Indiana Correspondent Agreement - Self-Employed Independent Contractor

Description

How to fill out Correspondent Agreement - Self-Employed Independent Contractor?

Have you ever been in a situation where you require documents for both business or specific purposes every single day.

There are numerous legal document templates available online, but locating ones you can trust is not straightforward.

US Legal Forms offers thousands of form templates, including the Indiana Correspondent Agreement - Self-Employed Independent Contractor, designed to meet state and federal regulations.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors.

The service offers professionally crafted legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Indiana Correspondent Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/area.

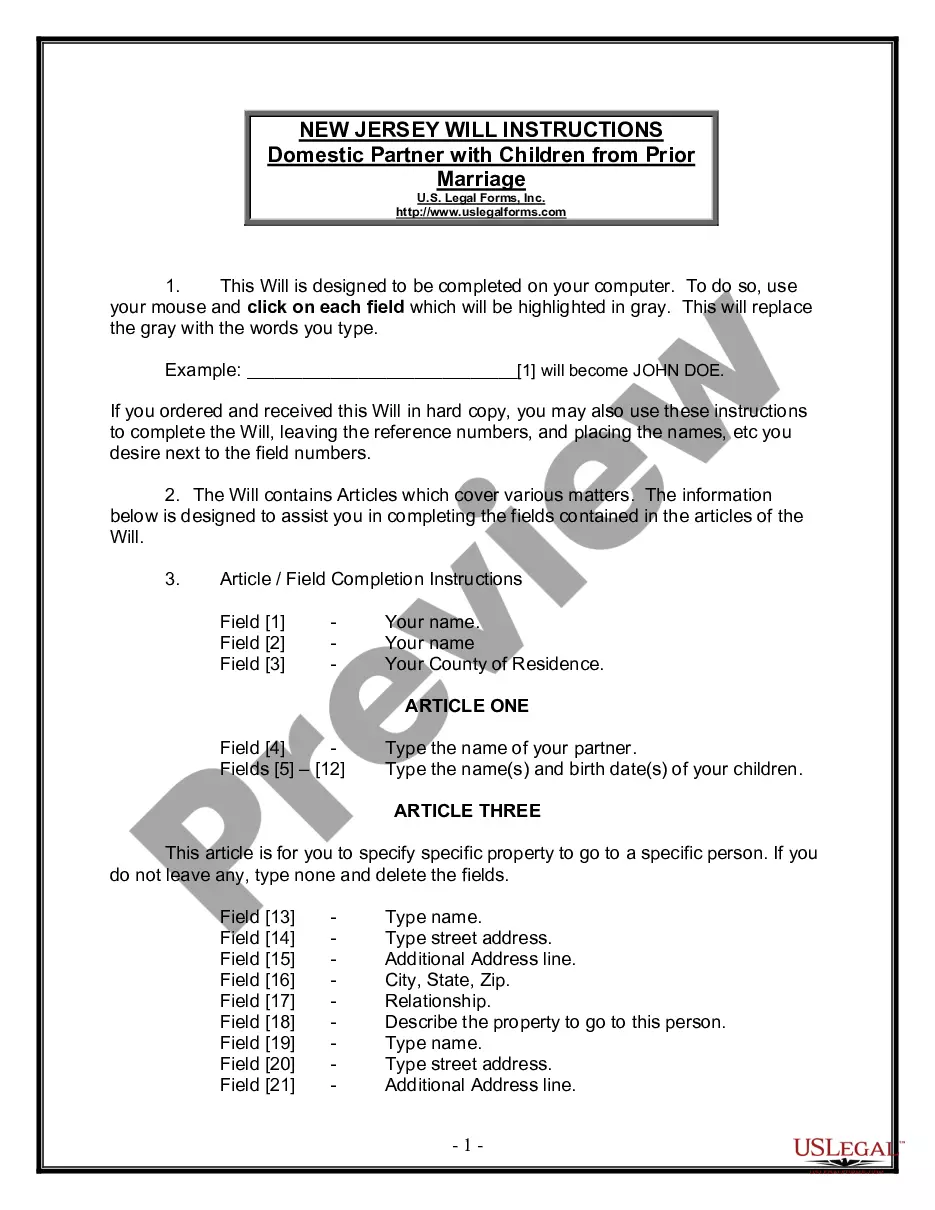

- Use the Preview option to review the document.

- Check the summary to confirm you have selected the right form.

- If the form is not what you are looking for, utilize the Search field to find the form that suits your needs and specifications.

- Once you find the correct form, click Purchase now.

- Select the pricing plan you want, provide the necessary information to create your account, and purchase the order using your PayPal or Visa or Mastercard.

- Choose a convenient file format and download your copy.

- Find all the document templates you have purchased in the My documents section. You can get another copy of the Indiana Correspondent Agreement - Self-Employed Independent Contractor at any time if needed. Just click the appropriate form to download or print the document template.

Form popularity

FAQ

An independent contractor agreement, such as the Indiana Correspondent Agreement - Self-Employed Independent Contractor, does not typically need notarization. However, notarization may add a layer of authenticity and serve as proof of the agreement if any disputes arise. It is always prudent to check state laws, as requirements can vary. For your convenience, you can explore resources on the uslegalforms platform to ensure compliance and secure the necessary documents.

Independent contractors should consider obtaining general liability insurance, professional liability insurance, and possibly business property insurance to safeguard their operations. These types of coverage protect against potential claims and liabilities that may arise during your work. As an independent contractor under the Indiana Correspondent Agreement, choosing the right insurance can enhance your professional reputation and protect your financial stability.

In Indiana, certain workers are exempt from workers' compensation requirements, including independent contractors and sole proprietors. Additionally, specific industries may have different exemptions based on their classification. When operating as a self-employed independent contractor under the Indiana Correspondent Agreement, it's essential to understand your specific standing regarding exclusions and protections.

Workers' compensation is not typically required for 1099 independent contractors in Indiana. However, businesses may voluntarily choose to provide coverage to protect against claims resulting from injuries. As you navigate your operations under the Indiana Correspondent Agreement as a self-employed independent contractor, understanding coverage options can help secure peace of mind.

Generally, independent contractors do not qualify for workers' compensation benefits since they are not classified as employees. However, this can vary based on specific circumstances and state laws. It’s advisable to explore options for coverage, particularly as an independent contractor under the Indiana Correspondent Agreement, to mitigate risks associated with work-related injuries.

The new federal rule seeks to clarify the classification of independent contractors versus employees, emphasizing factors like control over work and direction. This change aims to ensure workers' rights are protected while providing greater consistency in classifications. As someone entering an Indiana Correspondent Agreement as a self-employed independent contractor, staying informed about these updates can help you secure your rights and responsibilities.

Yes, independent contractors are considered self-employed individuals. They operate their own businesses, providing services to clients without being subject to direct supervision or control from an employer. Engaging in an Indiana Correspondent Agreement as a self-employed independent contractor allows you to manage your work while enjoying flexible scheduling and income potential.

In Indiana, independent contractors typically do not need a business license unless they operate under a specific business name or engage in certain regulated activities. However, it is important to check with local authorities for any specific requirements. To operate effectively as a self-employed independent contractor under the Indiana Correspondent Agreement, consider obtaining any necessary permits to avoid future complications.

Creating an independent contractor agreement involves outlining the terms of your working relationship. You should include details such as the scope of work, payment terms, and timelines. For a legally sound Indiana Correspondent Agreement - Self-Employed Independent Contractor, using templates from platforms like uslegalforms can simplify the process and ensure you cover all necessary aspects. This not only protects your rights but also clarifies expectations for both parties.

To provide proof of employment as an independent contractor, you should gather relevant documents, such as contracts, invoices, or payment records. These documents serve as evidence of your relationship with clients under an Indiana Correspondent Agreement - Self-Employed Independent Contractor. It's also beneficial to have a written statement from clients confirming your work and payment history. This combination of information will establish your credibility as an independent contractor.