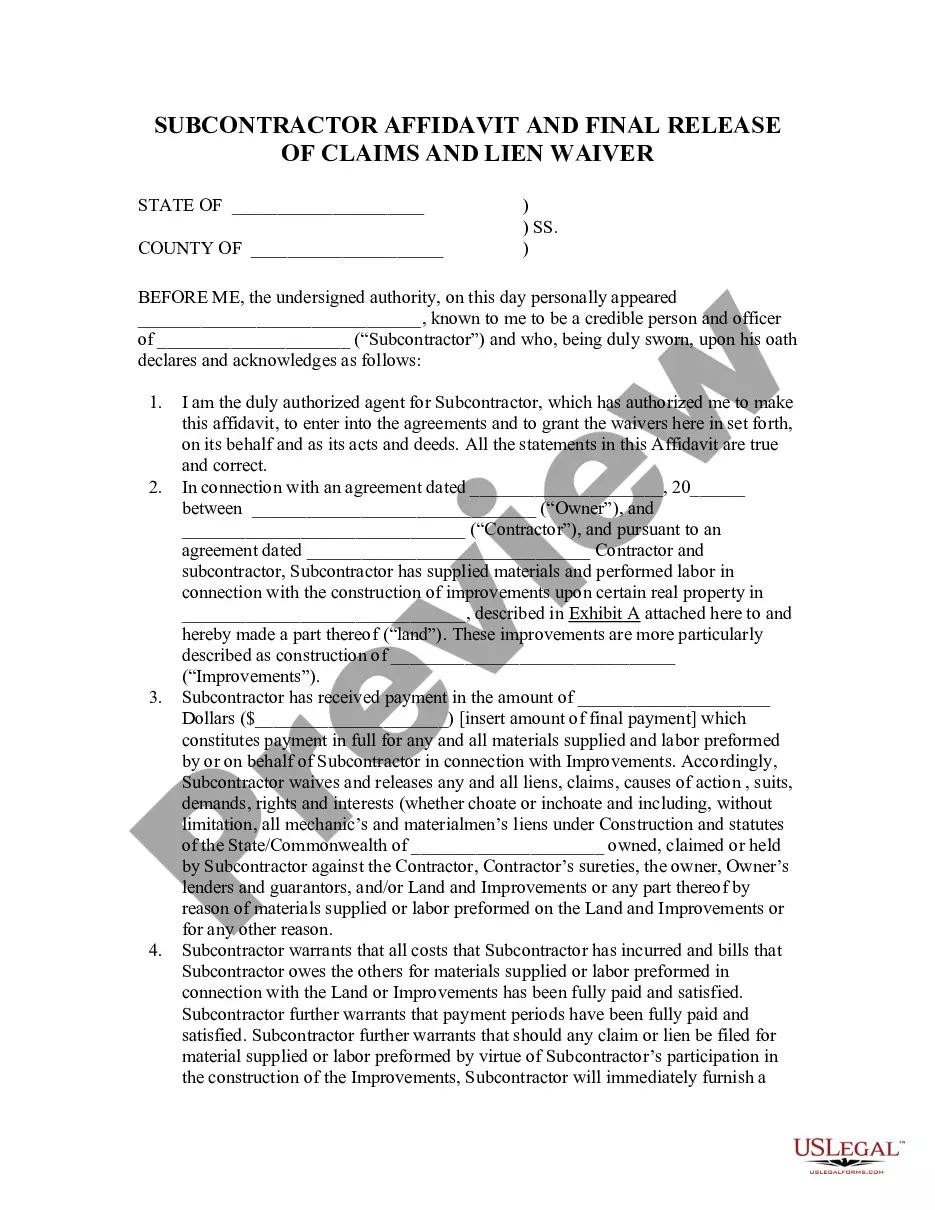

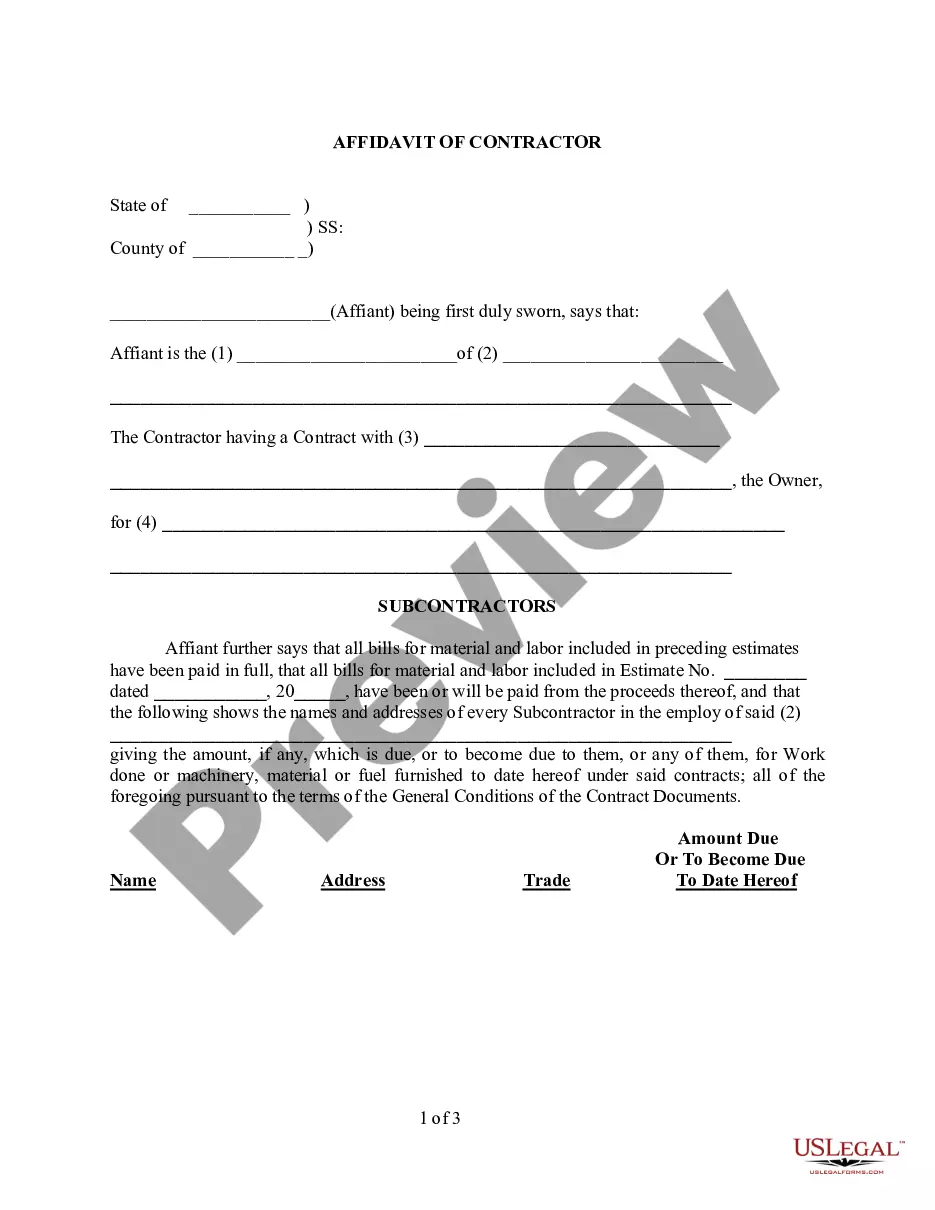

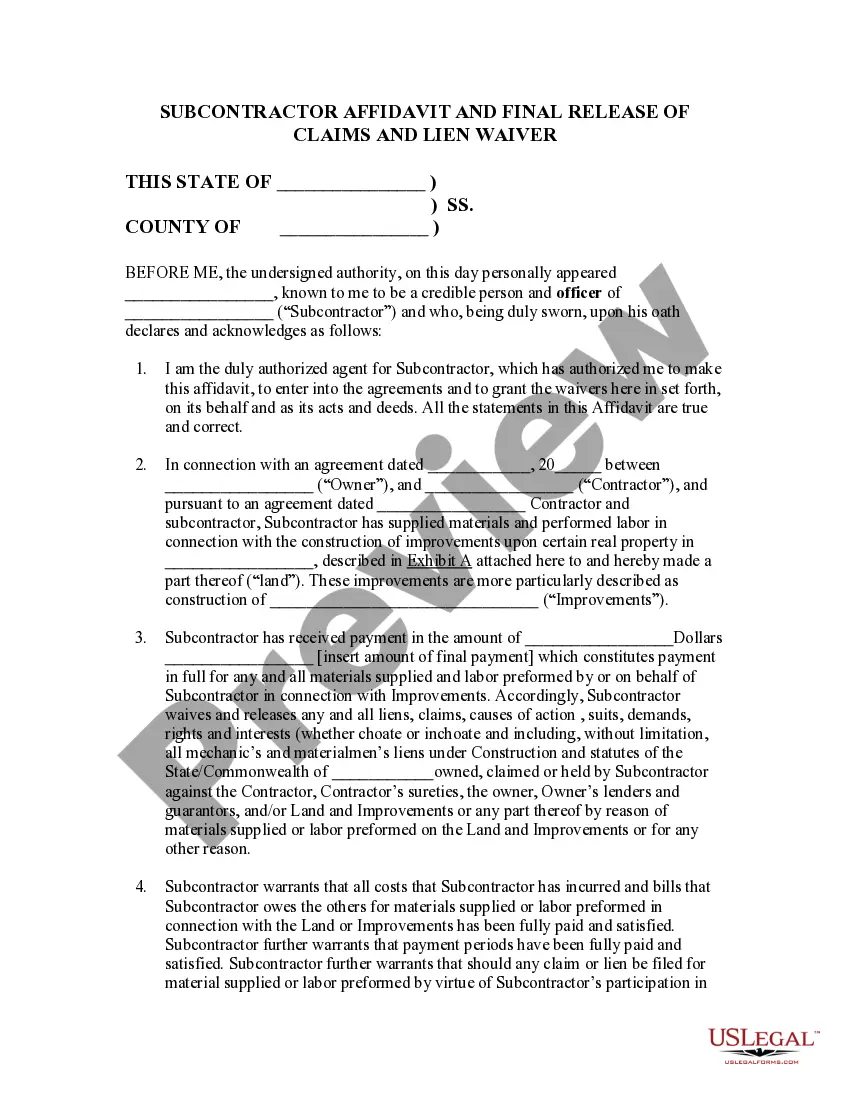

US Legal Forms offers a multitude of form templates, including the Kansas Contractor's Affidavit of Payment to Subs, which can be tailored to meet state and federal standards.

Once you have the correct template, click Purchase now.

Select the payment plan you want, fill in the necessary information to create your account, and settle the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Kansas Contractor's Affidavit of Payment to Subs template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct jurisdiction.

- Utilize the Preview button to inspect the form.

- Review the description to verify that you have chosen the right document.

- If the form isn't what you're searching for, use the Search section to find the form that satisfies your requirements.

Form popularity

FAQ

When Can Contractors Withhold Payment From Subcontractors? The main contractor is able to withhold payment if the work or goods supplied by a subcontractor are deemed unsuitable. Evidence of this should always be provided along with the option to rectify any shortcomings.

Certificate. The document that you send to the subcontractor, usually with the payments, as an acknowledgement of the payment.

Related Definitions Certificate for Payment means a written certificate executed by the Authority indicating the amount that the Trade Contractor is entitled to be paid in connection with each Trade Contractor Application for Payment. Sample 2.

Subcontractor example For example, a building contractor may hire a subcontractor to complete the electrical wiring part of the contractor's building job. The contractor is responsible to the client for the building job including the part performed by the subcontractor.

You usually pay your subcontractors directly. But you can pay them through a third party (such as a relative or debt company) if they ask you to. If you make deductions, you must give the subcontractor a payment and deduction statement within 14 days of the end of each tax month.

Typically, a contractor works under a contractual agreement to provide services, labor or materials to complete a project. Subcontractors are businesses or individuals that carry out work for a contractor as part of the larger contracted project.

A direct payment clause says that if you have paid the main contractor for work done by subcontractors and your money is not passed on to them, you can pay the subcontractor directly and deduct the payment from any other monies due to the main contractor.

A subcontractor agreement is a contract between contractors or project managers and subcontractors. This solidifies any agreement between the two parties and assures work. Subcontractors should read the subcontractor agreement and assure specifics to protect themselves from unfair risk.

When you pay subcontractors, you'll usually need to make deductions from their payments and pay the money to HMRC. Deductions count as advance payments towards the subcontractor's tax and National Insurance bill. You'll need to file monthly returns and keep full CIS records - you may get a penalty if you do not.

Paying subcontractorsYou usually pay your subcontractors directly. But you can pay them through a third party (such as a relative or debt company) if they ask you to. If you make deductions, you must give the subcontractor a payment and deduction statement within 14 days of the end of each tax month.