Indiana Application for Waiver of the Chapter 7 Filing Fee

Description

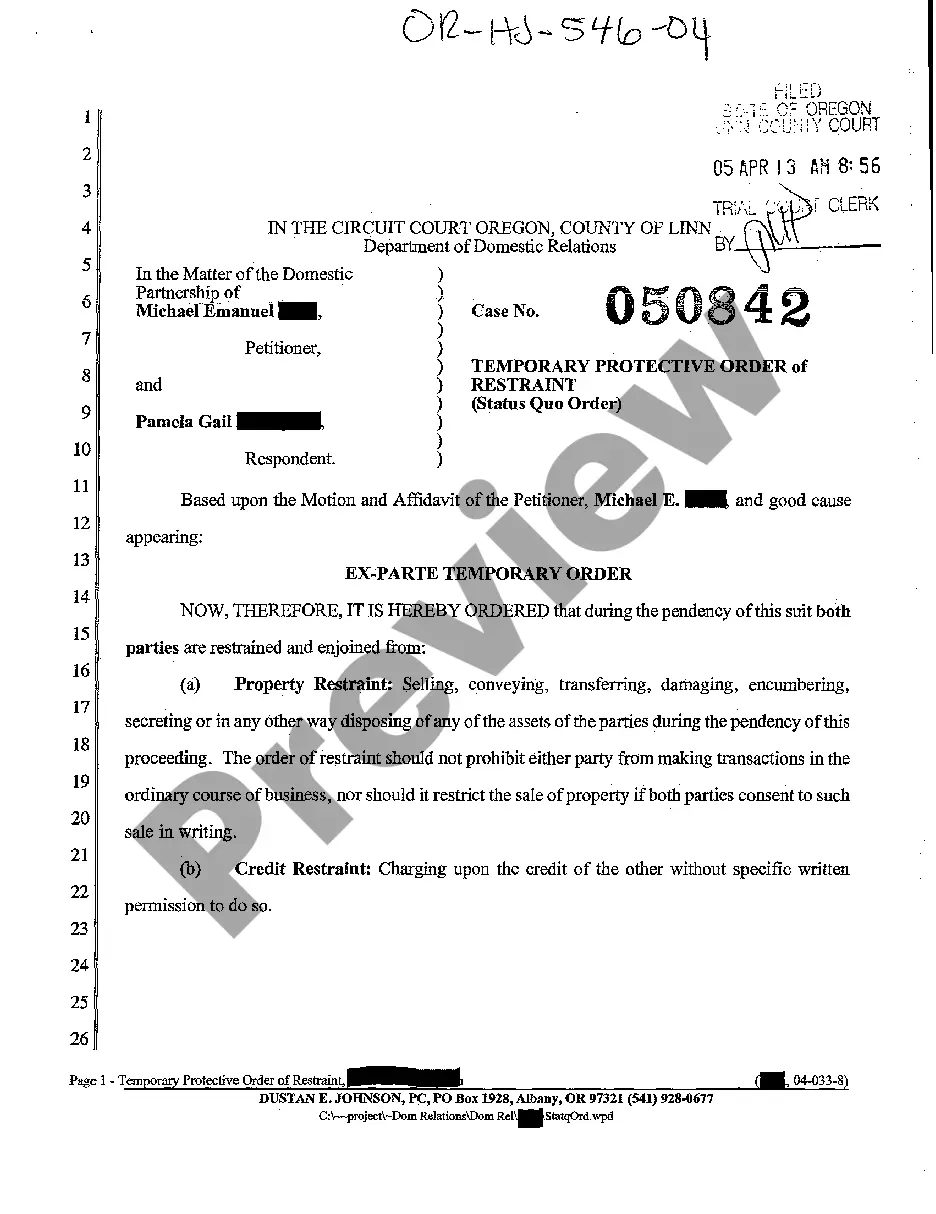

How to fill out Application For Waiver Of The Chapter 7 Filing Fee?

US Legal Forms - one of many biggest libraries of authorized kinds in the States - delivers an array of authorized file themes you may download or produce. Using the site, you can get thousands of kinds for organization and person uses, categorized by groups, says, or keywords and phrases.You can find the most recent types of kinds like the Indiana Application for Waiver of the Chapter 7 Filing Fee within minutes.

If you already possess a monthly subscription, log in and download Indiana Application for Waiver of the Chapter 7 Filing Fee from your US Legal Forms local library. The Obtain button will show up on every type you see. You have access to all previously acquired kinds inside the My Forms tab of your accounts.

In order to use US Legal Forms the first time, allow me to share straightforward directions to help you started:

- Be sure you have selected the proper type to your town/state. Select the Preview button to analyze the form`s content. Look at the type explanation to ensure that you have selected the right type.

- If the type doesn`t fit your specifications, take advantage of the Search industry at the top of the monitor to find the one which does.

- When you are happy with the shape, validate your choice by clicking on the Acquire now button. Then, opt for the costs prepare you prefer and offer your references to register on an accounts.

- Method the transaction. Make use of bank card or PayPal accounts to accomplish the transaction.

- Pick the structure and download the shape on your own system.

- Make modifications. Fill out, revise and produce and indicator the acquired Indiana Application for Waiver of the Chapter 7 Filing Fee.

Every format you included with your money does not have an expiry date which is yours eternally. So, in order to download or produce yet another duplicate, just check out the My Forms section and click on around the type you will need.

Get access to the Indiana Application for Waiver of the Chapter 7 Filing Fee with US Legal Forms, one of the most extensive local library of authorized file themes. Use thousands of expert and state-certain themes that satisfy your business or person needs and specifications.

Form popularity

FAQ

Of the two options, Chapter 7 is more popular because filers don't have to pay back part of their debts. Chapter 13 may be a better solution if you're in arrears on your mortgage because you can keep your house in Chapter 13 and have time to get caught up on payments.

Generally speaking, Sabatini says, "Chapter 7 is less expensive than Chapter 13 and much faster. A Chapter 7 is usually over within about four months. A Chapter 13 takes at least three years. But for some consumers, Chapter 13 offers some relief that is not available in Chapter 7."

The biggest difference between Chapter 7 and Chapter 13 is that Chapter 7 focuses on discharging (getting rid of) unsecured debt such as credit cards, personal loans and medical bills while Chapter 13 allows you to catch up on secured debts like your home or your car while also discharging unsecured debt.

Not All Debts Are Discharged Certain debts will remain on your account when you file for Chapter 7 bankruptcy. You will still be responsible for alimony and child support. Tax liens, student loans, and personal injury debts caused by intoxicated drivers are still on the docket, as well.