Indiana Sub-Operating Agreement

Description

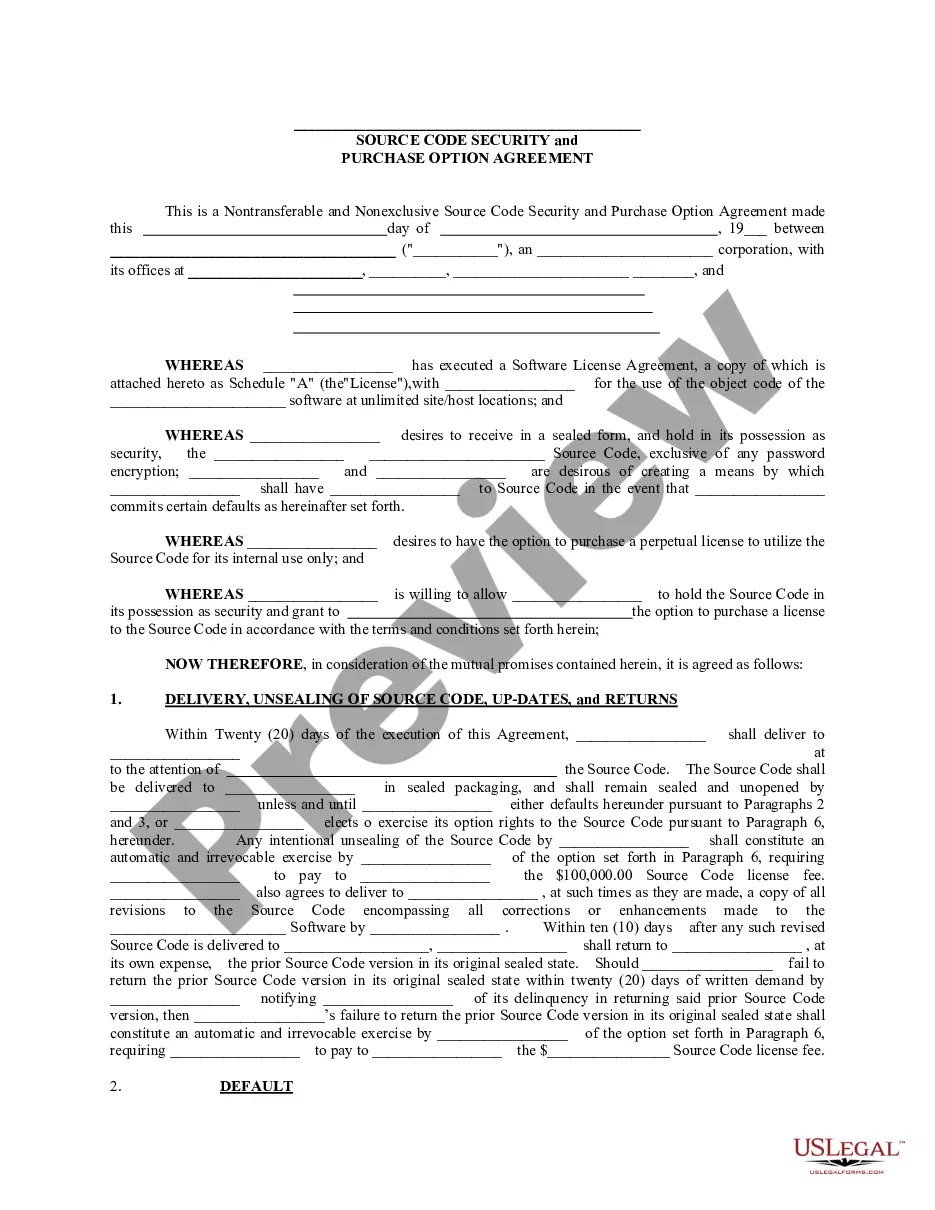

How to fill out Sub-Operating Agreement?

You are able to invest hrs on the web searching for the authorized papers web template which fits the state and federal demands you want. US Legal Forms provides thousands of authorized varieties which can be examined by pros. You can actually obtain or print the Indiana Sub-Operating Agreement from my services.

If you have a US Legal Forms bank account, you are able to log in and then click the Download option. Following that, you are able to comprehensive, change, print, or indication the Indiana Sub-Operating Agreement. Each and every authorized papers web template you buy is the one you have forever. To obtain yet another backup associated with a bought develop, check out the My Forms tab and then click the related option.

If you are using the US Legal Forms website for the first time, adhere to the straightforward instructions beneath:

- First, make certain you have selected the best papers web template for your state/city that you pick. Look at the develop explanation to make sure you have selected the correct develop. If accessible, take advantage of the Review option to look throughout the papers web template at the same time.

- If you would like find yet another variation in the develop, take advantage of the Research discipline to discover the web template that meets your requirements and demands.

- Once you have identified the web template you want, click Acquire now to move forward.

- Find the pricing prepare you want, type your qualifications, and register for an account on US Legal Forms.

- Total the deal. You can utilize your Visa or Mastercard or PayPal bank account to cover the authorized develop.

- Find the structure in the papers and obtain it to your product.

- Make modifications to your papers if required. You are able to comprehensive, change and indication and print Indiana Sub-Operating Agreement.

Download and print thousands of papers templates while using US Legal Forms web site, that offers the most important collection of authorized varieties. Use specialist and state-distinct templates to handle your company or individual requires.

Form popularity

FAQ

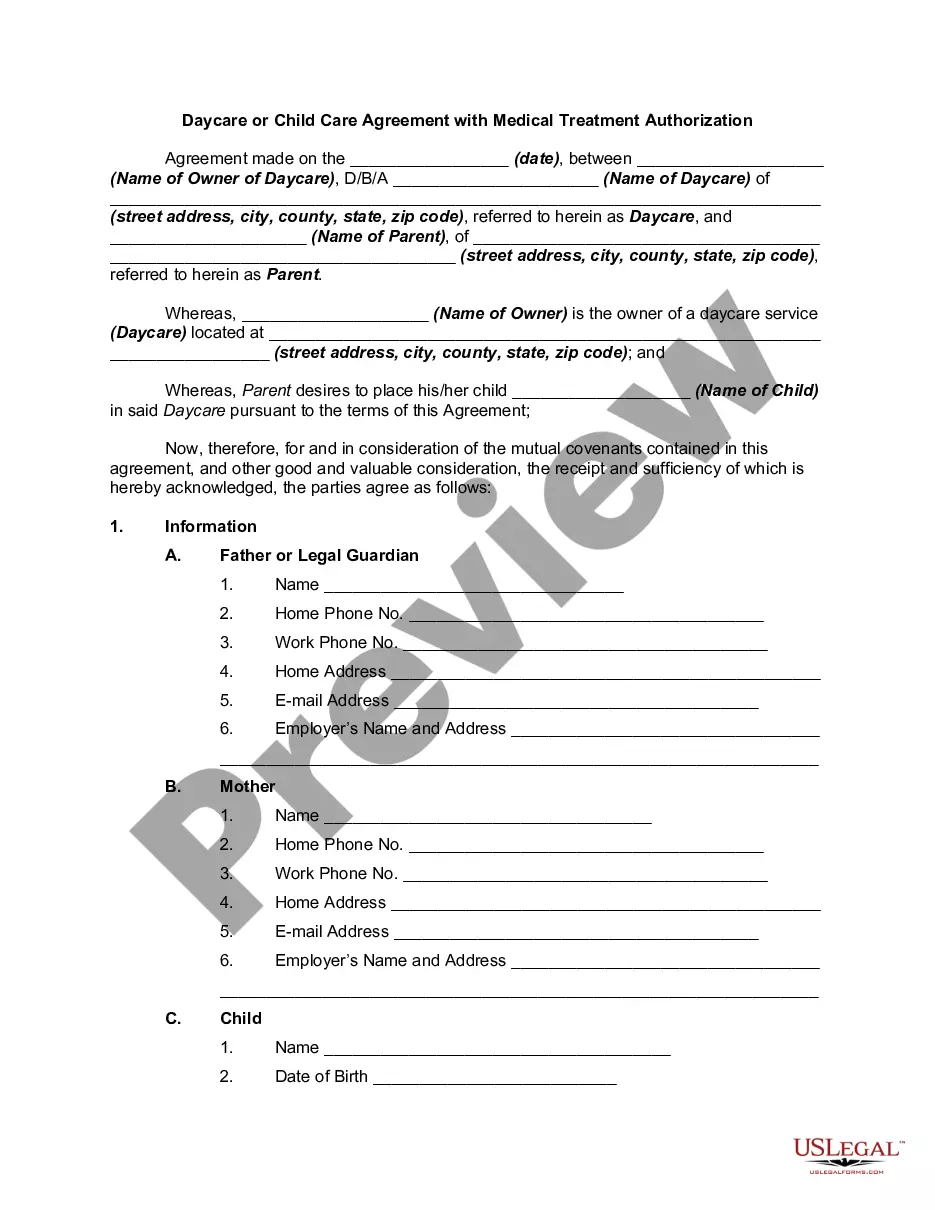

The articles of organization document contains all the information needed to establish your LLC in Indiana. Including: The name of your LLC. The street address of your LLC's registered office and the name of the registered agent at that office.

Establishing Your Indiana LLC You may submit a physical copy of your Articles of Organization or complete the process online. The cost for domestic LLC formation is $100 by mail or $95 online.

Unlike your LLC Formation Agreement, you are not required to file an operating agreement with the State of Indiana. However, as an internal document, a copy should be kept with your records. The operating agreement names the members of the company and spells out what percentage, or membership interest, they own.

Flexible Profit Distribution: When you register a new business in Indiana as an LLC, it will enjoy the benefit of being able to select different ways of distribution of profits. Flow through Entity: An LLC is considered to be a flow through entity, which means the LLC will not be subjected to corporate income tax.

An operating agreement, also known in some states as a limited liability company (LLC) agreement, is a contract that describes how a business plans to operate. Think of it as a legal business plan that reads like a prenup.

Transferring Ownership in an LLC When the ownership transfer is a sale of the LLC, a buy-sell agreement may be necessary. An operating agreement should specify the process for ownership transfer, but if it doesn't, you must follow state guidelines. Under some circumstances, the state may require you to form a new LLC.

Name your Indiana LLC. You'll need to choose a name to include in your articles before you can register your LLC. ... Choose your registered agent. ... Prepare and file articles of organization. ... Receive a certificate from the state. ... Create an operating agreement. ... Get an Employer Identification Number.

In the case that you have elected your LLC to be taxed as a corporation, you'll have to pay the Indiana Corporate Income Tax. The current rate of the Indiana Corporate Income Tax is at 5.25 percent and set to decrease to 4.9 percent by July 2021.