Indiana Resolution of Meeting of LLC Members to Amend the Articles of Organization

Description

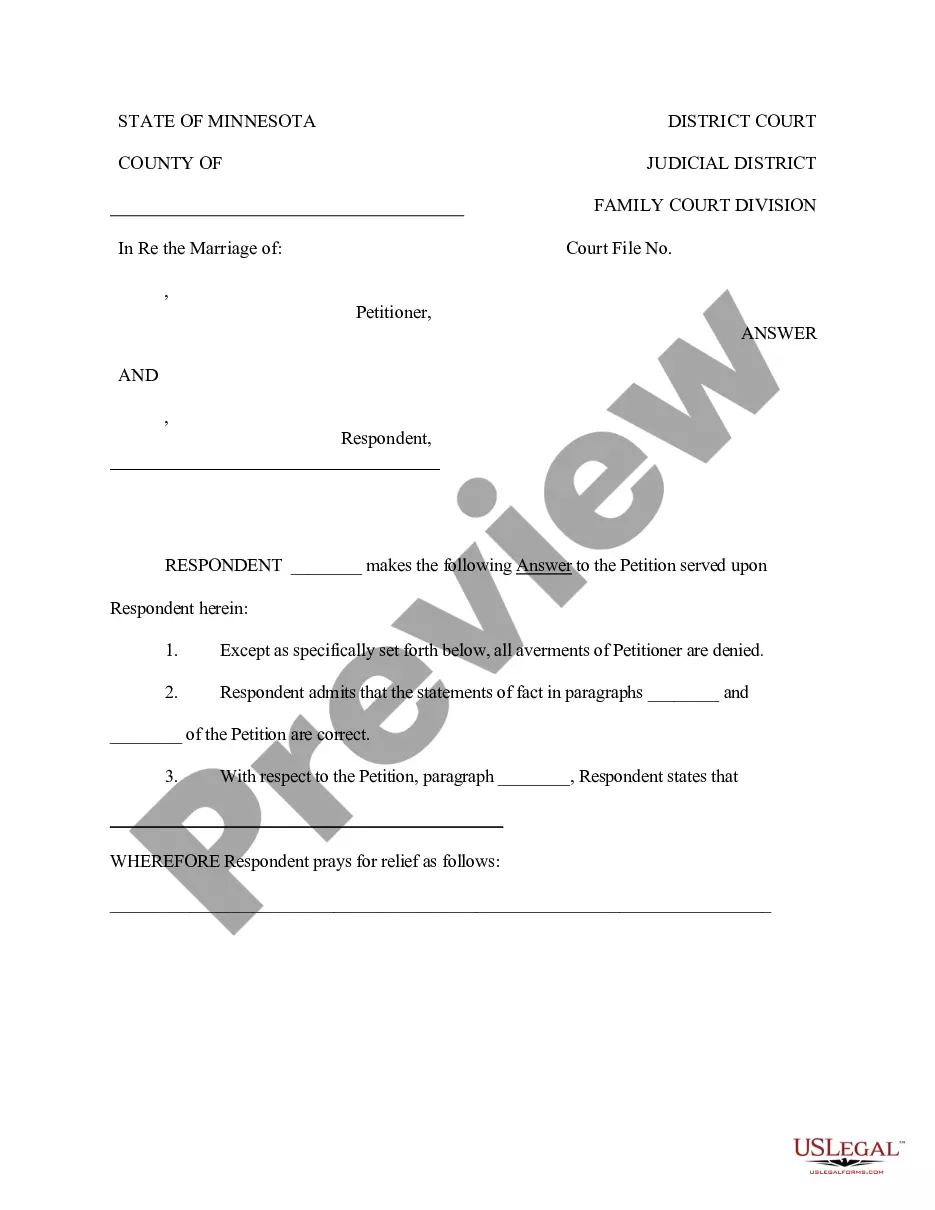

How to fill out Resolution Of Meeting Of LLC Members To Amend The Articles Of Organization?

You can invest time online trying to locate the legal document template that fulfills the state and national requirements you need.

US Legal Forms offers a multitude of legal forms that can be reviewed by experts.

You can download or print the Indiana Resolution of Meeting of LLC Members to Modify the Articles of Organization from the platform.

If available, use the Review button to look through the document template as well.

- If you possess a US Legal Forms account, you may Log In and click on the Download button.

- After that, you may complete, modify, print, or sign the Indiana Resolution of Meeting of LLC Members to Modify the Articles of Organization.

- Every legal document template you purchase is yours permanently.

- To get an extra copy of the acquired form, go to the My documents tab and click on the corresponding button.

- If you are visiting the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/city of your choice.

- Review the form description to confirm you have chosen the right document.

Form popularity

FAQ

Articles of Amendment are filed when your business needs to add to, change or otherwise update the information you originally provided in your Articles of Incorporation or Articles of Organization.

Follow these steps for a smooth process when you add an owner to an LLC.Understand the Consequences.Review Your Operating Agreement.Decide on the Specifics.Prepare and Vote on an Amendment to Add Owner to LLC.Amend the Articles of Organization (if Necessary)File any Required Tax Forms.

How long does it take to start an LLC in Indiana? It normally takes 1 day for the state to approve the LLC paperwork for online filings and 5-7 business days for mailed-in forms.

Title 23 - BUSINESS AND OTHER ASSOCIATIONS.

To amend your initial Articles of Organization for an Indiana LLC, you'll need to file Articles of Amendment with the Indiana Secretary of State, Business Services Division. In addition, you must pay the $30 paper filing fee or $20 online filing fee, depending on how you choose to submit your form.

To amend (change, add or delete) provisions contained in the Articles of Incorporation, it is necessary to prepare and file with the California Secretary of State a Certificate of Amendment of Articles of Incorporation in compliance with California Corporations Code sections 900-910.

To make amendments to the Articles of Organization of your Indiana LLC, you will have to file 2 copies of the completed Articles of Amendment of the Articles of Organization with the Secretary of State. You can submit online, in person, by mail, or express mail. You will also need to pay the $20 or $30 filing fee.

Online processing: immediate. Normal processing: 3-5 business days, plus additional time for mailing.

How to Amend Articles of IncorporationReview the bylaws of the corporation.A board of directors meeting must be scheduled.Write the proposed changes.Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on.Propose the amendment during the board meeting.More items...

To obtain a certified copy of Articles of Incorporation, go to the Indiana Secretary of State Business Page: and complete the following steps. 5. Click on Certified Copies Request - Here you will have the option to print or download your Articles free of charge.