Indiana Subcontract to Perform Work and Furnish Materials, Equipment and Labor for its Portion of Work, Together with all Plant, Tools, Machinery, Appliances, Winter Protection and all other Necessary Protection

Description

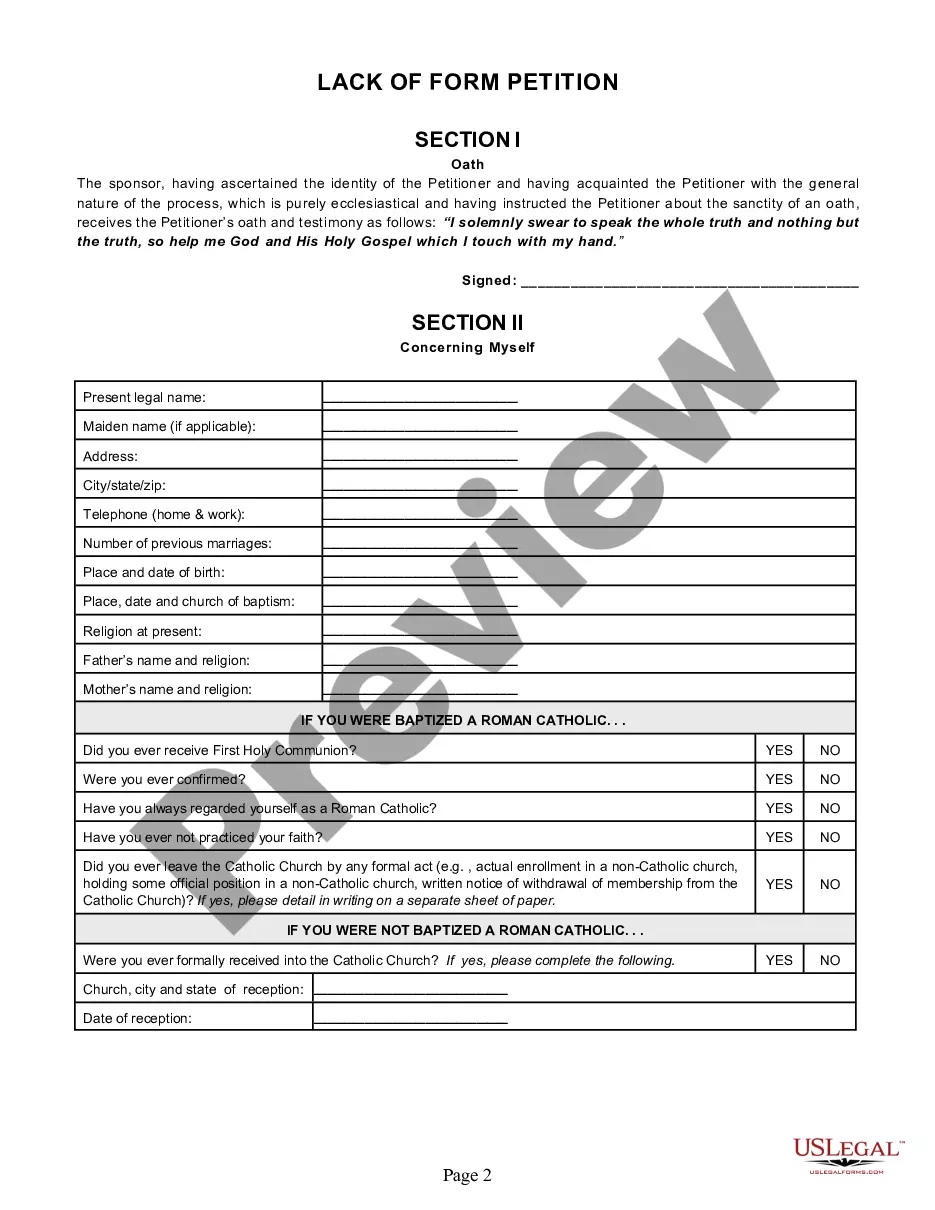

How to fill out Subcontract To Perform Work And Furnish Materials, Equipment And Labor For Its Portion Of Work, Together With All Plant, Tools, Machinery, Appliances, Winter Protection And All Other Necessary Protection?

You might invest time online trying to locate the sanctioned document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal documents that are reviewed by professionals.

You can easily download or print the Indiana Subcontract to Perform Work and Provide Materials, Equipment, and Labor for its Share of Work, along with all necessary Plant, Tools, Machinery, Appliances, Winter Protection, and additional Required Safeguards from the services.

If available, use the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and press the Acquire button.

- Then, you can fill out, edit, print, or sign the Indiana Subcontract to Perform Work and Provide Materials, Equipment, and Labor for its Share of Work, along with all necessary Plant, Tools, Machinery, Appliances, Winter Protection, and additional Required Safeguards.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of the purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the region/city of your choice.

- Review the form details to confirm you have selected the correct form.

Form popularity

FAQ

However, in California, assembly labor is taxable. The exceptions for taxable labor are repair and installation labor.

Are services subject to sales tax in Indiana? "Goods" refers to the sale of tangible personal property, which are generally taxable. "Services" refers to the sale of labor or a non-tangible benefit. In Indiana, services are generally not taxable.

Time and Material Contract means a contract in which the cost of construction material and the cost of labor or other charges are stated separately. Generally, all sales of tangible personal property, including sales of construction material, are subject to Indiana sales tax, while sales of real property are not.

Because all sales of tangible personal property, including sales of construction material, are taxable, contractors converting construction material into real property under a time and material contract must collect and remit sales tax on the material portion of their contracts.

Charges for labor to install an item of tangible personal property to real property are not subject to tax, even if not converted to real property, providing charges are separately stated on the invoice.

Installation charges that are not separately stated from the selling price of an item or the delivery charge for an item are subject to sales tax.

Goods that are subject to sales tax in Indiana include physical property, like furniture, home appliances, and motor vehicles. The purchase of groceries and prescription medicine are tax-exempt.

The intent of the Contract is to include all labor, materials, equipment and transportation necessary for the proper execution of the Work (2.01). 2.

In general, sales of all tangible personal property in Indiana by a retail merchant are subject to Indiana sales tax and, generally speaking, the storage, use or consumption in Indiana of property acquired in a retail transaction are subject to Indiana use tax.

In general, all sales of tangible personal property, including construction material, are subject to tax. Thus, absent an exemption, all purchases of construction material by contractors are taxable at the time the material is purchased, or, if acquired exempt, upon disposition.