This due diligence form is a workform summarizing the substance of miscellaneous agreements as well as any provisions or requirements that may apply in business transactions.

Indiana Miscellaneous Agreement Workform

Description

How to fill out Miscellaneous Agreement Workform?

Have you been in a position where you need documents for both business or personal use almost every day.

There are numerous legal form templates accessible online, but finding trustworthy versions isn't straightforward.

US Legal Forms offers thousands of form templates, including the Indiana Miscellaneous Agreement Workform, designed to comply with federal and state regulations.

Once you acquire the appropriate form, click Buy now.

Choose the pricing plan you want, complete the required details to create your account, and pay for the order using your PayPal or credit card. Opt for a convenient document format and download your version. Access all the document templates you have purchased in the My documents menu. You can obtain another copy of the Indiana Miscellaneous Agreement Workform anytime, if necessary. Just select the required form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you may download the Indiana Miscellaneous Agreement Workform template.

- If you do not possess an account and wish to start using US Legal Forms, follow these instructions.

- Select the form you need and ensure it is suitable for the right city/state.

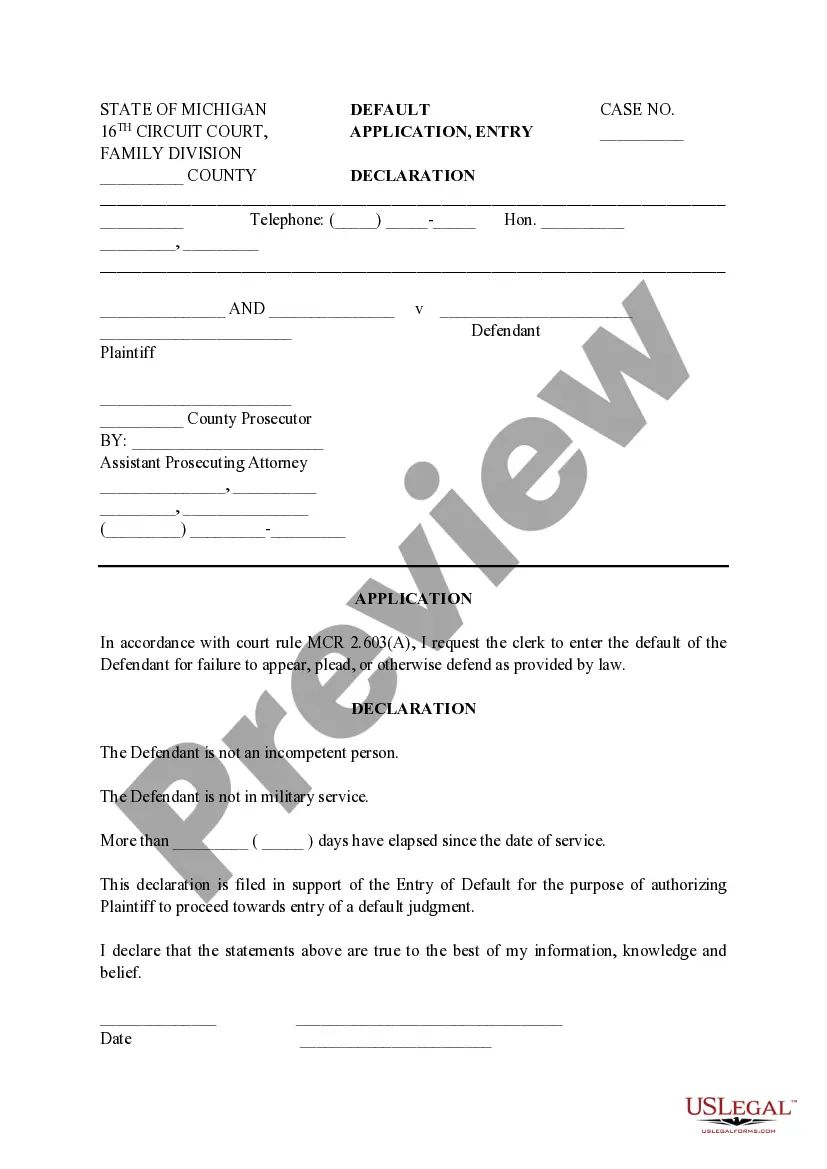

- Utilize the Review button to examine the form.

- Check the description to confirm you have chosen the correct form.

- If the form isn’t what you’re looking for, use the Search field to find the form that meets your needs and specifications.

Form popularity

FAQ

You can order Indiana tax forms through the Indiana Department of Revenue's website or by contacting their office. This process is especially straightforward for forms such as the Indiana Miscellaneous Agreement Workform. Keep in mind that you can also obtain forms from authorized tax professionals, ensuring that you are using the latest versions.

To order tax forms in Indiana, you can request them online from the Indiana Department of Revenue or call their customer service for assistance. Many forms, like the Indiana Miscellaneous Agreement Workform, are accessible in both physical and digital formats. Ensure you specify which forms you need for efficient processing.

Yes, many post offices in Indiana distribute tax forms, including popular ones and some specialized forms like the Indiana Miscellaneous Agreement Workform. It’s a good idea to call your local post office ahead of time to check for availability. This can save you a trip if they do not carry the forms you need.

To file for workers' comp in Indiana, you need to follow specific steps. Start by informing your employer about the injury or incident. Then, complete the necessary forms, which can include the Indiana Miscellaneous Agreement Workform if applicable. Submitting your forms on time ensures that you receive the benefits you deserve.

You can pick up paper tax forms at various government offices, libraries, and some post offices throughout Indiana. Additionally, local tax preparation offices may also provide paper forms, including the Indiana Miscellaneous Agreement Workform. It’s best to check availability before visiting. This way, you ensure you have all the necessary documents for your filing.

Yes, you can print your own tax forms, including the Indiana Miscellaneous Agreement Workform. To do this, visit the official state website or a trusted provider. Make sure to use the most current version to avoid any issues. Printing these forms directly can save you time and ensure accuracy.

Nonprofits in Indiana typically need to file annual reports, maintain compliance with federal regulations, and register for state tax exemptions. It is crucial to stay informed about state requirements to avoid penalties. Utilizing the Indiana Miscellaneous Agreement Workform can simplify this process and ensure your organization remains compliant with Indiana laws.

To file workers' comp in Indiana, you must first report the injury to your employer and complete a claim form. Be sure to collect all relevant documentation supporting your claim, including medical records. For assistance, the Indiana Miscellaneous Agreement Workform can guide you through the specific documentation and procedures required in Indiana.

Filling out the W-4V form requires you to specify the amount of federal income tax you wish to withhold from certain payments, like unemployment benefits or Social Security. It’s essential to provide accurate information to ensure proper withholding. For specific guidance, the Indiana Miscellaneous Agreement Workform can provide context on state-specific tax implications.

To complete the Indiana WH-4 form, start by providing detailed personal information and choosing the appropriate tax exemptions based on your situation. The form aims to establish the correct withholding amount, making the Indiana Miscellaneous Agreement Workform a valuable resource for clarity and accuracy. Double-check your entries before submission to prevent issues.