Indiana Heating Contractor Agreement - Self-Employed

Description

How to fill out Heating Contractor Agreement - Self-Employed?

Finding the appropriate legal document template can be challenging.

Certainly, there are numerous designs accessible online, but how do you locate the legal form you need.

Utilize the US Legal Forms website. The platform offers a vast array of templates, such as the Indiana Heating Contractor Agreement - Self-Employed, suitable for both business and personal use.

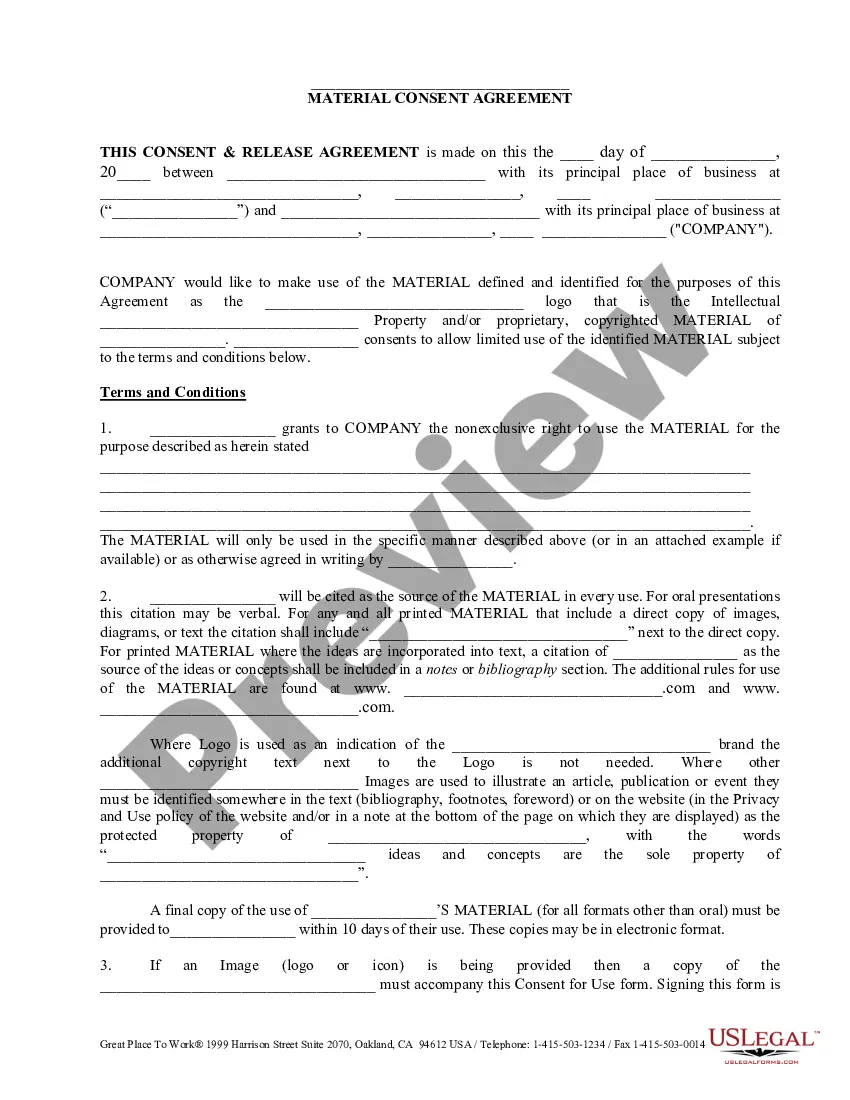

You can examine the document using the Preview button and read the form details to confirm it meets your needs.

- Each document is reviewed by professionals and complies with state and federal regulations.

- If you are already registered, sign in to your account and click the Obtain button to retrieve the Indiana Heating Contractor Agreement - Self-Employed.

- Use your account to review the legal documents you have previously purchased.

- Visit the My documents section of your account and download another copy of the document you need.

- If you are a new user at US Legal Forms, follow these straightforward steps.

- First, ensure you have selected the correct form for your jurisdiction.

Form popularity

FAQ

Yes, independent contractors are generally considered self-employed individuals. They operate their own businesses and manage their schedules, taxes, and benefits. This status allows them greater flexibility, but it also comes with certain responsibilities, such as filing self-employment taxes. Ensure your Indiana Heating Contractor Agreement - Self-Employed clearly defines this relationship.

Yes, independent contractors may need a business license in Indiana, depending on the type of work they perform. Regulations can vary by city and county, so it is vital to check local requirements. Additionally, having a license can enhance your credibility and increase trust with clients. Consider including this detail in your Indiana Heating Contractor Agreement - Self-Employed for clarity.

Creating an independent contractor agreement involves outlining the scope of work, payment terms, and duration of the project. Start by detailing specific tasks to be completed, deadlines, and how payments will be handled. It's essential to include terms regarding termination and confidentiality. Using a well-crafted Indiana Heating Contractor Agreement - Self-Employed can simplify this process and protect both parties.

Terminating an independent contractor without a formal agreement can be challenging, but it’s not impossible. In Indiana, you generally need to provide clear reasons for the termination, especially if the contractor has started work. To ensure a smooth process, document your communications and provide notice. Consider using an Indiana Heating Contractor Agreement - Self-Employed in the future to set clear expectations.

Yes, HVAC contractors are required to be licensed in Indiana to operate legally. Obtaining a license ensures that contractors meet state requirements and follow safety regulations. By using an Indiana Heating Contractor Agreement - Self-Employed, you can clarify the expectations for licensing and guarantee that all parties are aware of their responsibilities. It establishes a solid foundation for your contracting business.

Independent contractors file their taxes as self-employed individuals. This means they report income earned through contracts on their tax returns. When using the Indiana Heating Contractor Agreement - Self-Employed, it’s essential to track all income and expenses. Proper documentation can ensure you comply with tax regulations and maximize your deductions.

To effectively fill out an independent contractor agreement, begin by entering both parties' contact information and clearly defining the services to be provided. Specify payment details, including rates and schedule, along with any conditions relevant to the Indiana Heating Contractor Agreement - Self-Employed. Don't forget to include sections for confidentiality, termination, and dispute resolution. If you prefer a guided approach, consider using US Legal Forms, which provides helpful templates to ensure you cover all necessary aspects.

Filling out an independent contractor form involves gathering essential details about the contractor's identity and the job specifics. Include the contractor's name, address, and contact information, along with a description of the services provided under the Indiana Heating Contractor Agreement - Self-Employed. Clearly state payment terms, project timelines, and any legal agreements necessary for compliance. For assistance, US Legal Forms offers customizable forms that simplify this process.

To write an independent contractor agreement for your Indiana Heating Contractor Agreement - Self-Employed, start by clearly outlining the scope of work you expect from the contractor. Specify payment terms, deadlines, and any required licenses or permits. It's important to define the relationship between you and the contractor, ensuring they understand they are not an employee. For a more streamlined process, consider using platforms like US Legal Forms, which provide templates tailored for independent contractors.

Absolutely, you can be both self-employed and have a contract in place. In fact, having a well-drafted contract enhances your credibility and defines your services. Utilizing an Indiana Heating Contractor Agreement - Self-Employed provides a structured approach to your self-employment, allowing you to focus on your work.