Indiana Clauses Relating to Initial Capital contributions

Description

How to fill out Clauses Relating To Initial Capital Contributions?

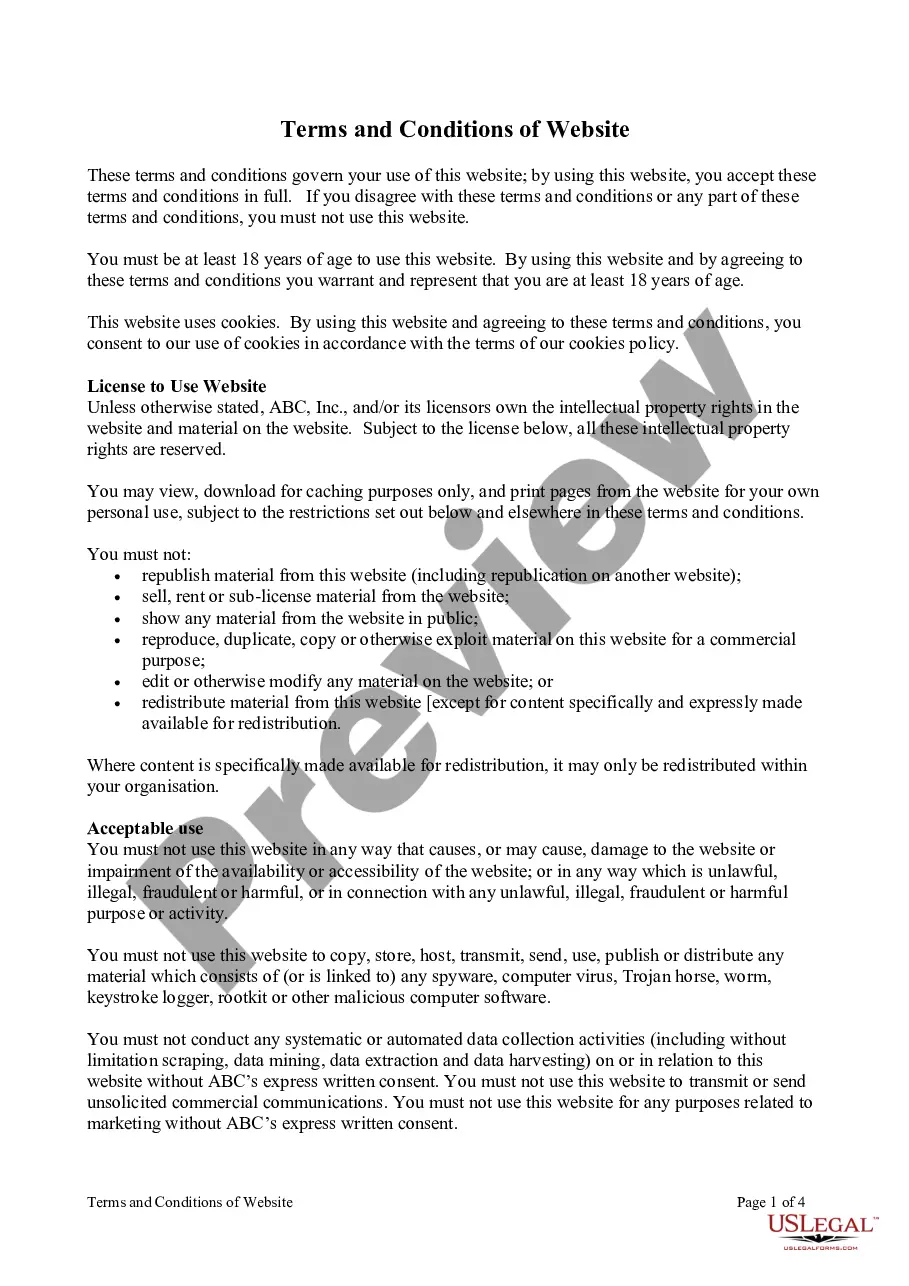

If you need to full, down load, or produce legitimate papers templates, use US Legal Forms, the greatest assortment of legitimate forms, which can be found on the web. Utilize the site`s basic and practical research to obtain the paperwork you require. Numerous templates for enterprise and person uses are sorted by types and suggests, or search phrases. Use US Legal Forms to obtain the Indiana Clauses Relating to Initial Capital contributions in a couple of click throughs.

In case you are previously a US Legal Forms buyer, log in to the profile and click the Download key to have the Indiana Clauses Relating to Initial Capital contributions. You may also accessibility forms you earlier acquired within the My Forms tab of your own profile.

If you work with US Legal Forms for the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the shape to the right city/nation.

- Step 2. Utilize the Review option to check out the form`s content material. Never neglect to read through the information.

- Step 3. In case you are not happy with all the form, take advantage of the Search discipline towards the top of the display screen to discover other variations from the legitimate form template.

- Step 4. Upon having discovered the shape you require, select the Buy now key. Pick the prices plan you prefer and add your qualifications to register for the profile.

- Step 5. Procedure the purchase. You should use your bank card or PayPal profile to finish the purchase.

- Step 6. Select the structure from the legitimate form and down load it on your device.

- Step 7. Comprehensive, change and produce or sign the Indiana Clauses Relating to Initial Capital contributions.

Every single legitimate papers template you buy is yours permanently. You might have acces to every single form you acquired within your acccount. Click the My Forms segment and choose a form to produce or down load once more.

Remain competitive and down load, and produce the Indiana Clauses Relating to Initial Capital contributions with US Legal Forms. There are thousands of specialist and express-particular forms you can utilize to your enterprise or person requires.

Form popularity

FAQ

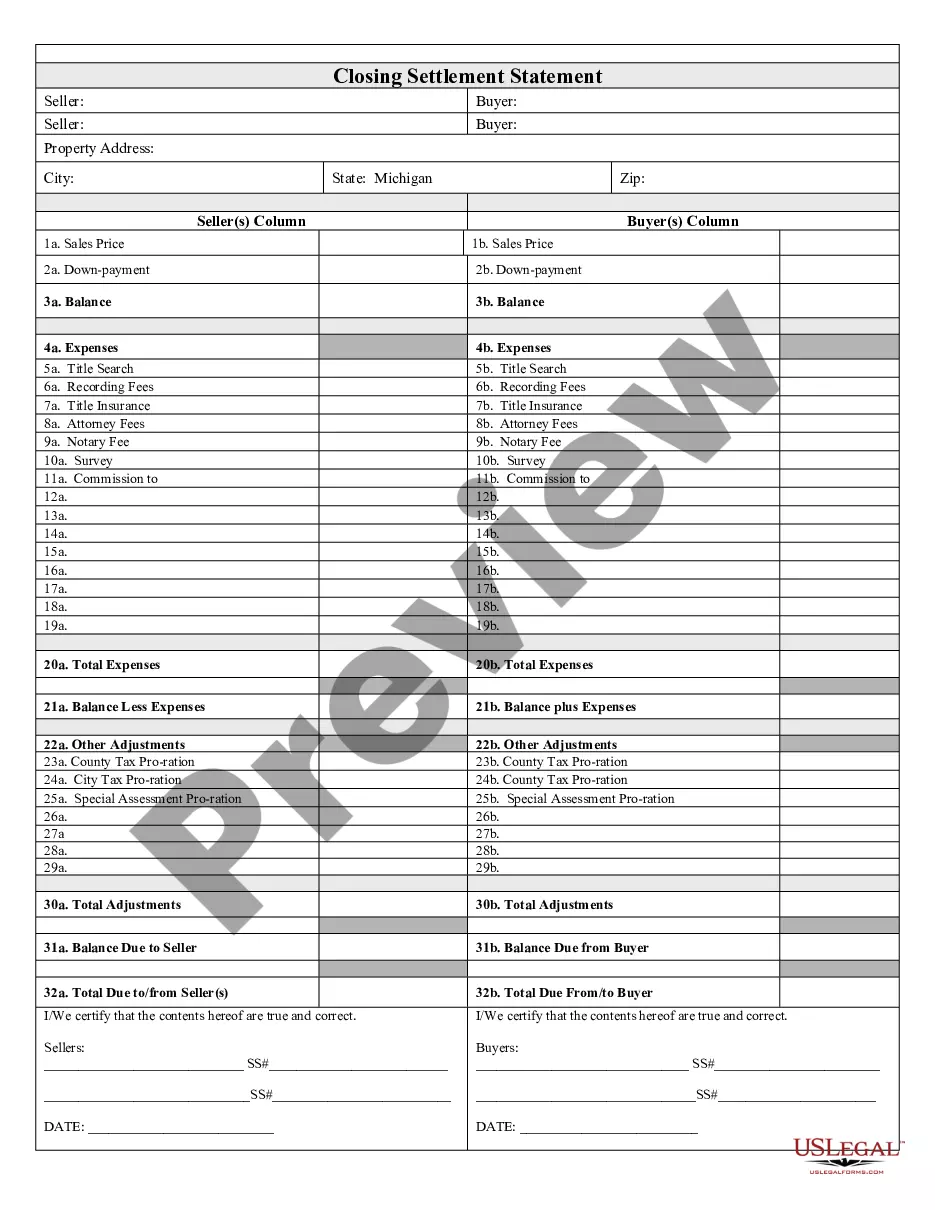

Set Up an Owner Contribution Category Whether you are using the category to receive a physical payment (contribution) from an owner, or simply using the category to transfer funds between properties for the owner, the funds are not commonly considered income.

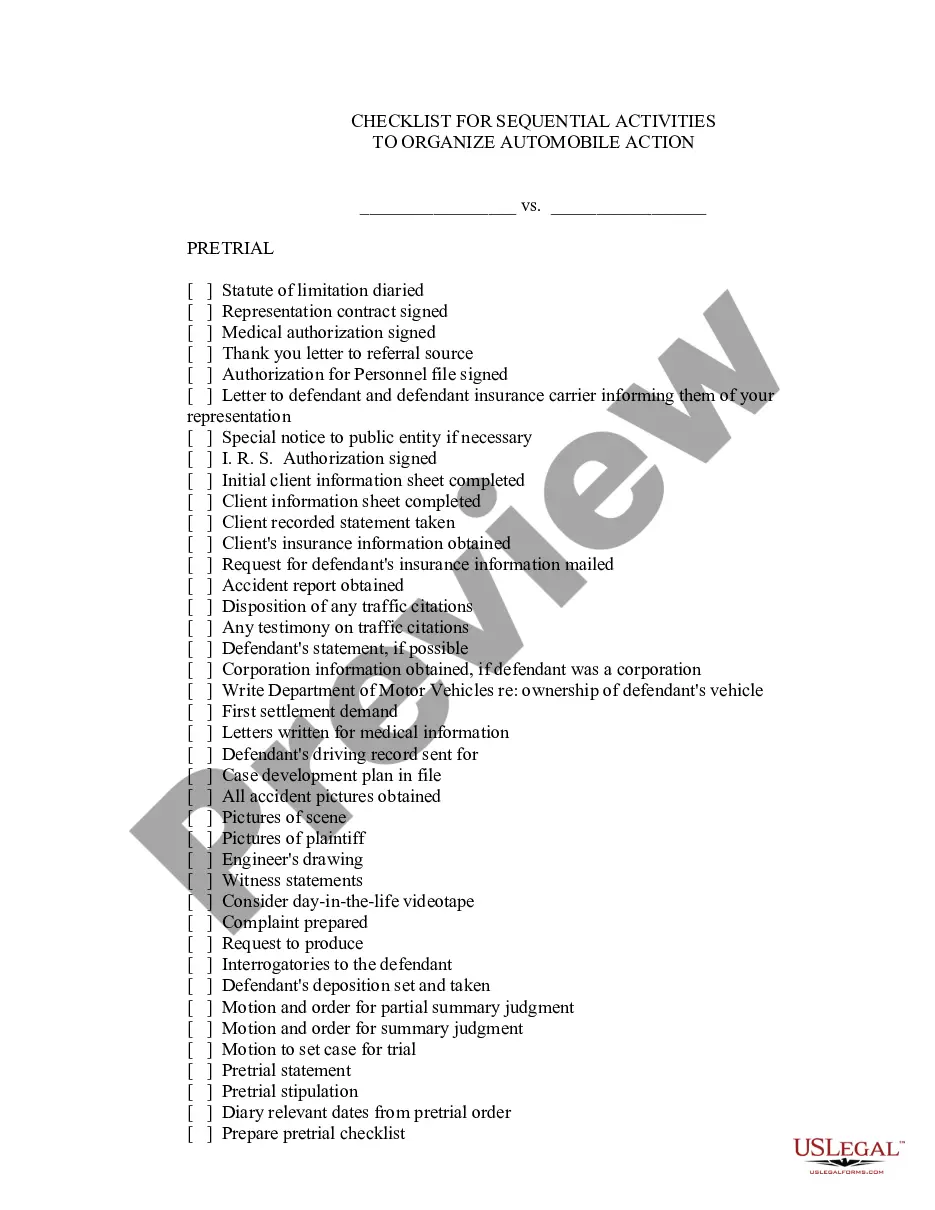

One of the most important sections in the operating agreement is the capital contribution section. A capital contribution section usually addresses what happens if members fail to contribute their portion of the initial start-up capital.

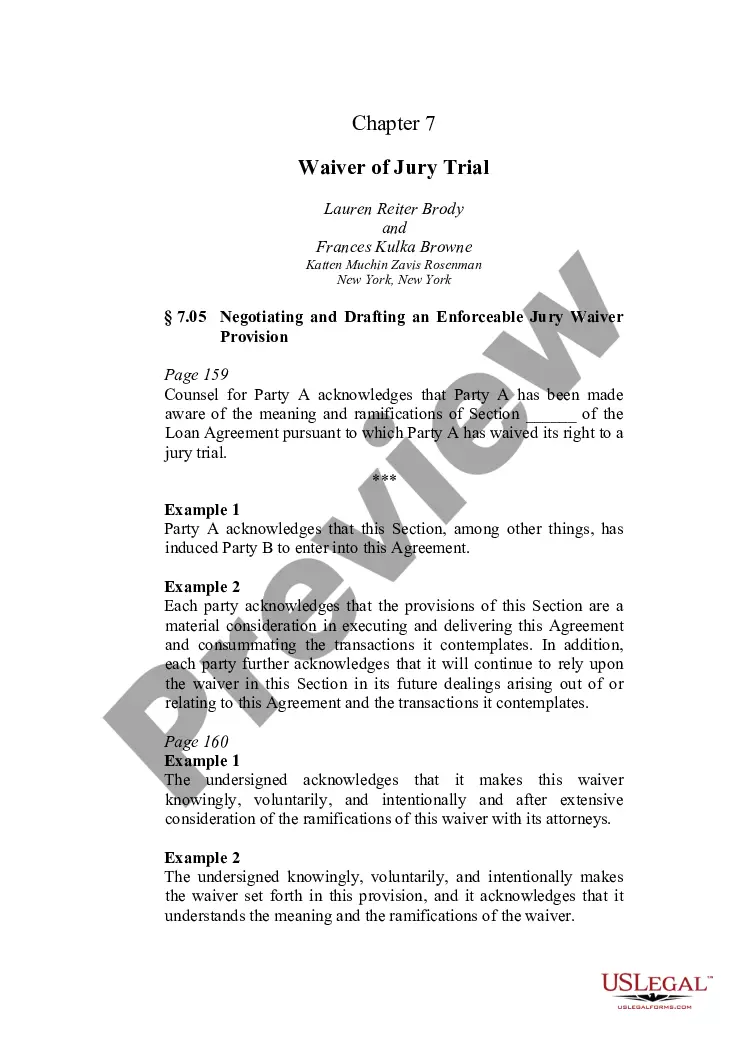

An Initial Capital Stock Contribution is a specific amount of money you noted on your Operating Agreement that you as a shareholder in your LLC with S Corp tax formation would 'contribute' to get the business up and running.

Are Capital Contributions to a Corporation Included in Gross Income? A corporation's gross income generally does not include contributions to its capital.

This is the price that shareholders paid for their stake in the company. Contributed capital is reported in the shareholder's equity section of the balance sheet and usually split into two different accounts: common stock and additional paid-in capital account.

This clause should be used when one member contributed real property to the joint venture in exchange for membership interests and another member has contributed capital. The capitalized terms and section references used in this clause should be conformed to the relevant joint venture operating agreement.

The IRS permits tax free capital contributions of non-cash assets as long as the value of the asset equals the value of the equity received in exchanged. If the value of the asset is less than the value of the equity received, the excess amount may be a taxable gain.

What Is Contributed Capital? Contributed capital, also known as paid-in capital, is the cash and other assets that shareholders have given a company in exchange for stock. Investors make capital contributions when a company issues equity shares based on a price that shareholders are willing to pay for them.