Kansas Affidavit of Domicile

Description

How to fill out Affidavit Of Domicile?

Locating the appropriate authentic document template can be a challenge. Naturally, there are numerous templates accessible online, but how can you find the authentic form you need? Utilize the US Legal Forms website. The service offers thousands of templates, including the Kansas Affidavit of Domicile, which can be utilized for business and personal purposes. All of the forms are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to retrieve the Kansas Affidavit of Domicile. Use your account to search for the legal forms you have previously purchased. Go to the My documents section of your account and obtain another copy of the document you need.

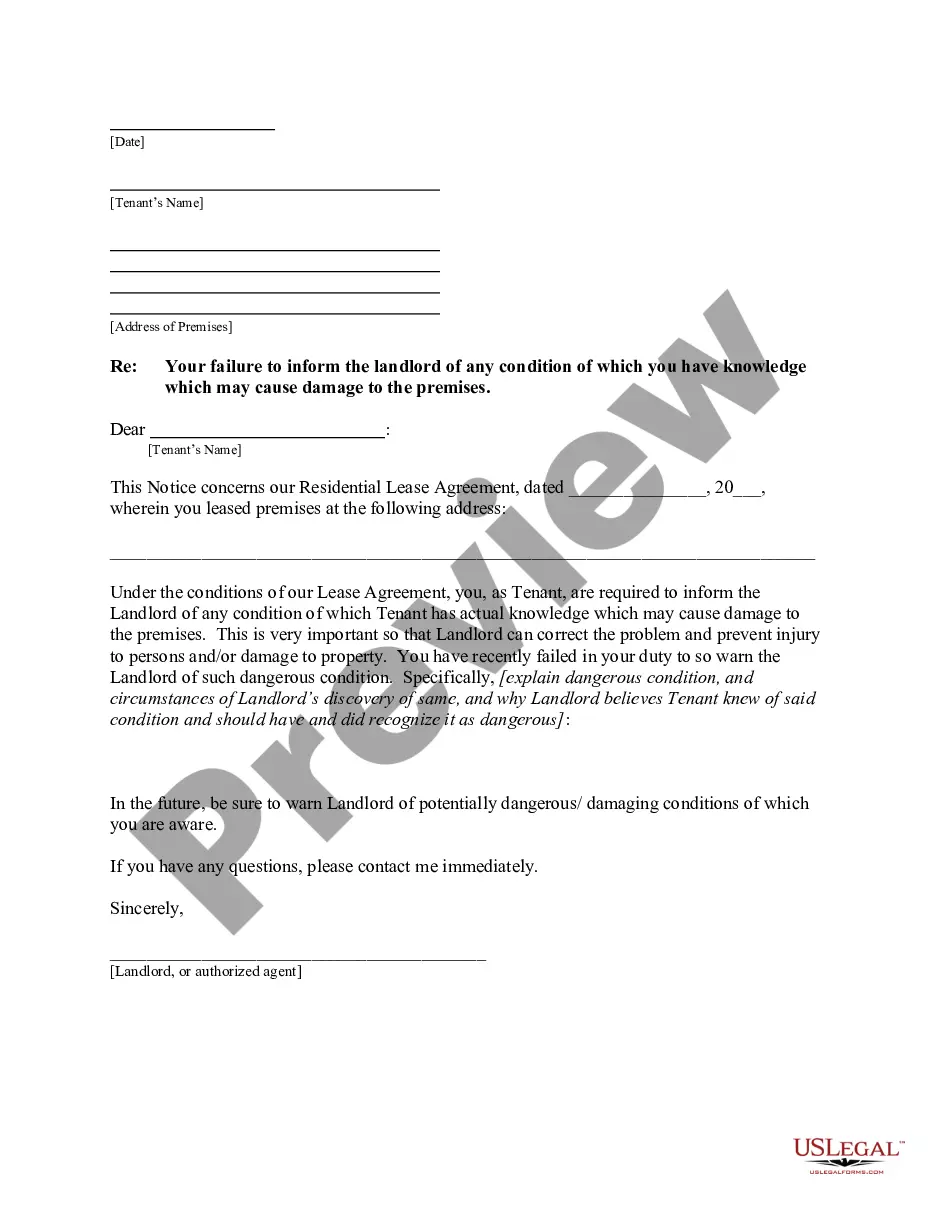

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your city/county. You can review the form using the Review button and examine the form summary to confirm this is indeed the right one for you. If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are confident the form is correct, click the Purchase now button to obtain the form. Select the pricing plan you prefer and enter the necessary information. Create your account and finalize the order using your PayPal account or credit card. Choose the file format and download the legal document template to your system. Complete, modify, and print and sign the downloaded Kansas Affidavit of Domicile. US Legal Forms is the largest collection of legal forms where you can find various document templates. Utilize the service to acquire professionally crafted papers that adhere to state regulations.

Form popularity

FAQ

To use a small estate affidavit in Kansas, the estate must meet specific criteria, such as having a total value under $40,000. You will need to list the decedent's assets and liabilities and provide the names and addresses of all heirs. The affidavit must be signed by the heirs, affirming their relationship to the decedent. To ensure accuracy and compliance, consider using US Legal Forms, which offers resources tailored to Kansas estate laws.

A Kansas Affidavit of Domicile is a legal document that confirms where a deceased person resided at the time of their death. This affidavit is essential for settling the estate and transferring assets, as it helps establish the jurisdiction for legal matters. Essentially, it serves as proof of residence, which can be crucial for beneficiaries and estate administrators during the probate process.

In Kansas, an affidavit of heirship must identify the deceased person and provide details about their surviving heirs. You should include the names, relationships, and addresses of all heirs. Additionally, this document often requires the signatures of two disinterested witnesses who can confirm the heirship. Using a reliable platform like US Legal Forms can simplify this process by providing templates and guidance.

To write a Kansas Affidavit of Domicile, begin by stating your name and address clearly. Next, include the details of the deceased person, such as their name, date of death, and last known address. You will also need to declare the purpose of the affidavit, affirming the decedent's residency in Kansas at the time of death. Finally, sign and date the document in the presence of a notary public to ensure its legal validity.

An affidavit of domicile is a legal document that confirms an individual's residency at a specific address. In Kansas, this affidavit serves to establish your primary residence, which may be necessary for various legal processes, including estate matters. It's an important tool for anyone needing to prove their residency status. For those looking to create a Kansas Affidavit of Domicile, USLegalForms provides user-friendly templates to facilitate the process.

To show proof of residency in Kansas, you can use a Kansas Affidavit of Domicile as a formal declaration of your residential status. Additionally, documents like utility bills, bank statements, or rental agreements can also serve as proof. It’s important to keep these documents organized, as they may be required for various legal or administrative purposes. USLegalForms can assist you in creating an affidavit that supports your proof of residency.

To fill out an affidavit example, start by reviewing the provided template carefully. Input your information where required, ensuring accuracy and clarity. Follow the structure closely, and include all necessary declarations. Using USLegalForms can provide you with a reliable example to follow, ensuring you meet all legal requirements for your Kansas Affidavit of Domicile.

Filling out an affidavit of residence involves similar steps to the Kansas Affidavit of Domicile. You will need to include your personal details, the address you claim as your residence, and a declaration stating that you reside there. Ensure you have the document notarized to affirm its validity. For assistance, consider using USLegalForms, which offers comprehensive templates for various affidavit needs.

When writing a Kansas Affidavit of Domicile, begin with a title indicating the document's purpose. Clearly state your name, current address, and the date of the affidavit. Then, include a declaration of residency, affirming that you live at the stated address. USLegalForms provides templates that can simplify this process, making it easier for you to draft a proper affidavit.

Any individual who has established residency in Kansas can complete a Kansas Affidavit of Domicile. This includes homeowners, tenants, and individuals living in the state for a significant period. It is essential that the person filling out the affidavit is the one claiming residency. USLegalForms offers resources to assist anyone in preparing their affidavit correctly.