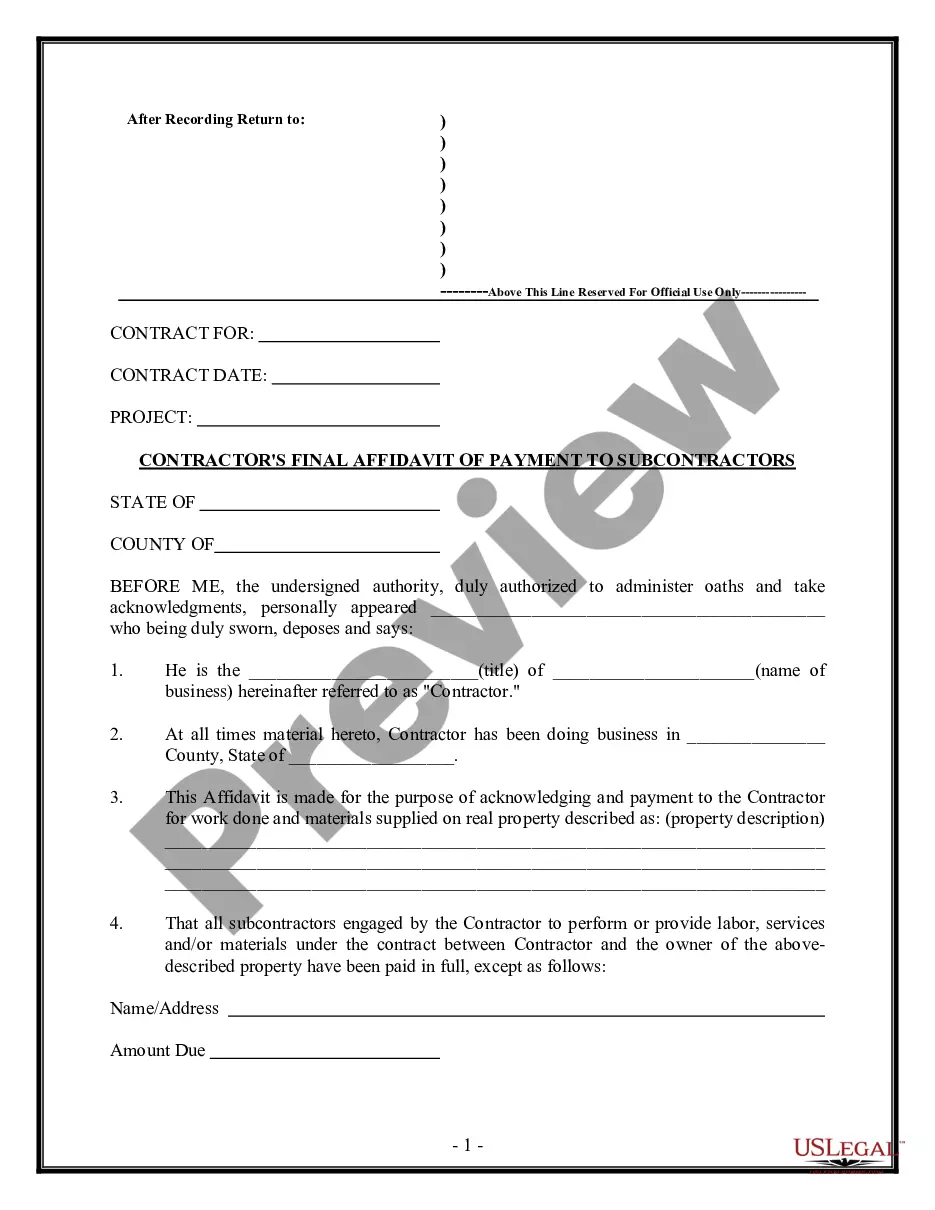

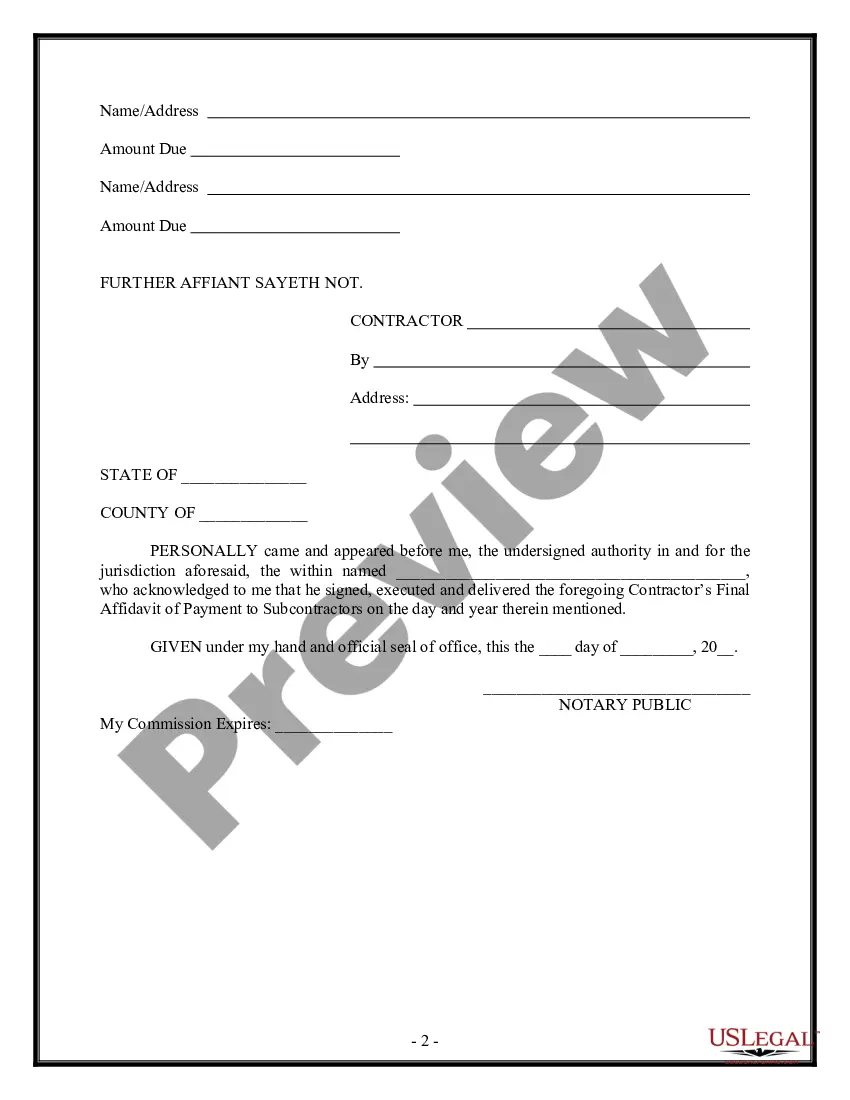

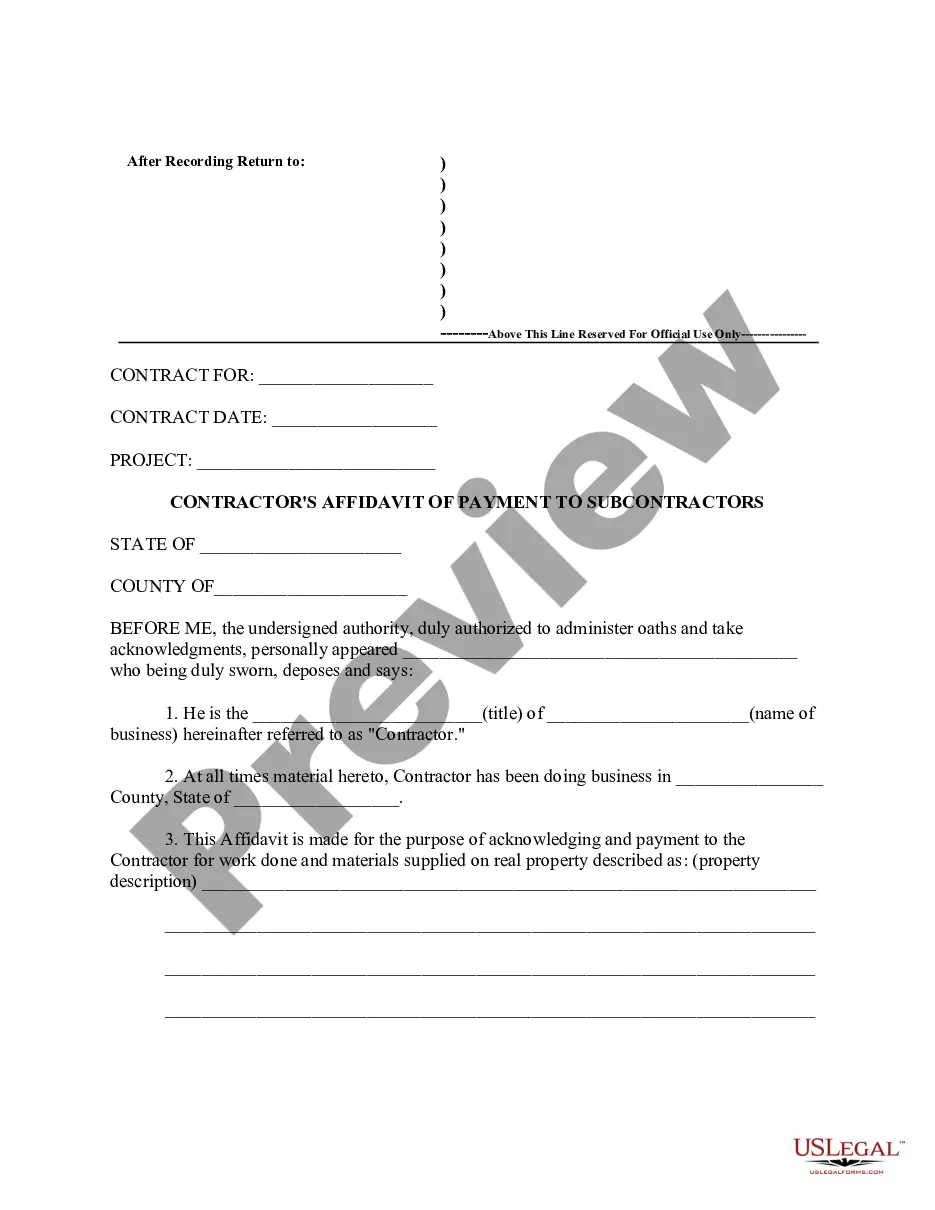

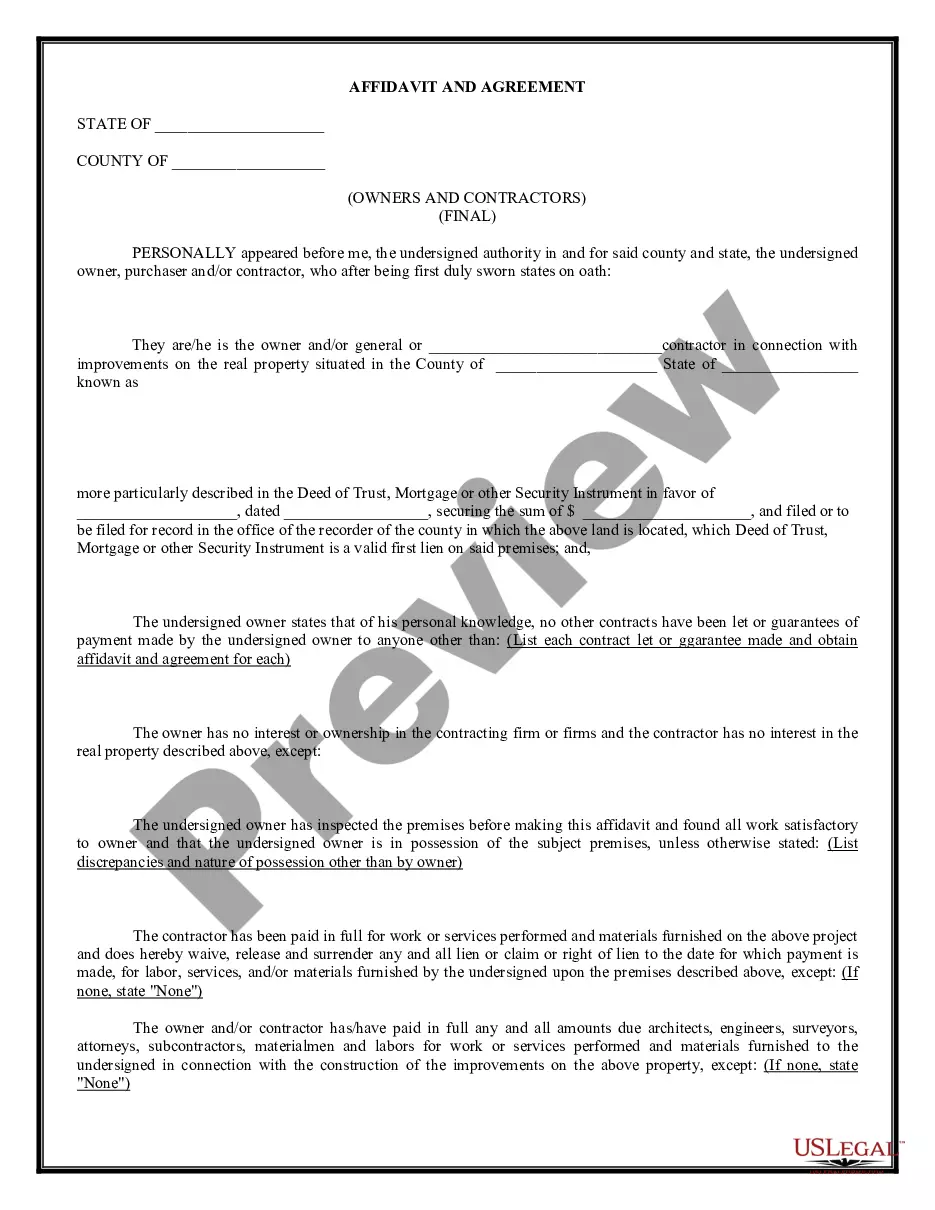

Kansas Contractor's Final Affidavit of Payment to Subcontractors

Description

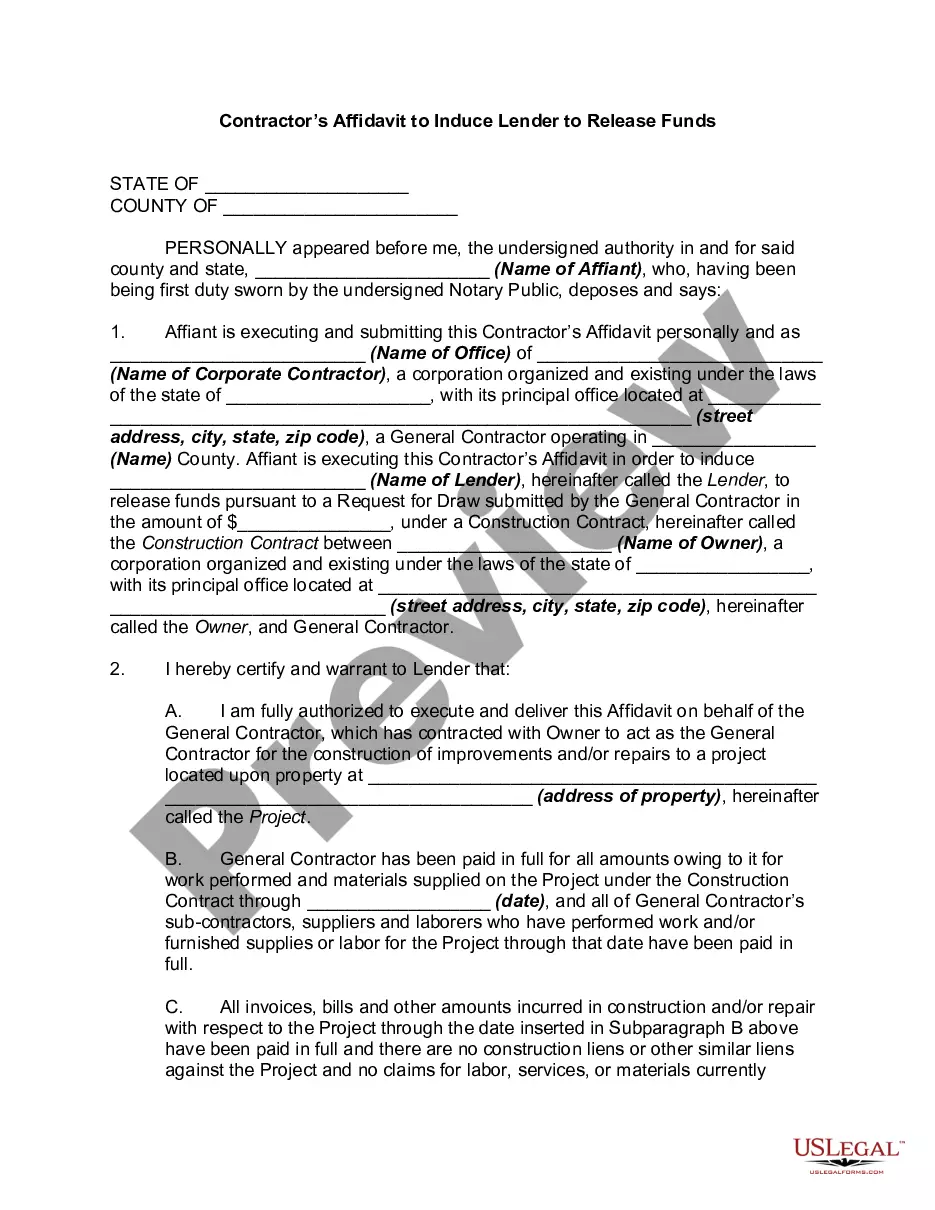

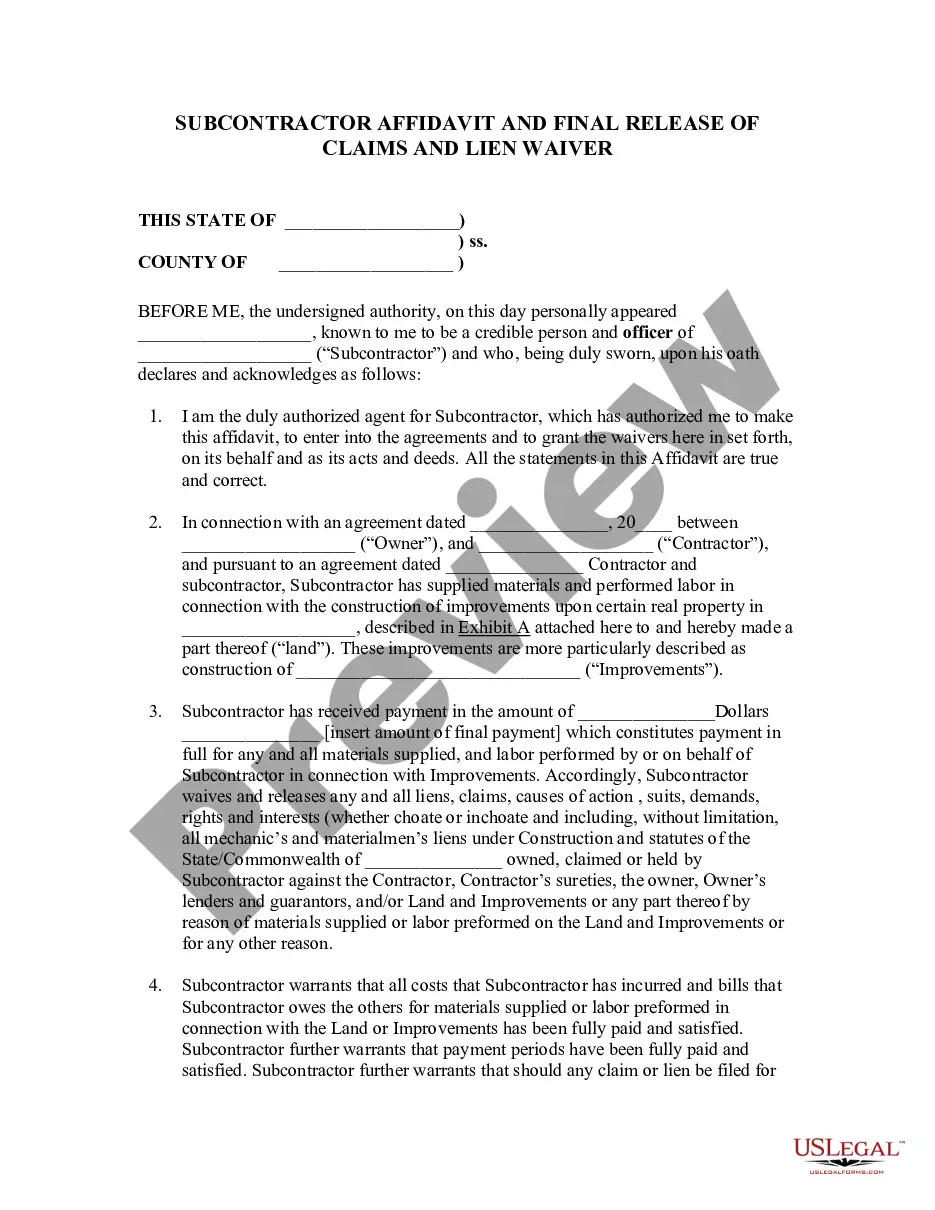

How to fill out Contractor's Final Affidavit Of Payment To Subcontractors?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal form templates that you can download or print.

By using the website, you can locate thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the Kansas Contractor's Final Affidavit of Payment to Subcontractors in just minutes.

If you have a monthly subscription, Log In and obtain the Kansas Contractor's Final Affidavit of Payment to Subcontractors from the US Legal Forms library. The Download option will be available on each form you access. You can view all previously downloaded forms in the My documents section of your account.

Choose the format and download the form to your device.

Make adjustments. Fill out, edit, print, and sign the downloaded Kansas Contractor's Final Affidavit of Payment to Subcontractors. All templates added to your account have no expiration date and belong to you indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

- If you are looking to use US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your area/state.

- Use the Preview option to review the form's content.

- Check the form description to confirm you have chosen the right one.

- If the form doesn’t meet your needs, use the Search bar at the top of the screen to find one that does.

- Once satisfied with the form, confirm your selection by clicking the Buy now button. Then choose your preferred payment plan and provide your credentials to register for an account.

- Process the payment. Use a credit card or PayPal account to complete the transaction.

Form popularity

FAQ

The contractor must pay the subcontractor(s) within 7 days of receiving full payment from the owner or issue a notice of non-payment to the subcontractor(s).

As such, the prime contractor cannot subcontract more than $6,800,000 to non-similarly situated entities, and the prime and/or similarly situated entities must perform at least $1,200,000.

When the subcontractor does not get paid then they have grounds to pursue the contractor for monies owed. This could be in the form of wages or unpaid invoices for services rendered. In the USA, the owner of the property can be held liable for payment under a Mechanics Lien.

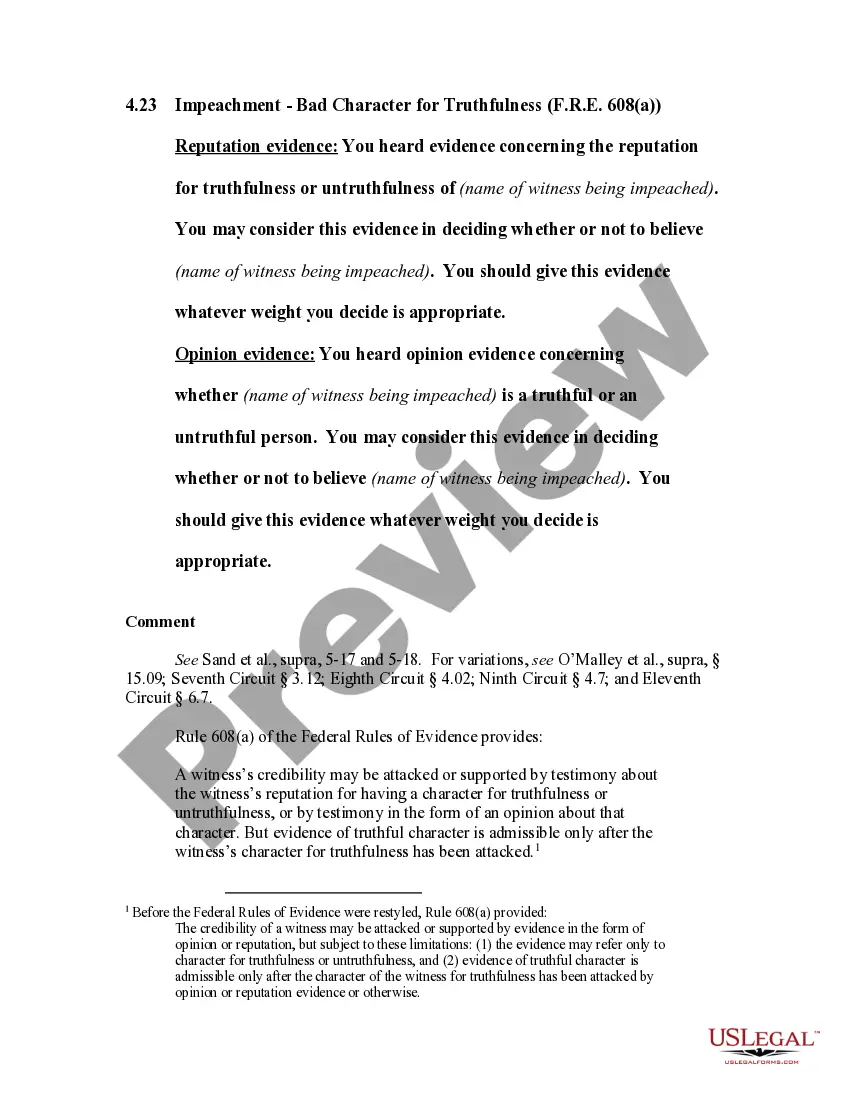

AIA Document G706A21221994 supports AIA Document G70621221994 in the event that the owner requires a sworn statement of the contractor stating that all releases or waivers of liens have been received.

You usually pay your subcontractors directly. But you can pay them through a third party (such as a relative or debt company) if they ask you to. If you make deductions, you must give the subcontractor a payment and deduction statement within 14 days of the end of each tax month.

The most common causes of back charges are defective work, damages to the property caused by performance of your work, costs for use of contractor's equipment, and site clean-up costs.

In order to get paid, subcontractors need to issue invoices to the contractors they work for. Every invoice you issue needs to include some basic information, including: An invoice number: a unique code that follows a sequential order.

Paying subcontractorsYou usually pay your subcontractors directly. But you can pay them through a third party (such as a relative or debt company) if they ask you to. If you make deductions, you must give the subcontractor a payment and deduction statement within 14 days of the end of each tax month.

How to get paid (faster) on every construction projectGet licensed.Write a credit policy.Prequalify potential customers.Get the contract in writing.Collect information about the property and other parties.Track your deadlines.Send Preliminary Notice.Submit Detailed Pay Applications or Invoices.More items...?

When you pay subcontractors, you'll usually need to make deductions from their payments and pay the money to HMRC. Deductions count as advance payments towards the subcontractor's tax and National Insurance bill. You'll need to file monthly returns and keep full CIS records - you may get a penalty if you do not.