This form is a Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith-Jury Trial Demand. Adapt to your specific circumstances. Don't reinvent the wheel, save time and money.

Kansas Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand

Description

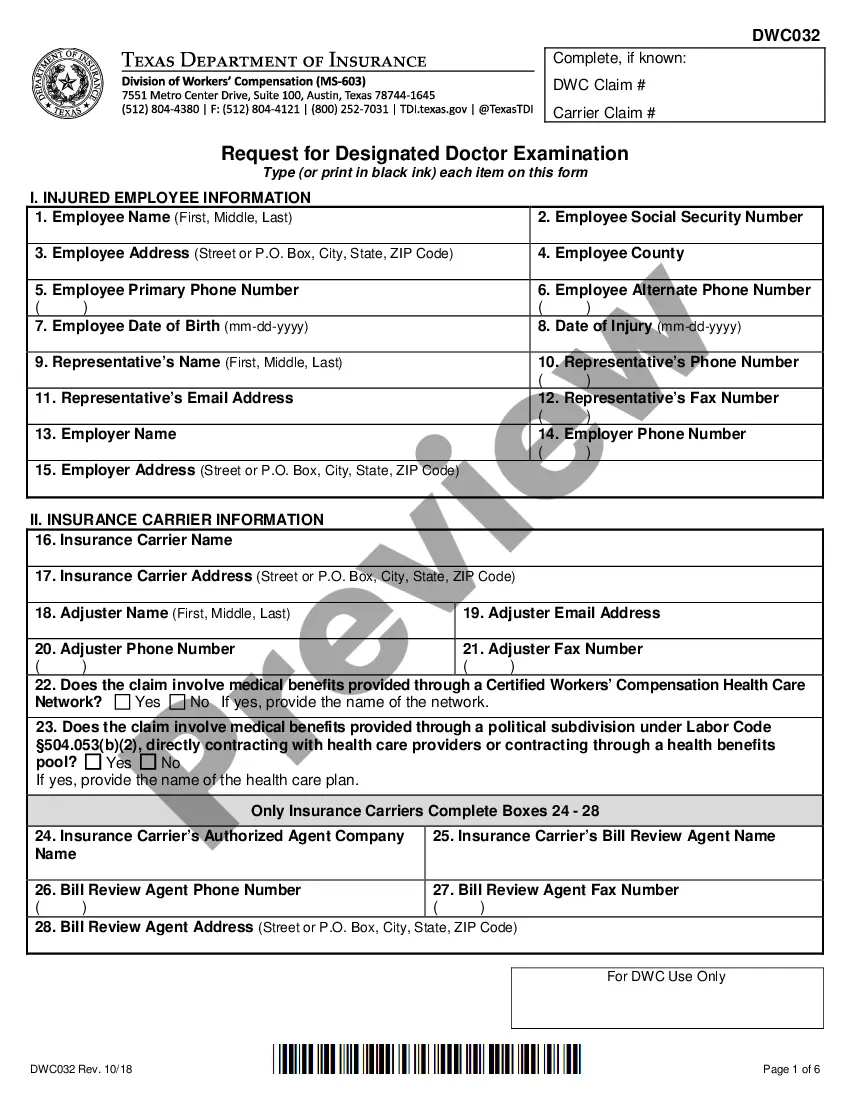

How to fill out Complaint For Wrongful Termination Of Insurance Under ERISA And For Bad Faith - Jury Trial Demand?

Selecting the appropriate authorized document template can be quite challenging. Naturally, there are numerous templates accessible on the web, but how do you find the authorized form you need.

Utilize the US Legal Forms platform. The service provides thousands of templates, including the Kansas Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand, which can be utilized for commercial and personal purposes. All of the forms are vetted by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Kansas Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand. Use your account to review the authorized forms you may have obtained previously. Navigate to the My documents tab of your account and obtain another copy of the document you need.

Create your account and pay for your order using your PayPal account or credit card. Select the download format and obtain the authorized document template to your device. Complete, edit, print, and sign the received Kansas Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand. US Legal Forms is the largest repository of authorized forms where you can find a variety of document templates. Use the service to acquire professionally crafted documents that meet state standards.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your area/state.

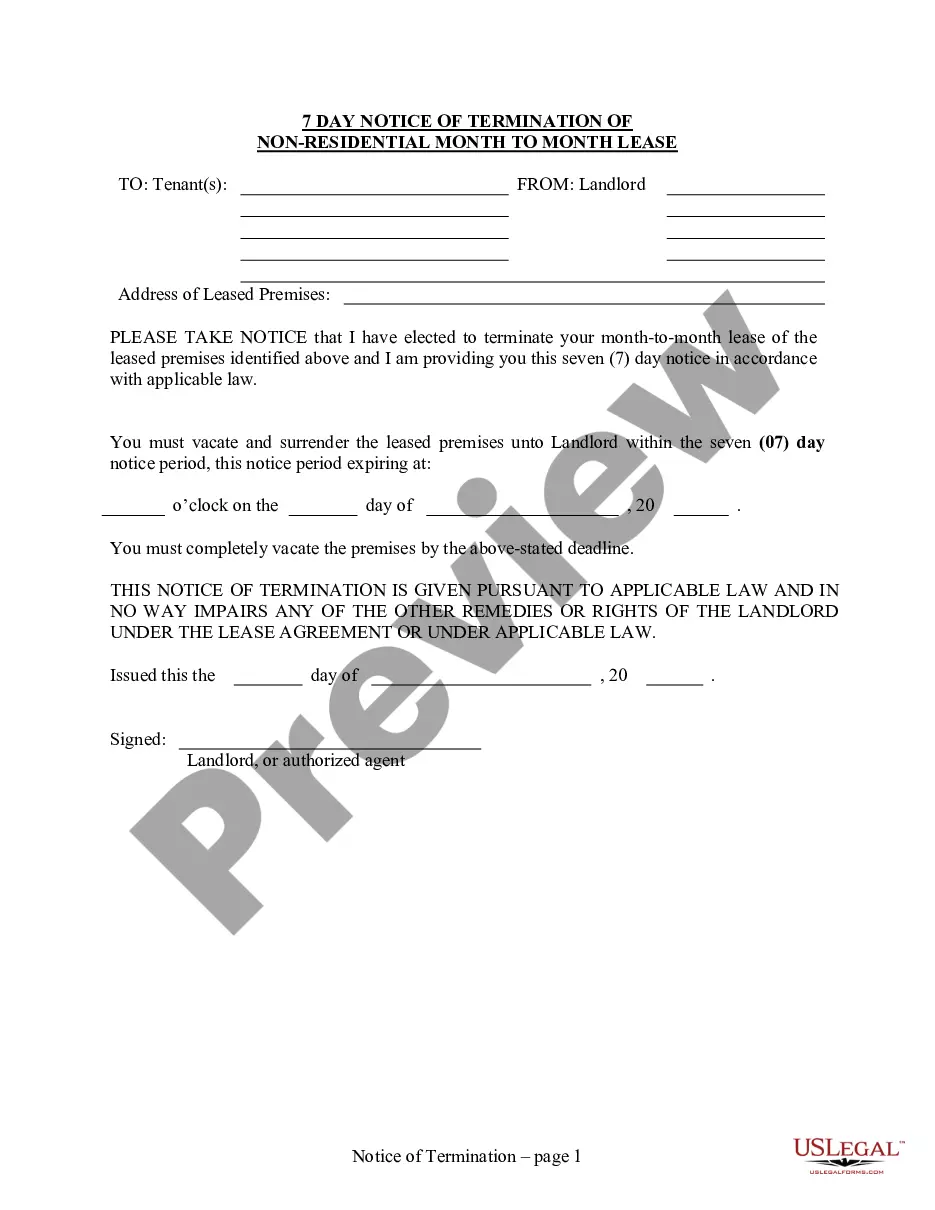

- You may preview the form using the Review button and check the form summary to ensure it is suitable for you.

- If the form does not meet your needs, utilize the Search section to find the appropriate form.

- Once you are confident that the form is suitable, select the Get now button to acquire the form.

- Choose the pricing plan you prefer and enter the required information.

Form popularity

FAQ

Under ERISA, individuals who are participants or beneficiaries of an employee benefit plan can sue for violations of their rights. This includes those whose benefits have been wrongfully terminated or denied. If you believe you have grounds for a Kansas Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand, it's important to understand your rights and options. You may want to seek assistance from platforms like uslegalforms, which can help you navigate the legal process effectively.

To prove that an insurance company acted in bad faith, gather evidence such as correspondence, claim denials, and any documentation showing the insurer's failure to act reasonably. Highlight instances where the company did not adhere to its obligations under the policy. If you are considering filing a Kansas Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand, being organized and thorough will bolster your claim. Consulting with an expert can also provide guidance to navigate this complex area.

To write a bad faith letter, start by clearly stating the reasons you believe the insurance company has acted in bad faith. Include specific details about your claim and any evidence that supports your position. In your letter, mention the Kansas Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand if applicable, as this can strengthen your case. Finally, be sure to request a prompt response from the insurance company to resolve the issue.

You can indeed sue an ERISA plan, but the process is specific. If you feel your rights have been violated under the plan, you may have grounds to take legal action. Consulting with an expert can guide you through filing a Kansas Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand, ensuring you understand your options.

Yes, you can sue your insurance company for acting in bad faith if they fail to uphold their contractual obligations. If you believe your insurer has unjustly denied your claim or delayed payment, you have the right to seek legal recourse. Filing a Kansas Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand can help you pursue justice.

In Kansas, wrongful termination occurs when an employee is fired for reasons that violate public policy or contractual obligations. For instance, if your employer terminates you for filing an insurance claim, it may be deemed wrongful termination. Understanding these nuances is essential, especially when considering a Kansas Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand.

Insurers can be liable for bad faith through various actions. First, if they deny a valid claim without a reasonable basis, they may face liability. Second, if they fail to investigate claims thoroughly, they can be held responsible. Lastly, if an insurer delays payment unreasonably, you might have grounds for a Kansas Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand.