Indiana Self-Employed Mechanic Services Contract

Description

How to fill out Self-Employed Mechanic Services Contract?

Selecting the appropriate legitimate document format can be a challenge.

Of course, there are numerous templates accessible online, but how do you locate the legitimate form you need.

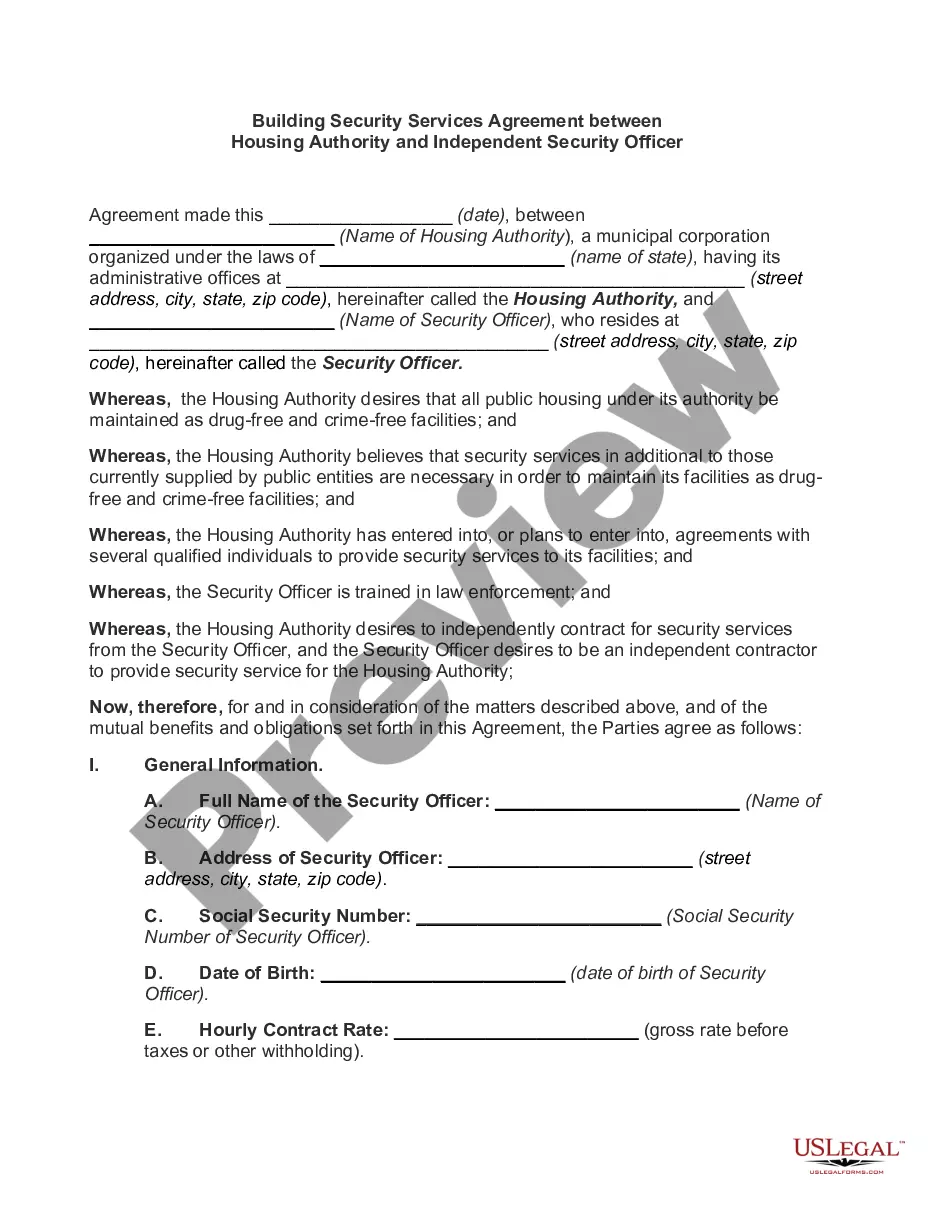

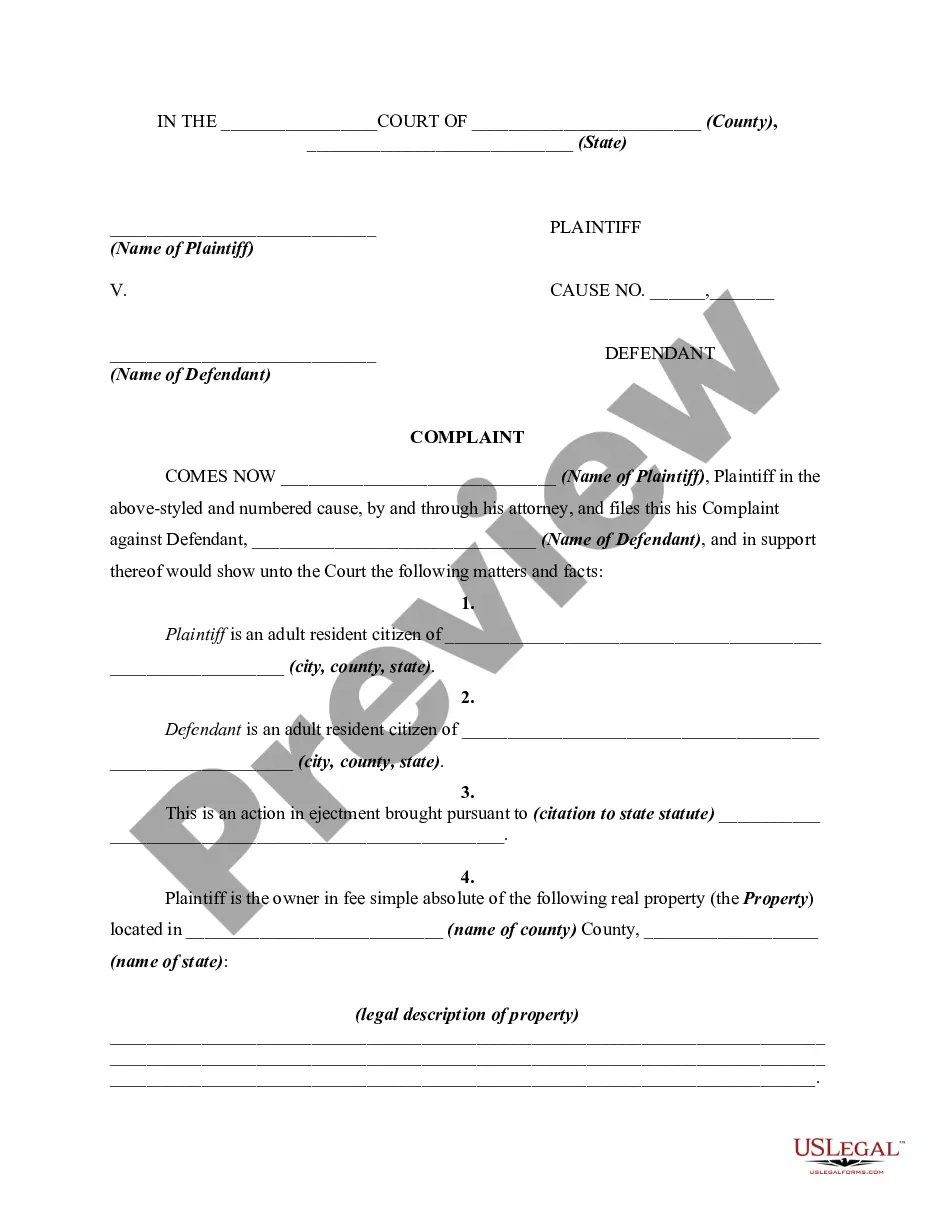

Utilize the US Legal Forms website. This service offers a vast array of templates, such as the Indiana Self-Employed Mechanic Services Contract, suitable for both business and personal needs.

First, ensure that you have chosen the correct form for your city/region. You can view the form using the Preview button and review the form details to confirm it is the right one for you. If the form does not meet your requirements, use the Search field to find the correct form. Once you are confident that the form is suitable, click on the Purchase now button to obtain the form. Select your desired pricing plan and enter the required information. Create your account and process the transaction using your PayPal account or credit card. Choose the file format and download the legal document format to your device. Complete, modify, print, and sign the obtained Indiana Self-Employed Mechanic Services Contract. US Legal Forms is the largest collection of legal documents where you can find a variety of document templates. Use this service to obtain professionally crafted documents that meet state requirements.

- All forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, sign in to your account and click the Download button to access the Indiana Self-Employed Mechanic Services Contract.

- You can use your account to search for the legal forms you have previously purchased.

- Go to the My documents tab in your account and obtain another copy of the document you need.

- If you’re a new client of US Legal Forms, here are simple steps to follow.

Form popularity

FAQ

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

In an independent contractor relationship, you're not obliged to provide work. And the independent contractor doesn't have to accept every job. In contrast, as an employer, you have to assign regular work, and the employee can't turn it down. This is called the mutuality of obligation.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

10 steps to setting up as a contractor:Research the regulations and responsibilities surrounding contractors.Be prepared to leave your permanent role and set up as a limited company.Consider your tax position and understand IR35.Decide whether to form a limited company or join an umbrella organisation.More items...?

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Make sure you really qualify as an independent contractor. Choose a business name (and register it, if necessary). Get a tax registration certificate (and a vocational license, if required for your profession). Pay estimated taxes (advance payments of your income and self-employment taxes).

A 1099 employee is a contractor rather than a full-time employee. These employees may also be referred to as freelancers, self-employed workers, or independent contractors. If you are a business that is contracting 1099 employees, determine what type of work this individual will do for your business.