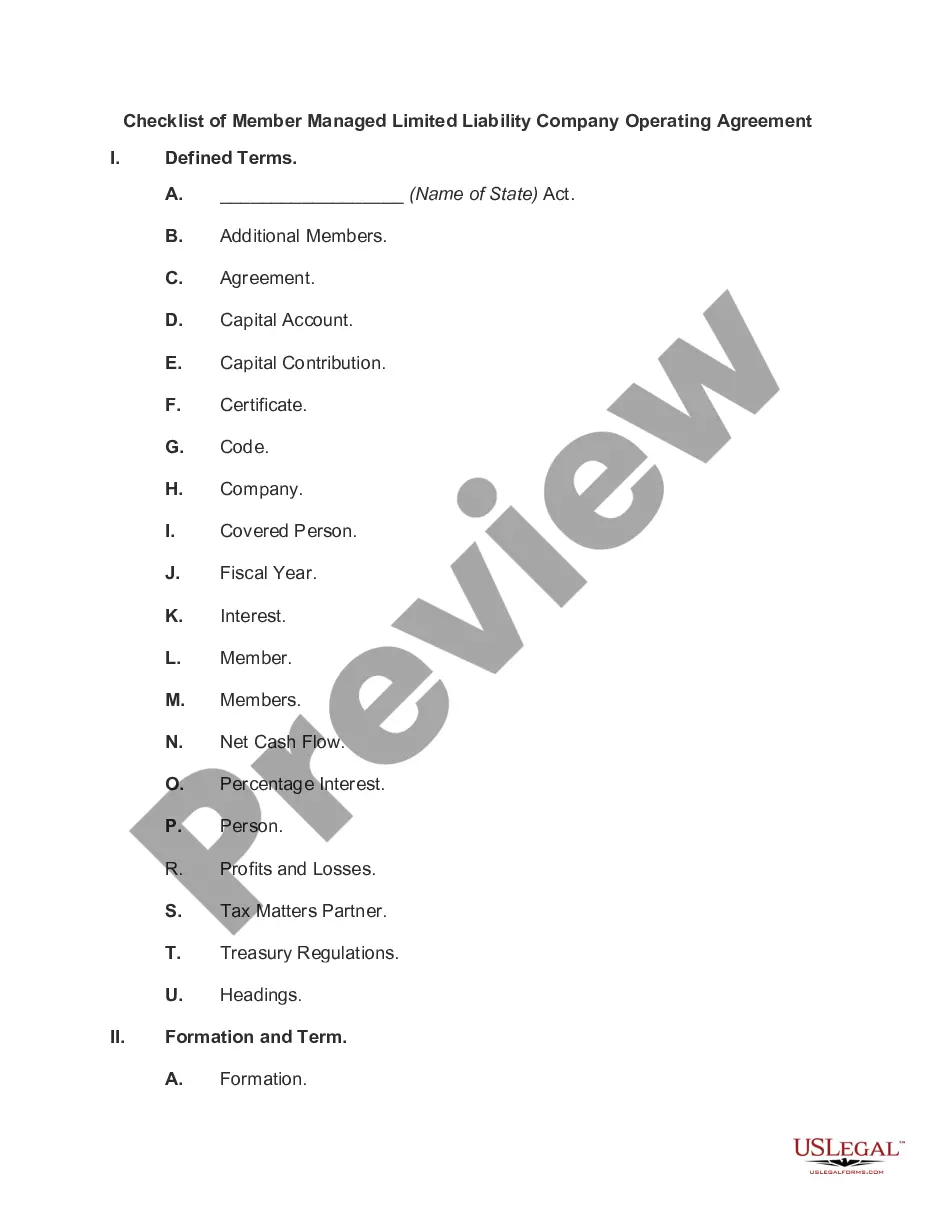

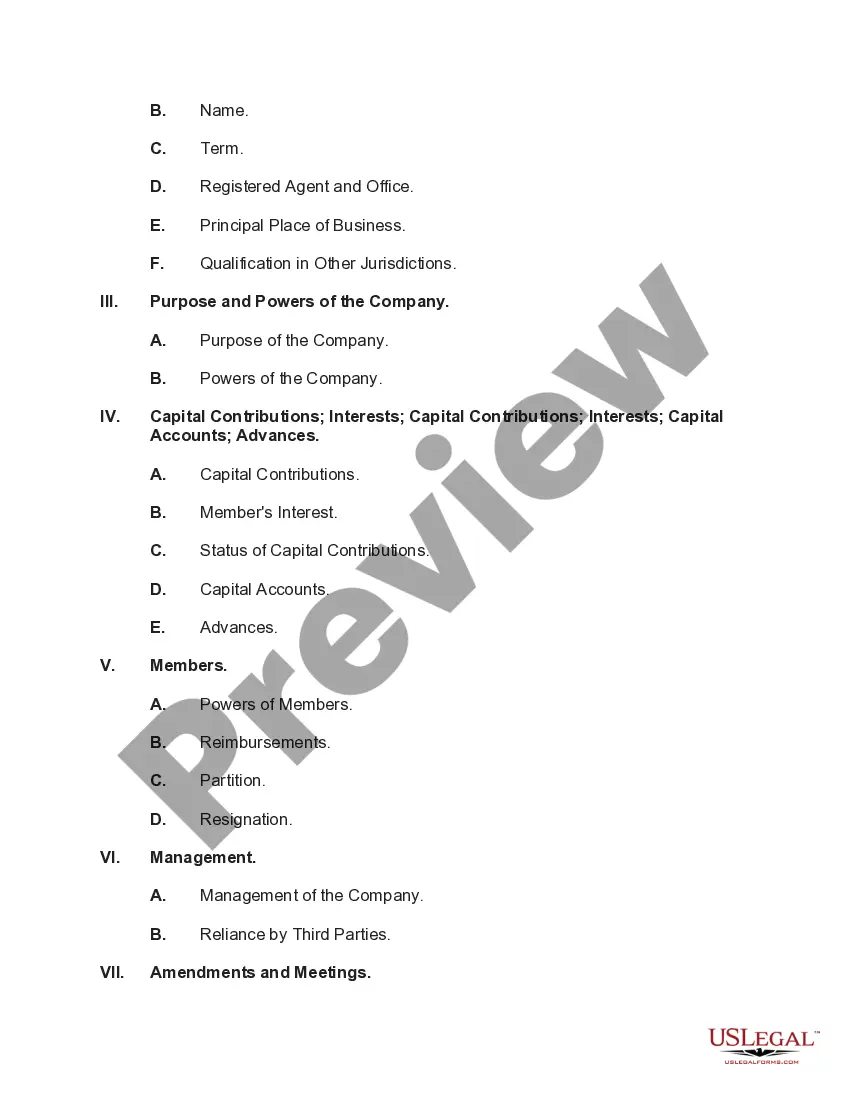

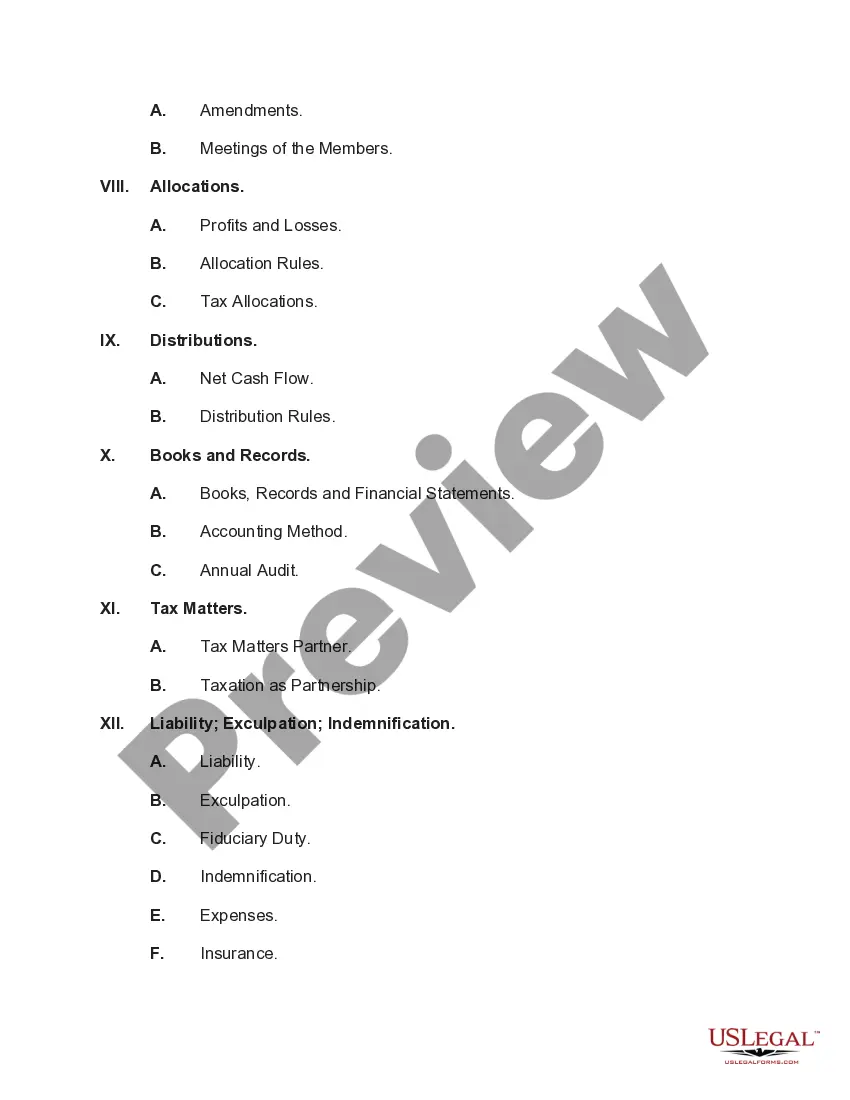

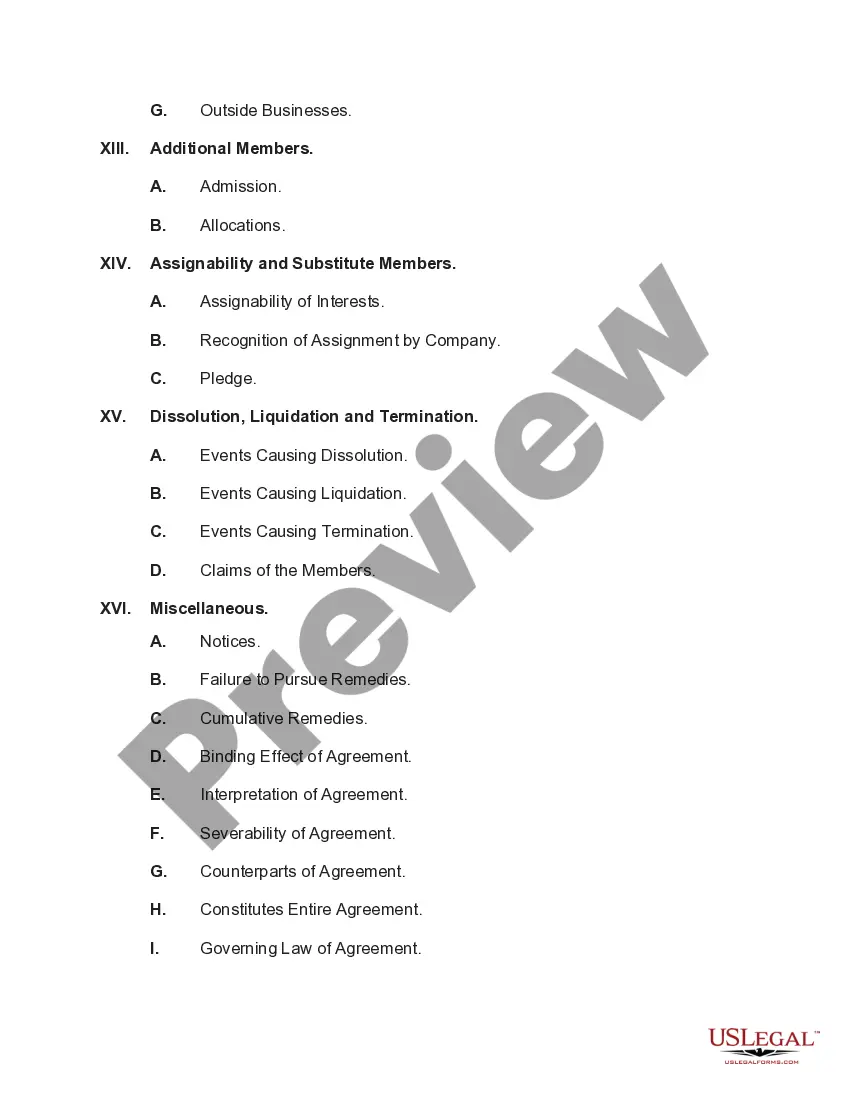

Indiana Checklist of Member Managed Limited Liability Company Operating Agreement

Description

How to fill out Checklist Of Member Managed Limited Liability Company Operating Agreement?

If you need to compile, acquire, or print sanctioned document templates, utilize US Legal Forms, the largest database of legal forms available online.

Take advantage of the site's straightforward and user-friendly search feature to find the documents you require.

A variety of templates for business and personal purposes are categorized by types and jurisdictions, or keywords.

Step 4. After locating the desired form, click the Buy now button. Select your preferred pricing plan and input your details to sign up for an account.

Step 5. Process the payment. You may use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to locate the Indiana Checklist of Member Managed Limited Liability Company Operating Agreement in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to access the Indiana Checklist of Member Managed Limited Liability Company Operating Agreement.

- You can also access documents you have previously downloaded in the My documents section of your account.

- For first-time users of US Legal Forms, follow these steps.

- Step 1. Confirm you have chosen the form for the correct city/state.

- Step 2. Utilize the Preview option to review the contents of the form. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find alternative versions of the legal form template.

Form popularity

FAQ

What should an LLC operating agreement include?Basic company information.Member and manager information.Additional provisions.Protect your LLC status.Customize the division of business profits.Prevent conflicts among owners.Customize your governing rules.Clarify the business's future.

LLC Indiana - To form an Indiana LLC, you'll need to file the Articles of Organization with the Indiana Secretary of State Business Services Division, which costs $95-$100. You can apply online or by mail. The Articles of Organization is the legal document that officially creates your Indiana Limited Liability Company.

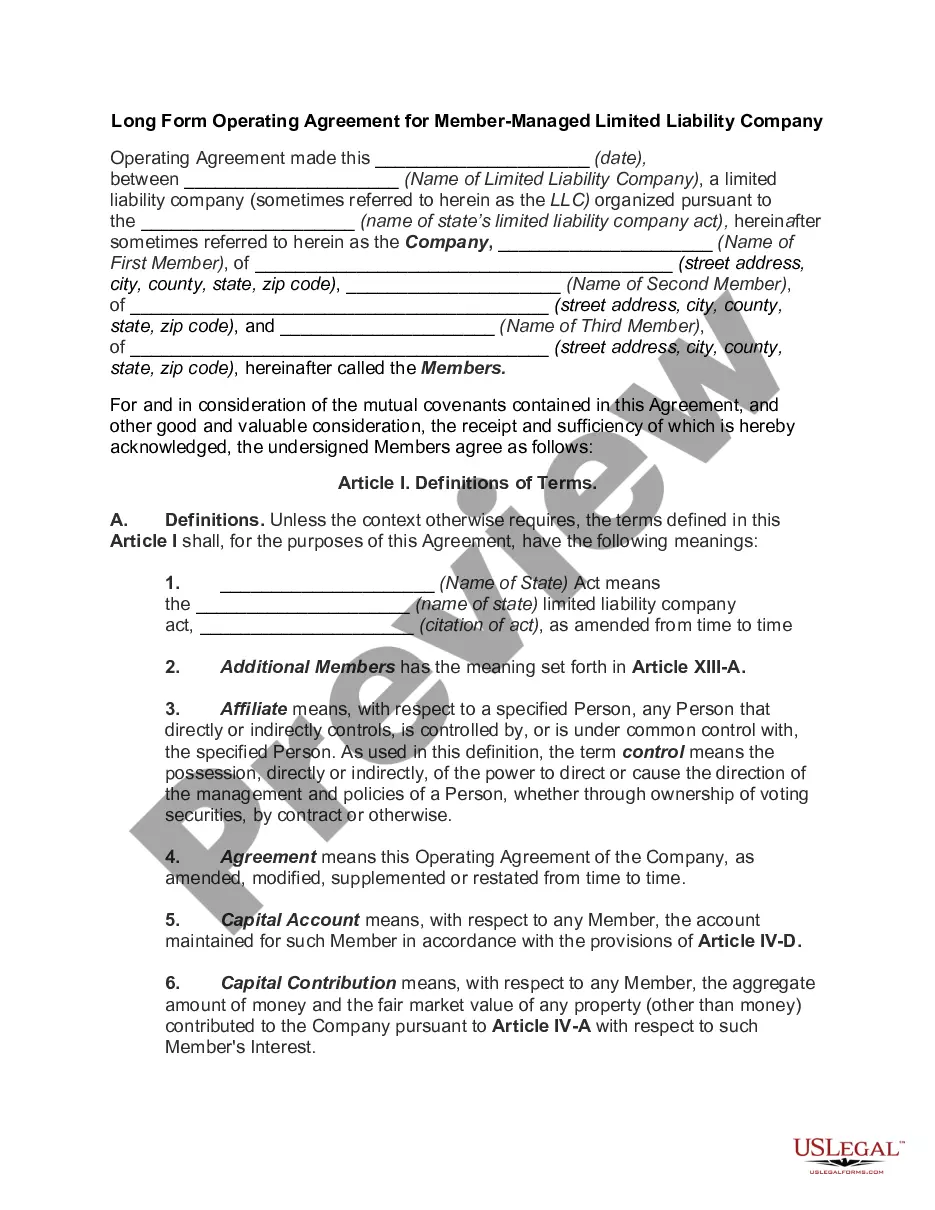

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.

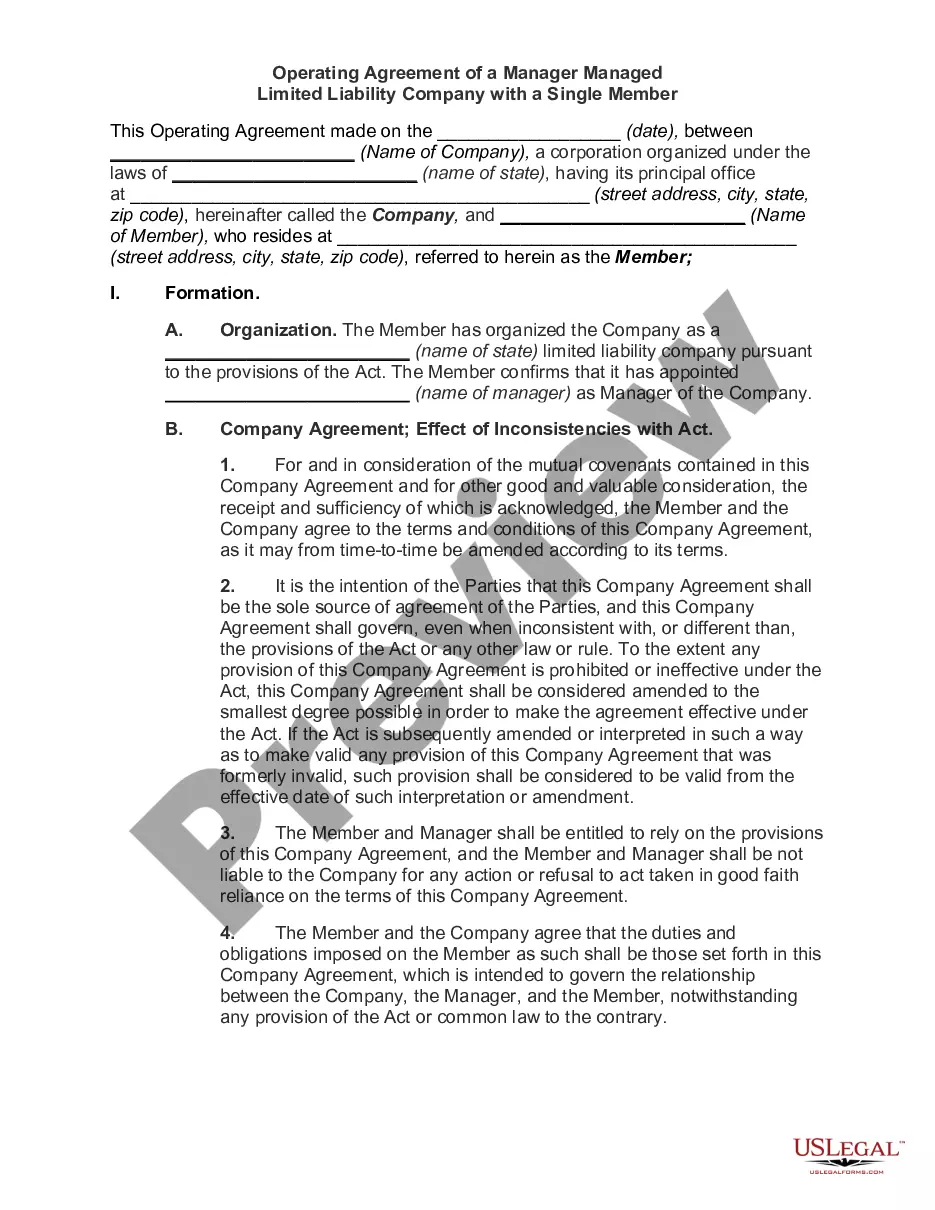

An Indiana LLC operating agreement is a legal document that will provide assistance to the member(s) of businesses, in any size, to provide an outline of the company's organization of members, operational procedures, and many various aspects of the business that will be agreed upon by all members prior to

Is an LLC Operating Agreement required in Indiana? No, Indiana does not require LLCs to create an Operating Agreement as a legal document to operate. However, the state does recommend having an Operating Agreement on file in case of disputes or issues.

The form and contents of operating agreements vary widely, but most will contain six key sections: Organization, Management and Voting, Capital Contributions, Distributions, Membership Changes, and Dissolution.

Single member LLCs are treated the same as sole proprietorships. Profits are reported on Schedule C as part of your individual 1040 tax return. Self-employment taxes on Indiana LLC net income must be paid just as you would with any self-employment business.

member LLC (also called a membermanaged LLC) is a limited liability company that has more than one owner but no managers. Instead, owners run the daytoday operations of the LLC.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.