Indiana Stock Appreciation Right Plan of Helene Curtis Industries, Inc.

Description

How to fill out Stock Appreciation Right Plan Of Helene Curtis Industries, Inc.?

US Legal Forms - one of several biggest libraries of legal kinds in the United States - offers a variety of legal file themes you may download or print. Using the internet site, you can find a large number of kinds for organization and specific reasons, categorized by groups, claims, or keywords.You will find the most recent models of kinds much like the Indiana Stock Appreciation Right Plan of Helene Curtis Industries, Inc. in seconds.

If you have a registration, log in and download Indiana Stock Appreciation Right Plan of Helene Curtis Industries, Inc. through the US Legal Forms collection. The Download option can look on every develop you perspective. You have access to all formerly delivered electronically kinds from the My Forms tab of your account.

If you wish to use US Legal Forms for the first time, allow me to share straightforward recommendations to obtain started off:

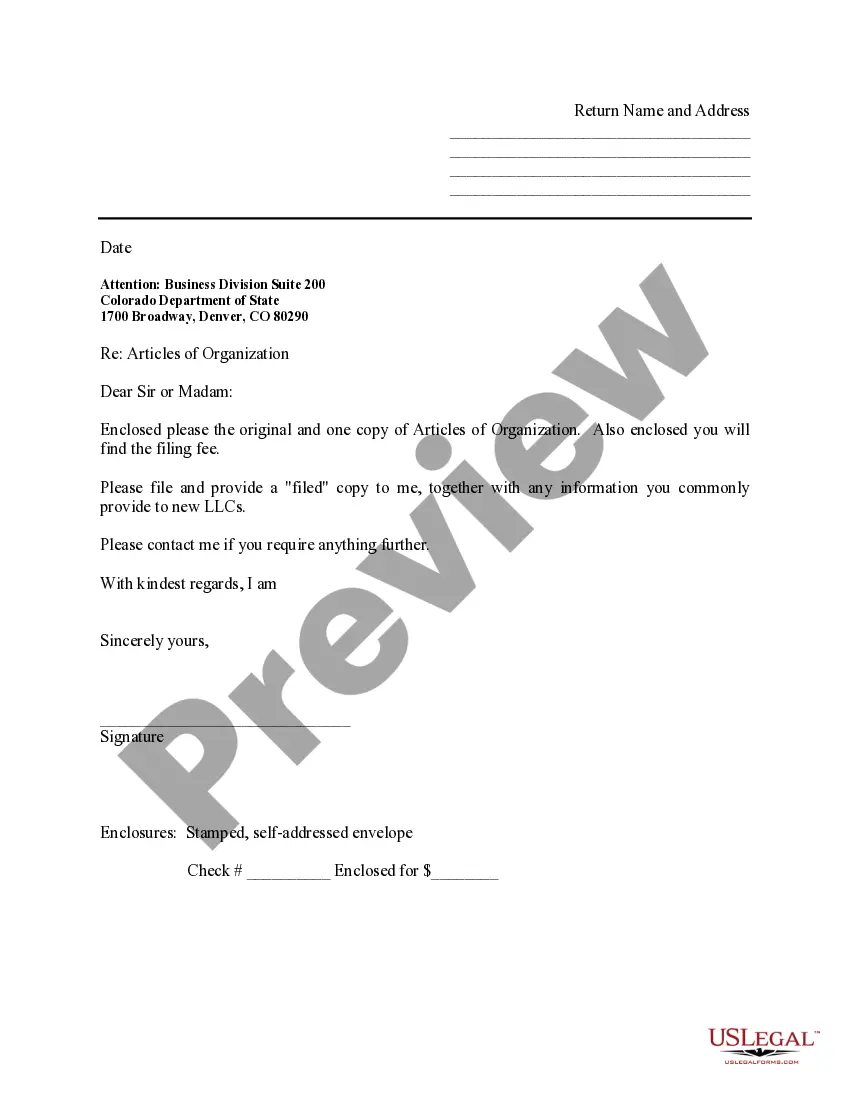

- Make sure you have picked out the proper develop for your area/county. Select the Review option to analyze the form`s content. Read the develop description to ensure that you have selected the proper develop.

- If the develop doesn`t satisfy your needs, take advantage of the Research industry on top of the screen to find the one that does.

- When you are satisfied with the form, confirm your option by visiting the Purchase now option. Then, opt for the rates strategy you like and provide your references to sign up for an account.

- Method the financial transaction. Use your bank card or PayPal account to complete the financial transaction.

- Select the file format and download the form on your own gadget.

- Make alterations. Fill out, modify and print and sign the delivered electronically Indiana Stock Appreciation Right Plan of Helene Curtis Industries, Inc..

Every single format you added to your money lacks an expiration time and it is the one you have eternally. So, if you wish to download or print an additional copy, just check out the My Forms area and then click on the develop you will need.

Obtain access to the Indiana Stock Appreciation Right Plan of Helene Curtis Industries, Inc. with US Legal Forms, probably the most substantial collection of legal file themes. Use a large number of professional and condition-certain themes that fulfill your organization or specific demands and needs.

Form popularity

FAQ

How Do Stock Appreciation Rights Work? Stock Appreciation Rights are similar to Stock Options in that they are granted at a set price, and they generally have a vesting period and an expiration date. Once a SAR vests, an employee can exercise it at any time prior to its expiration.

For purposes of financial disclosure, you may value a stock appreciation right based on the difference between the current market value and the grant price. This formula is: (current market value ? grant price) x number of shares = value.

A stock appreciation right (SAR) entitles an employee to the appreciation in value of a specified number of shares of employer stock over an ?exercise price? or ?grant price? over a specified period of time. The base price generally is equal to the underlying stock's fair market value on the date of grant.

In accounting, the process that the company uses to record SAR agreements is to accrue a liability and recognize expense over the term of service. At the end of the service period, the liability is settled in cash or stock (or both).