Indiana Guaranty without Pledged Collateral

Description

How to fill out Guaranty Without Pledged Collateral?

Have you ever been in a location where you require documents for either business or personal purposes almost every working day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms provides thousands of template options, including the Indiana Guaranty without Pledged Collateral, that are designed to meet federal and state requirements.

Select the pricing plan you prefer, fill in the required information to create your account, and complete the payment using your PayPal or credit card.

Choose a convenient document format and download your copy. You can access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of Indiana Guaranty without Pledged Collateral anytime, if needed. Just select the necessary form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service offers professionally crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Indiana Guaranty without Pledged Collateral template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it corresponds to your specific area/region.

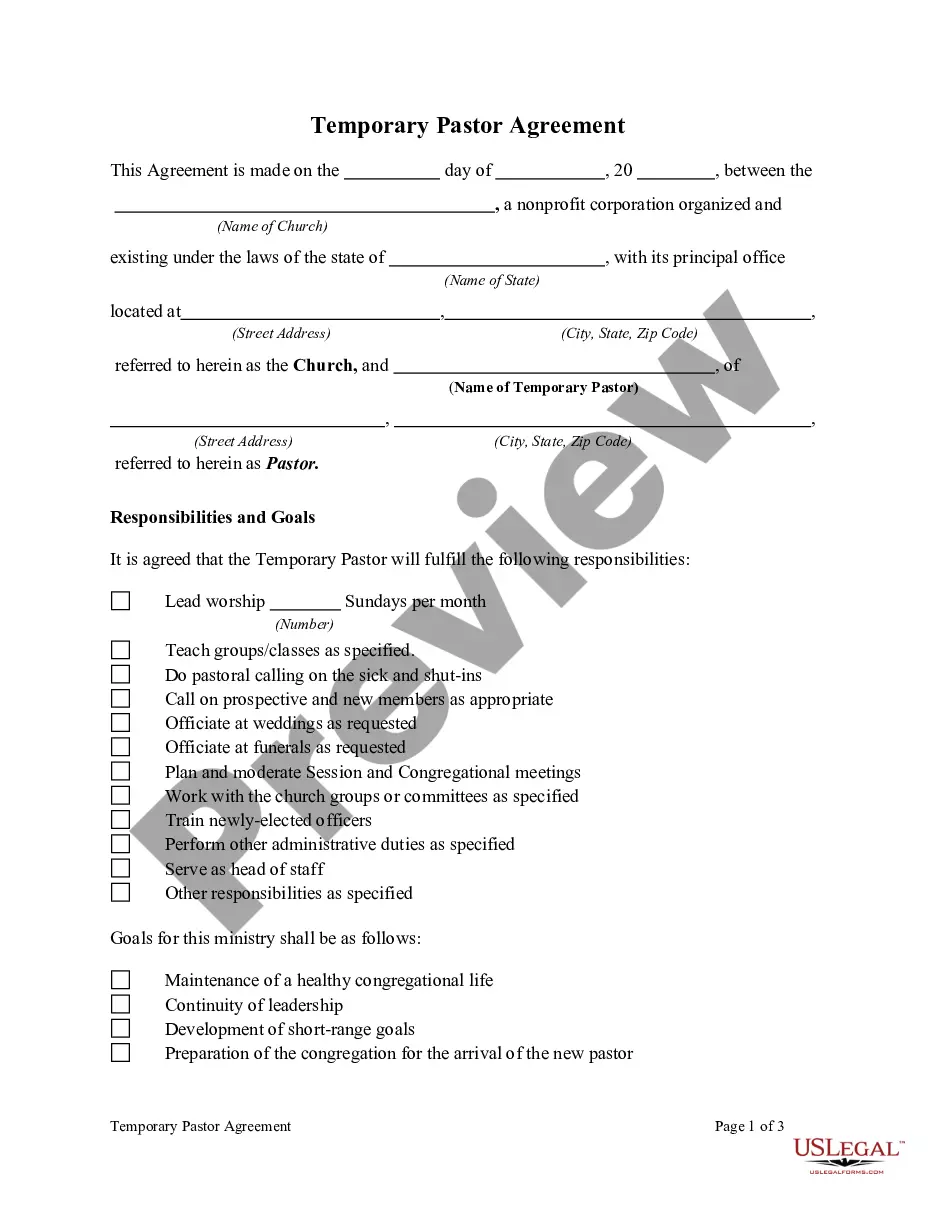

- Use the Preview button to review the form.

- Check the outline to verify that you have chosen the correct document.

- If the form does not meet your needs, utilize the Search field to find a form that suits your requirements.

- Once you find the right form, click Get now.

Form popularity

FAQ

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

Substance over form Just because the word 'guarantee' has been used, that does not make it a guarantee. In writing The guarantee must be evidenced in writing to be enforceable. Signed The document must be signed by the guarantor or their authorised agent. Their name can be written or printed.

Understanding Financial Guarantees Guarantees may take on the form of a security deposit. Common in the banking and lending industries, this is a form of collateral provided by the debtor that can be liquidated if the debtor defaults.

An offer to guarantee must be accepted, either by express or implied acceptance. If a surety's assent to a guarantee has been procured by fraud by the person to whom it is given, there is no binding contract.

Pledge TypesActive Pledge. Active pledge is defined as a pledge that is active, regardless if it has a payment schedule or not.Annual Fund Pledge.Conditional Pledge.Open Pledge.Pledge Intention.Straight Pledge.Will Commitment.

The Guarantor undertakes to pay compensation up to a certain amount to the Beneficiary in case the Applicant/Instructing Party fails to deliver the goods or to carry out certain work. This type of Guarantee is often issued for 5-10% of the contract value, although the percentage varies case by case.

When used as a verb, to agree to pay another person's debt or perform another person's duty, if that person fails to come through. As a noun, the written document in which this assurance is made.

As nouns the difference between pledge and guaranty is that pledge is a solemn promise to do something while guaranty is (legal) an undertaking to answer for the payment of some debt, or the performance of some contract or duty, of another, in case of the failure of such other to pay or perform; a warranty; a security.

Guarantee. 1) v. to pledge or agree to be responsible for another's debt or contractual performance if that other person does not pay or perform.

To be enforceable as a personal guaranty, the signatory must sign the guaranty in his or her personal capacity and not as the president or CEO of the company receiving the loan, which is its own legal entity, separate and apart from the people that run and operate it.