Indiana Disclosure of Compensation of Non-Attorney Bankruptcy Petition Preparer - For 2005 Act

Description

How to fill out Disclosure Of Compensation Of Non-Attorney Bankruptcy Petition Preparer - For 2005 Act?

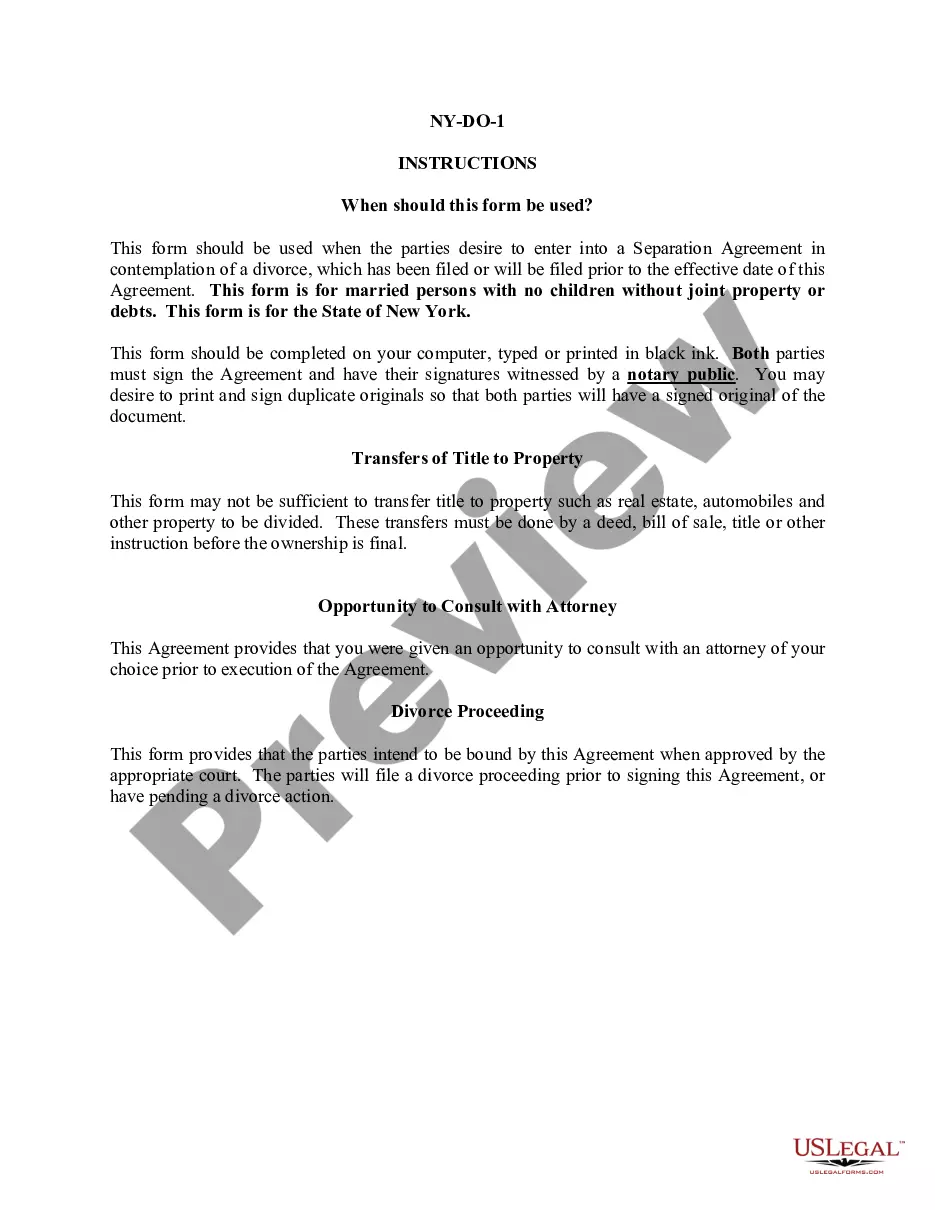

Discovering the right legal file template could be a battle. Obviously, there are tons of themes available on the Internet, but how would you get the legal develop you need? Make use of the US Legal Forms internet site. The service gives 1000s of themes, like the Indiana Disclosure of Compensation of Non-Attorney Bankruptcy Petition Preparer - For 2005 Act, that can be used for enterprise and private demands. All the varieties are inspected by professionals and satisfy state and federal demands.

In case you are already registered, log in to your profile and click the Download button to obtain the Indiana Disclosure of Compensation of Non-Attorney Bankruptcy Petition Preparer - For 2005 Act. Utilize your profile to search through the legal varieties you possess purchased previously. Go to the My Forms tab of your own profile and get another backup of the file you need.

In case you are a brand new consumer of US Legal Forms, listed below are basic guidelines so that you can stick to:

- Very first, make sure you have chosen the right develop for the town/state. You are able to look over the shape using the Review button and study the shape description to guarantee it will be the right one for you.

- When the develop is not going to satisfy your requirements, use the Seach industry to discover the right develop.

- When you are positive that the shape is suitable, select the Purchase now button to obtain the develop.

- Choose the rates program you desire and enter the essential information and facts. Make your profile and pay for the transaction with your PayPal profile or charge card.

- Select the file formatting and down load the legal file template to your device.

- Total, edit and printing and sign the acquired Indiana Disclosure of Compensation of Non-Attorney Bankruptcy Petition Preparer - For 2005 Act.

US Legal Forms will be the greatest collection of legal varieties for which you can discover different file themes. Make use of the company to down load expertly-created paperwork that stick to state demands.

Form popularity

FAQ

No, the court does not require that you use an attorney and you may be able to go through the process without an attorney. However, we would not recommend it ? Read more: Do I need a lawyer to file for bankruptcy?

Chapter 7 bankruptcy is a type of bankruptcy filing commonly referred to as liquidation because it involves selling the debtor's assets in bankruptcy. Assets, like real estate, vehicles, and business-related property, are included in a Chapter 7 filing.

Chapter 7 bankruptcy allows liquidation of assets to pay creditors. Unsecured priority debt is paid first in a Chapter 7, after which comes secured debt and then nonpriority unsecured debt. Filing Chapter 7 typically involves completing forms and a review of assets by the trustee.

Background. A chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Instead, the bankruptcy trustee gathers and sells the debtor's nonexempt assets and uses the proceeds of such assets to pay holders of claims (creditors) in ance with the provisions of the Bankruptcy Code.

The undeniable upside to filing for Chapter 7 bankruptcy is the debt relief it provides. It has the power to lift a major burden off your shoulders in just a few months. Most unsecured debt can be discharged, including credit cards, medical bills, and personal loans.