Kansas Consulting Agreement - with Former Shareholder

Description

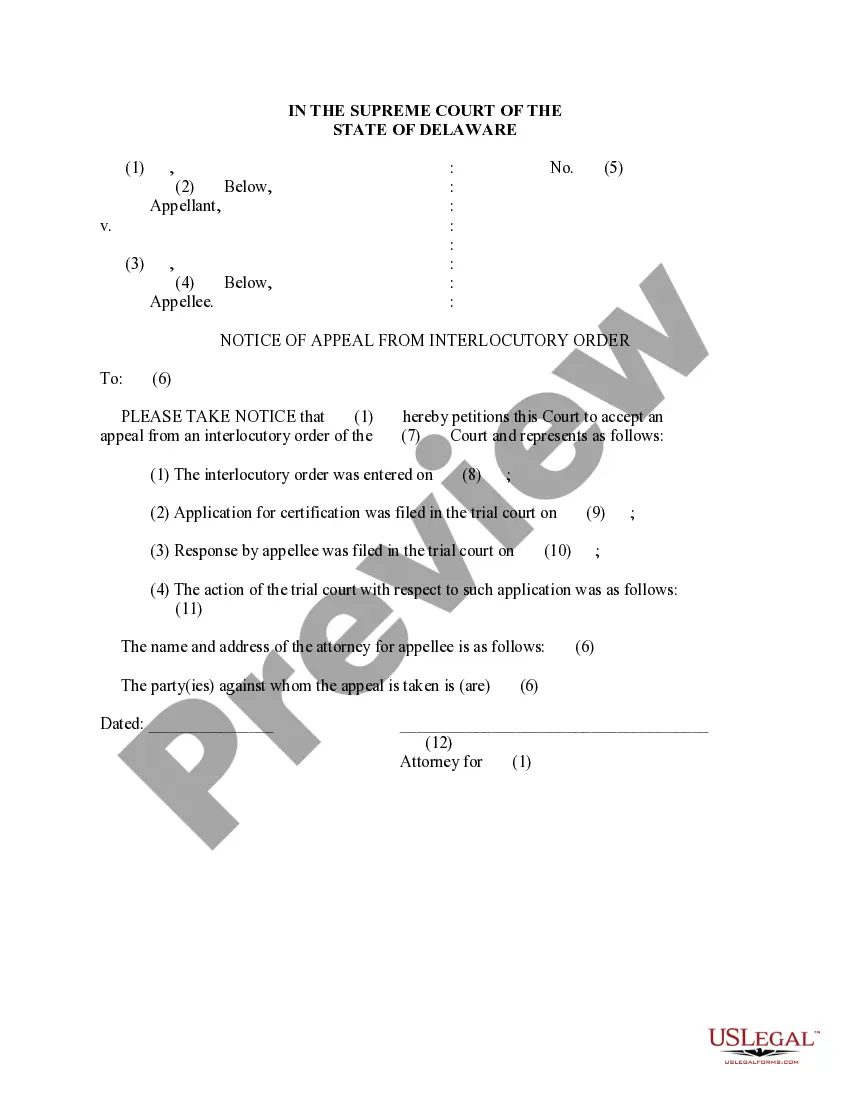

How to fill out Consulting Agreement - With Former Shareholder?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a variety of legal document formats that you can download or print.

Using the website, you can find thousands of forms for commercial and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms like the Kansas Consulting Agreement - with Former Shareholder in just a few minutes.

If you have an account, Log In to download the Kansas Consulting Agreement - with Former Shareholder from your US Legal Forms library. The Download button appears on every form you view. You can retrieve all previously acquired forms from the My documents tab of your account.

Process the purchase. Utilize your credit card or PayPal account to complete the transaction.

Choose the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Kansas Consulting Agreement - with Former Shareholder. Each template you added to your account does not expire and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

- Ensure you have selected the correct form for your city/state.

- Click the Review button to verify the form's content.

- Read the form description to confirm you have chosen the right form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, affirm your choice by clicking the Purchase now button.

- Then, choose the pricing plan you desire and provide your details to register for an account.

Form popularity

FAQ

A Statement of Work (SOW) in consulting is a key document that outlines the specific tasks, business objectives, and deliverables to be achieved during a consulting engagement. It acts as a roadmap, detailing timelines, responsibilities, and payment terms that align with the goals set in the Kansas Consulting Agreement - with Former Shareholder. Using a well-defined SOW helps manage expectations and ensures that both parties are on the same page throughout the project.

A consulting agreement broadly defines the relationship between the consultant and the client, while a SOW provides detailed specifications for a specific project or service to be delivered. Essentially, the Kansas Consulting Agreement - with Former Shareholder ensures both parties agree on the consulting arrangement, whereas the SOW serves as a work plan that outlines what will be done within that framework. Understanding both documents enhances your project planning and execution.

In Kansas, having an operating agreement is not a legal requirement but is highly recommended for limited liability companies (LLCs). This document outlines the management structure and operational guidelines, helping prevent disputes among members. Even though it's not mandated, establishing an operating agreement can provide clarity and legal protection, especially for former shareholders entering into a Kansas Consulting Agreement.

To set up a Kansas Consulting Agreement - with Former Shareholder, start by identifying the key terms, such as the scope of work, payment structure, and duration of the agreement. It's important to detail the responsibilities of both parties and include confidentiality clauses as necessary. Using platforms like US Legal Forms can simplify this process by offering templates and guidelines to ensure your agreement is legally sound.

A Statement of Work (SOW) details specific project tasks, timelines, and deliverables, while a Kansas Consulting Agreement - with Former Shareholder outlines the overall terms of the consulting relationship. The SOW serves as a guiding document for a particular project, whereas the Kansas Consulting Agreement establishes the legal framework governing the consultant and client relationship. Understanding these distinctions is essential for setting clear expectations.

An independent consultant agreement is a formal document that outlines the relationship between a consultant and their client, establishing them as separate entities rather than employees. This agreement clarifies the terms of service, responsibilities, and compensation. When it comes to a Kansas Consulting Agreement - with Former Shareholder, this document can protect both parties while promoting a clear understanding of expectations. Consider using resources from uslegalforms for tailored templates to streamline the process.

The terms 'contract' and 'agreement' often get used interchangeably, but there are distinctions. A contract is a legally enforceable agreement that includes specific obligations and rights for the parties involved. Conversely, an agreement may not always carry legal weight; it may simply describe a mutual understanding. When creating a Kansas Consulting Agreement - with Former Shareholder, ensure you adhere to contractual principles to secure your interests.

Yes, a consulting agreement is essentially a type of contract, specifically outlining the relationship between a consultant and their client. Both documents set forth the terms and conditions under which services will be provided. In the case of a Kansas Consulting Agreement - with Former Shareholder, it delineates the expectations for both parties involved. Thus, clarity in language and detail can prevent misunderstandings in the future.

To write a Kansas Consulting Agreement - with Former Shareholder, start by defining the parties involved and outlining the scope of services. Clearly specify the duration of the agreement, payment terms, and any confidentiality clauses necessary. It is beneficial to include terms covering termination and any dispute resolution procedures. Utilizing a platform like uslegalforms can provide you with templates and guidance to ensure your contract meets all legal requirements.

A consulting agreement specifically addresses the terms of consulting services provided, while an MSA covers a broader range of services and overall terms for multiple future engagements. Each serves different purposes and can be vital in structuring business relationships. Implementing a Kansas Consulting Agreement - with Former Shareholder can complement an MSA for clearer, more efficient collaboration.