Indiana Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005

Description

How to fill out Statement Of Current Monthly Income And Disposable Income Calculation For Use In Chapter 13 - Post 2005?

It is possible to invest hours on-line looking for the legal document design which fits the state and federal demands you need. US Legal Forms offers thousands of legal varieties that happen to be analyzed by professionals. It is simple to download or printing the Indiana Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005 from my support.

If you have a US Legal Forms accounts, you are able to log in and then click the Down load key. After that, you are able to complete, revise, printing, or indication the Indiana Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005. Each and every legal document design you get is your own property for a long time. To acquire yet another backup associated with a acquired type, visit the My Forms tab and then click the related key.

If you work with the US Legal Forms website initially, keep to the easy guidelines below:

- Initial, make certain you have chosen the right document design to the county/town that you pick. Read the type outline to ensure you have chosen the proper type. If available, take advantage of the Preview key to search from the document design as well.

- If you want to get yet another model of the type, take advantage of the Search discipline to get the design that fits your needs and demands.

- Upon having located the design you would like, just click Acquire now to continue.

- Find the pricing prepare you would like, enter your credentials, and sign up for your account on US Legal Forms.

- Total the purchase. You should use your credit card or PayPal accounts to cover the legal type.

- Find the format of the document and download it to your system.

- Make alterations to your document if needed. It is possible to complete, revise and indication and printing Indiana Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005.

Down load and printing thousands of document web templates while using US Legal Forms website, which provides the most important variety of legal varieties. Use skilled and condition-specific web templates to deal with your business or specific requirements.

Form popularity

FAQ

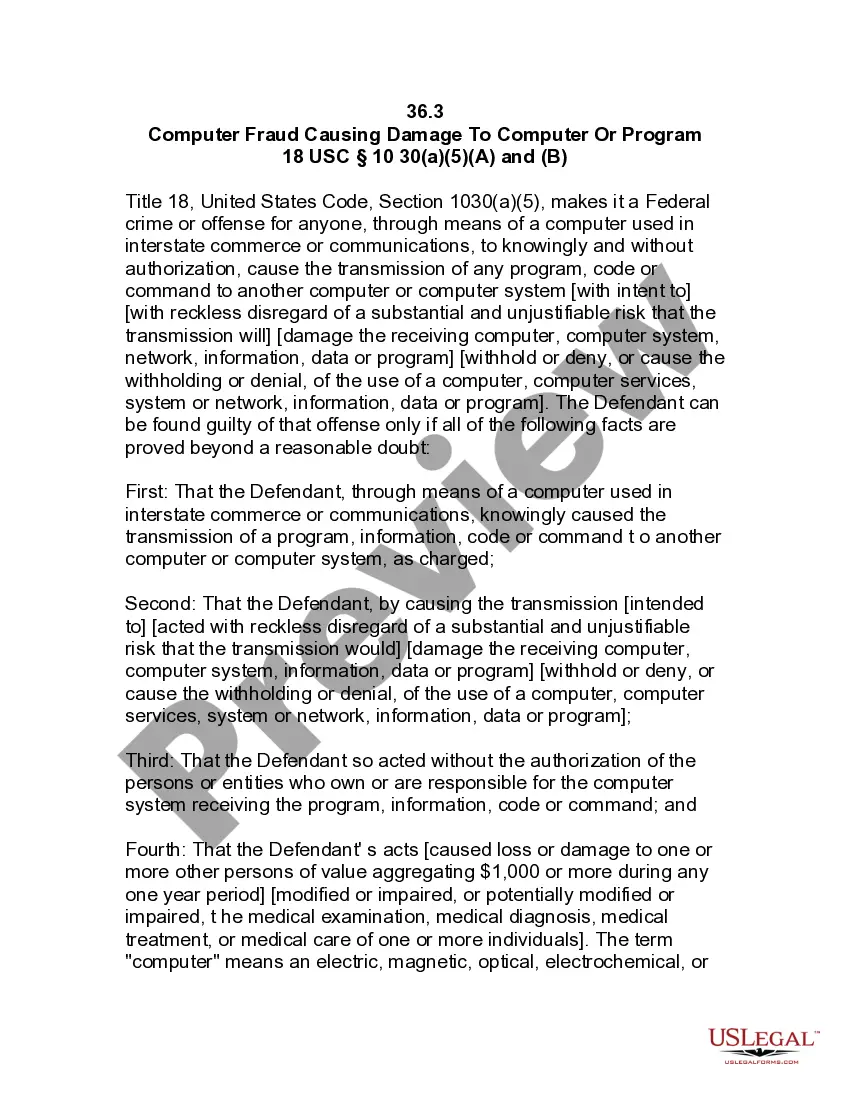

You can't pay more than your disposable income in Chapter 13, because your disposable income represents all earnings that remain after paying required debts. However, there is another step in the Chapter 13 payment calculation, and if you don't meet the criteria, the judge won't approve your plan.

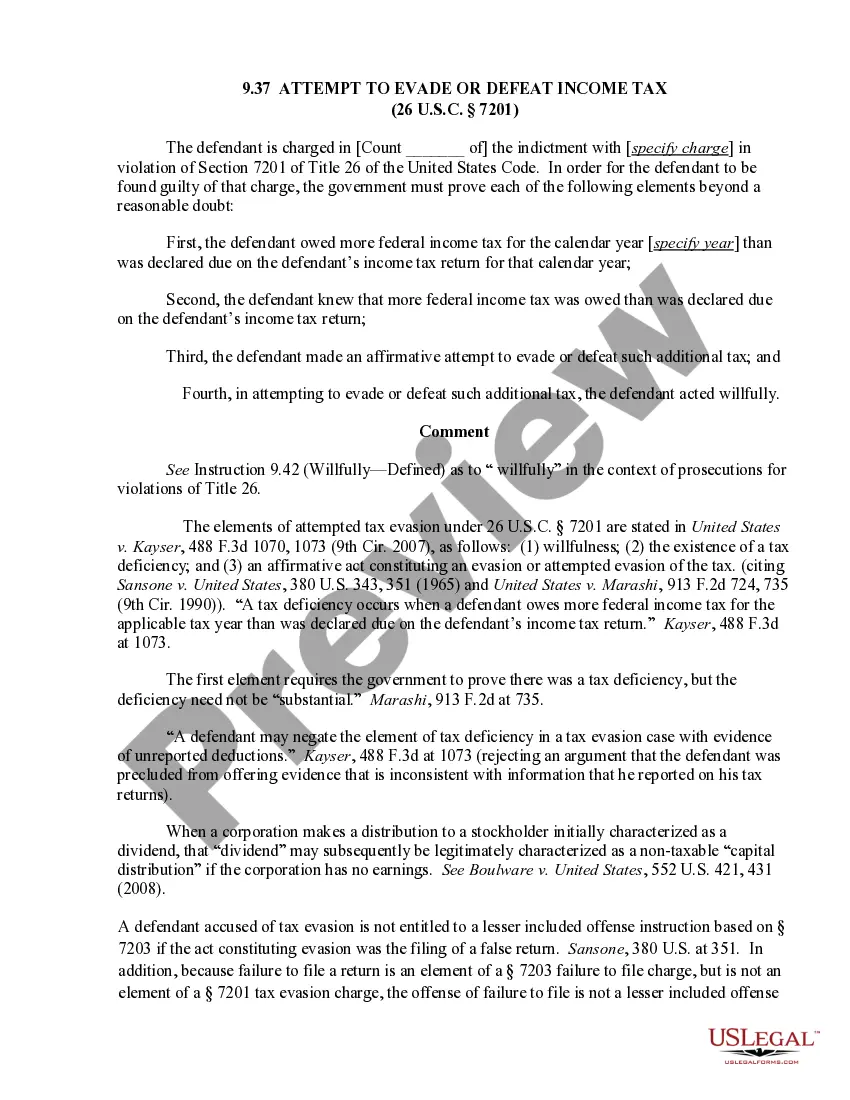

The means test compares a debtor's income for the previous six months to what he or she owes on debts. If a person has enough money coming in to gradually pay down debts, the bankruptcy judge is unlikely to allow a Chapter 7 discharge.

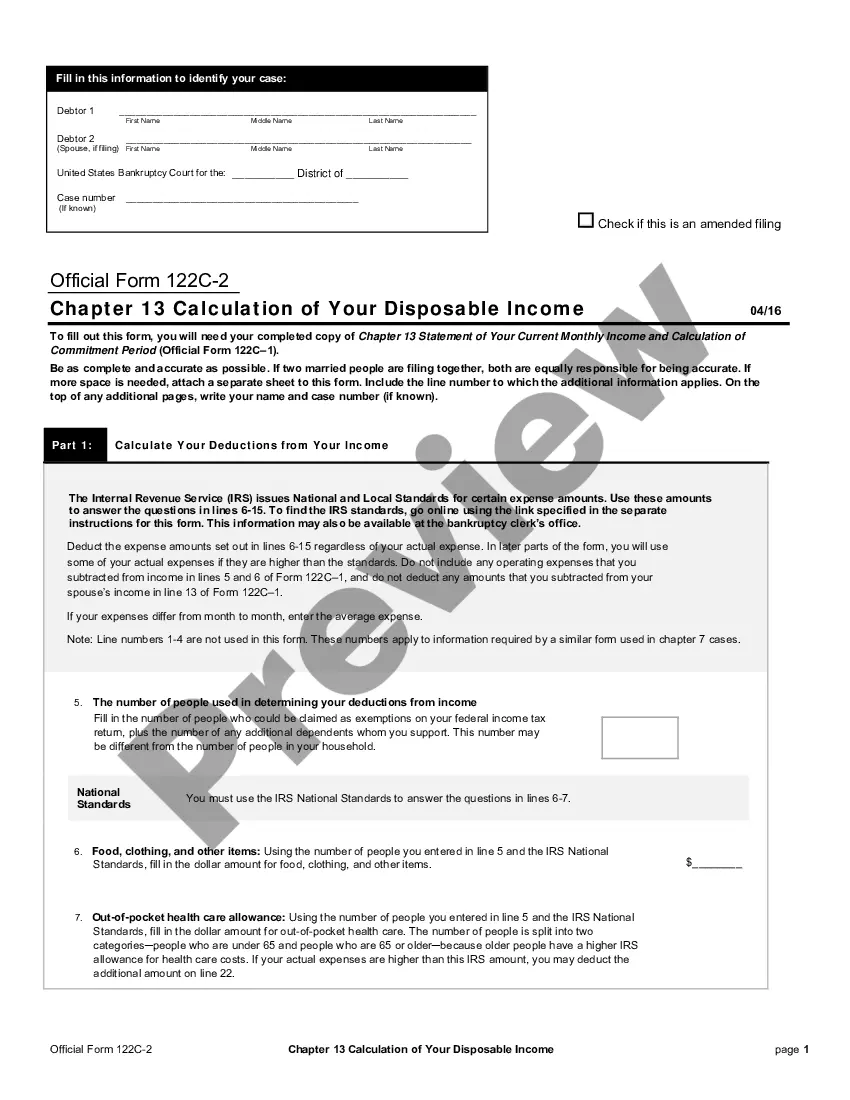

The disposable income calculation starts with your gross income. You must also be a wage earner in order to file a Chapter 13. Then, certain expenses are deducted based on an IRS deduction. The deduction is based upon a national average, taking into consideration the metropolitan area you live.

For an individual, gross income is your total pay, which is the amount of money you've earned before taxes and other items are deducted. From your gross income, subtract the income taxes you owe. The amount left represents your disposable income.

After subtracting all the allowed expenses from your ?current monthly income,? the balance is your ?disposable income.? If you have no disposable income ? your allowed expenses exceed your ?current monthly income? ? then you've passed the means test.

To calculate your monthly payment amount in a Chapter 13 bankruptcy, calculate your income for the six months before your bankruptcy filing. Deduct allowable expenses to determine your disposable income. Pay your priority debtors and any secured debts that you want to keep after the bankruptcy.

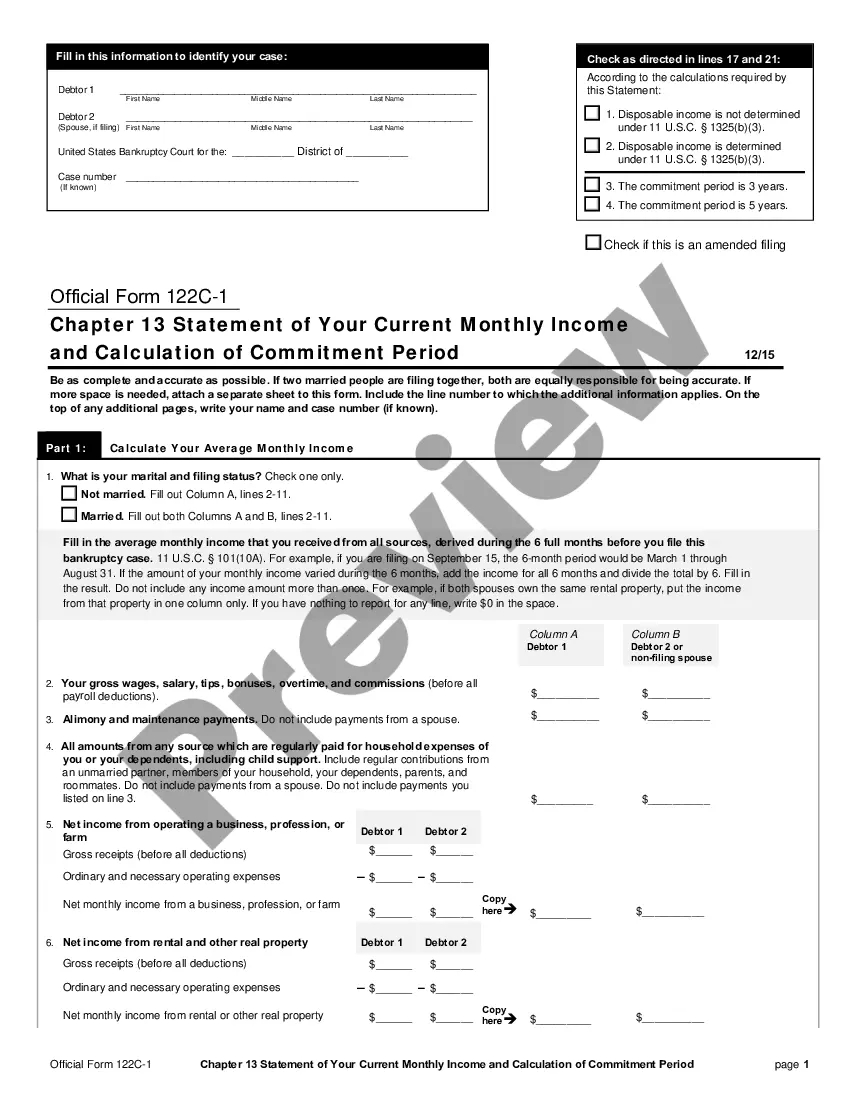

For a Chapter 13, the ?Chapter 13 Statement of Your Current Monthly Income and Calculation of Commitment Period? (Form 122C-1) tells the court your average monthly income. Your income is compared to the median income for your state, which will assist in calculating your disposable income.

The documents in your repayment plan include income information on monthly expenses, assets, and debts. The trustee confirms those figures by using your tax returns, paycheck stubs, bank statements, etc. It's not expressly the job of the trustee to keep checking your pay stubs or direct deposits for wage increases.