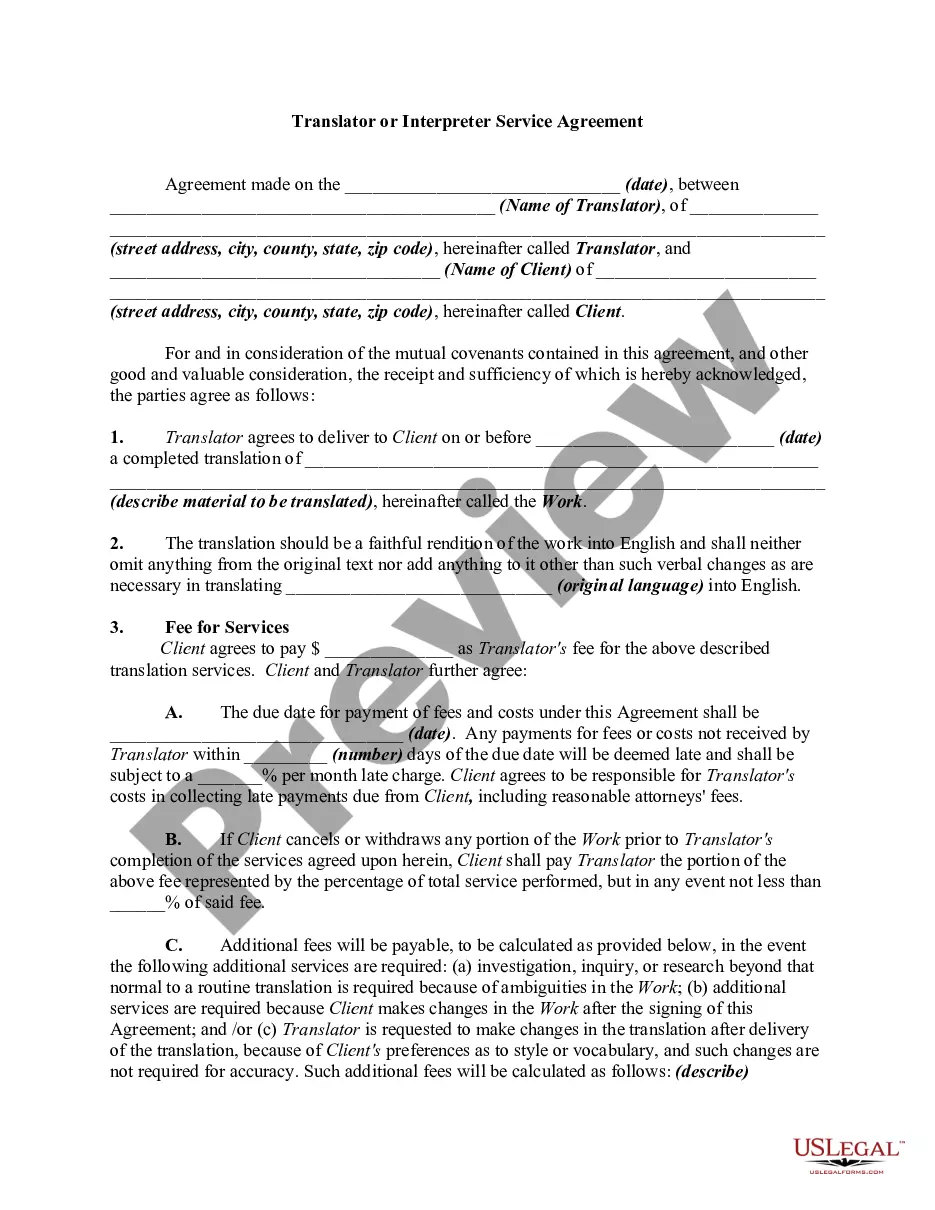

Indiana Translator And Interpreter Agreement - Self-Employed Independent Contractor

Description

How to fill out Translator And Interpreter Agreement - Self-Employed Independent Contractor?

If you wish to gather, acquire, or print sanctioned document formats, utilize US Legal Forms, the largest assortment of legal templates available online.

Leverage the site's straightforward and user-friendly search feature to find the papers you require.

A wide range of templates for commercial and personal purposes are categorized by types and regions, or keywords. Utilize US Legal Forms to locate the Indiana Translator And Interpreter Agreement - Self-Employed Independent Contractor in just a few clicks.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

Step 6. Select the format of the legal document and download it to your device. Step 7. Complete, edit, and print or sign the Indiana Translator And Interpreter Agreement - Self-Employed Independent Contractor. Every legal document template you obtain is yours indefinitely. You have access to each form you acquired in your account. Visit the My documents section and select a form to print or download again. Stay competitive and acquire, and print the Indiana Translator And Interpreter Agreement - Self-Employed Independent Contractor with US Legal Forms. There are numerous professional and state-specific templates you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to access the Indiana Translator And Interpreter Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously obtained in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Make sure you have selected the form for the correct city/state.

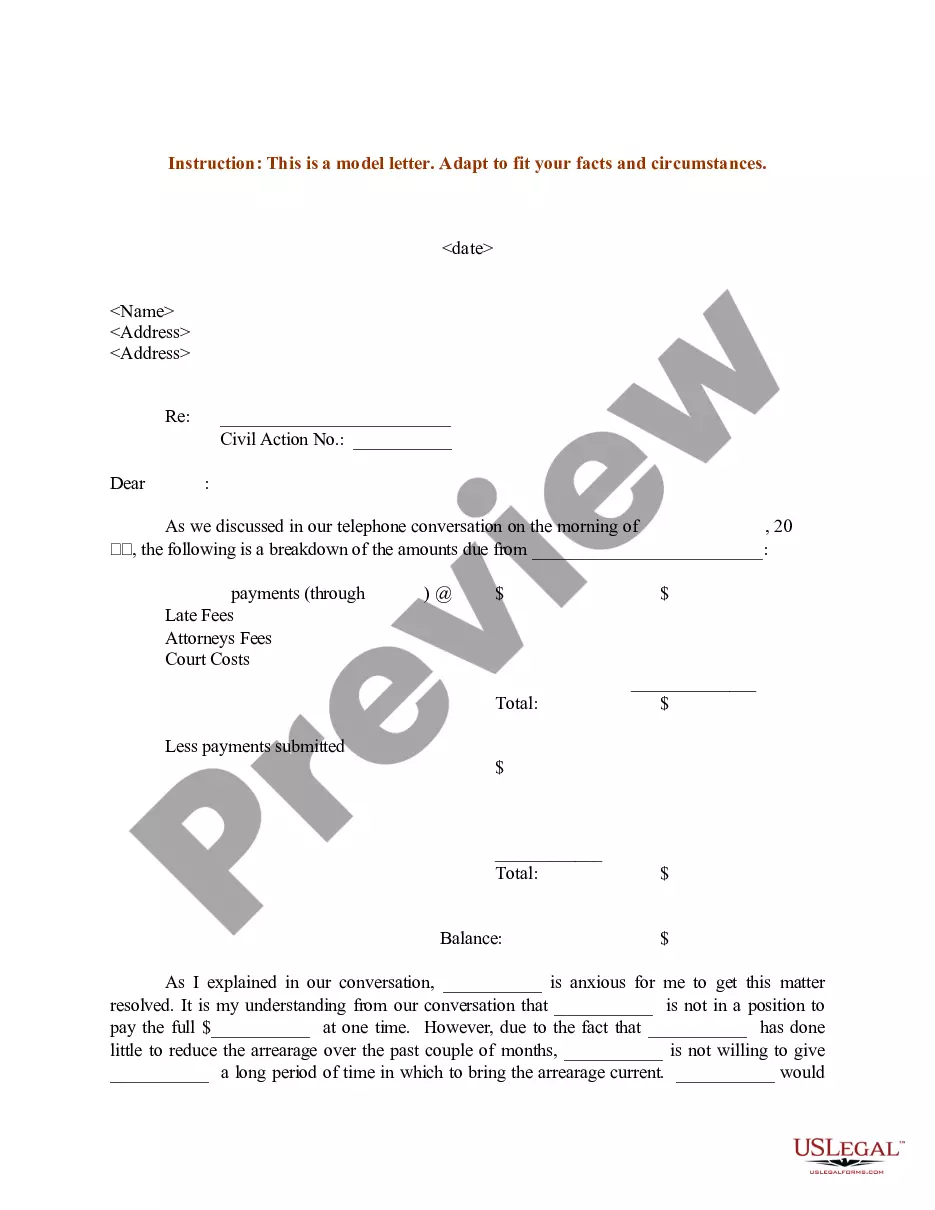

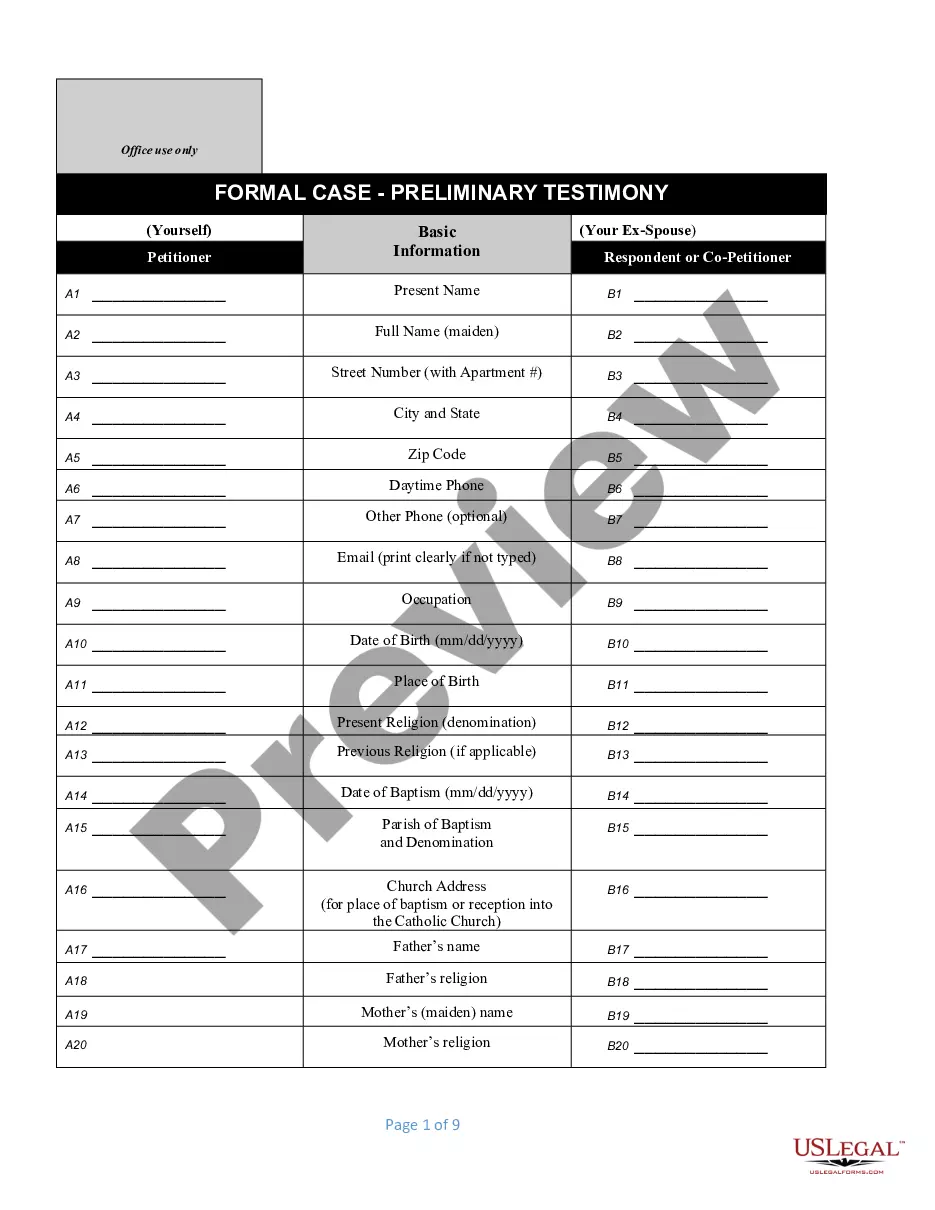

- Step 2. Use the Preview option to review the form's content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the template, use the Search box at the top of the screen to find different versions within the legal form catalog.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose your preferred pricing plan and enter your credentials to register for an account.

Form popularity

FAQ

Filling out an independent contractor agreement involves several key steps. First, enter the names and addresses of both parties, followed by a detailed description of the services to be performed. Include payment terms, duration of the contract, and any specific clauses necessary for protection. The Indiana Translator And Interpreter Agreement - Self-Employed Independent Contractor template on uslegalforms provides a clear format that helps you navigate this process smoothly, ensuring all essential information is included.

To fill out an independent contractor form, begin by providing your personal information, including your name and contact details. Next, outline the services you will provide, payment rates, and any relevant deadlines. Finally, review your entries for accuracy and completeness. Utilizing the Indiana Translator And Interpreter Agreement - Self-Employed Independent Contractor template from uslegalforms can simplify this process, ensuring you capture all required details effectively.

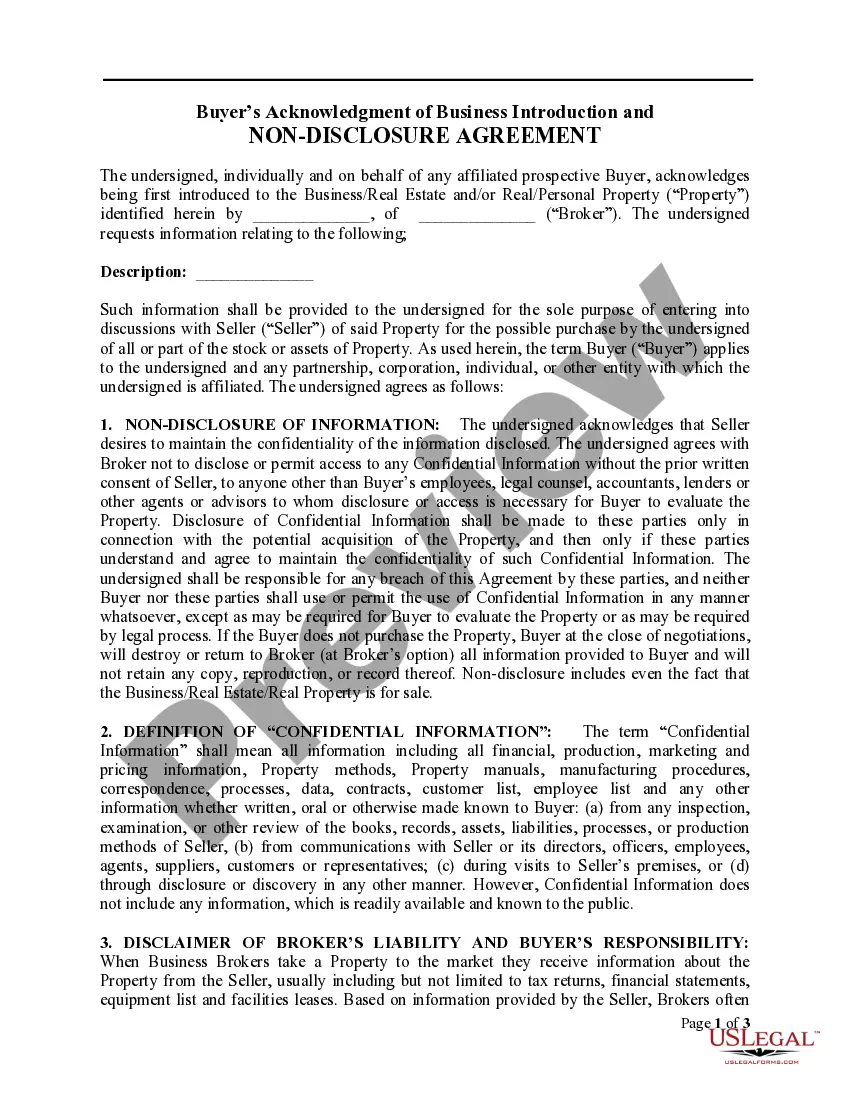

To write an independent contractor agreement, start by clearly defining the scope of work, payment terms, and deadlines. Incorporate essential elements such as confidentiality clauses and dispute resolution processes to protect both parties. The Indiana Translator And Interpreter Agreement - Self-Employed Independent Contractor template available on uslegalforms is a great resource to help you draft a comprehensive agreement. This ensures you cover all necessary points while adhering to legal standards.

In most cases, an independent contractor agreement, including the Indiana Translator And Interpreter Agreement - Self-Employed Independent Contractor, does not need to be notarized. However, some parties may choose to notarize the agreement to add an extra layer of validity. It's essential to understand your specific requirements and any regulations that apply in your state. Using a platform like uslegalforms can help you create a compliant agreement that meets your needs.

Independent contractors in Indiana are generally not required to carry workers' compensation insurance; however, it is wise to assess your risk factors. If you are self-employed, you may want to consider obtaining coverage to protect against potential liabilities. The Indiana Translator And Interpreter Agreement - Self-Employed Independent Contractor can assist you in understanding your responsibilities and whether workers' comp is necessary for your situation.

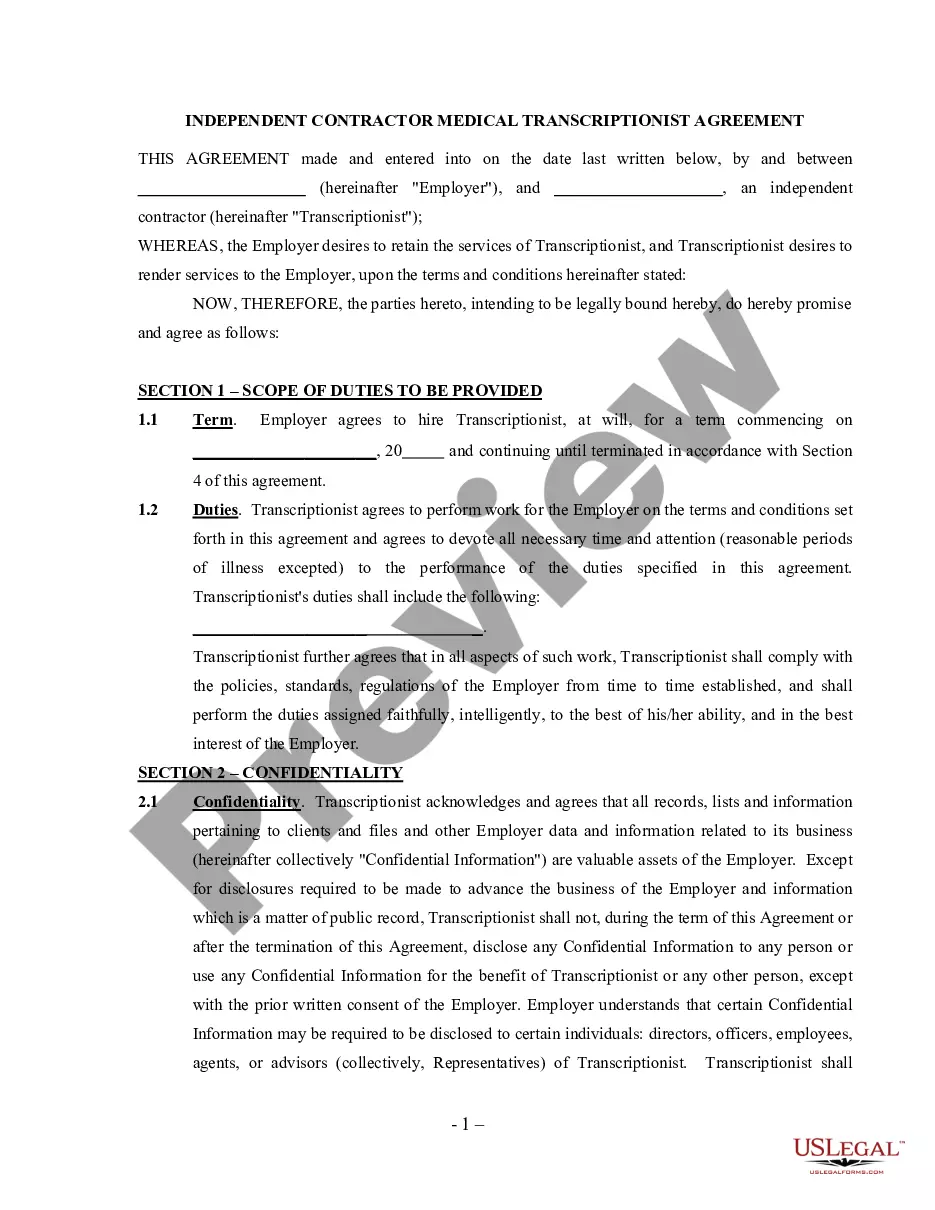

Yes, interpreters can operate as independent contractors. Many interpreters choose this path to have flexibility and control over their projects and schedules. The Indiana Translator And Interpreter Agreement - Self-Employed Independent Contractor is a useful tool that defines the relationship and terms between the interpreter and clients, ensuring a clear understanding of expectations.

Yes, independent contractors in Indiana may need a business license, depending on the nature of their work and their location. It is essential to check with local authorities for specific licensing requirements. Utilizing the Indiana Translator And Interpreter Agreement - Self-Employed Independent Contractor ensures that you meet all necessary legal obligations while providing your services professionally.

To get authorized as an independent contractor in the US, you typically need to register your business and obtain a tax identification number. You should also review the requirements specific to your state, as regulations may vary. The Indiana Translator And Interpreter Agreement - Self-Employed Independent Contractor can help outline the necessary terms and conditions for your services, making it easier for you to establish proper authorization.

To create an Indiana Translator And Interpreter Agreement - Self-Employed Independent Contractor, you should start by outlining the specific services the contractor will provide. Include the payment terms, deadlines, and conditions for termination. It’s also essential to specify the relationship between the parties to clarify that the contractor operates independently. Using a template from US Legal Forms can simplify this process, ensuring you cover all necessary aspects effectively.