Indiana Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner And Disproportionate Distribution Of Assets?

Selecting the appropriate legal document format can be difficult. Naturally, there are numerous templates accessible online, but how can you obtain the legal document you require? Utilize the US Legal Forms website.

This service offers thousands of templates, including the Indiana Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets, which can serve both business and personal needs. All forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Acquire button to obtain the Indiana Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets. Use your account to browse the legal forms you may have purchased previously. Navigate to the My documents tab of your account to get another copy of the documents you require.

Select the file format and download the legal document template for your system. Complete, modify, print, and sign the acquired Indiana Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets. US Legal Forms provides the largest collection of legal forms where you can find various document templates. Utilize this service to obtain professionally prepared documents that meet state requirements.

- First, ensure you have selected the correct form for your specific city/state.

- You can view the form using the Preview button and read the form description to confirm it is the correct one for you.

- If the form does not meet your requirements, use the Search box to find the appropriate form.

- Once you are confident that the form is suitable, click the Get now button to acquire the form.

- Choose the pricing plan you prefer and enter the necessary details.

- Create your account and complete the order using your PayPal account or Visa or MasterCard.

Form popularity

FAQ

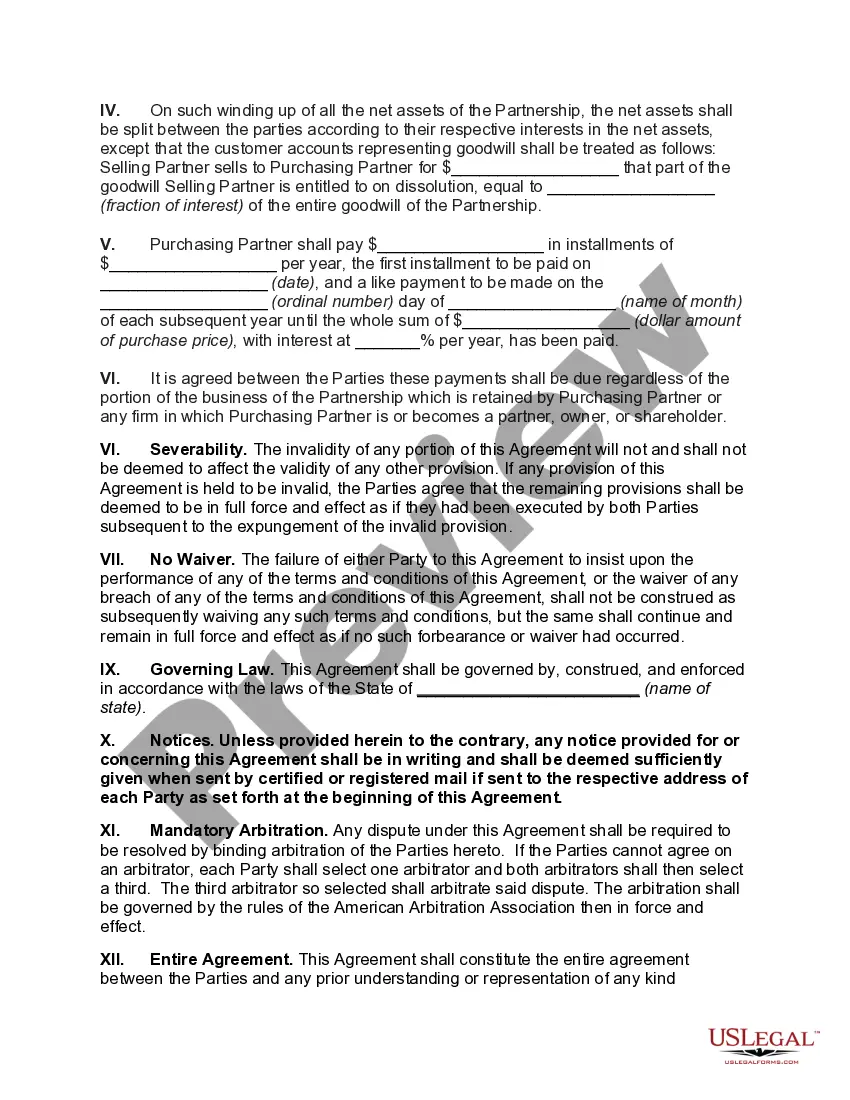

Typically, state law provides that the partnership must first pay partners according to their share of capital contributions (the investments in the partnership), and then distribute any remaining assets equally.

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.

Once the debts owed to all creditors are satisfied, the partnership property will be distributed to each partner according to their ownership interest in the partnership. If there was a partnership agreement, then that document controls the distribution.

A distribution is disproportionate if a partner receives more or less than his pro rata share of IRC 751(b) hot assets. Partnership distributes money and/or property to a partner.

A distribution is disproportionate if a partner receives more or less than his pro rata share of IRC 751(b) hot assets. Partnership distributes money and/or property to a partner.

Do partnership distributions have to be equal? Partner equity does not typically equate to equivalent investment contributions from all business partners. Instead, partners can make equal contributions to the company and possess equal ownership rights, but make contributions in a variety of different forms.

File a Dissolution Form. You'll need to file a dissolution of partnership form with the state your business is based in to formally announce the end of the partnership. Doing so makes it clear that you are no longer in a partnership or liable for its debts; it's a good protective measure to take.

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves. Your partners may not want to dissolve the partnership due to your departure.

In the general partnership, the limited liability partnership, the limited liability limited partnership and the limited partnership, profits and losses are passed through to the partners as specified in the partnership agreement. If left unspecified, profits and losses are shared equally among the partners.

A disproportionate distribution is a payout of corporate profits whereby some shareholders receive cash or other assets and others receive an increased interest in the company.