Kansas Direct Deposit Form for Chase

Description

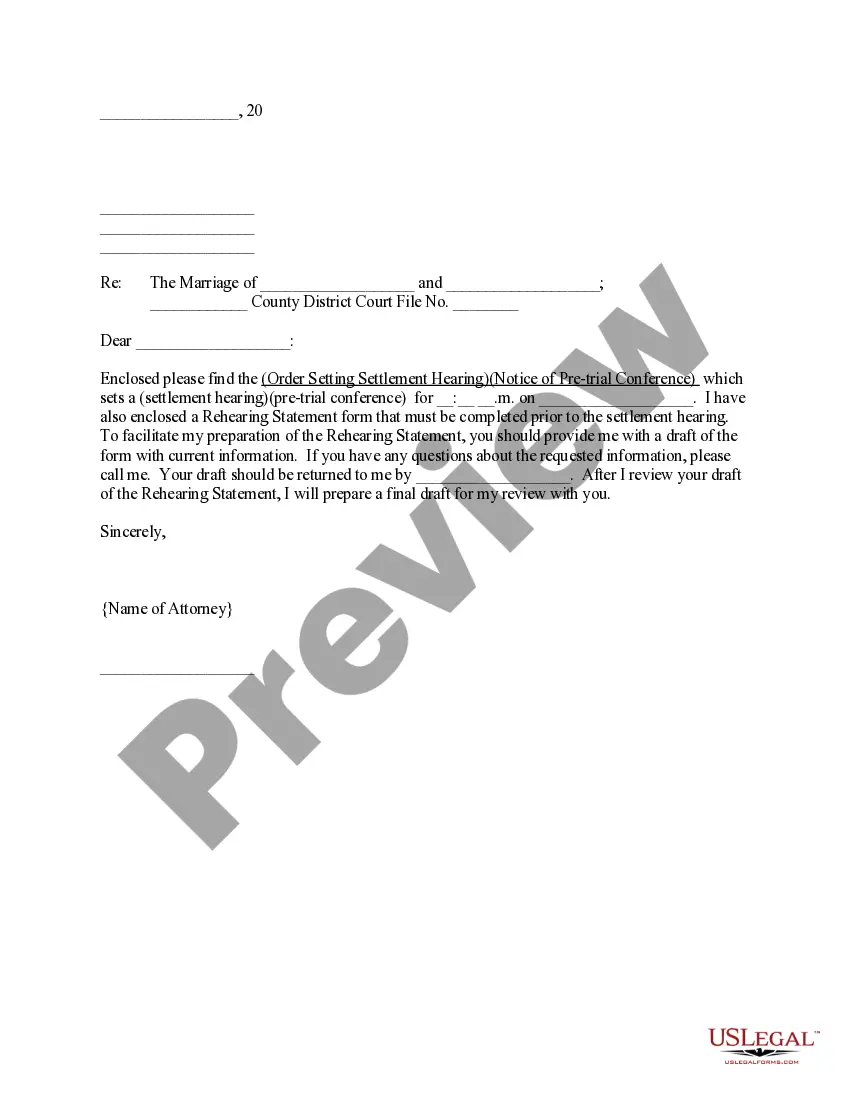

How to fill out Direct Deposit Form For Chase?

If you wish to be thorough, obtain, or print authorized document templates, utilize US Legal Forms, the most extensive collection of legal forms available online. Take advantage of the site's user-friendly and efficient search feature to locate the documents you require. A variety of templates for business and personal uses are categorized by groups and categories, or keywords.

Utilize US Legal Forms to find the Kansas Direct Deposit Form for Chase with just a few clicks. If you are already a US Legal Forms user, Log In to your account and then click the Obtain button to access the Kansas Direct Deposit Form for Chase. You can also retrieve forms you have previously downloaded from the My documents section of your account.

If you are using US Legal Forms for the first time, follow these steps: Step 1. Ensure you have selected the form for the correct city/state. Step 2. Use the Preview option to review the form's content. Don't forget to read the description. Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to discover other versions of the legal form format. Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your information to register for the account. Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase. Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Kansas Direct Deposit Form for Chase.

Avoid altering or removing any HTML tags. Only synonymize plain text outside of the HTML tags.

- Every legal document template you acquire is yours indefinitely.

- You have access to every form you downloaded in your account.

- Select the My documents section and choose a form to print or download again.

- Stay competitive and download, and print the Kansas Direct Deposit Form for Chase using US Legal Forms.

- There are thousands of professional and state-specific forms available for your personal or business needs.

- Make the most of the extensive resources available for legal documentation.

Form popularity

FAQ

Yes, Chase routing numbers do differ by state. Each region has its own routing number to facilitate accurate and efficient processing of transactions. If you need to find the correct routing number for your Kansas Direct Deposit Form for Chase, consult Chase's official website or your account documents for the most accurate information.

Chase’s routing number for direct deposit varies by state, but if you are in Kansas, the routing number is typically 101000013. This number is crucial for ensuring that your funds are deposited correctly into your account. Always double-check your form to confirm that you have the right routing number when completing the Kansas Direct Deposit Form for Chase.

Filling out the Chase direct deposit form is straightforward. Start by entering your personal details, including your name and contact information. Then, input your Chase bank account number and the corresponding routing number. Ensure that the Kansas Direct Deposit Form for Chase is signed and submitted to ensure timely deposits into your account.

To properly fill out a direct deposit form, first, gather your bank details, including your account number and the routing number. Next, clearly write your personal information, such as your name and address, at the top of the form. Be sure to provide accurate information to avoid delays. Finally, submit the Kansas Direct Deposit Form for Chase to your employer or payment provider.

To obtain a Kansas Direct Deposit Form for Chase, you can visit any local Chase branch where a representative can assist you. Alternatively, you can log into your Chase online banking account and find the form in the direct deposit section. If you prefer, you can also download the Kansas Direct Deposit Form for Chase from the Chase website. For added convenience, consider using uslegalforms, which provides templates and guidance to streamline the process.

Yes, you can obtain a direct deposit form from Chase online. By logging into your online banking account, you can easily access and download the Kansas Direct Deposit Form for Chase. This feature eliminates the need to visit a branch and allows you to manage your direct deposit efficiently.

Yes, you can print out a Chase deposit slip. This is typically available in your online banking account under the deposit section. By using this feature, you can easily complete your transactions and manage your finances, including any direct deposits related to the Kansas Direct Deposit Form for Chase.

To create a voided check for direct deposit at Chase, write 'VOID' across the front of a blank check. Ensure you include your account details, as you will need these for the Kansas Direct Deposit Form for Chase. This method provides your employer or payer with the necessary information to set up your direct deposit.

To get a bank verification form from Chase, you can either request it through your online banking account or visit a local branch. If you prefer a digital option, Chase's online platform provides easy access to necessary forms, including the Kansas Direct Deposit Form for Chase. This streamlines the process, saving you time.

Yes, you can obtain a direct deposit form online with Chase. Simply log into your online banking account and look for the section regarding direct deposit. Once you find it, you can download and print your Kansas Direct Deposit Form for Chase quickly and securely.