Indiana Employee News Form

Description

How to fill out Employee News Form?

Are you presently in a situation where you require documentation for potential organization or specific duties nearly every day? There are numerous authorized document templates available online, yet locating ones you can trust is not easy.

US Legal Forms offers thousands of form templates, such as the Indiana Employee News Form, designed to comply with federal and state regulations.

If you are familiar with the US Legal Forms site and have an account, simply Log In. After that, you can download the Indiana Employee News Form template.

- Identify the form you need and ensure it is for the appropriate city/region.

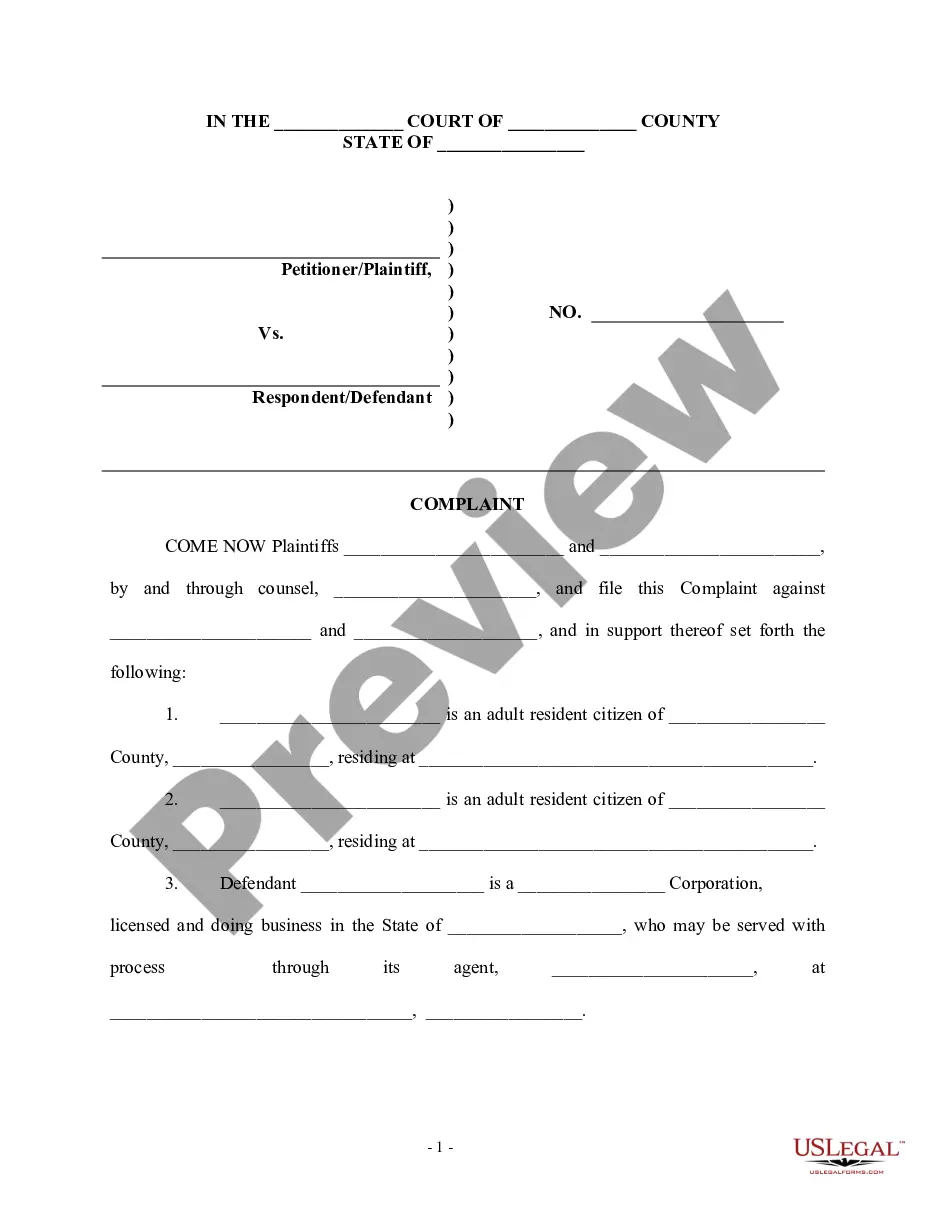

- Utilize the Review feature to examine the form.

- Check the overview to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find a form that suits your needs.

- Once you find the correct form, click on Buy now.

- Select the pricing plan you prefer, provide the necessary information to create your account, and pay for your order using PayPal or credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

The employee's first day of employment is the date the employee begins working in exchange for wages or other remuneration. The employee's first day of employment is recorded in Section 2 of Form I-9.

Paperwork. The tax documents and Form I-9 must be completed on or before your first day of employment. To comply with federal law, we must verify the identity and employment authorization of each person we hire, and retain a Form I-9 for each employee. Indiana state government is an E-verify employer.

Proof of employment can include: paycheck stubs, 2022 earnings and leave statements showing the employer's name and address, and 2022 W-2 forms when available.

You can upload proof of employment. click on the blue box that says, Go to DWD Secure File Exchange. to submit your proof of employment or self-employment to become eligible or to continue to be eligible for Pandemic Unemployment Assistance (PUA) benefits.

Please contact the reporting center at (866) 879-0198 or contact@in-newhire.com for more information or assistance in verifying your file layout.

Please visit to report new hires. Find Frequently Asked Questions on New Hire reporting here.

Steps to Hiring your First Employee in IndianaStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.More items...?

The law defines a "newly hired employee" as (i) an employee who has not previously been employed by the employer; or (ii) was previously employed by the employer but has been separated from such prior employment for at least 60 consecutive days.

The Indiana Department of Workforce Development (DWD) has announced that the unemployment quarterly contribution (Form UC-1) and wage (Form UC-5) reports must be filed electronically by all employers, beginning with the first quarter 2019 reports.

Form ME UC-1 QUARTERLY REPORT OF UNEMPLOYMENT CONTRIBUTIONS must be filed by all employers registered to remit unemployment contributions.