Indiana Assignment of Note and Deed of Trust as Security for Debt of Third Party

Description

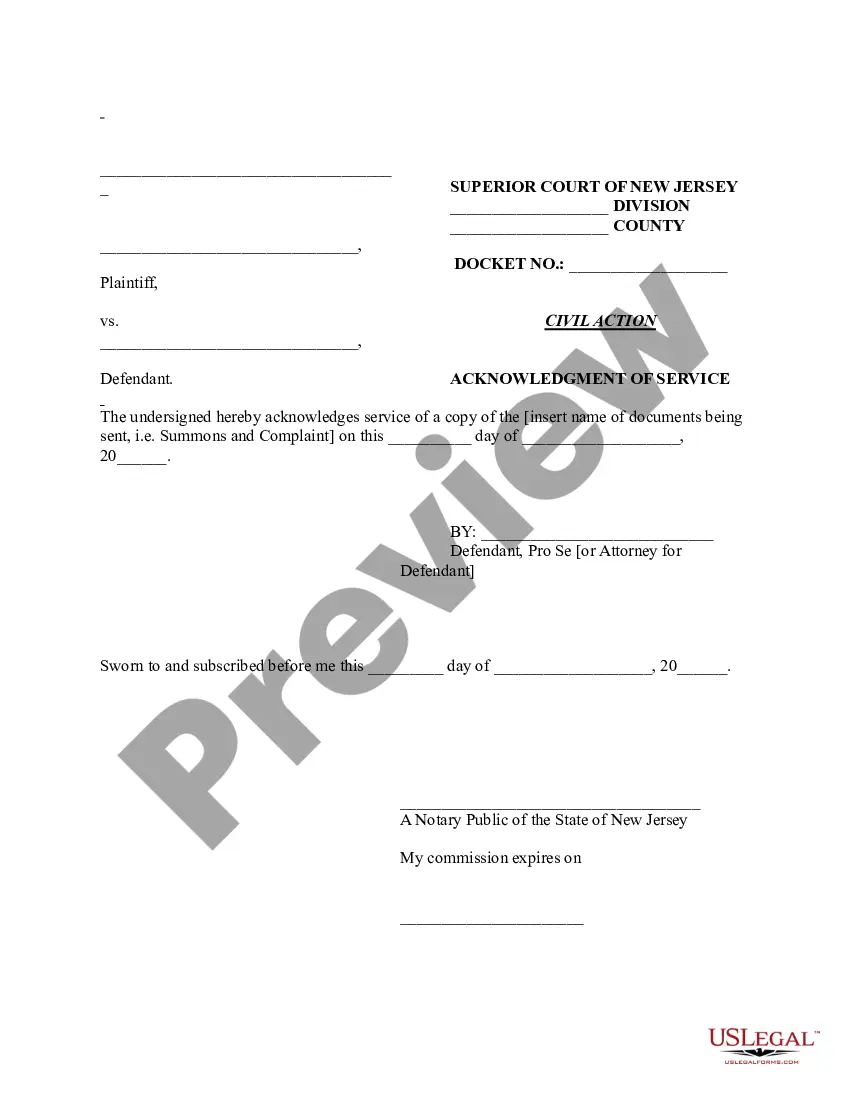

How to fill out Assignment Of Note And Deed Of Trust As Security For Debt Of Third Party?

You can spend hours on the Internet looking for the legal record web template which fits the federal and state demands you want. US Legal Forms supplies thousands of legal types which can be reviewed by pros. It is simple to download or produce the Indiana Assignment of Note and Deed of Trust as Security for Debt of Third Party from our service.

If you have a US Legal Forms profile, you may log in and then click the Down load key. Following that, you may full, revise, produce, or indication the Indiana Assignment of Note and Deed of Trust as Security for Debt of Third Party. Each and every legal record web template you purchase is yours for a long time. To have another version associated with a obtained develop, go to the My Forms tab and then click the related key.

If you are using the US Legal Forms website for the first time, adhere to the straightforward directions listed below:

- First, make certain you have selected the right record web template for that county/city that you pick. Browse the develop description to make sure you have chosen the proper develop. If available, utilize the Review key to search through the record web template as well.

- In order to discover another edition of your develop, utilize the Lookup area to get the web template that meets your needs and demands.

- When you have identified the web template you would like, click Acquire now to carry on.

- Pick the rates program you would like, type in your references, and sign up for a merchant account on US Legal Forms.

- Comprehensive the financial transaction. You can use your charge card or PayPal profile to purchase the legal develop.

- Pick the file format of your record and download it in your device.

- Make alterations in your record if possible. You can full, revise and indication and produce Indiana Assignment of Note and Deed of Trust as Security for Debt of Third Party.

Down load and produce thousands of record themes while using US Legal Forms Internet site, that offers the most important selection of legal types. Use skilled and express-distinct themes to handle your organization or individual demands.

Form popularity

FAQ

Essentially, a deed of trust provides a lender with security for the repayment of the loan and effectively functions similarly to a mortgage. A deed of trust is a deed that transfers a legal interest in a piece of real property owned by the lendee to the lender, or trustee, in order to secure the debt owed on the loan.

The Note is signed by the people who agree to pay the debt (the people that will be making the mortgage payments). The Deed and the Deed of Trust are signed by those who will own the property that is being mortgaged.

The Mortgage pledges your home as security for the loan. In some states, the buyer signs a Deed of Trust rather than a mortgage, but both documents serve the same purpose. The Mortgage Note is your promise to repay your loan.

For a Deed of Trust, the parties involved are the lender, the borrower, and a neutral third party who will serve as a trustee. The title of the property is held as security for the loan and held by the trustee for the benefit of the lender. The title is released from the trust once the loan is paid.

The three parties involved in a deed of trust are: The borrower is the trustor. The third party who holds the title is the trustee. The lender is the beneficiary.

There are three parties involved in a deed of trust: Trustor: This is the borrower. Trustee: This is the third party who will hold the legal title to the real property. Beneficiary: This is the lender.

A mortgage agreement is between two parties: the borrower and the lender. With a deed of trust, a third-party trustee holds the equitable title to the real property secured by the deed. Deeds of trust are used in conjunction with promissory notes.

Back to top. Balloon Payment: An installment payment on a promissory note - usually the final one for discharging the debt - which is significantly larger than the other installment payments provided under the terms of the promissory note. Beneficiary: The lender on the note secured by a deed of trust.