Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual

Description

How to fill out Kansas Transfer On Death Deed Or TOD - Beneficiary Deed For Individual To Individual?

Locating a Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual template and completing it may pose a difficulty.

To conserve time, expenses, and effort, utilize US Legal Forms and discover the appropriate sample specifically for your state in just a few clicks.

Our attorneys prepare each document, allowing you to only fill them in. It is that straightforward.

Select your plan on the pricing page and set up your account. Choose your payment method with a card or via PayPal. Save the template in your preferred format. You can now print the Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual template or complete it with any online editor. Don't worry about errors, as your template can be used, sent, and printed as many times as necessary. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and revisit the form's page to save the document.

- All your saved templates are stored in My documents and are available at any time for later use.

- If you have not yet subscribed, you will need to register.

- Review our comprehensive instructions on how to secure your Kansas Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual template in just a few minutes.

- To obtain an eligible sample, verify its validity for your state.

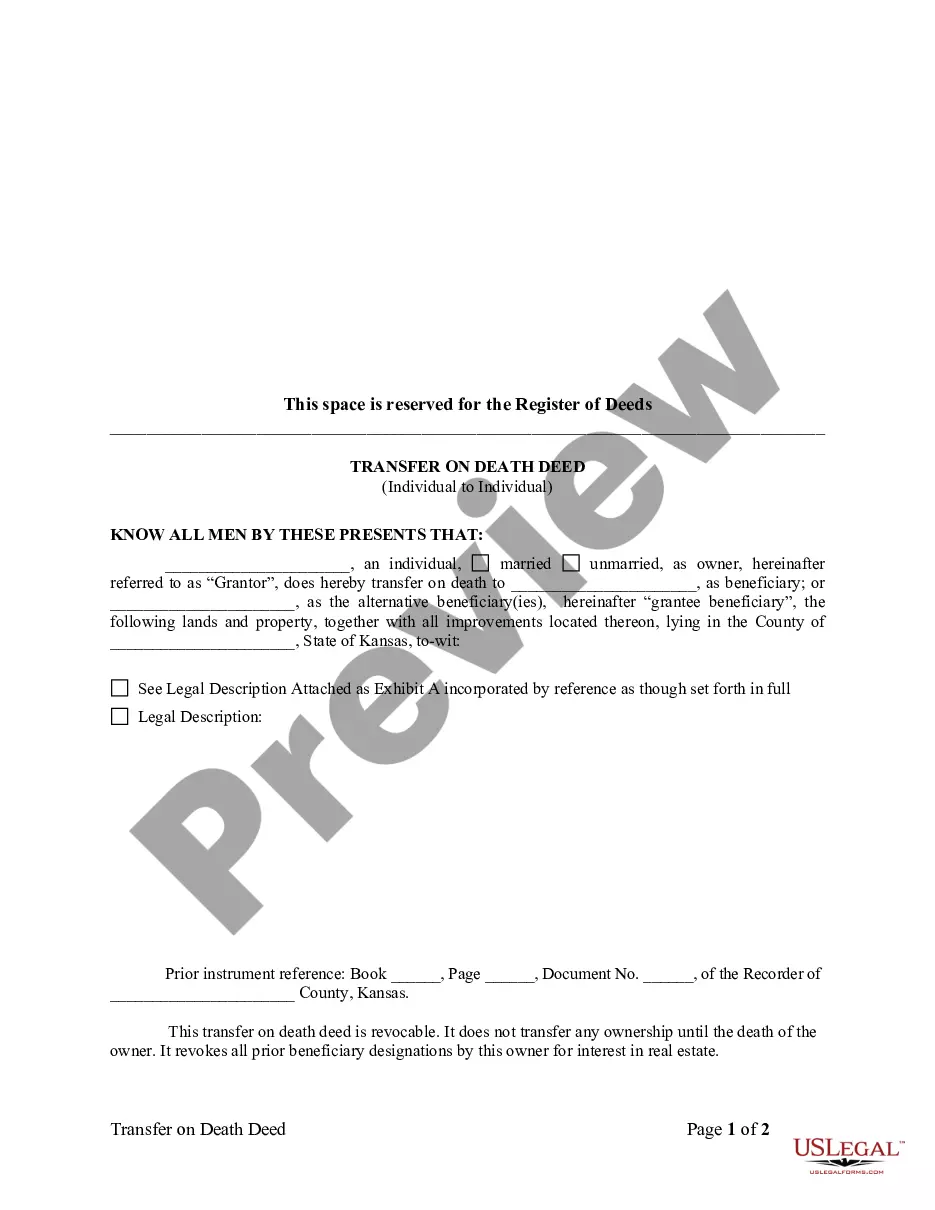

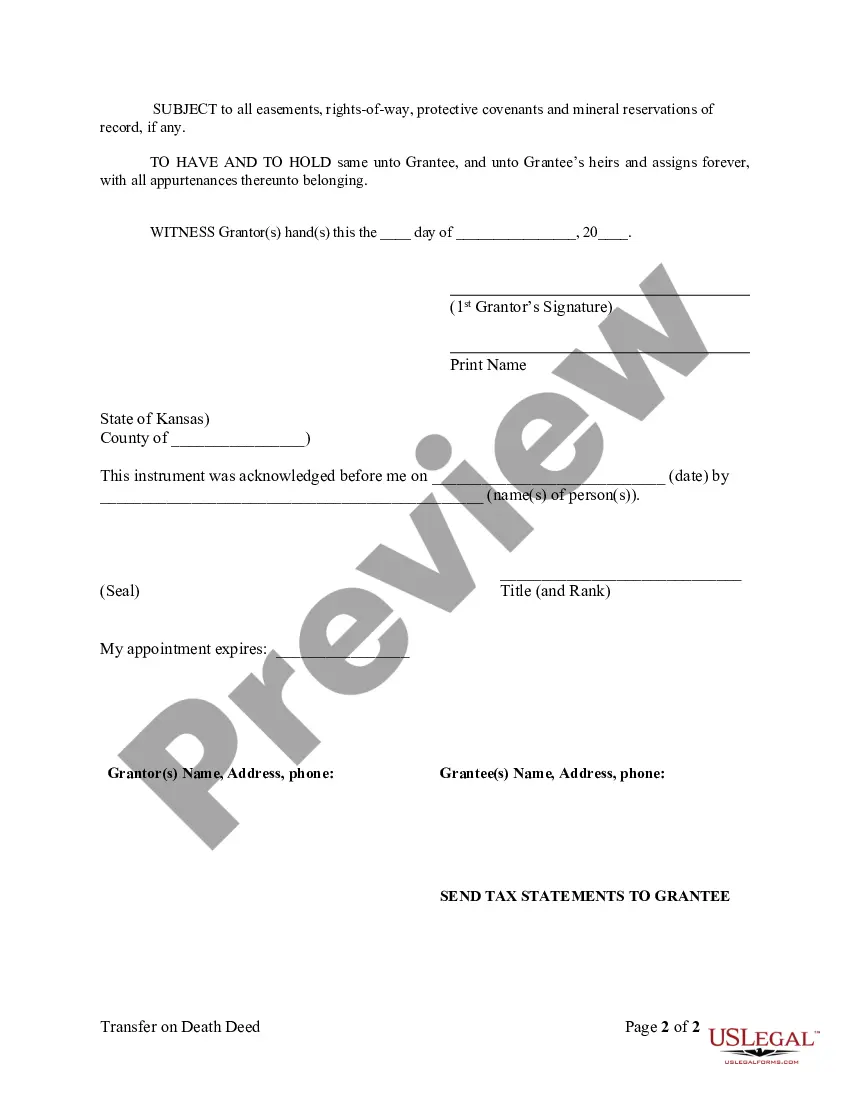

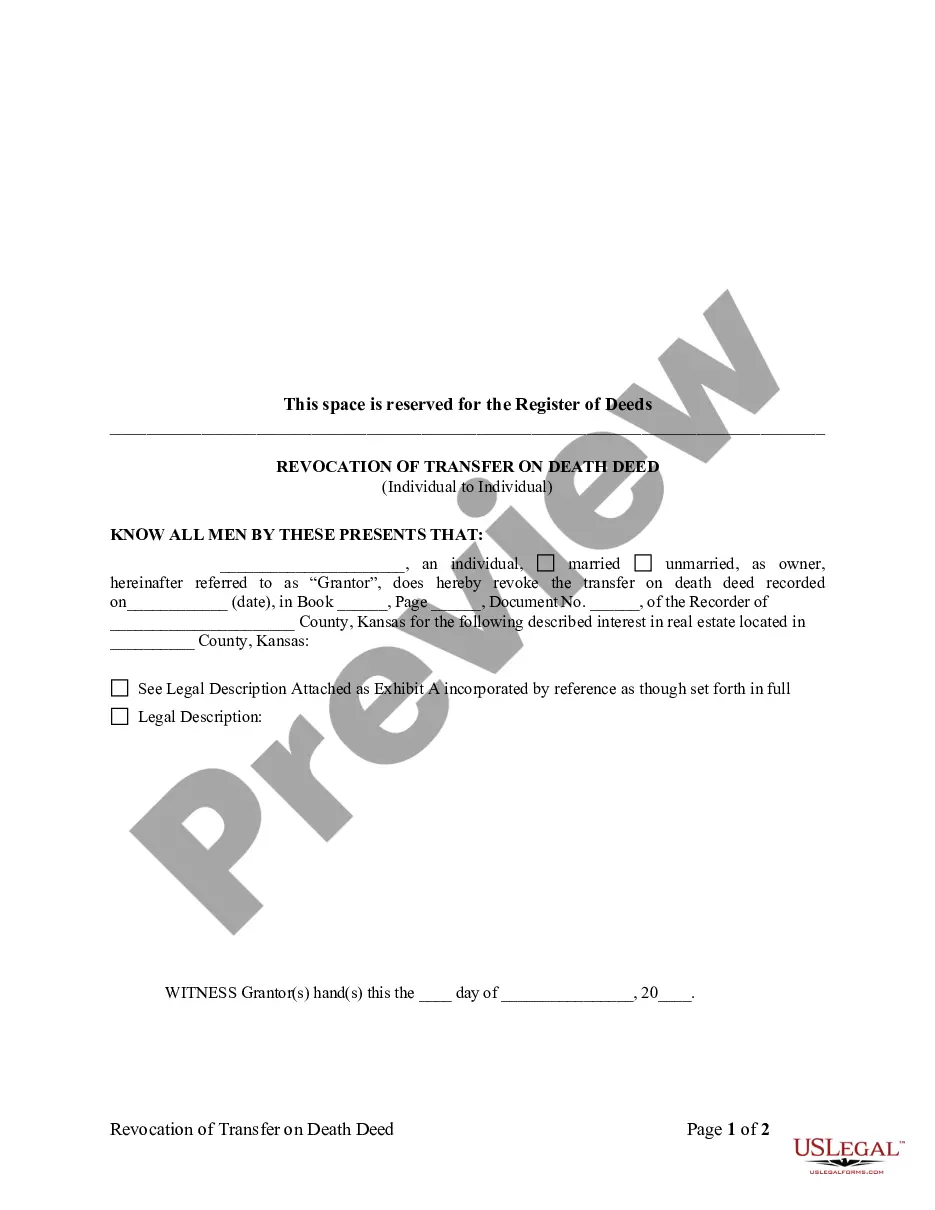

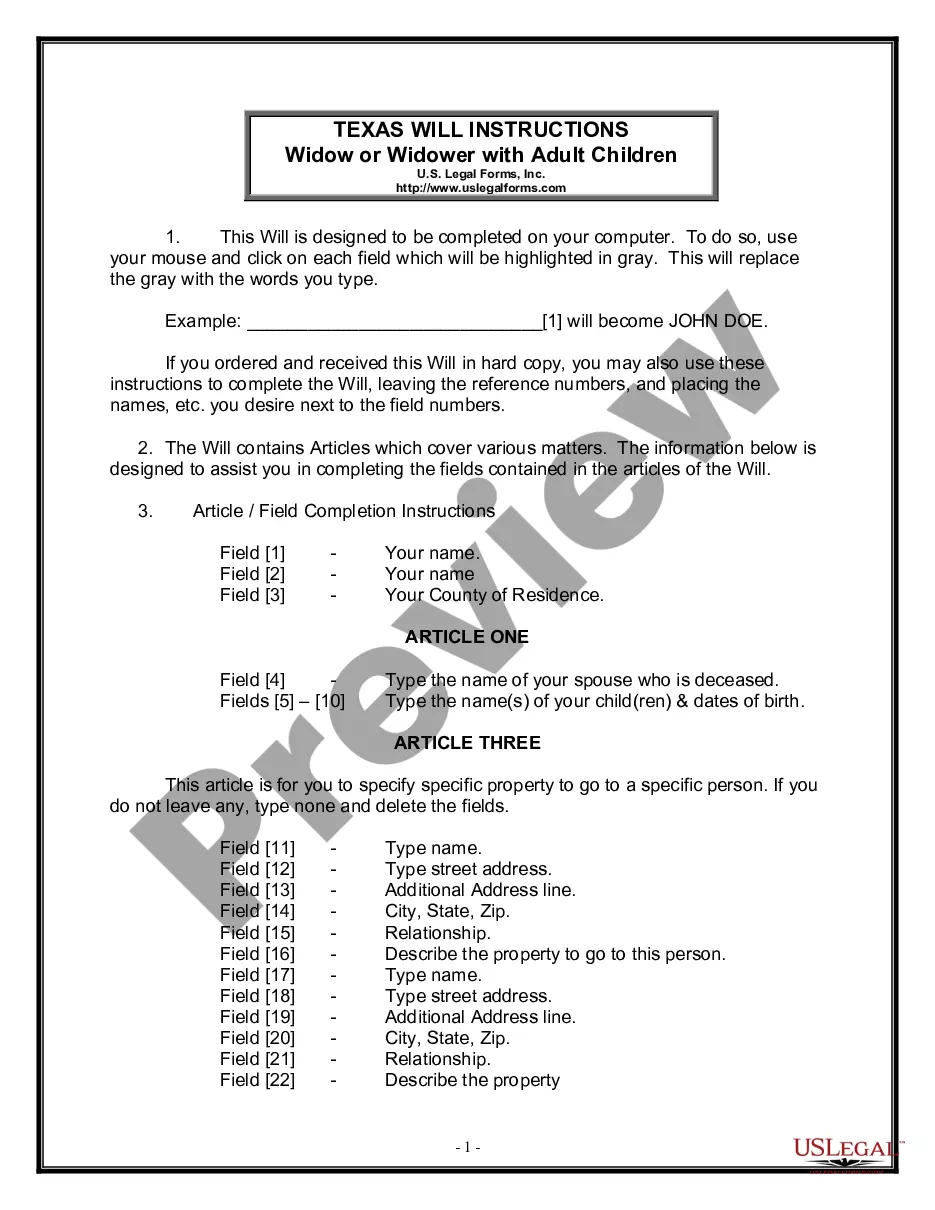

- Examine the sample using the Preview feature (if it's available).

- If there is a description, read it to grasp the details.

- Click Buy Now if you found what you're looking for.

Form popularity

FAQ

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

Receiving an inheritance can be an unexpected windfall. In fact, transfer on death accounts are exposed to all the same income and capital gains taxes when the account owner is alive, as well as estate and inheritance taxes upon the owner's death.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

A transfer on death deed (TOD) lets a property owner pass land or real estate to a designated beneficiary outside of the probate process. A transfer on death deed can be a helpful estate planning tool but it is not permitted in every state.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

A transfer on death (TOD) account automatically transfers its assets to a named beneficiary when the holder dies For example, if you have a savings account with $100,000 in it and name your son as its beneficiary, that account would transfer to him upon your death.

Transfer on death applies to certain assets that have a named beneficiary. The beneficiaries (or a spouse) receive the assets without having to go through probate. Beneficiaries of the TOD don't have access to the assets prior to the owner's death.