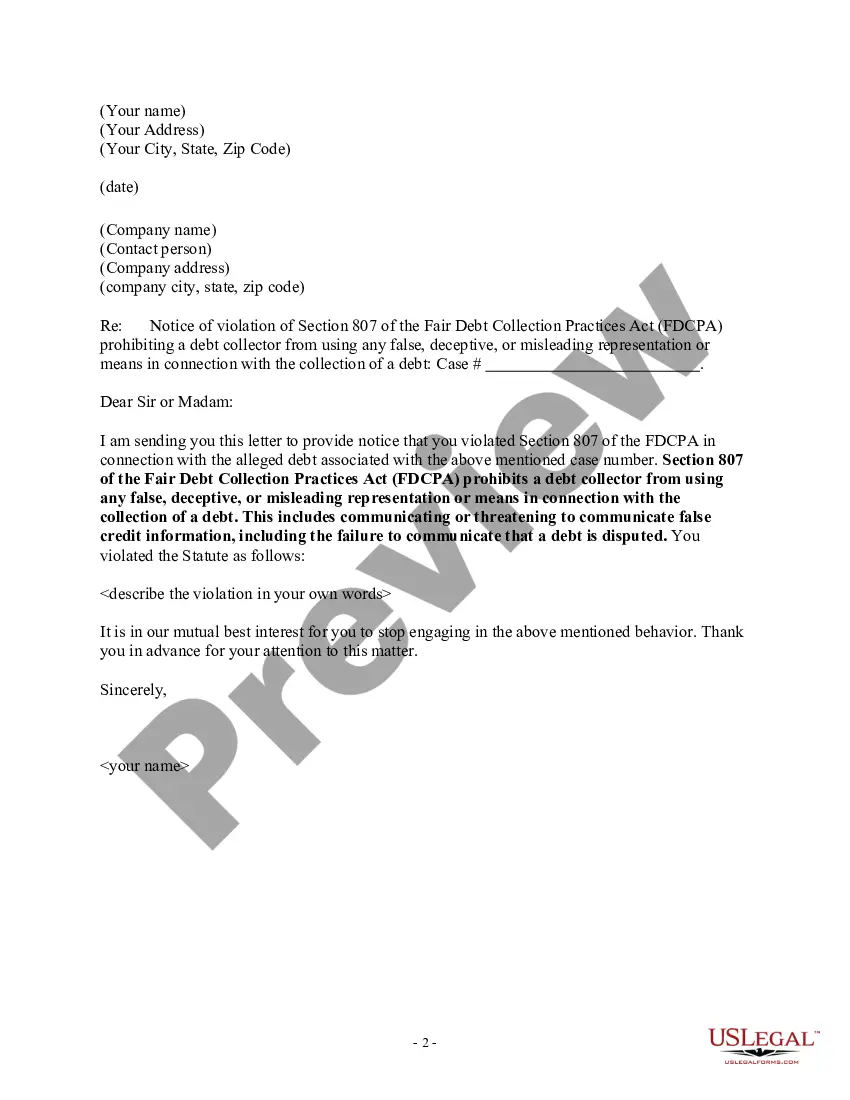

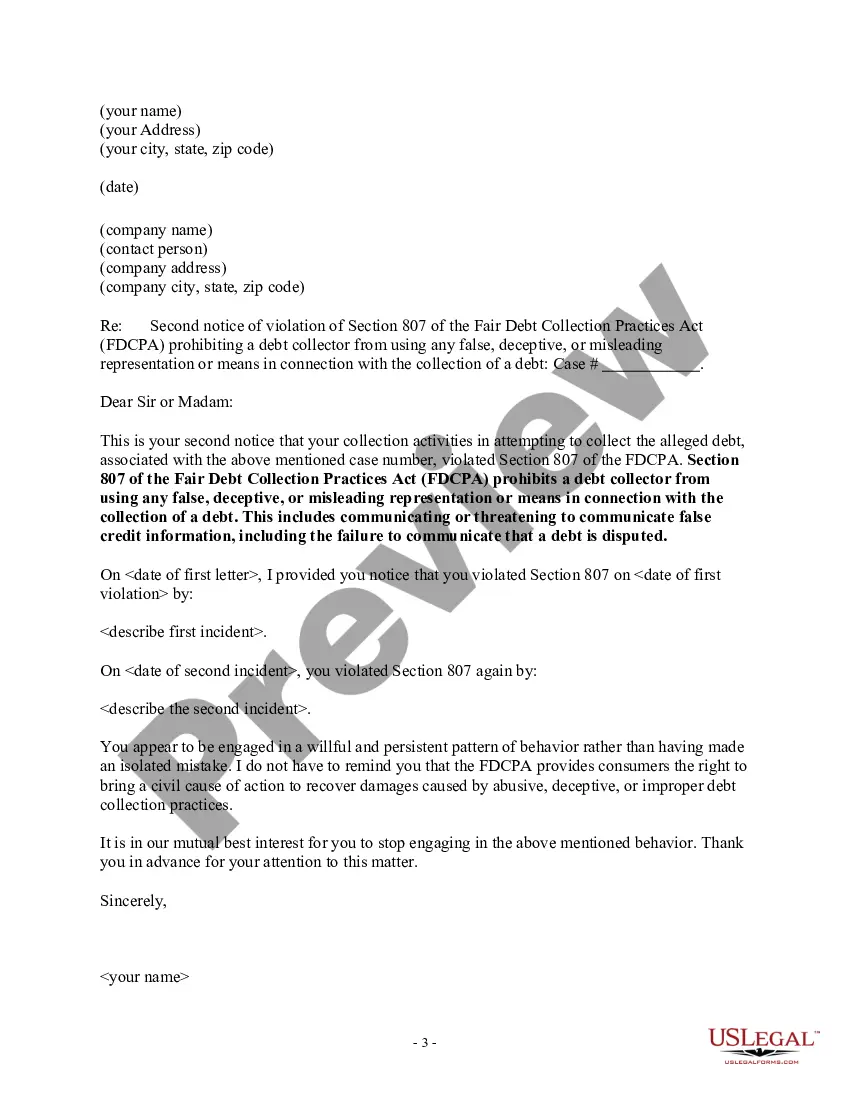

Indiana Notice of Violation of Fair Debt Act - False Information Disclosed

Description

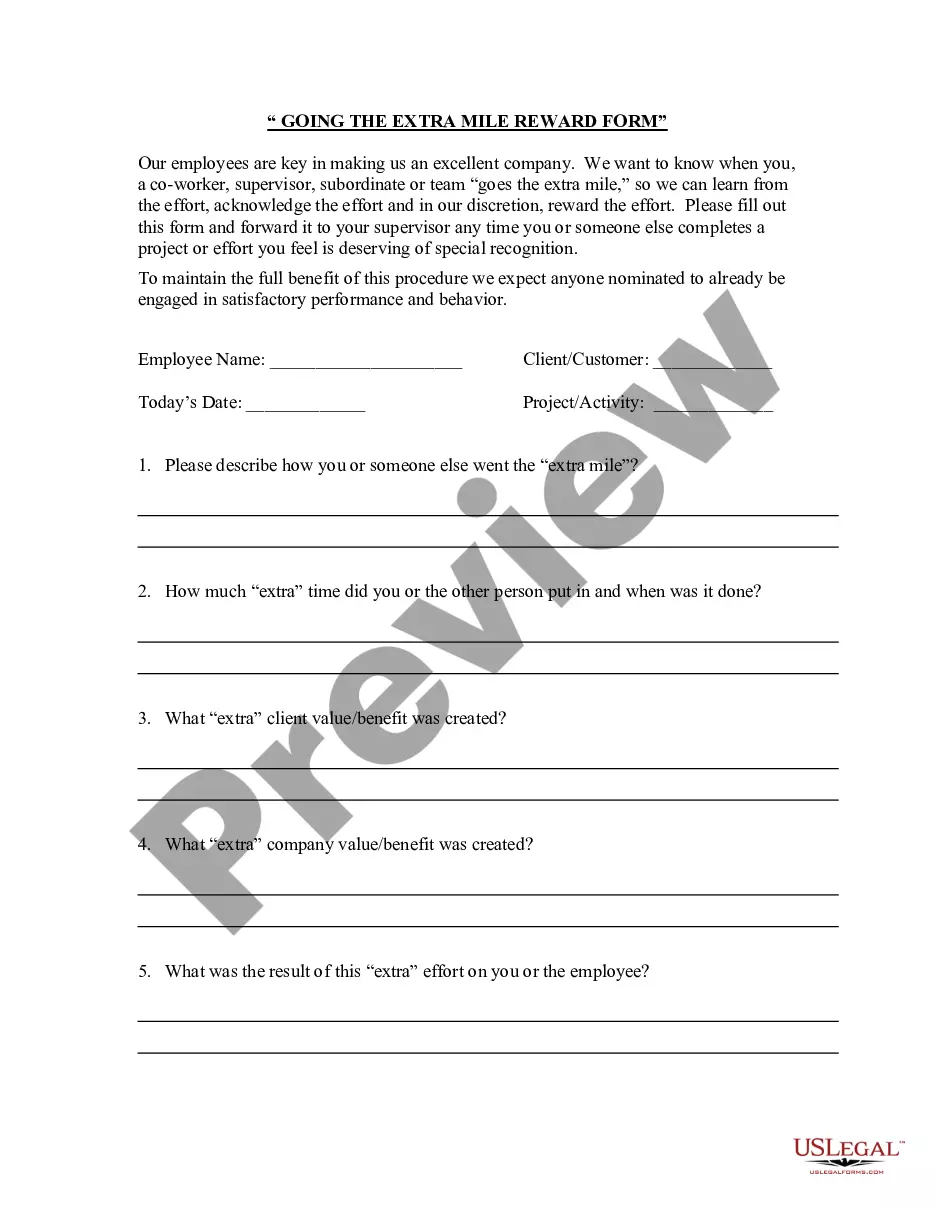

How to fill out Notice Of Violation Of Fair Debt Act - False Information Disclosed?

If you wish to complete, obtain, or create legal document templates, utilize US Legal Forms, the leading collection of legal forms available online.

Employ the site’s straightforward search feature to find the documents you require.

Numerous templates for business and personal purposes are classified by categories and states, or keywords.

Every legal document template you acquire is permanently yours. You have access to every form you downloaded within your account. Click the My documents section and select a form to print or download again.

Participate and download, and print the Indiana Notice of Violation of Fair Debt Act - False Information Disclosed with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- Utilize US Legal Forms to locate the Indiana Notice of Violation of Fair Debt Act - False Information Disclosed in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download option to obtain the Indiana Notice of Violation of Fair Debt Act - False Information Disclosed.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to browse through the form’s contents. Don’t forget to review the summary.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to look for alternative variations of the legal form template.

- Step 4. After locating the form you need, click the Purchase now option. Select the payment plan you prefer and enter your information to register for an account.

- Step 5. Process the transaction. You can utilize your credit card or PayPal account to complete the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Indiana Notice of Violation of Fair Debt Act - False Information Disclosed.

Form popularity

FAQ

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

5 Things Debt Collectors Are Forbidden to DoPretend to Work for a Government Agency. The FDCPA prohibits debt collectors from pretending to work for any government agency, including law enforcement.Threaten to Have You Arrested.Publicly Shame You.Try to Collect Debt You Don't Owe.Harass You.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

Write a dispute letter and send it to each credit bureau. Include information about each of the disputed itemsaccount numbers, listed amounts and creditor names. Write a similar letter to each collection agency, asking them to remove the error from your credit reports.

Debt collectors are generally prohibited under federal law from using any false, deceptive, or misleading misrepresentation in collecting a debt. The federal law that prohibits this is called the Fair Debt Collection Practices Act (FDCPA).

Yes, you may be able to sue a debt collector or a debt collection agency if it engages in abusive, deceptive, or unfair behavior. A debt collector is generally someone who buys a debt from a creditor who, for whatever reason, has been unable to collect from a consumer.

You can sue a company for sending you to collections for a debt that you don't owe. If a debt collector starts calling you out of the blue, but you know perfectly well that you made the payment in question, the law gives you the right to file an action in court against the company.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

Under the Fair Credit Reporting Act (FCRA) (15 U.S.C. § 1681 and following), you may sue a credit reporting agency for negligent or willful noncompliance with the law within two years after you discover the harmful behavior or within five years after the harmful behavior occurs, whichever is sooner.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.