Indiana Grant Agreement from 501(c)(3) to 501(c)(4)

Description

How to fill out Grant Agreement From 501(c)(3) To 501(c)(4)?

Finding the right legitimate document web template could be a struggle. Obviously, there are plenty of web templates accessible on the Internet, but how will you get the legitimate form you require? Utilize the US Legal Forms website. The assistance delivers 1000s of web templates, like the Indiana Grant Agreement from 501(c)(3) to 501(c)(4), which can be used for company and personal requires. Every one of the types are checked out by specialists and fulfill state and federal requirements.

When you are previously listed, log in to your accounts and click the Acquire button to get the Indiana Grant Agreement from 501(c)(3) to 501(c)(4). Make use of accounts to appear through the legitimate types you might have bought formerly. Proceed to the My Forms tab of your accounts and acquire one more version in the document you require.

When you are a whole new end user of US Legal Forms, listed below are basic recommendations so that you can comply with:

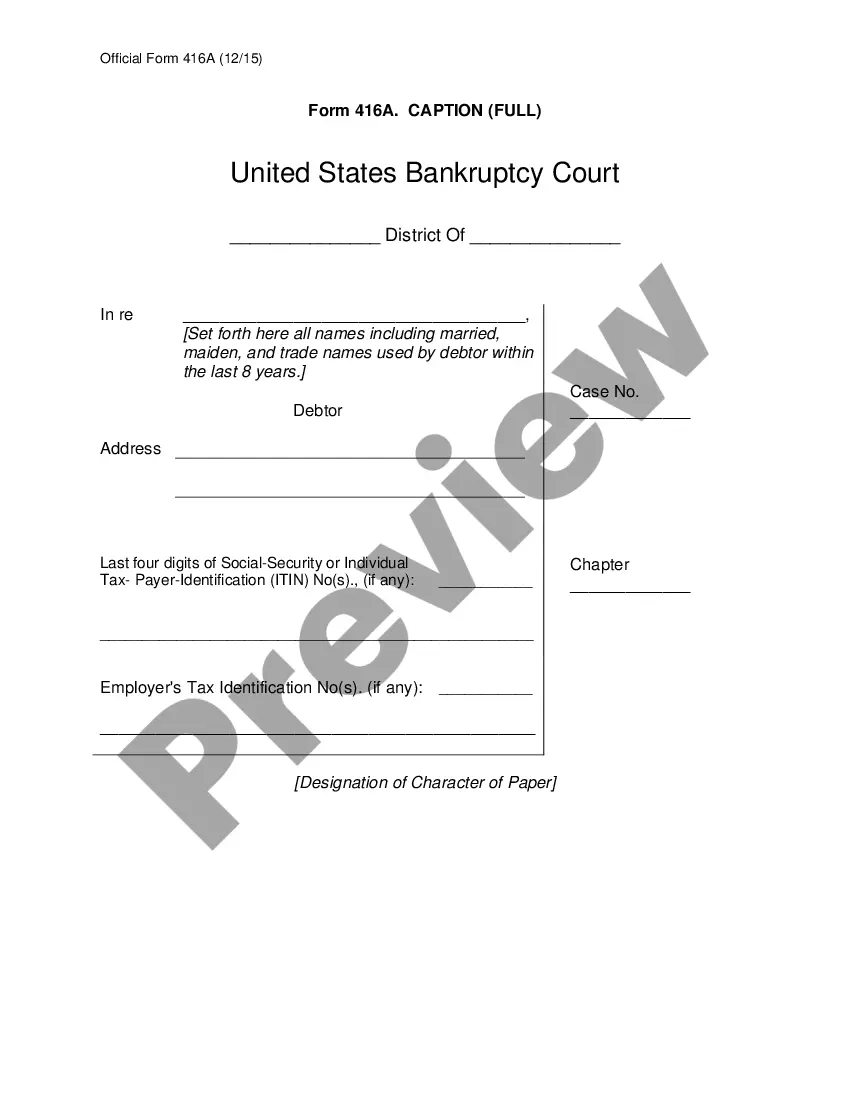

- Initially, ensure you have selected the appropriate form to your metropolis/county. You may check out the shape using the Preview button and browse the shape description to guarantee it will be the right one for you.

- In the event the form is not going to fulfill your expectations, take advantage of the Seach discipline to find the appropriate form.

- When you are certain the shape would work, select the Buy now button to get the form.

- Choose the pricing plan you want and type in the necessary info. Create your accounts and buy the transaction making use of your PayPal accounts or charge card.

- Pick the file formatting and acquire the legitimate document web template to your product.

- Complete, revise and produce and indicator the received Indiana Grant Agreement from 501(c)(3) to 501(c)(4).

US Legal Forms will be the largest collection of legitimate types where you can see a variety of document web templates. Utilize the company to acquire appropriately-manufactured files that comply with status requirements.

Form popularity

FAQ

To successfully obtain 501(c)3 status, an organization must be able to show a defined charitable purpose, and a structure that ensures that the organization benefits the public, not the employees or owners of the organization. There is no special structure for faith-based organizations.

To start a nonprofit in Indiana, you must file nonprofit articles of incorporation with the Indiana Secretary of State. You can file your articles in person, by mail, or online. The articles of incorporation cost $50 for mailed filing and $31 for online filing.

Paperwork Form 4162: Articles of Incorporation for a Nonprofit Corporation. IRS Form 1023: 501(c) Tax Exempt Application. IRS Determination Letter. Form BT-1: Indiana Business Tax Application. Form NP-20A: Nonprofit Application for Sales Tax Exemption. URS Charitable Registration, if applicable.

The only limitation for the size of a board of directors in Indiana is the requirement of a minimum of three members. The size of the board may exceed fifty members, depending on the size of the organization it is governing and the number of tasks set out before it.

The operational test for exemption under Section 501(c)(3) consists of four broad categories: Requirement to operate exclusively for exempt purposes. Prohibition against inurement. Prohibition against becoming an action organization; and. Prohibition against substantial private benefit.

In addition to standard terms describing grant amounts and purposes, agreements also include provisions regarding intellectual property rights, reporting requirements, and indemnification, among other subjects. Special provisions are included that deal with international philanthropy.