Indiana Affidavit of Heirship for Small Estates

Description

How to fill out Affidavit Of Heirship For Small Estates?

US Legal Forms - one of many largest libraries of legal types in the States - provides a wide range of legal file web templates you are able to obtain or printing. Making use of the web site, you will get 1000s of types for organization and individual functions, categorized by classes, says, or search phrases.You will discover the most up-to-date models of types like the Indiana Affidavit of Heirship for Small Estates in seconds.

If you already possess a registration, log in and obtain Indiana Affidavit of Heirship for Small Estates in the US Legal Forms catalogue. The Acquire key will show up on each and every form you look at. You gain access to all previously delivered electronically types within the My Forms tab of your respective account.

If you want to use US Legal Forms the very first time, here are basic instructions to help you get started:

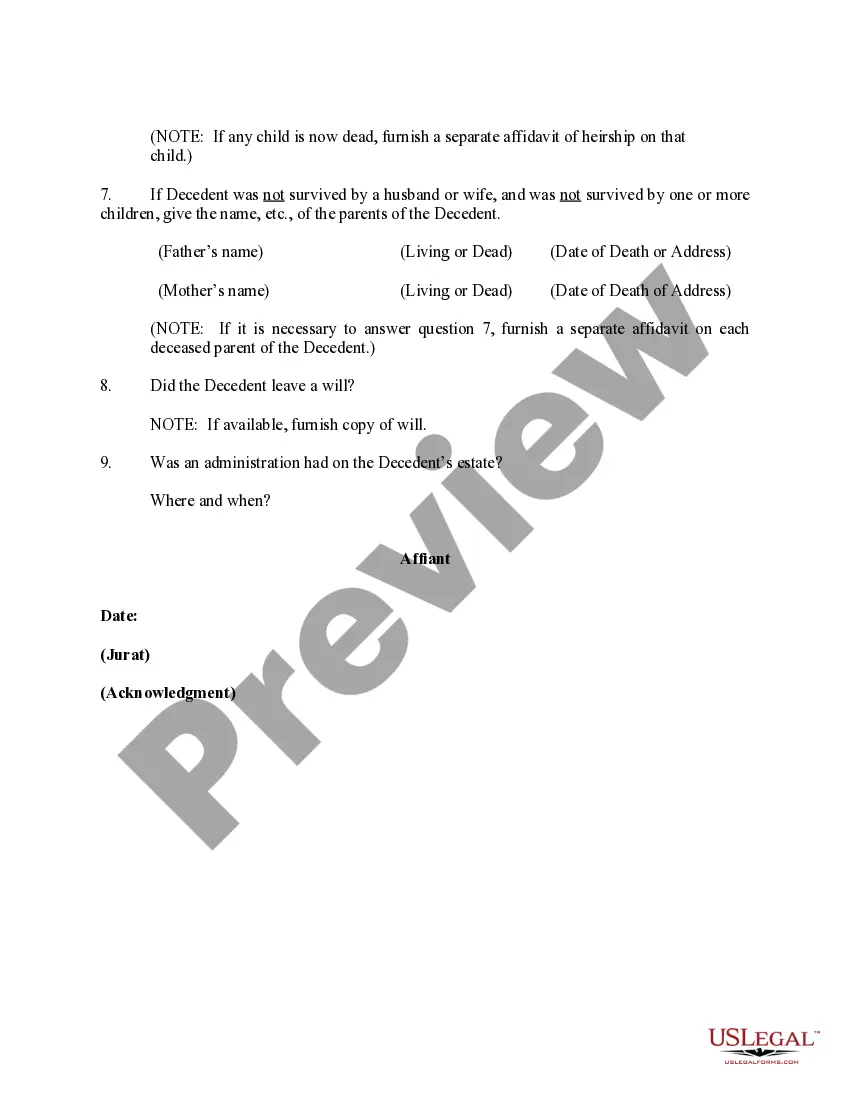

- Be sure you have picked the best form for your city/area. Select the Review key to check the form`s articles. Read the form outline to actually have selected the appropriate form.

- In case the form does not fit your demands, take advantage of the Lookup industry at the top of the screen to obtain the one who does.

- In case you are content with the form, verify your selection by simply clicking the Purchase now key. Then, pick the prices plan you prefer and supply your credentials to register on an account.

- Approach the purchase. Utilize your charge card or PayPal account to perform the purchase.

- Choose the structure and obtain the form on the system.

- Make modifications. Load, change and printing and signal the delivered electronically Indiana Affidavit of Heirship for Small Estates.

Every web template you included with your account does not have an expiry day and is your own property eternally. So, if you would like obtain or printing another version, just visit the My Forms portion and then click about the form you need.

Gain access to the Indiana Affidavit of Heirship for Small Estates with US Legal Forms, one of the most extensive catalogue of legal file web templates. Use 1000s of expert and status-certain web templates that fulfill your company or individual needs and demands.

Form popularity

FAQ

An Indiana small estate affidavit is used to gather the assets of a person who has died and left behind an estate worth less than $100,000. The affidavit cannot be filed earlier than forty-five (45) days after the date of death and must be signed in front of a notary public.

In this situation, an heir can simply file what is called an affidavit of heirship with the court. You may find this form on your state court website or through the court clerk's office, or you may need to have an attorney or legal services firm create one for you.

I.C. 29-1-8-1 provides for the use of a small estate affidavit for estates less than $100,000 for individuals who die after June 30, 2022, and $50,000 for individuals who died after June 30, 2006 and before July 1, 2022.

Increases the value of estates that may be distributed via affidavit from $50,000 to $100,000. Increases the threshold for summary procedures for unsupervised estates from $50,000 to $100,000.

Indiana law says that a small estate affidavit must: Provide the name, address, Social Security number and date of the decedent's death. State that the value of the assets in the estate is less than $50,000. State that 45 days have passed since the death.

Is Probate Required in Indiana? Any estate worth more than $50,000 is subject to probate in Indiana. Estates worth less than $50,000 transfer ownership to heirs through the small estate administration with a written statement proving entitlement to the assets.

The Small Estate Affidavit may be helpful when an Estate has not been opened. Access the Small Estate Affidavit Form (PDF). As of July 1, 2022, the value of the decedent's estate was increased to $100,000. This form is not required to be filed with the Court.

Indiana residents can use a transfer-on-death form to name beneficiaries for vehicles, securities, and real estate to bypass probate. Cars, small boats, stocks, bonds, brokerage accounts, land, and houses all qualify.