A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are not legal process forms or do not require action by the consumer.

Indiana Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action

Description

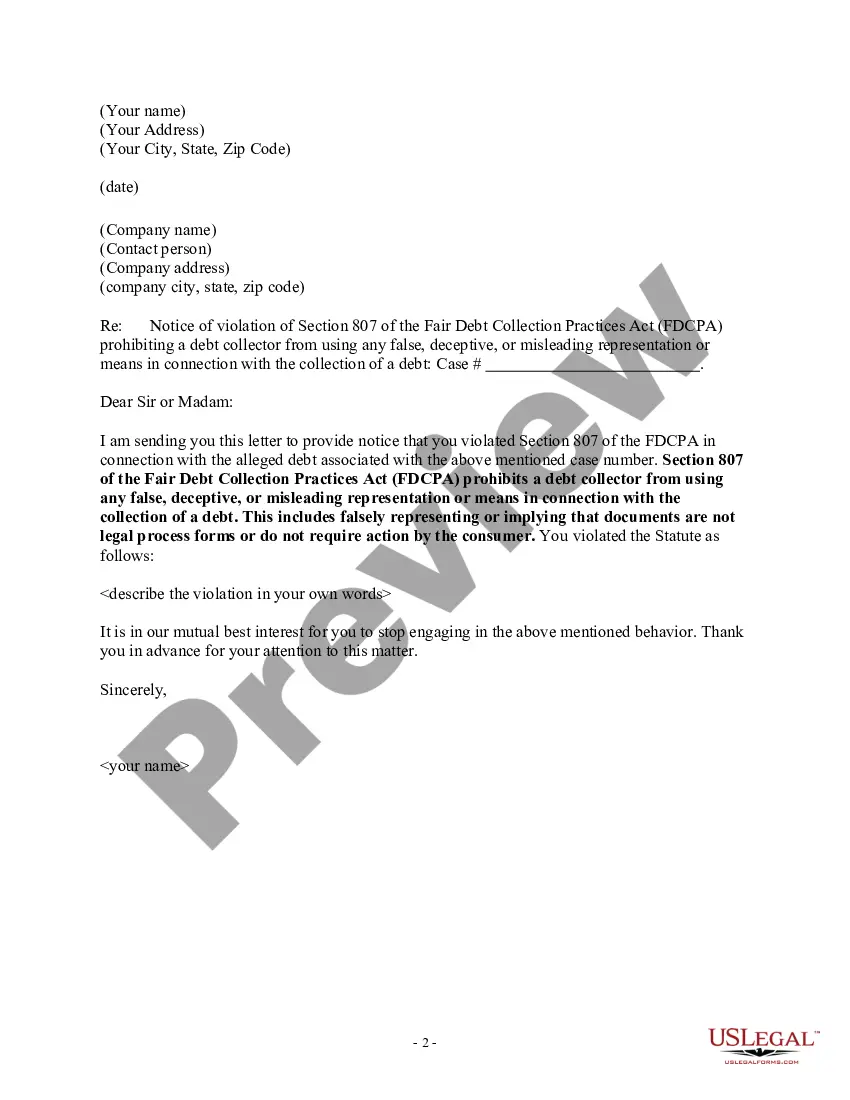

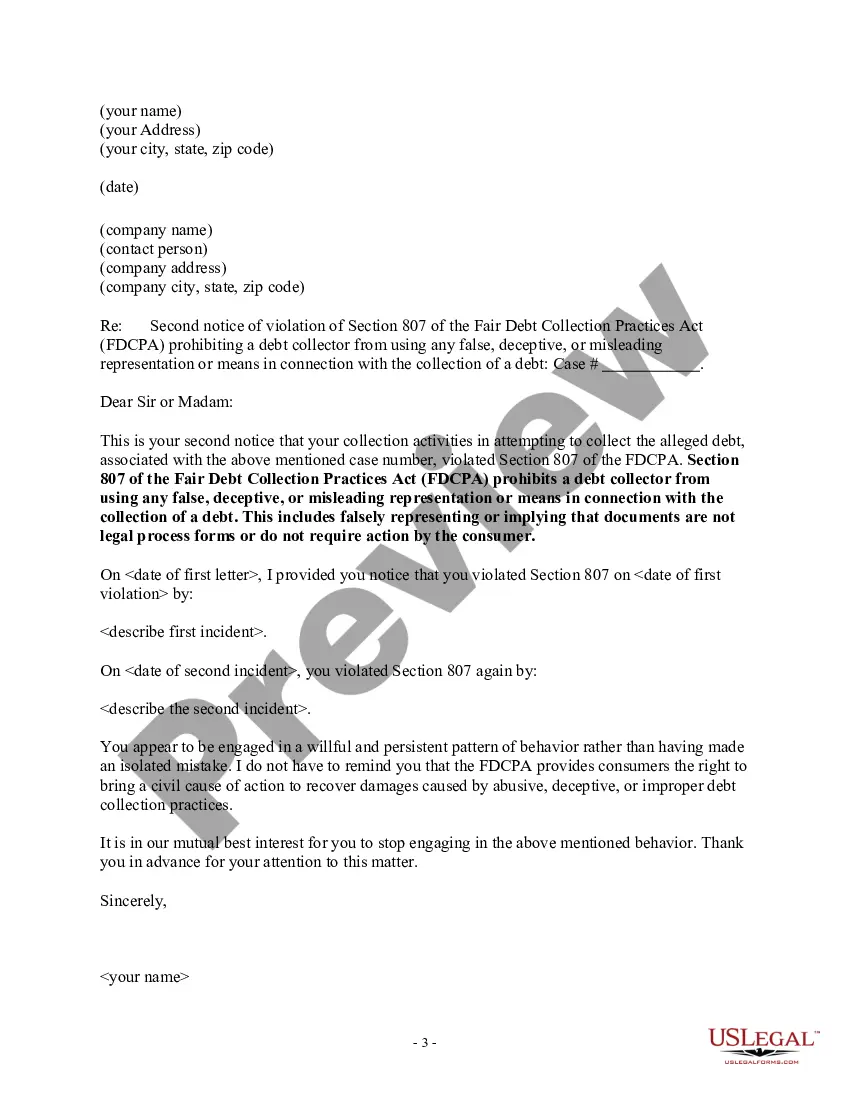

How to fill out Notice To Debt Collector - Falsely Representing Documents Are Not Legal Process Or Do Not Require Action?

Have you ever been in a situation where you require documents for either business or personal purposes nearly every day.

There are numerous official document templates available online, but locating trustworthy ones isn't simple.

US Legal Forms offers thousands of form templates, including the Indiana Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action, designed to comply with state and federal regulations.

Once you find the correct form, click Acquire now.

Select the payment plan you prefer, complete the required information to create your account, and pay for the order using your PayPal or credit card. Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Indiana Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Use the Review option to inspect the form.

- Check the summary to ensure you have selected the right form.

- If the form isn't what you're looking for, use the Search box to find the template that meets your needs and requirements.

Form popularity

FAQ

Under the Fair Credit Reporting Act (FCRA) (15 U.S.C. § 1681 and following), you may sue a credit reporting agency for negligent or willful noncompliance with the law within two years after you discover the harmful behavior or within five years after the harmful behavior occurs, whichever is sooner.

Yes, you may be able to sue a debt collector or a debt collection agency if it engages in abusive, deceptive, or unfair behavior. A debt collector is generally someone who buys a debt from a creditor who, for whatever reason, has been unable to collect from a consumer.

Misleading or deceptive conduct is when a business makes claims or representations that are likely to create a false impression in consumers as to the price, value or quality of goods or services on offer. This is against the law.

Debt collectors are generally prohibited under federal law from using any false, deceptive, or misleading misrepresentation in collecting a debt. The federal law that prohibits this is called the Fair Debt Collection Practices Act (FDCPA).

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Unfair practices are prohibitedDeposit or threaten to deposit a postdated check before your intended payment date. Take or threaten to take property if it's not allowed. Collect more than you owe on a debt, which may include fees and interest.

Examples of fraud by false representation Examples include: Exaggerating your income on a mortgage application form. Falsifying details to obtain a credit card. Selling assets that are not yours to sell, or that do not exist.

You can sue a company for sending you to collections for a debt that you don't owe. If a debt collector starts calling you out of the blue, but you know perfectly well that you made the payment in question, the law gives you the right to file an action in court against the company.

Write a dispute letter and send it to each credit bureau. Include information about each of the disputed itemsaccount numbers, listed amounts and creditor names. Write a similar letter to each collection agency, asking them to remove the error from your credit reports.

Courts have found false and misleading representations in these cases - a: manufacturer sold socks, which were not pure cotton, labelled as 'pure cotton' retailer placed a label on garments showing a sale price and a higher, crossed-out price. However, the garments had never sold for the higher price.