Indiana Approval of performance goals for bonus

Description

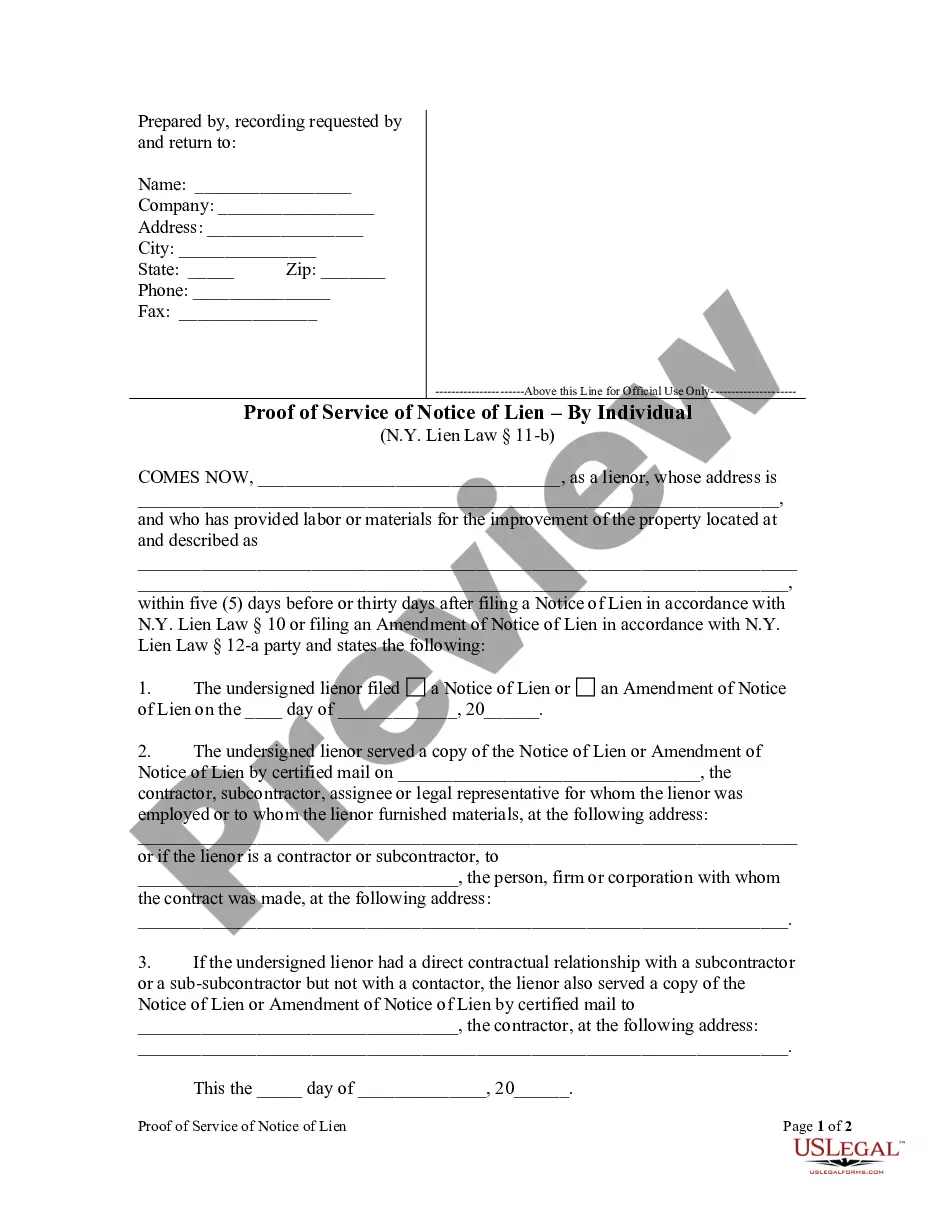

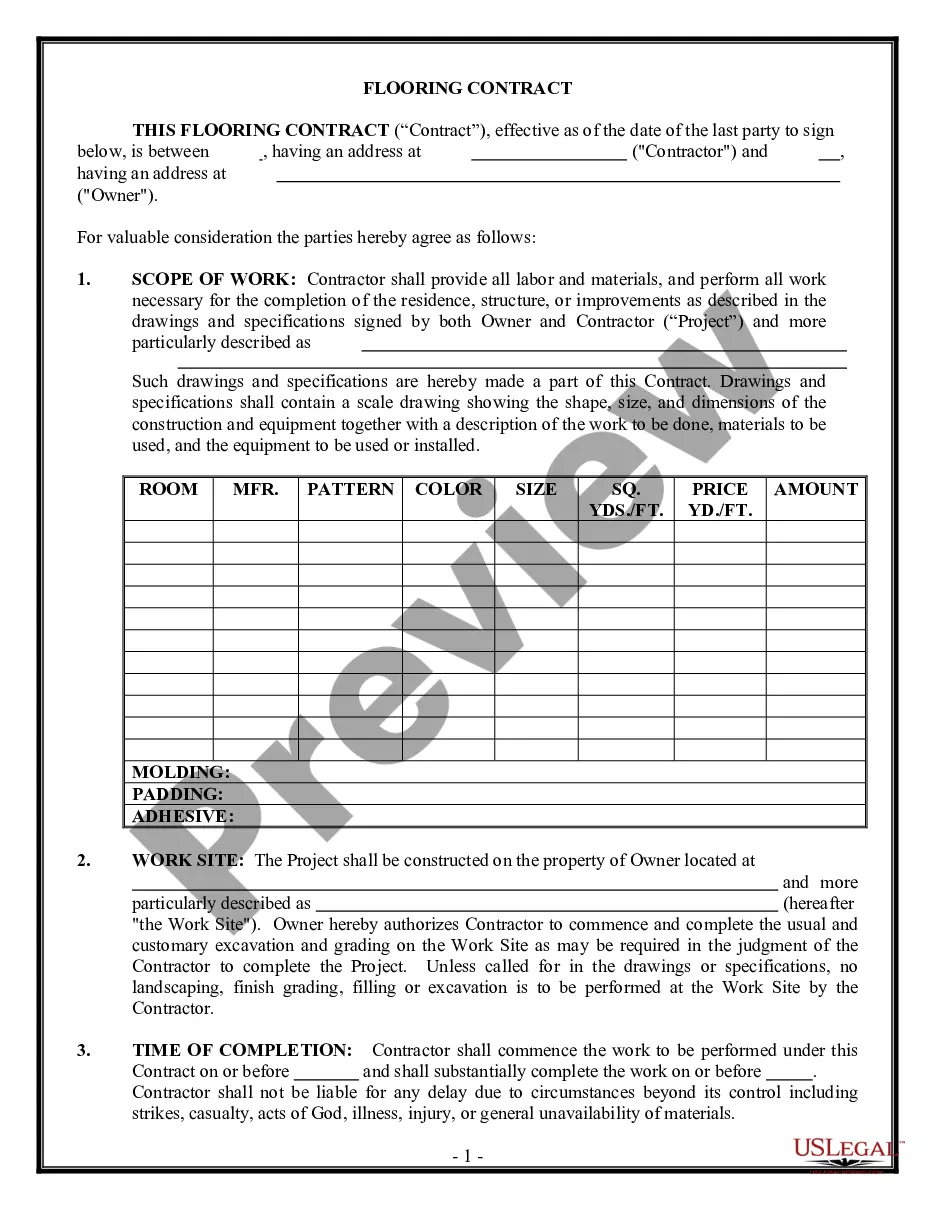

How to fill out Approval Of Performance Goals For Bonus?

Are you presently inside a place in which you require paperwork for possibly company or individual purposes just about every day time? There are a lot of legal papers themes available on the Internet, but discovering versions you can trust is not straightforward. US Legal Forms offers thousands of form themes, like the Indiana Approval of performance goals for bonus, that happen to be written to satisfy federal and state specifications.

When you are previously knowledgeable about US Legal Forms site and have a free account, just log in. Following that, you are able to down load the Indiana Approval of performance goals for bonus web template.

Unless you come with an accounts and want to begin to use US Legal Forms, abide by these steps:

- Discover the form you will need and ensure it is for your appropriate town/county.

- Make use of the Review button to analyze the form.

- Read the explanation to ensure that you have selected the appropriate form.

- If the form is not what you are seeking, use the Look for field to obtain the form that meets your needs and specifications.

- Once you find the appropriate form, click on Get now.

- Choose the pricing prepare you want, complete the specified information to make your money, and pay money for the order using your PayPal or credit card.

- Pick a convenient data file structure and down load your copy.

Locate all of the papers themes you possess purchased in the My Forms food list. You can obtain a additional copy of Indiana Approval of performance goals for bonus any time, if necessary. Just go through the necessary form to down load or print the papers web template.

Use US Legal Forms, the most extensive variety of legal types, to save time and prevent errors. The support offers appropriately produced legal papers themes that can be used for a range of purposes. Produce a free account on US Legal Forms and begin creating your life a little easier.

Form popularity

FAQ

Sec. 4. As used in this chapter, "full-time employee" means an individual who is employed for consideration for at least thirty-five (35) hours each week or who renders any other standard of service generally accepted by custom or specified by contract as full-time employment.

A performance bonus is a form of additional compensation paid to an employee or department as a reward for achieving specific goals or hitting predetermined targets.

California Labor Laws and Bonuses All earned bonuses are treated as wages under California Labor Code Section 200. These bonuses are ?earned? as part of an employment contract, work performance policy, obligation, or an understanding between the employer and employees.

sum Discretionary Bonus payment(s) of up to $1,500 for a part time employee and $5,000 for a staff employee in a fiscal year may be considered. Under exceptional circumstances, the President or a Vice President may approve a higher amount.

Spot bonus payments are delivered after the fact, based on a supervisor's judgment of performance and the warranted reward. It is discretionary in nature and may not be used to incentivize an employee in advance of performing the work.

There are no state laws regarding breaks or meal periods, so federal law applies. The federal law does not require employers to provide breaks, but if they choose to do so, breaks less than 20 minutes must be paid. Meal periods do not need to be paid as long as the employees are free to do as they wish.

Unpaid commissions fall under Indiana's definition of general wages. Wages include all compensation for labor or service whether or not you're paid hourly. If you're paid by the job, by commission or by any other calculation, your reasonable and usual calculations for payment are wages under Indiana law.

?Wages? are generally paid on ?a regular periodic basis for regular work done by the employee,? as distinguished from irregular payments or an annual bonus. If the compensation is the only form of pay to the employee, it is probably ?wages.?