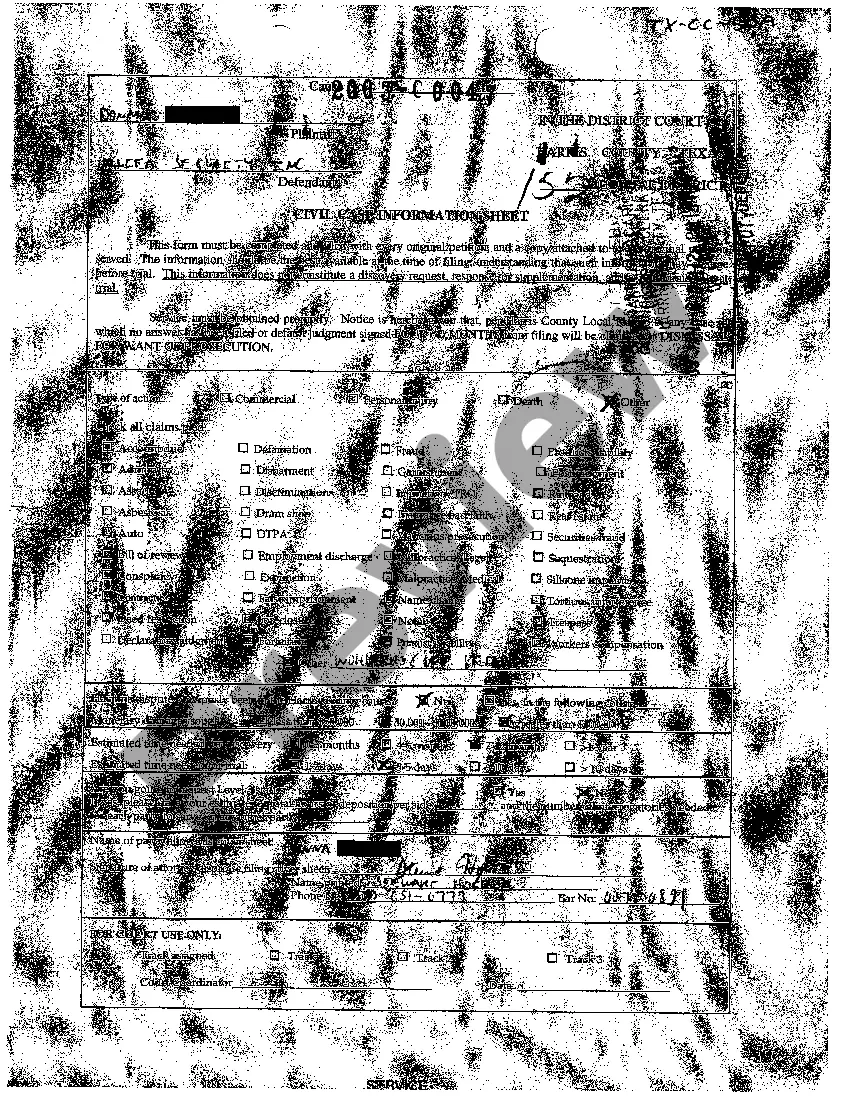

Indiana Schedule 14B Information

Description

How to fill out Schedule 14B Information?

Are you currently in the situation in which you require paperwork for both company or person functions just about every day time? There are a lot of authorized file themes available online, but locating kinds you can depend on isn`t easy. US Legal Forms offers a huge number of develop themes, like the Indiana Schedule 14B Information, which are written to satisfy federal and state requirements.

If you are already familiar with US Legal Forms site and get a merchant account, basically log in. Next, you can obtain the Indiana Schedule 14B Information design.

Should you not come with an account and need to start using US Legal Forms, adopt these measures:

- Obtain the develop you require and ensure it is for your right metropolis/county.

- Take advantage of the Preview option to check the form.

- Read the information to actually have selected the right develop.

- In the event the develop isn`t what you`re looking for, make use of the Lookup industry to get the develop that meets your requirements and requirements.

- If you get the right develop, click Get now.

- Choose the prices prepare you would like, complete the desired details to generate your money, and pay for your order with your PayPal or Visa or Mastercard.

- Select a handy document file format and obtain your copy.

Find every one of the file themes you have bought in the My Forms menus. You can get a more copy of Indiana Schedule 14B Information at any time, if possible. Just click on the essential develop to obtain or print out the file design.

Use US Legal Forms, by far the most substantial assortment of authorized types, to save lots of some time and prevent mistakes. The service offers skillfully made authorized file themes that you can use for a selection of functions. Create a merchant account on US Legal Forms and begin producing your life easier.

Form popularity

FAQ

On March 21, 2022, Governor Eric J. Holcomb signed into law House Enrolled Act 1260-2022 (HEA 1260). Section 12 of HEA 1260 repeals the mortgage deduction in its entirety, effective January 1, 2023.

Personal deductions State and local income or sales taxes and property taxes up to an aggregate of USD 10,000. Medical expenses, certain casualty, disaster, and theft losses, and charitable contributions, subject to limitations. Child care expenses.

10 Deductions You Can Claim Without Receipts Home Office Expenses. This is usually the most common expense deducted without receipts. ... Cell Phone Expenses. ... Vehicle Expenses. ... Travel or Business Trips. ... Self-Employment Taxes. ... Self-Employment Retirement Plan Contributions. ... Self-Employed Health Insurance Premiums. ... Educator expenses.

Indiana code exempts tangible personal property and real property from property tax for charitable, educational, and religious purposes. Form 136 must be filed to obtain this property tax exemption.

Deduction Forms Homestead Deduction Form. Over 65 Deduction and Over 65 Circuit Breaker Credit Form. County Option Circuit Breaker Credit (MARION COUNTY ONLY) Veteran Deductions Form. Disabled Person Deduction Form. Rehabilitated Property Deduction For. Historical Rehabilitated Property Deduction Form.

If you have education expenditures for each dependent child who is enrolled in a private school or homeschooled you may be qualified for a $1,000 deduction per qualified child.

Digest. Freezes the property tax liability on a homestead of an individual who is at least 65 years of age and has maintained a qualified interest in the homestead for at least 10 years.

Indiana property tax caps limit the amount of property taxes to 1% of property values for homesteads (owner-occupied), 2% for other residential property and farmland, and 3% for all other property.