Kansas Quitclaim Deed from Individual to LLC

Description

Key Concepts & Definitions

Quitclaim Deed: A legal instrument by which the owner of a real estate property transfers their interest to a recipient, in this case, an LLC. The term quit claim indicates that the transferor ceases any rights, but does not guarantee that the title is valid. LLC (Limited Liability Company): A business structure in the United States whereby the owners are not personally liable for the company's debts or liabilities. Transferring property to an LLC can help protect personal assets from business-related lawsuits.

Step-by-Step Guide

- Determine the suitability of the transfer: Assess why transferring property to an LLC is beneficial, considering factors like personal liability and asset protection.

- Form or choose an existing LLC: Establish an LLC if not already done. Ensure it is properly set up to hold real estate.

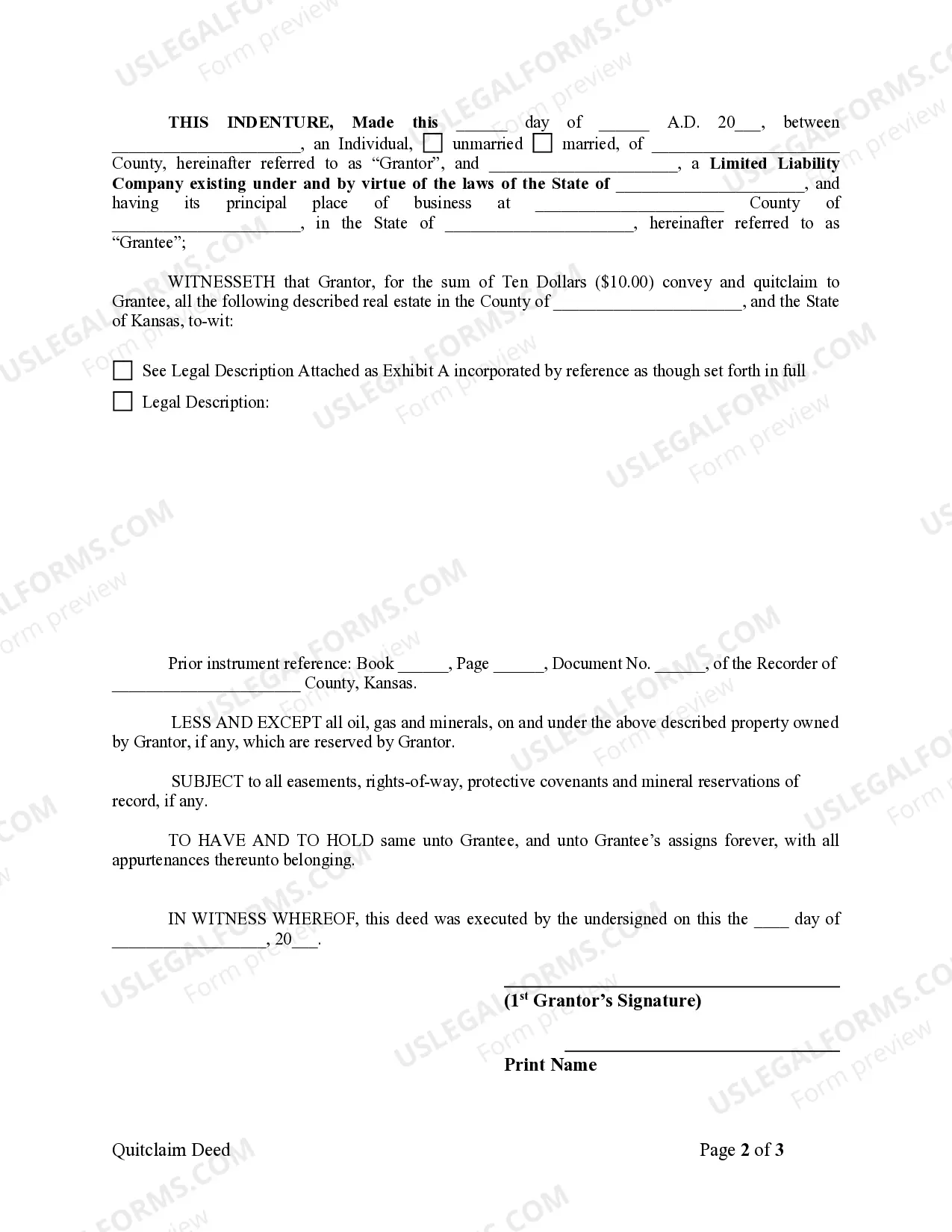

- Prepare the quitclaim deed: The deed should state your name as the grantor and the LLC as the grantee. Describe the property being transferred.

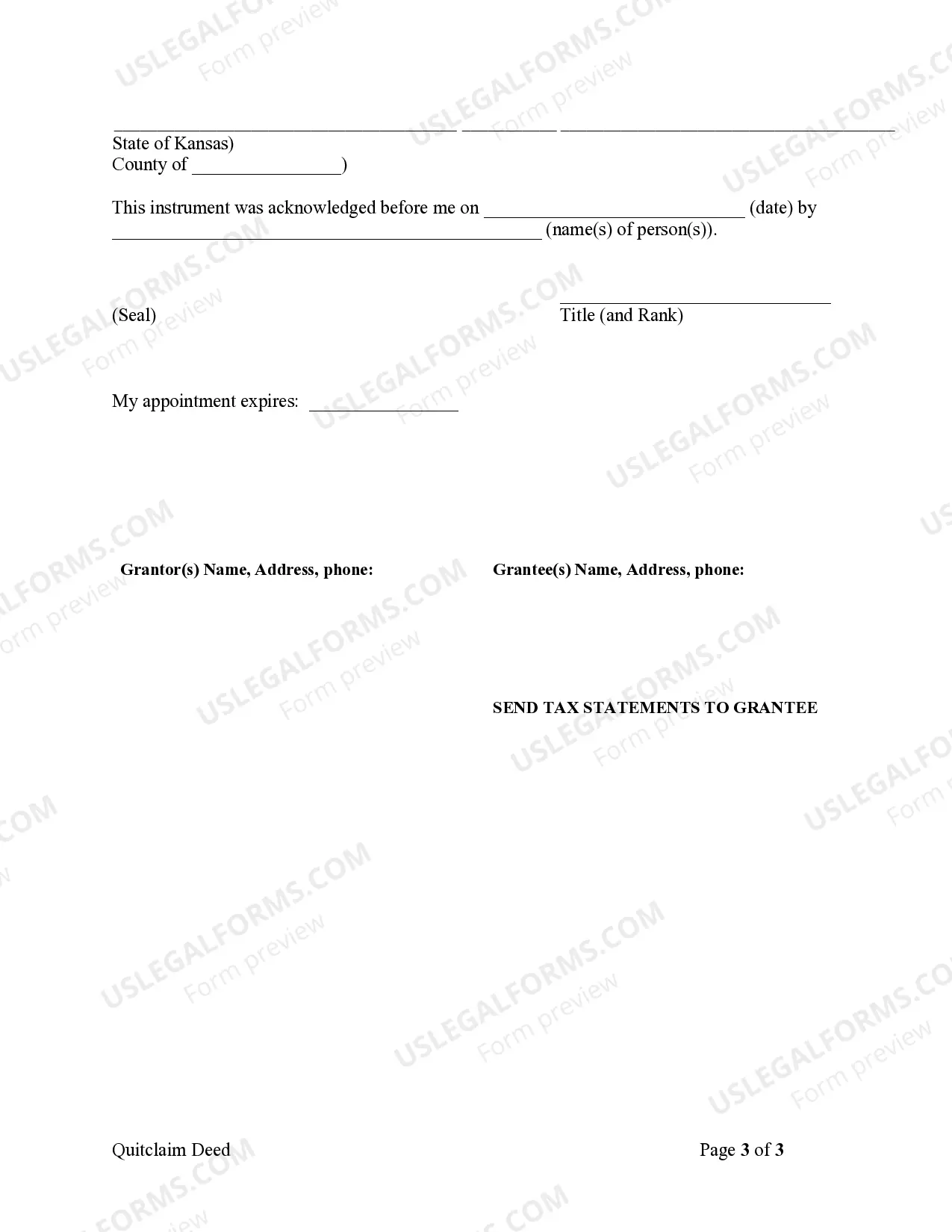

- Execute the deed: Sign the deed in front of a notary.

- Record the deed: File the deed with the local county office to make the transfer official.

- Consider further steps: Depending on local laws and the details of the property, you may need to update tax records and consult on refinance rates if the property has a mortgage.

Risk Analysis

- Legal Risks: Incorrectly executing a quitclaim deed might result in tax implications or disputes over property ownership.

- Financial Implications: Transferring a mortgaged property to an LLC may trigger a due on sale clause, necessitating the full repayment of the mortgage or refinance at possibly higher rates.

- Mismanagement Risks: If the LLC is poorly managed, the property's value and utility might be adversely affected, despite the legal protections against personal liabilities.

Pros & Cons of Using Quitclaim Deed from Individual to LLC

- Pros: Simplified transfer process; enhanced asset protection from personal liabilities; potential tax benefits under certain conditions.

- Cons: Provides no warranty against encumbrances; potential for increased financial and legal complications; can invoke mortgage clauses like due on sale.

Best Practices

- Consult a legal expert: Before executing a quitclaim deed, consult with a real estate or LLC attorney to understand all implications.

- Careful review of mortgages: Discuss with your lender or a financial expert about how the transfer affects your loan and refinance options.

- Maintain clear records: Keep detailed records and proper filings to avoid future legal or financial complications.

Common Mistakes & How to Avoid Them

- Ignoring Mortgage Impacts: Understand from your lender how transferring property will affect your mortgage. In some cases like with entities like JVM Lending, knowing beforehand can prevent costly mistakes.

- Failing to Properly File Deeds: Ensure the quitclaim deed is filed correctly with the relevant county office to avoid disputes and penalties.

- Not Updating Insurance: Update your property insurance to reflect the LLC as the new owner to maintain proper coverage.

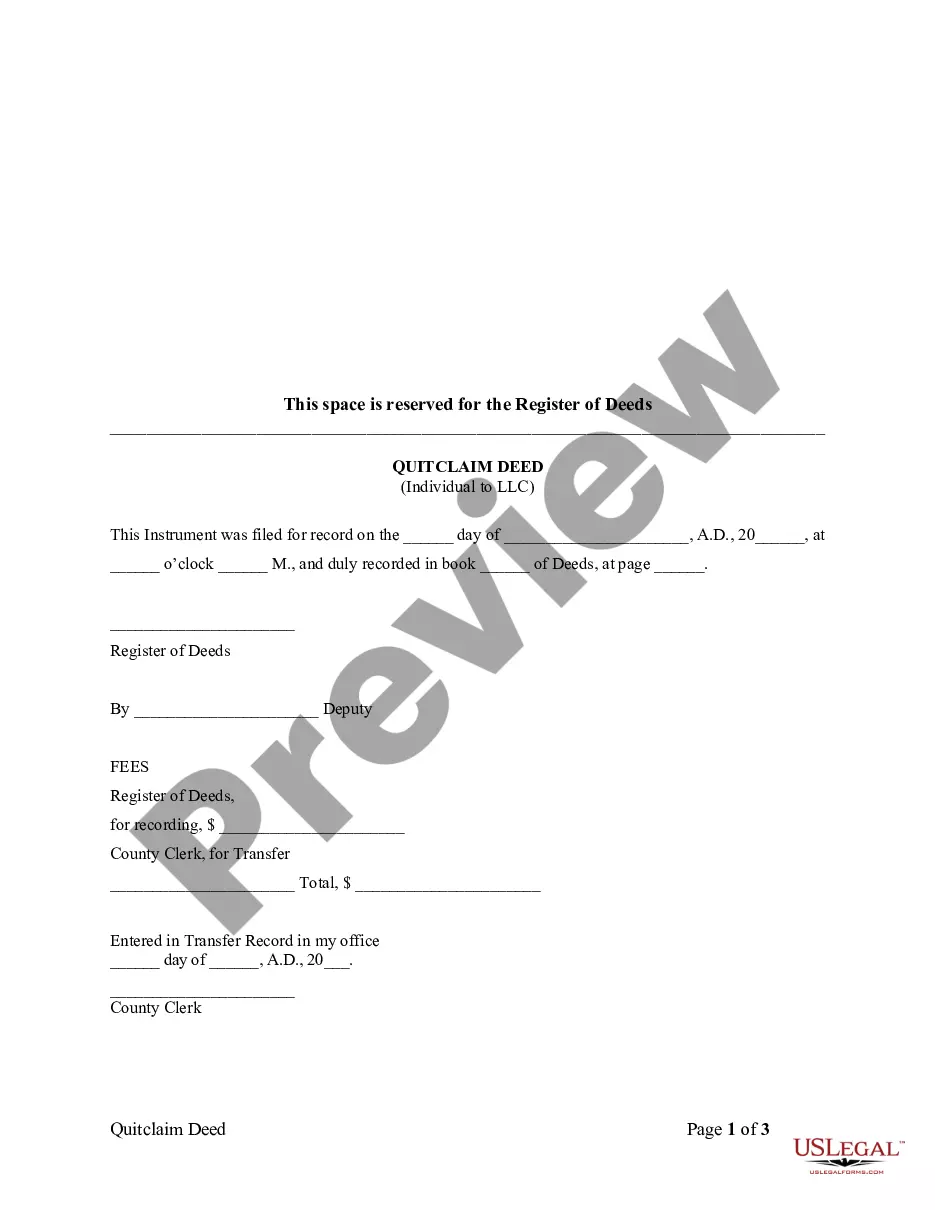

How to fill out Kansas Quitclaim Deed From Individual To LLC?

Searching for Kansas Quitclaim Deed from Individual to LLC forms and filling out them can be a challenge. In order to save time, costs and effort, use US Legal Forms and find the correct sample specifically for your state in just a couple of clicks. Our attorneys draw up all documents, so you just need to fill them out. It is really that easy.

Log in to your account and return to the form's page and download the sample. Your saved samples are saved in My Forms and therefore are available all the time for further use later. If you haven’t subscribed yet, you should sign up.

Take a look at our comprehensive guidelines on how to get your Kansas Quitclaim Deed from Individual to LLC template in a few minutes:

- To get an entitled form, check out its validity for your state.

- Look at the example utilizing the Preview function (if it’s available).

- If there's a description, read through it to understand the details.

- Click Buy Now if you found what you're searching for.

- Select your plan on the pricing page and make an account.

- Select you want to pay out with a card or by PayPal.

- Save the sample in the favored file format.

You can print the Kansas Quitclaim Deed from Individual to LLC form or fill it out utilizing any web-based editor. Don’t worry about making typos because your form may be employed and sent away, and printed out as often as you would like. Try out US Legal Forms and access to around 85,000 state-specific legal and tax files.

Form popularity

FAQ

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

A Quitclaim Deed must be notarized by a notary public or attorney in order to be valid.Consideration in a Quitclaim Deed is what the Grantee will pay to the Grantor for the interest in the property.

Recording A quitclaim deed must be filed with the County Recorder's Office where the real estate is located. Go to your County Website to locate the office nearest you. Signing (§ 58-2205) A quitclaim deed is required to be authorized with a notary public present.

However, there are substantial downsides associated with transferring your primary home into an LLC.If you are using your personal residence for estate planning purposes, a qualified personal residence trust (QPRT) may be more effective than transferring your property to a limited liability company.

A quitclaim deed is a legal instrument that is used to transfer interest in real property.The owner/grantor terminates (quits) any right and claim to the property, thereby allowing the right or claim to transfer to the recipient/grantee.

How to Quitclaim Deed to LLC. A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.