Indiana Agreement for Sales of Data Processing Equipment

Description

How to fill out Agreement For Sales Of Data Processing Equipment?

Are you in a situation where you will require documents for potentially professional or personal purposes almost every day.

There are numerous official document templates accessible online, but locating reliable versions can be challenging.

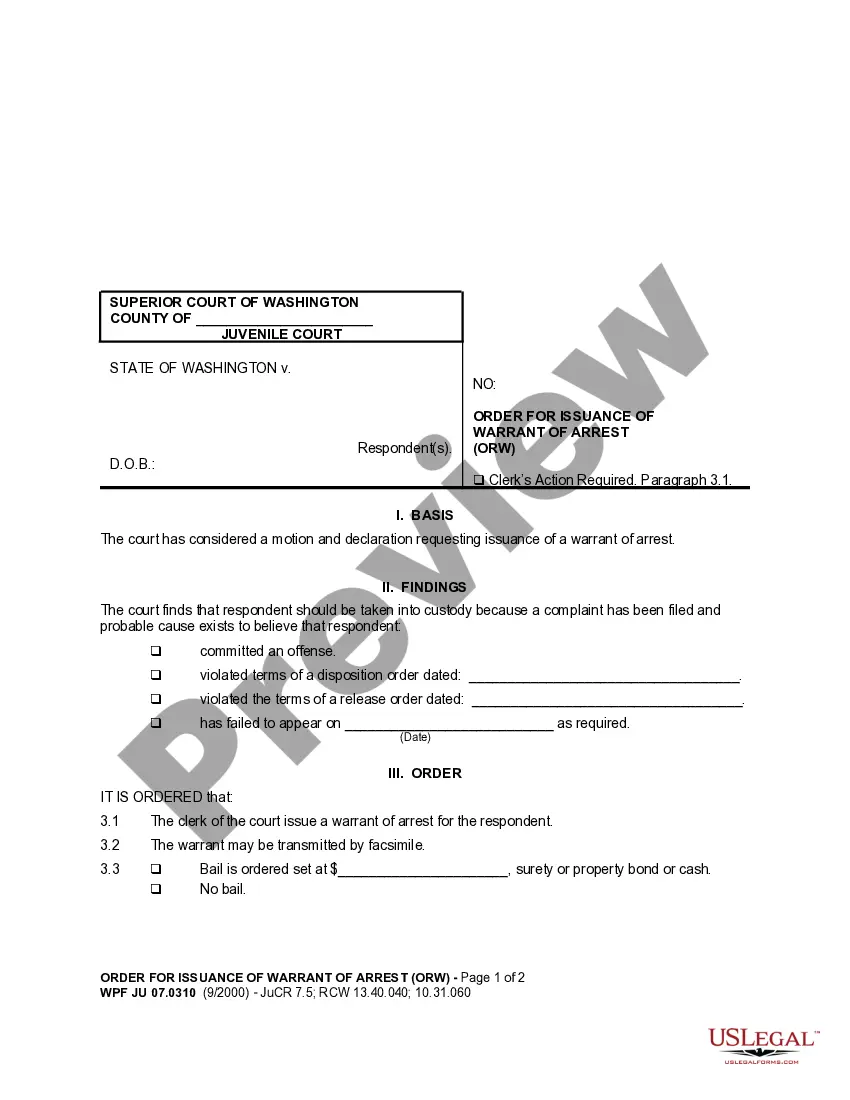

US Legal Forms offers thousands of form templates, such as the Indiana Agreement for Sales of Data Processing Equipment, designed to meet federal and state requirements.

Avoid altering or removing any HTML tags. Only synonymize plain text outside of the HTML tags.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Indiana Agreement for Sales of Data Processing Equipment template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct city/region.

- Utilize the Review button to examine the document.

- Check the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the document that meets your needs and specifications.

- If you find the correct form, click Buy now.

- Select the pricing plan you desire, fill in the required information to create your account, and purchase your order using your PayPal or credit card.

- Choose a convenient file format and download your version.

- Access all the document templates you have purchased in the My documents section.

- You can obtain an additional copy of the Indiana Agreement for Sales of Data Processing Equipment at any time, if needed.

- Simply click on the necessary form to download or print the document template.

- Utilize US Legal Forms, the most extensive collection of official forms, to save time and avoid mistakes.

- The service provides professionally crafted legal document templates that you can use for various purposes.

- Create an account on US Legal Forms and start making your life a bit easier.

Form popularity

FAQ

The ST-103 form is another important sales tax exemption certificate in Indiana. It is specifically used by organizations that qualify for sales tax exemption, such as non-profits and government entities. If your organization engages in the Indiana Agreement for Sales of Data Processing Equipment, utilizing the ST-103 can help you avoid unnecessary tax expenses. Make sure to check if your organization meets the criteria for using this form to benefit from tax savings.

Yes, Indiana requires a seller's permit for businesses that sell tangible personal property or certain services. This permit is necessary to collect sales tax from customers, including those involved in the Indiana Agreement for Sales of Data Processing Equipment. To obtain a seller's permit, you need to register your business with the Indiana Department of Revenue. This step ensures you operate legally and stay compliant with state regulations.

Indiana offers various incentives aimed at attracting data centers, including favorable tax treatment under the Indiana Agreement for Sales of Data Processing Equipment. These incentives often come in the form of property tax deductions and sales tax exemptions, which significantly lower operational costs. Consequently, establishing data centers in Indiana can be financially advantageous. Engaging with local experts can provide further insights into maximizing these benefits.

The sales tax rules in Indiana specify that most retail sales are subject to a general sales tax rate. However, exceptions exist, particularly for items under the Indiana Agreement for Sales of Data Processing Equipment. Understanding these rules helps businesses comply and optimize their purchases accordingly. Regularly reviewing updates from the Indiana Department of Revenue can keep you informed and compliant.

Several items qualify for exemption from sales tax in Indiana, especially those pertaining to the manufacturing and processing industries. The Indiana Agreement for Sales of Data Processing Equipment specifically outlines countless eligible purchases, including essential machinery and technology. To benefit from these exemptions, businesses must familiarize themselves with the criteria listed by the Department of Revenue. This knowledge can save significant costs in the long run.

Indiana offers various sales tax exemptions designed to foster growth across specific sectors. These exemptions include, but are not limited to, manufacturing equipment and specific technology purchases, particularly relevant to the Indiana Agreement for Sales of Data Processing Equipment. Understanding these exemptions can aid businesses in maximizing their resources. Always consult an expert to navigate this landscape effectively.

Not all products attract sales tax in Indiana. For instance, equipment related to data processing may qualify for tax-exempt status under the Indiana Agreement for Sales of Data Processing Equipment. This exemption often applies to products that are essential to business operations and advantages. It's wise to check specific product categories for confirmation, ensuring you benefit from available exemptions.

In Indiana, certain items can be purchased without incurring sales tax. These include specific types of machinery, equipment, and related services that fit within the Indiana Agreement for Sales of Data Processing Equipment. Generally, this exemption applies to items that are directly used in manufacturing or production. To ensure you are compliant, industries should review the detailed guidelines provided by the state.

Sales tax exemption in Indiana applies to items meant for resale, nonprofit organizations, and specific government agencies. It's crucial to provide the correct documentation to substantiate any claim for exemption. In the context of an Indiana Agreement for Sales of Data Processing Equipment, being informed about qualifying exemptions can lead to significant savings.

In Indiana, software sales may be subject to sales tax depending on how it is delivered. Software purchased on tangible media is generally taxable, while software delivered electronically could qualify for exemptions if certain conditions are met. Knowing these details is crucial when formalizing an Indiana Agreement for Sales of Data Processing Equipment.