Indiana Irrevocable Power of Attorney for Transfer of Stock by Executor

Description

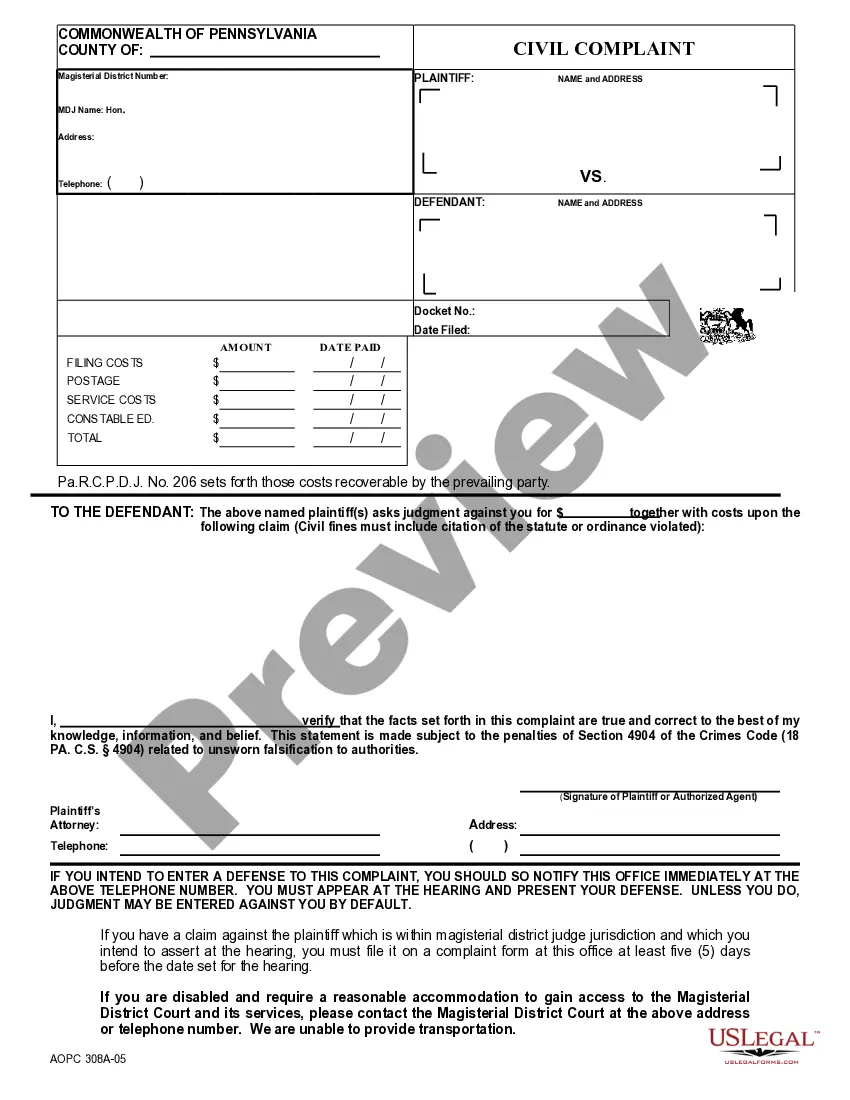

How to fill out Irrevocable Power Of Attorney For Transfer Of Stock By Executor?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast selection of legal form templates that you can download or print. By using the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Indiana Irrevocable Power of Attorney for Transfer of Stock by Executor in moments.

If you already have an account, Log In and download the Indiana Irrevocable Power of Attorney for Transfer of Stock by Executor from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously downloaded forms in the My documents tab of your account.

If you are using US Legal Forms for the first time, here are simple instructions to get started: Ensure you have selected the correct form for your city/state. Click the Preview button to review the form’s content. Check the form details to confirm that you have chosen the right one. If the form doesn’t meet your needs, use the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select your preferred pricing plan and provide your information to register for an account. Complete the payment. Use your credit card or PayPal account to finalize the transaction. Choose the format and download the form to your device. Make adjustments. Fill out, modify, print, and sign the downloaded Indiana Irrevocable Power of Attorney for Transfer of Stock by Executor.

- Every template you add to your account has no expiration date and is yours indefinitely.

- Therefore, if you need to download or print another copy, simply go to the My documents section and click on the form you need.

- Access the Indiana Irrevocable Power of Attorney for Transfer of Stock by Executor with US Legal Forms, the most comprehensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal requirements and specifications.

- Enjoy the convenience of having a large library of legal forms at your fingertips.

- Ensure your legal needs are met efficiently.

Form popularity

FAQ

Yes, an Indiana Irrevocable Power of Attorney for Transfer of Stock by Executor should be recorded to ensure it is valid and enforceable. Recording the document with the local county recorder's office protects against disputes and clarifies the agent's authority. Although not all powers of attorney require recording, it is especially important for those involving stock transfers. UsLegalForms offers resources to help you understand the recording process and ensure your documents are properly filed.

An Indiana Irrevocable Power of Attorney for Transfer of Stock by Executor cannot be used to make decisions that violate the law or act against the principal's best interests. Additionally, the agent cannot change the principal's will or make personal gifts unless specifically authorized within the document. Understanding these limitations is crucial to ensure the agent operates within legal boundaries. If you have questions about specific powers, UsLegalForms can provide clarity on the rights and responsibilities involved.

To file an Indiana Irrevocable Power of Attorney for Transfer of Stock by Executor, you must first complete the necessary forms, ensuring they meet Indiana's legal requirements. After signing the document in front of a notary, you can file it with the county recorder's office where the principal resides. This process ensures the power of attorney is recognized for stock transfers and other legal matters. For assistance, consider using UsLegalForms to access templates and guidance tailored to Indiana's laws.

You can find power of attorney paperwork at various online legal service platforms, including US Legal Forms. They provide state-specific templates, ensuring you get the right forms for Indiana. If you are looking for an Indiana Irrevocable Power of Attorney for Transfer of Stock by Executor, US Legal Forms can streamline your search and help you create a legally binding document with ease.

You can obtain a power of attorney in Indiana without a lawyer by creating the document yourself or using online resources. It is essential to ensure the document complies with state laws to be enforceable. US Legal Forms offers user-friendly templates for the Indiana Irrevocable Power of Attorney for Transfer of Stock by Executor, making it easier for you to complete the process confidently.

To create a power of attorney in Indiana, you need a written document that identifies the principal and the agent. This document should outline the powers granted and must be signed in front of a notary public. For specific needs, like the Indiana Irrevocable Power of Attorney for Transfer of Stock by Executor, exploring resources on US Legal Forms can provide the necessary forms and instructions to meet your requirements.

To obtain a durable power of attorney in Indiana, you need to create a document that clearly states your intentions. This document should specify that it remains effective even if you become incapacitated. Utilizing US Legal Forms can simplify this process by providing easy-to-follow templates, including the Indiana Irrevocable Power of Attorney for Transfer of Stock by Executor, ensuring your wishes are well-documented.

Yes, you can write your own power of attorney in Indiana, but it's important to follow specific legal guidelines. An Indiana Irrevocable Power of Attorney for Transfer of Stock by Executor must meet certain requirements to be valid. To ensure your document is legally sound, consider using a platform like US Legal Forms, which provides templates and guidance tailored to Indiana law.